This year’s Midas List Europe was driven by a rising cohort of European-based companies whose success has attracted more investors and venture dollars to the region. Investments in innovative companies with a clear vision for how AI integration can create value have continued to pay off – and increasingly for the Midas List Europe, these winning bets are at home.

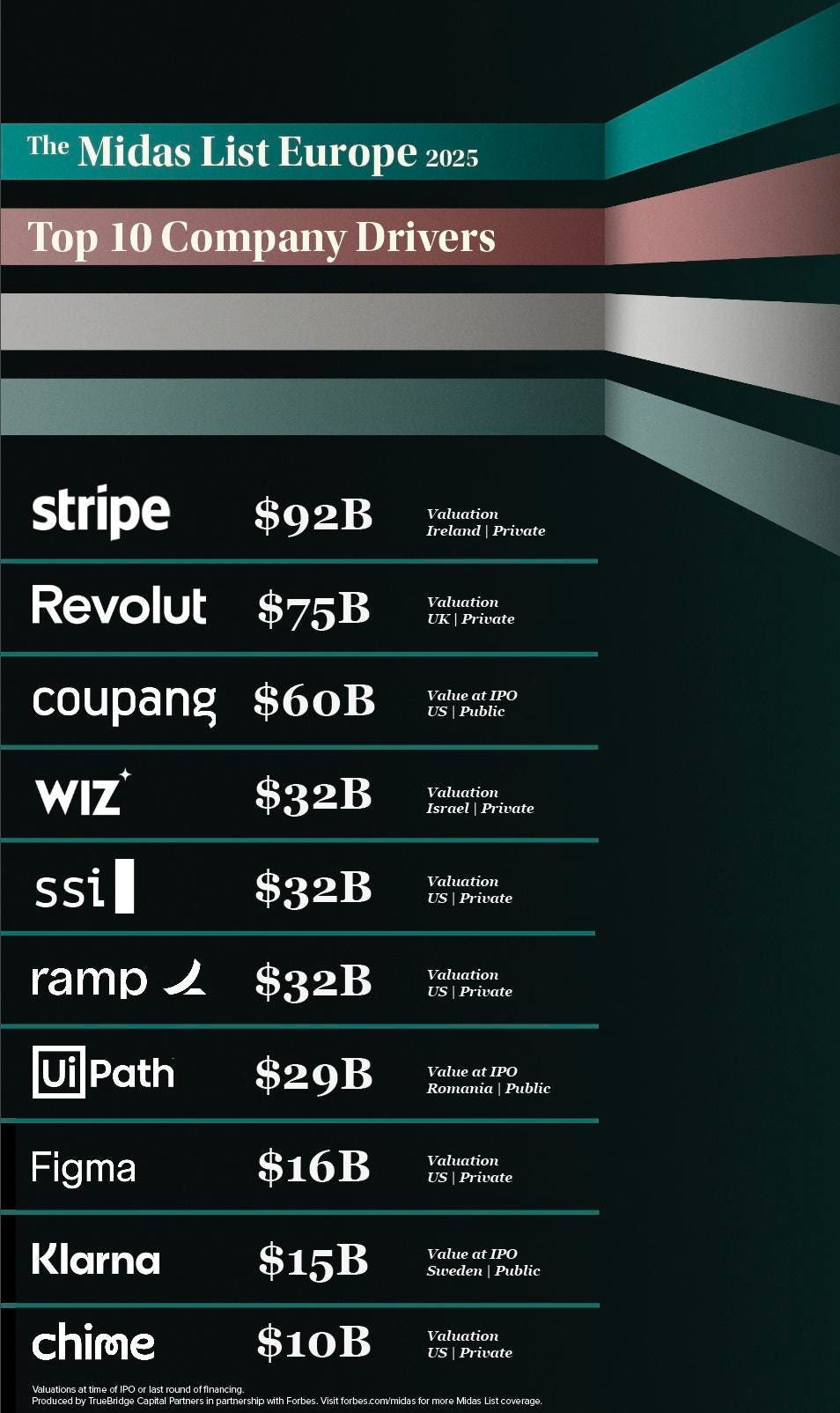

2025 Midas List Europe Drivers

TrueBridge Capital

Notably, for the first time, half the companies featured on our drivers list are based in Europe and the Middle East, including three out of the top five. Established mainstays like Stripe and Revolut, as well as newer entrants Wiz and Klarna, have driven robust returns for investors on the list.

It is also worth noting that beyond these top 10 companies, there was a significant number of newer homegrown AI champions like Helsing, 1X and Mistral that are driving strong results for VCs as Europe pursues AI sovereignty.

Here are the top 10 companies that helped investors secure a spot on the 2025 Midas List Europe.

1. Stripe

With a publicly reported 409A valuation of $106.7 billion as of September 2025, Stripe has reaffirmed its status as one of the world’s most valuable privately owned companies. This latest valuation exceeds an employee tender offer in February 2025 which valued the Irish-founded company with dual headquarters in Dublin and San Francisco at $91.5 billion.

The fintech giant continues to lead the market with a steady stream of AI-driven products, including the launch of its Open Issuance stablecoin platform and Agentic Commerce Protocol (ACP) this year. ACP now powers Instant Checkout in ChatGPT which enables users in certain geographies to purchase goods from businesses directly in the chat.

Stripe’s massive valuation gains are supported by impressive growth metrics. Stripe reported $1.4 trillion in total payment volume in 2024, up 38% from the prior year. It also said its customers include half of the Fortune 100, 80% of the Forbes Cloud 100, and 78% of the Forbes AI 50. While no firm commitment has been made to go public, its momentum and impressive returns continue to drive value for European investors.

Where It Counted the Most on the Midas List Europe 2025:*

Tom Stafford | DST Global | #4

Avi Eyal | Entrée Capital | #5

2. Revolut

Digital banking pioneer Revolut increased its impact on the Midas List Europe this year. Last April, the London-based company announced its fourth consecutive year of profitability, driven by a 38% increase in its customer base to 52.5 million globally. It also announced increased customer engagement metrics, boosting total customer balances 66% to $38 billion. In November, the company completed a secondary share sale which vaulted its valuation to $75 billion, a 66% jump from its last reported valuation in 2024, signaling strong investor confidence.

The company’s extraordinary growth has been driven by major global expansion initiatives, bringing its retail customer base to more than 65 million worldwide. As an example, Revolut recently announced new banking authorizations in Mexico and Colombia, positioning it for further international growth.

Revolut also recently announced a significant expansion of its multi-year and multi-million-dollar partnership with Google Cloud and a partnership with Booking.com to enable customers to check out using Revolut Pay. With these strategic partnerships and consistent delivery on its 2025 plan, Revolut has further cemented its position as one of Europe’s most valuable fintech companies.

Where It Counted the Most on the Midas List Europe 2025:*

Pawel Chudzinski | Point Nine | #3

Tom Stafford | DST Global | #4

Carlos Eduardo Espinal | Seedcamp | #10

John Doran | TCV | #17

3. Coupang

With its integrated ecosystem encompassing food delivery, streaming and digital payments all under one platform, Coupang has come to be known as “the Amazon of Asia.” The e-commerce giant continued to drive strong returns for European investors in 2025.

Coupang’s global operations are powered by heavy investments in AI and custom robotics, which have enabled the company to rapidly scale services that have redefined supply chains. With its proprietary machine learning and AI systems that make trillions of predictions per day, Coupang has set new industry standards and consistently delivered strong financial performance. The company most recently reported revenues of $9.3 billion, an 18% year-over-year increase, with gross profit rising even faster at 20%.

Rising revenue per active customer continues to be a strong indication of success in building resilient customer loyalty across markets. Coupang dominates the South Korean retail market, and has quickly replicated its success in Taiwan, where it is already seeing high levels of customer adoption and retention.

This combination of innovative service delivery and strategic market entry continues to drive value for investors and reinforce Coupang’s status as a leading force in global e-commerce.

Where It Counted the Most on the Midas List Europe 2025:*

Avi Eyal | Entrée Capital | #5

4. Wiz

Since its founding in Tel Aviv in 2020, Wiz has become one of the fastest-growing software companies in the world, as strong demand for cloud-native security solutions continues to boost the company’s valuation. (Read Forbes’ 2023 cover story on the company and its CEO and cofounder Assaf Rappaport here.)

In March, Wiz announced a landmark agreement to be acquired by Google for $32 billion, which will be Google’s largest acquisition to date once completed and a $9 billion premium over its initial bid in 2024. The deal not only cements Wiz’s status as a global cloud security leader but also underscores the strategic importance of advanced cloud-native security in today’s digital landscape. Slated to close in 2026, the deal positions Google to accelerate the pace of security innovation to support and protect customers across all major clouds.

Where It Counted the Most on the Midas List Europe 2025:*|

Gili Raanan | Cyberstarts | #2

5. Safe Superintelligence

Safe Superintelligence (SSI) has emerged as one of the world’s most closely watched AI labs. Cofounded in 2024 by former OpenAI chief scientist Ilya Sutskever, former Y Combinator partner Daniel Gross and former OpenAI engineer Daniel Levy, the company’s mission and sole focus is to provide safe AI that serves as a force for good in the world.

Although it has yet to commercially launch its AI platform, SSI’s valuation surged to $32 billion following a $2 billion funding round earlier this year, which will be used to accelerate the development of systems with alignment and control at their core. It’s one of a growing number of AI companies bringing in massive investment before ever launching a product.

SSI recently entered into an infrastructure partnership with Google Cloud which equips the company with state-of-the-art TPUs that Google has historically reserved for internal use. The company remains one to watch as it aims to provide a responsible path forward to superintelligence.

Where It Counted the Most on the Midas List Europe 2025:*

Rahul Mehta | DST Global | #11

6. Ramp

As businesses double down on AI-powered efficiency gains, Ramp has risen to prominence as one of the most in-demand global expense management platforms.

Following a $300 million equity raise last November, Ramp surpassed $1 billion in annualized revenue with a total valuation of $32 billion. With over 50,000 customers including household names such as Shopify, Anduril, Figma and Notion, Ramp continues to attract businesses seeking to modernize and optimize their finances.

This year, the company launched Ramp Treasury, enabling companies to earn 2.5% on idle operating cash. It also rolled out Ramp Travel in partnership with Priceline to simplify corporate travel, launched its App Center and expanded its offering of AI-powered vendor payment tools following its acquisition of procurement software startup Venue last January.

Where It Counted the Most on the Midas List Europe 2025:*

Jeannette zu Fürstenberg | General Catalyst | #8

7. UiPath

Since its 2021 IPO at a $29 billion valuation, UiPath has weathered market volatility and remains a leader in AI-powered automation for the world’s largest enterprises. Throughout 2025, UiPath launched a series of products designed to enable organizations to automate even more complex and variable workflows and achieve real ROI on their AI investments. Notably, the launch of UiPath Maestro this year enables businesses to connect and manage a range of AI agents, accelerating and simplifying how processes are managed.

UiPath recently reported $362 million in revenue, a 14% year-over-year increase, underscoring strong execution and surging demand for its solutions.

Where It Counted the Most on the Midas List Europe 2025:*

Luciana Lixandru | Sequoia | #6

Philippe Botteri | Accel | #9

Carlos Eduardo Espinal | Seedcamp | #10

Dan Lupu | Earlybird | #21

Eric Liaw | IVP | #24

8. Figma

Figma made headlines in July with its blockbuster IPO, closing the first day with a market cap of $67.7 billion – more than tripling the value of the abandoned Adobe acquisition and delivering strong returns for early backers. However, Figma’s stock has steadily declined over the past four months, reflecting market skepticism about premium SaaS valuations and the challenges of sustaining rapid growth as a public company.

That said, Figma continues to command over 40% market share, and, with a wave of new products, is now positioning itself as essential infrastructure for creative, product and marketing teams.

As Figma continues its journey as a public company, industry watchers will look to see if its expansion translates into sustainable, long-term growth.

Where It Counted the Most on the Midas List Europe 2025:*

Danny Rimer | Index Ventures | #1

9. Klarna

Stockholm-based “Buy Now, Pay Later” fintech giant Klarna reached a $20 billion valuation as a result of its highly publicized IPO last September, delivering strong returns to early backers. While initial market optimism was high, Klarna’s valuation has steadily declined over the past few months, highlighting enduring challenges in market conditions. Despite posting record-breaking revenue in its first earnings report, the company reported a $95 million net loss, raising questions about the timeline for a return to profitability.

That said, Klarna has continued to expand its footprint this year with new and expanded partnerships with major retailers like Google, DoorDash and eBay in the U.S., and continues to focus on using AI to reduce costs and enhance operational efficiency.

Where It Counted the Most on the Midas List Europe 2025:*

Johan Brenner | Creandum | #16

Eric Liaw | IVP | #24

10. Chime

Chime’s successful listing in June 2025 was one of the largest fintech IPOs of 2025, valuing the company at roughly $11.6 billion. While that represented a steep discount to its last private-market valuation of $25 billion in 2021, the company’s IPO was warmly-received and widely interpreted at the time as an early sign that the IPO market could be thawing.

Share price has experienced a post-IPO pullback, but Chime is operating at meaningful scale, generating roughly $1.7 billion in revenue in 2024. Its appeal is rooted in its mobile-first, fee-free banking model that offers banking options like early access to deposits and credit-building tools, designed to help underserved and cost-conscious consumers manage their money.

Many in the industry will be watching to see whether the company can continue to scale and unlock additional revenue streams while remaining focused on achieving consistent profitability.

Where It Counted the Most on the Midas List Europe 2025:*

Denis Barrier | Cathay Innovation | #25

* Does not include all investors in the company.