Your special 30-day trial

Today’s unlocked story is What happens when a failed founder goes job hunting? : On average, over 35 startups shut down every day in India. Employees move on to their next stint, but most founders find themselves unemployed, thanks to their high pay and a leadership attitude

Continue reading to see other new subscriber stories from The Ken.

You are on a free plan.

Your subscription has expired.

Upgrade now to unlock premium newsletters, top feature stories, exclusive podcasts, and more.

Let’s say you’re a fintech firm and you’ve tapped the market as much as you can. What’s your next move?

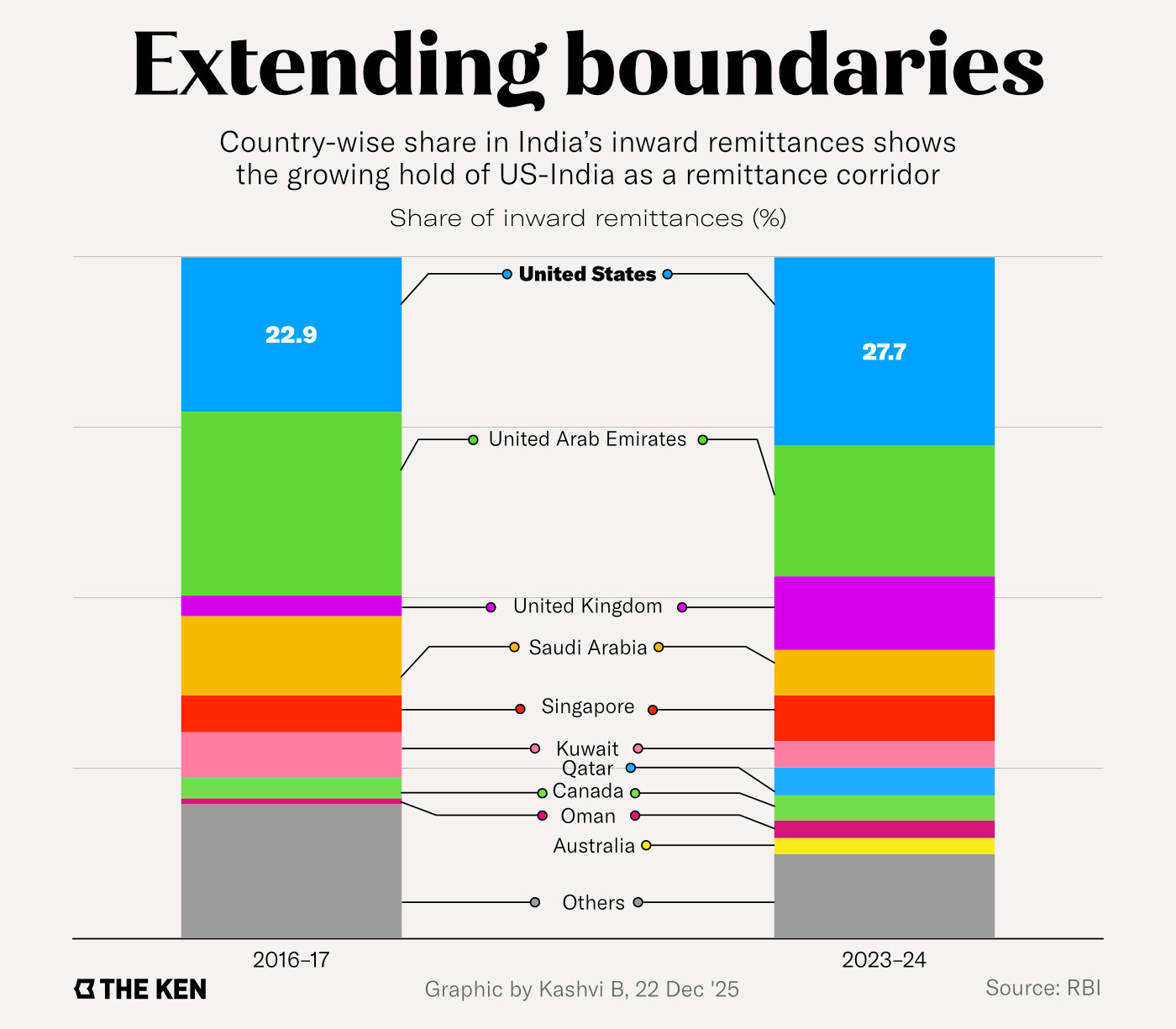

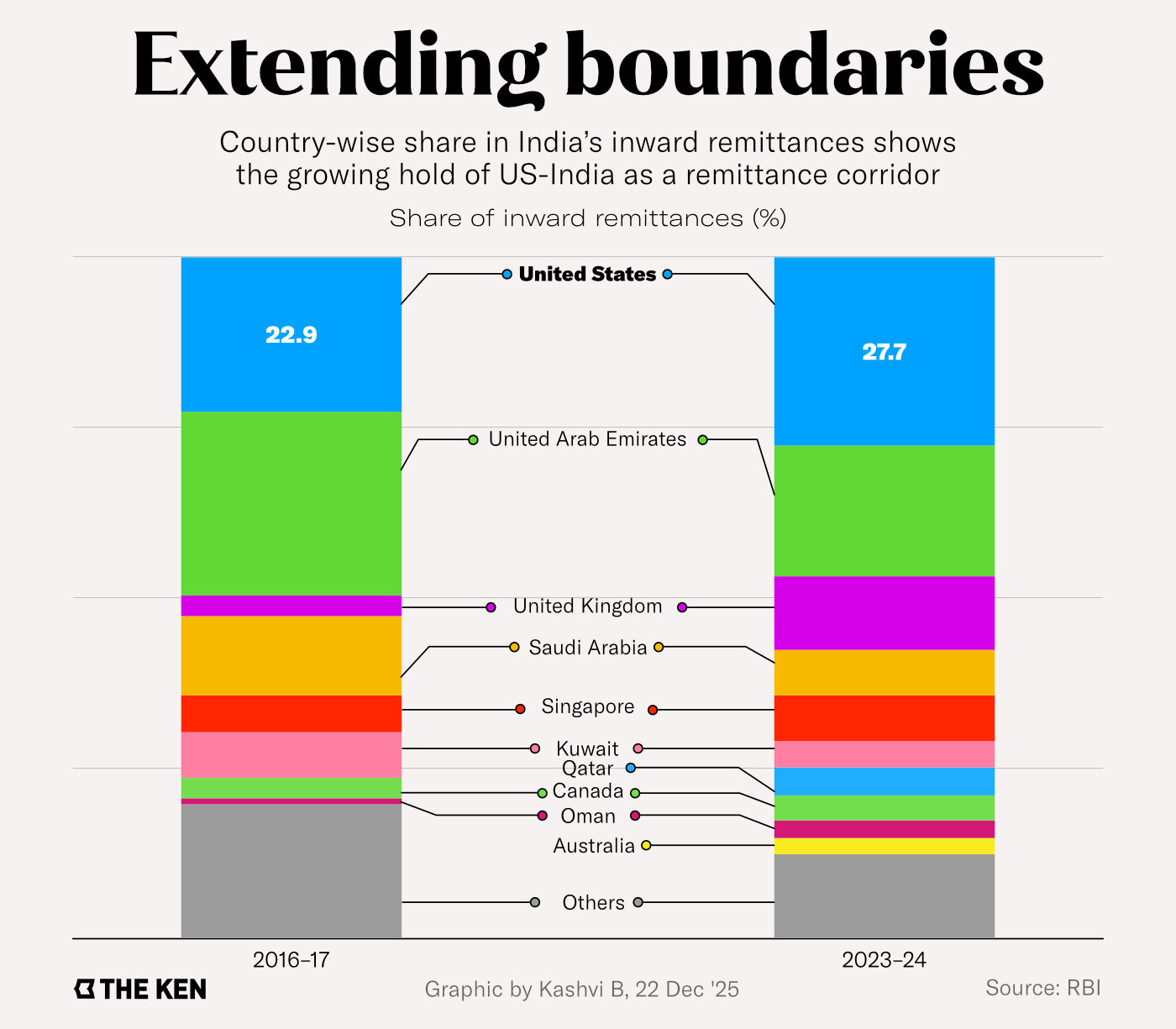

For Aspora (formerly known as Vance), the choice was straightforward: help 15 million non-resident Indians move their money back into the country. After all, the diaspora sent $135 billion back to India in 2025, so securing a slice is no small deal.

The catch is that other fintech service providers have the same plan. But Aspora appears to have found a way to differentiate itself. It claims to have 800,000 users who have sent a combined $2 billion to India over three years—an impressive pace of growth in a crowded space.

Cross-border remittance is a notoriously low-margin business. For customers, Aspora is the cheapest service provider out there, charging a $3 flat fee on transactions of any size. In a sector where there’s virtually no room to cut costs, Aspora is utilising rails that carry risk, including the banking regulator simply not recognising some of the deposits it makes to receivers’ accounts.

Arundhati found out how all of this works and why it might not last in the long run, unless banking regulations change. Check out today’s story to read about it.

Got a tip? If you have a lead for a great story that The Ken can pursue, please send it to [email protected] or share it through this form. To find out more about how to do this securely, read our blog post about sharing tips with The Ken.