After topping Li Auto’s market value in Hong Kong last week, XPeng is narrowing the gap with its rival’s valuation on U.S. exchanges.

XPeng’s Hong Kong-listed shares closed 2.7% higher on Tuesday at HK$86.95.

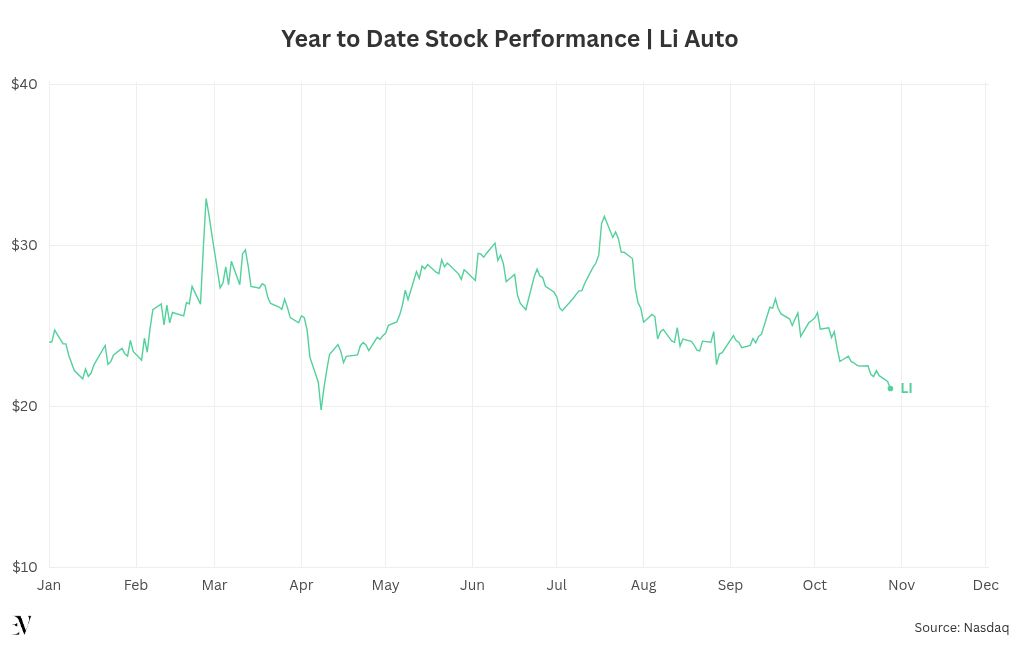

Li Auto, in contrast, has been facing continued losses this year over lower than expected demand and missed sales targets.

The stock hit earlier this Tuesday a new 6-month low at HK$81.25 and has fallen nearly 40% in the last 100 days.

The different performances of the two stocks has led to XPeng outperforming Li Auto‘s market cap, for the first time, in Hong Kong.

The Guangzhou-based company now has a HK$165.73 billion valuation, just slightly above Li Auto‘s HK$165.368 billion.

In Nasdaq, XPeng‘s market valuation was about $21.98 billion on Monday, $1.1 billion below Li Auto‘s $23.08 billion.

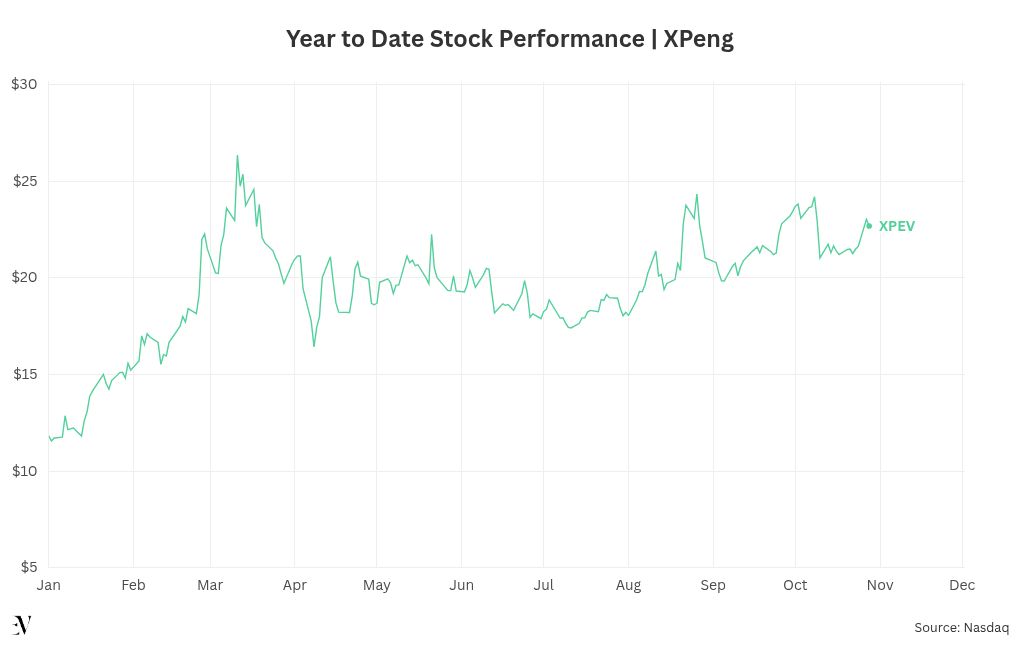

In the US, XPeng’s stock has shown a similar upward trend, nearly doubling over the past twelve months, with most of the gains occurring since the start of 2025.

Chinese EV maker Nio followed, at $16.18 billion.

On August 21, XPeng shares saw one of its biggest days intra-day, surging nearly 12% to $22.75, following strong second-quarter earnings and news that founder and CEO He Xiaopeng had increased his stake in the company.

Earlier in March, XPeng reached a new peak year-to-date at $27.16. Since then, the stock has been trading between $22 and $25.

Li Auto, still the most valuable Chinese NEV (new energy vehicle) maker listed in the US, has been on a downward trend, losing 26.1% of its stock over the past three months.

Year to date, the stock is down 10%.

The decline follows weak demand for the company’s new fully electric vehicles and the aging of its hybrid lineup.

While Li Auto and XPeng were not rivals before, the landscape has shifted as the Beijing-based company has entered the battery electric vehicle (BEV) segment.

At the same time, XPeng is preparing to release its first hybrid vehicles, which will include extended-range versions (EREV) of the X9 MPV, already launched in China and tested in Europe.

Li Auto focused only on extended-range vehicles, from its inception in 2015 until March 2024, when it launched its first fully electric model, the Mega.

Launched just three months after the first generation XPeng X9, sales of the Mega MPV have underperformed its rival, which is now the best-selling electric multi-purpose van in China.

Li Auto introduced its second fully electric model, the Li i8 SUV, in late July.

However, amid growing competition in the three-row EV segment, sales of the SUV have fallen short of expectations.

Its main competitor, Onvo L90, which was also launched in late July, has led registrations in China over the past two months.

The Shanghai-based company has already completed 30,000 deliveries of its six-seat model — 86 days after deliveries begun.

Li Auto, on the other hand, delivered 2,212 i8 units in August and 5,716 in September, totaling around 8,000 units.

In early September, Li Auto‘s founder and CEO Li Xiang said that the company is aiming for the Li i8 to reach stable monthly deliveries of 6,000 units for the Li i8 and 9,000 to 10,000 units for the recently launched five-seat Li i6.

From January 1 to September 30, Li Auto sold 297,149 vehicles, which is less than half of its annual target of 640,000 units.

Li Auto trimmed its annual delivery target from 700,000 units to 640,000 in May, citing “weaker than expected” orders for the revamped Li L6 (the brand’s best-selling model).

XPeng is the only Chinese brand to have achieved above 80% of the target by the end of the third quarter.

As of September 30, XPeng had delivered 313,000 vehicles across the globe, meaning it completed 90% of its 380,000-unit target.

Source link