We’re emerging from one of the darkest periods of fintech; from 2022 to 2024, valuations were slashed, swathes of workers were laid off and cultural benefits eroded. The industry is beginning to bounce back, evidenced by successful IPOs and an increase in fundraises. For fintech employees, however, it’s not the same industry they once knew.

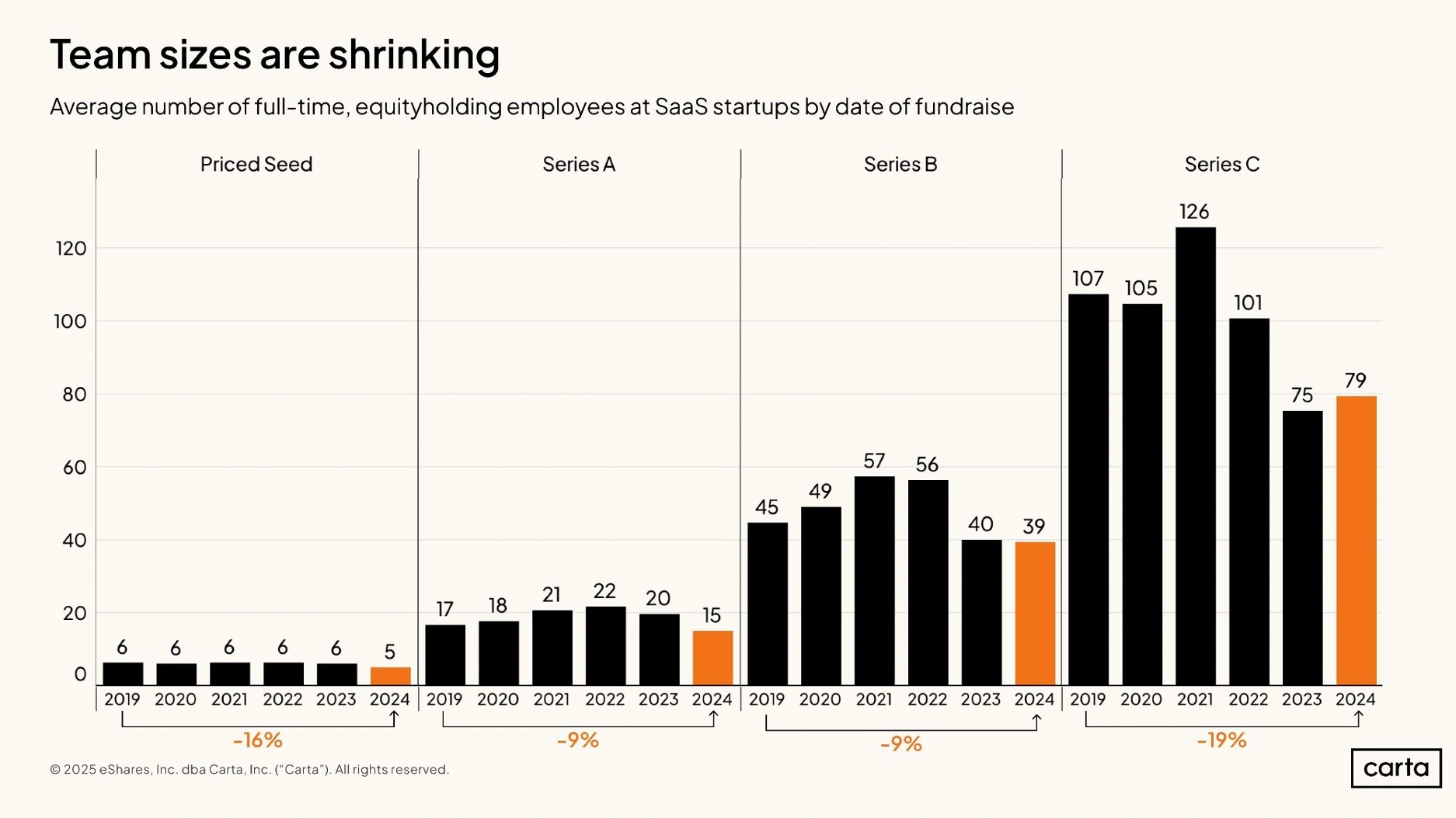

Fintech teams are staying lean despite the recovery. Peter Walker of fundraising platform Carta released data earlier this month for start-ups using the platform; it showed that average equity-holding headcount had decreased for seed-stage, series A and series B startups (where the real money is made). Headcount at series C start-ups was up marginally to 79 employees on average, but still down massively from an average of 126 employees in 2021.

Walker’s data showed that more employees were leaving start-ups than were being hired in the last quarter of 2024. In December, just 11k employees were hired while 14.6k left, either voluntarily or via layoffs. In January 2022, by contrast, 73k people were hired and attrition figures were largely the same.

There are exceptions. Digital asset startup Arda Global raised $3m in seed funding earlier this year with a headcount of 10, double Walker’s average for that funding stage. Founder Oli Harris, an ex-Goldman Sachs MD, told us Arda would add “a few more, but that’s enough for now until our next round.” Financial management platform Finom, meanwhile, raised $133m in Series C funding last month, and has big plans for expansion. Tijana Kovacevic, Finom’s chief people officer, told us the firm had a total headcount of 500 and plans to use its new funds to hire 100 more.

The UK fintech scene at large may also be more inclined to hire. A report from Morgan McKinley earlier this year estimated that there will be there will be 16,575 professional vacancies at fintech firms in the UK, up 31.6% from 2024. This might be influenced by London becoming a low-cost area for US start-ups to build engineering teams. Vacancies aren’t always filled, however, and recruiters have noted that interview processes can reach up to 17 stages without candidates receiving an offer, as the firms aren’t willing to commit to them.

You might think that, with firms broadly reducing headcount, equity compensation packages would be more generous. You’d be mistaken. Walker said that “employees, even the earliest ones, aren’t really seeing bigger equity packages.” His data showed that the first hire by startups received equity grants equal to 1.5% of the value of their startup on average in 2024; by the sixth hire this fell to just 0.3%. The result, therefore, is that employees now have greater responsibility when scaling start-ups, but receive little in return. Employees will be hoping this new normal doesn’t last.

Have a confidential story, tip, or comment you’d like to share? Contact: Telegram: @AlexMcMurray, Signal: @AlexMcMurrayEFC.88 Click here to fill in our anonymous form, or email [email protected].

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libellous (in which case it won’t.)

Photo by Jackson Simmer on Unsplash