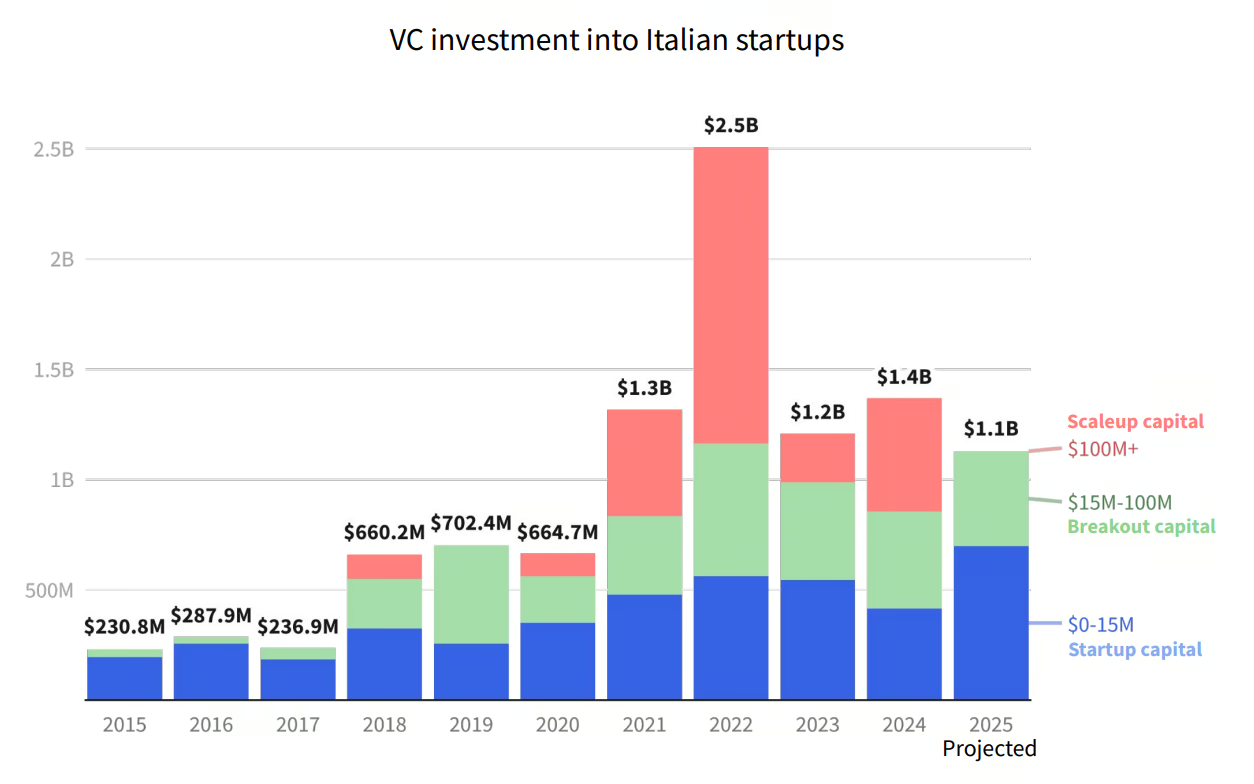

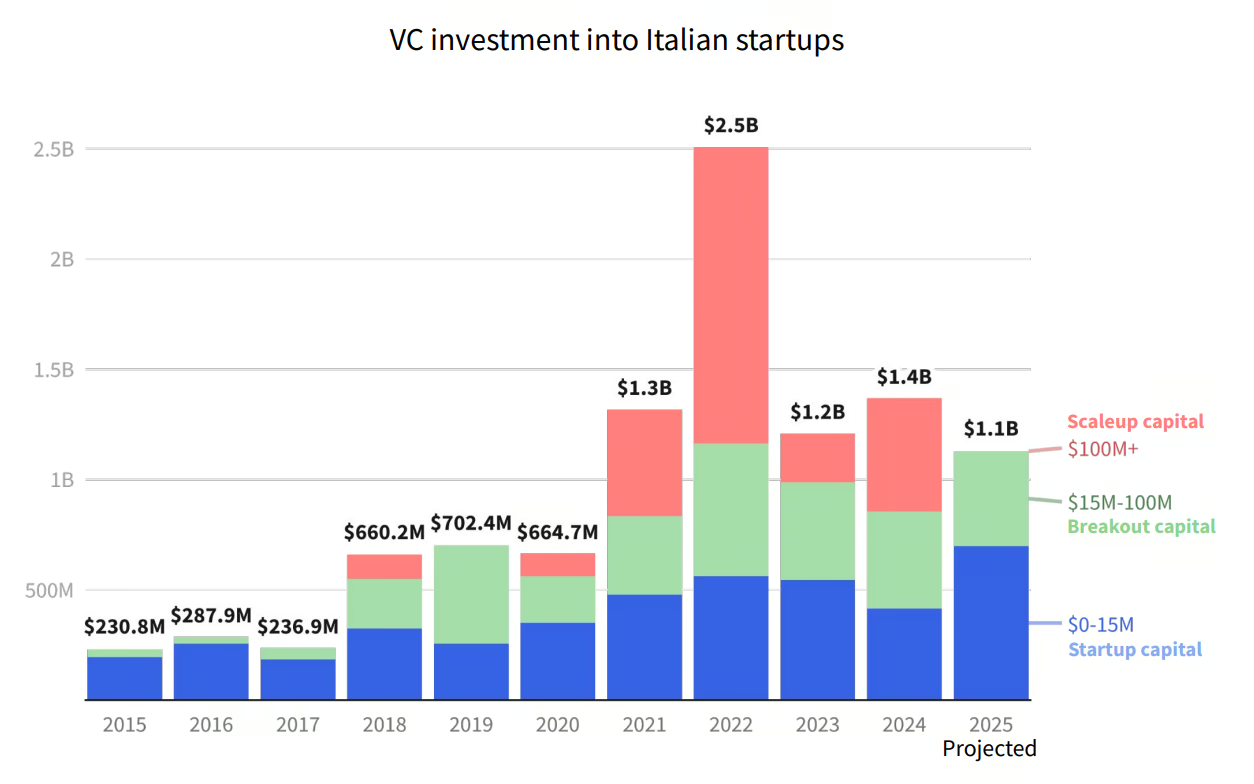

Though smaller than leading European markets like France or Germany, Italy’s startup investment landscape has grown steadily over the past few years.

In 2024, Italian startups attracted roughly US$1.4 billion, and investment is expected to exceed US$1 billion again in 2025, data from Dealroom show, underscoring the country’s increasingly vibrant innovation ecosystem.

Deal sizes have also increased as funding continues to shift toward later-stage rounds, reflecting the sector’s ongoing growth and maturation.

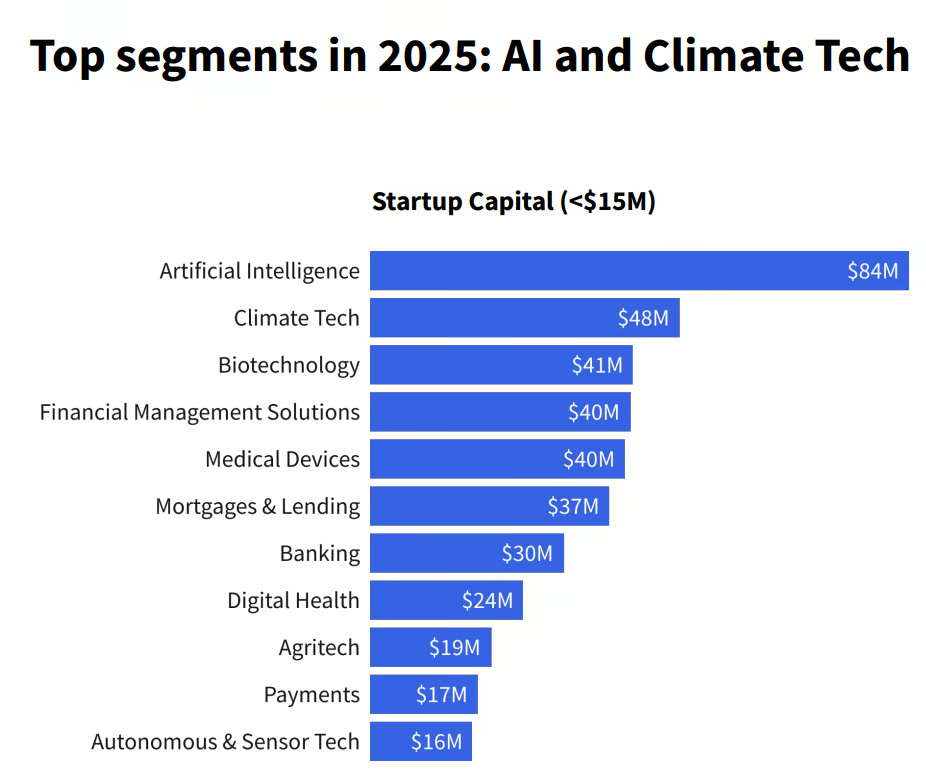

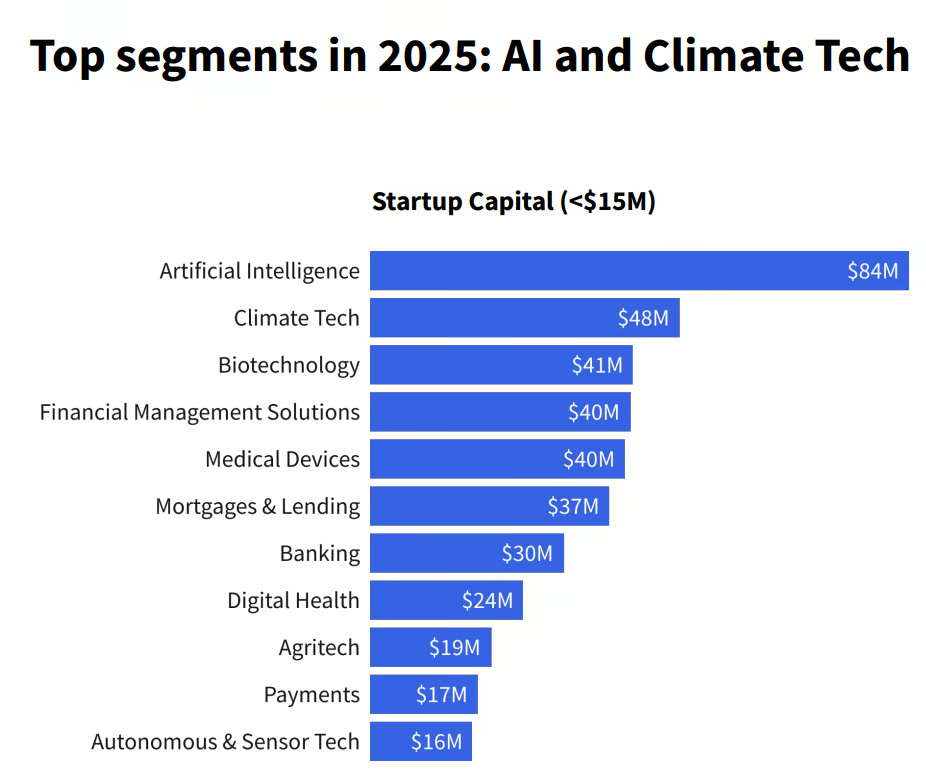

Fintech remains one of Italy’s strongest startup verticals. During the first seven months of 2025, Italian startups raised a total of US$396 million in startup capital, or rounds below US$15 million. Of this, 31.3% or US$124 million went to fintech ventures operating across financial management, lending, banking and payments, underscoring the dominant position of fintech in the country’s startup ecosystem.

Within this expanding ecosystem, several investors are standing out for their active role in supporting fintech innovation. These investors are recognized for being one of the most influential Italian investors in the sector, noted for their strong portfolios and sustained engagement.

They are all featured in a new research by CB Insights, which profiles the country’s top venture firms. The study ranks them based on their portfolio strengthen, ability to predict future winners, and their CB Insights Mosaic Score, a metric which assesses a company’s health, growth, and success potential.

Cassa Depositi e Prestiti (CDP)

Cassa Depositi e Prestiti (CDP) is the national promotional and development bank of Italy. Founded in 1850 in Turin, CDP originally financed public works but has since evolved into the country’s primary institution supporting long-term economic development and innovation. Today, CDP plays a key role by supporting Italian companies, public-sector projects, and high-growth industries, including fintech, blockchain, robotics and deeptech.

Its venture arm, CDP Venture Capital SGR – Fondo Nazionale Innovazione (National Innovation Fund) operates through direct and indirect investment funds, to support startups in all the stages of their lifecycle, with the aim of making the VC system a cornerstone of Italy’s economic development and innovation. It manages over EUR 1 billion in resources.

CDP’s Fin+Tech accelerator, part of its national accelerator network, supports fintech and insurtech startups, providing seed investments of up to EUR 300,000 (US$351,000), mentorship, and access to a network of partners.

According to Dealroom, CDP Venture Capital has backed 30 fintech startups. Notable fintech ventures in its portfolio include BKN301 Group, a London-based banking-as-a-service (BaaS) company; Viceversa, a revenue-based financing startup with offices in Milan and Dublin; and Digital Brokerage Europe, the operator of a digital brokerage lending platform in Italy called Leally.

Vento Ventures

Wholly funded by investment holding company Exor, Vento Ventures is one of the most active non-governmental early-stage fund in Italy. The firm backs young and promising startups, investing typically EUR 150,000 in initial investment with follow-on potential up to EUR 1 million. It’s sector- and geography-agnostic, but requires at least one Italian founder within each team it backs.

In addition to equity funding, Vento Ventures also runs a number of initiatives to strengthen the Italian tech ecosystem. These include Venture Building, an intensive five-month program designed to train aspiring founders, and Italian Tech Week, one of Europe’s most prominent innovation events.

Vento Ventures has backed more than 10 fintech companies. These include Qomodo, a buy now, pay later (BNPL) company from Italy; Tundr, a startup developing digital corporate welfare; and Perpethua, a digital platform that connects small and medium-sized enterprises (SMEs) with potential investors, and supports mergers and acquisitions (M&A) processes.

LVenture Group

LVenture Group is a publicly listed VC holding company that invests in early-stage digital startups with globally scalable business models. Together with its accelerator Luiss EnLabs, born from a joint venture

with Luiss University and thanks to a wide range of strategic partners such as Meta, Leonardo and CDP Venture Capital, LVenture Group is today a key point of reference on the Italian innovation scene.

LVenture Group provides seed investment of up to EUR 250,000 (US$293,000), alongside structured acceleration, mentorship, workspace, and access to a large investor network. It has accelerated more than 130 startups, with over EUR 174 million invested in its portfolio, and 13 exits.

In the fintech space, LVenture Group has invested in 13 ventures, according to Dealroom. Notable portfolio companies include 99Bros, an insurance brokerage platform combining AI and consultancy to help users compare and buy insurance; Insoore, a platform for insurance claims management; and Together Price, a digital platform helping users share the cost of subscription services.

United Ventures

United Ventures is an independent VC firm that supports tech innovators from seed to growth stage, providing capital, mentorship, business development support, and access to its extensive network of corporate and industry partners. The firm focuses on enabling technologies that reshape traditional industries and prioritizes founders capable of building products that modernize underserved markets.

In the fintech industry, United Ventures has invested in 14 fintech startups, according to Dealroom. Currently, it has at least five fintech companies in its portfolio, including Moneyfarm, a digital wealth manager; Credimi, a Italy-based factoring platform; and Trustfull, a Milan-based AI-powered fraud prevention technology company.

Primo Capital

Primo Capital is one of Italy’s leading independent platforms for alternative investments, focusing on cutting-edge technology in sectors that are crucial for economic development. Active in the VC and private equity segments, the firms now has over EUR 500 million (US$586 million) committed over multiple funds specializing in the digital, healthcare, climate tech and space economy sectors.

Its digital-focused investment fund, Primo Digital, focuses on high-potential tech startups in the digital sector, targeting fintech, business-to-business (B2B) software, retail and marketplaces, and cybersecurity. It closed at over EUR 62 million (US$73 million) in 2024, and is subscribed by the European Investment Fund, CDP Venture Capital, Banca Sella Holding, Tinexta and other high-standing family offices.

Primo Capital has backed five fintech startups, according to Dealroom. These include ChAI, a commodity pricing forecasting platform; Cryptobooks, a company developing accounting software solutions for digital assets; Eoliann, a startup helping financial institutions forecast climate risks; and Yolo, an on-demand insurance provider.

Gellify

Gellify is an Italian innovation platform that combines investment, technology development, strategy, and open innovation services. The platform connects B2B digital startups with established companies, supporting open innovation and digital transformation. It also operates as an investor, venture builder, and advisor to tech ventures, working across strategy, product development, technology integration, and business growth for digital businesses.

Gellify operates a wide innovation ecosystem, supported by a network of more than 30,000 innovators, and has validated 700 startups, invested in 60, and achieved six exits. In 2018, the firm acquired FinTechStage, a fintech-focused network, and has engaged in fintech ecosystem activities.

According to Dealroom, Gellify has backed eight fintech startups, including Datrix, a group of tech companies bringing artificial intelligence (AI) to vertical markets; Young Platform, a cryptocurrency trading platform in Italy; and Voices of Wealth, the Milan, Italy-based provider of We Wealth, a wealth management marketplace.

Featured image: Edited by Fintech News Switzerland, based on image by pranavkr via Freepik

Source link