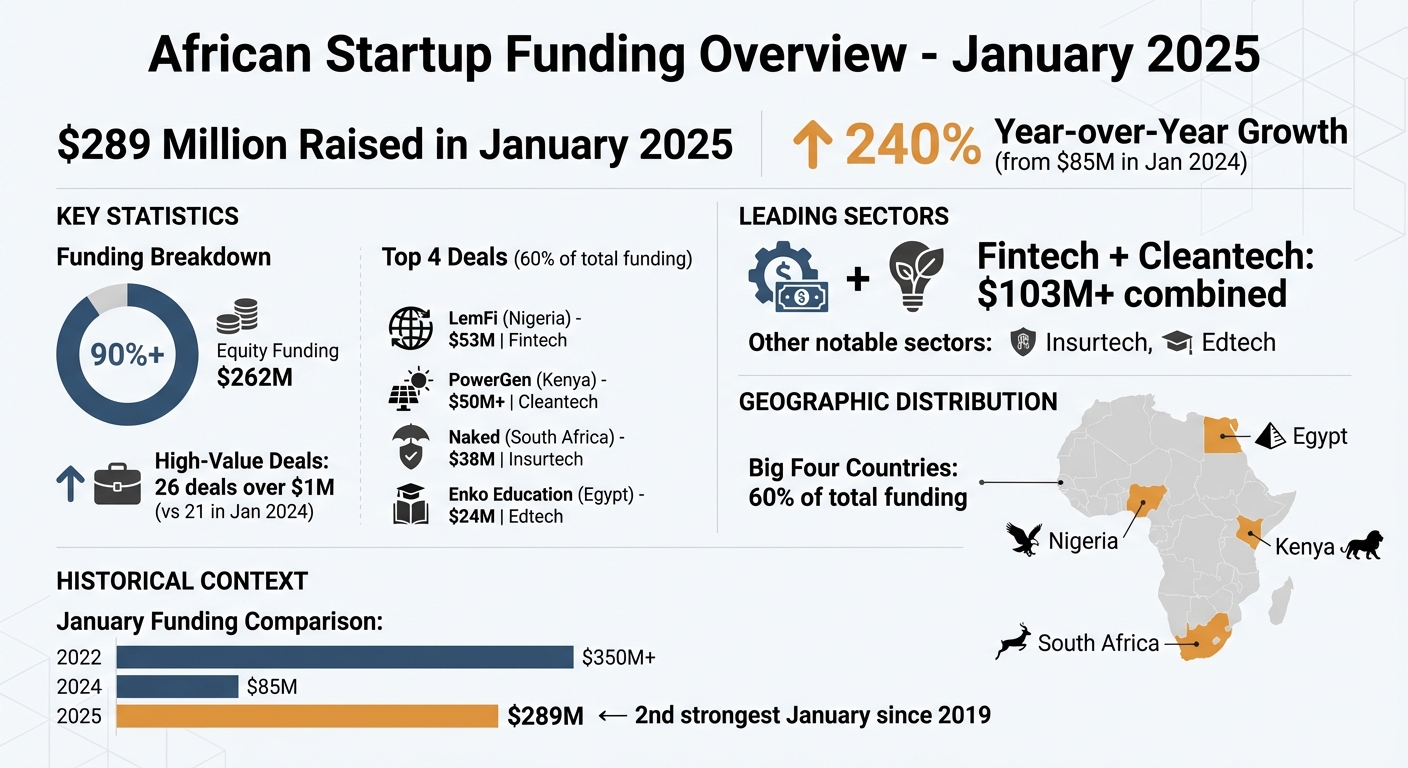

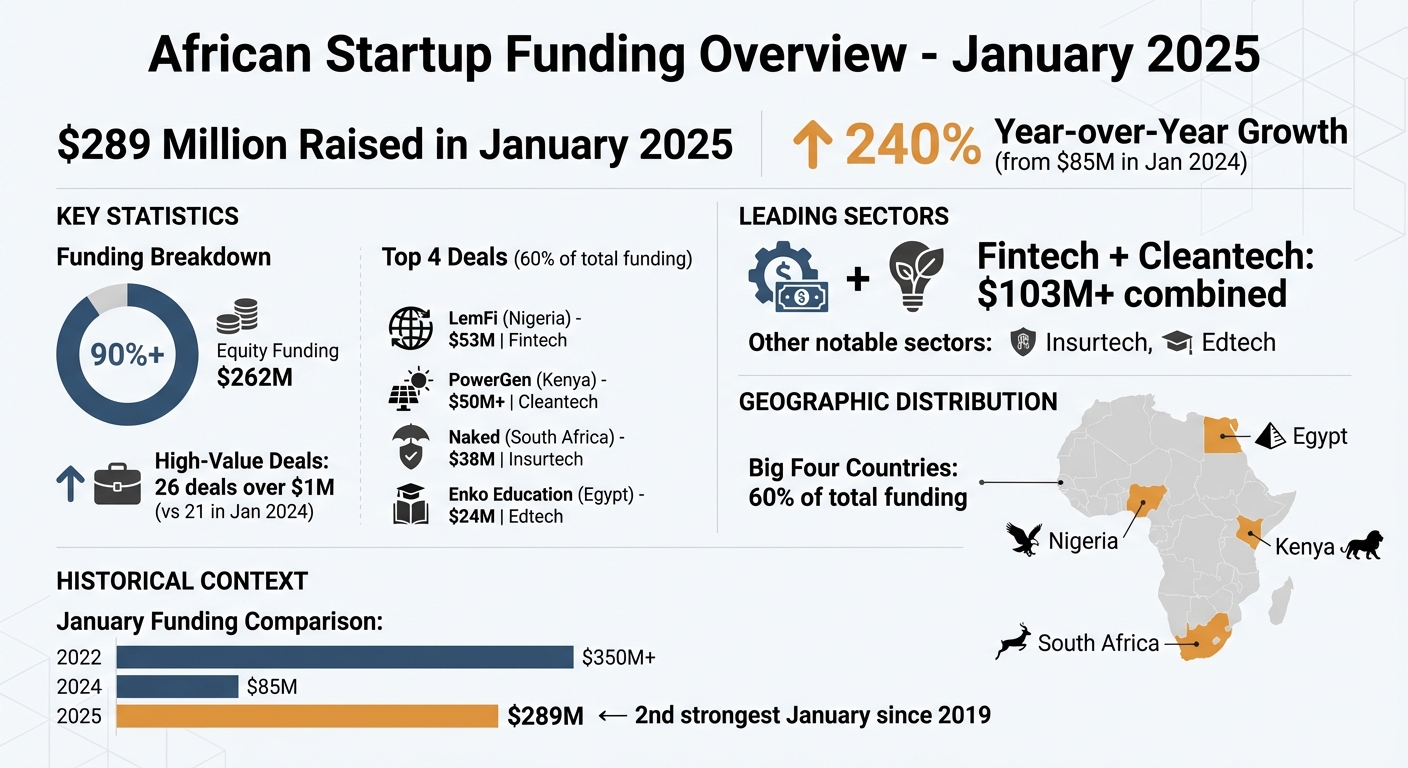

African startups secured $289 million in January 2025, a sharp 240% increase from the $85 million raised in January 2024. This marks the second-strongest January for funding since 2019, signaling renewed investor confidence after a challenging 2024. Key highlights include:

- Equity funding dominated: $262 million (over 90% of total funding).

- High-value deals increased: 26 deals over $1M, compared to 21 in January 2024.

- Top sectors: Fintech and cleantech led with over $103 million combined.

- Major deals: Nigeria’s LemFi ($53M), Kenya’s PowerGen ($50M+), South Africa’s Naked ($38M), and Egypt’s Enko Education ($24M).

- Big Four countries: Nigeria, Kenya, South Africa, and Egypt accounted for 60% of total funding.

This strong start hints at a recovery for Africa’s startup ecosystem, with funding momentum expected to grow throughout 2025.

African Startup Funding January 2025: $289M Raised, 240% YoY Growth

Funding Numbers and Patterns

Equity Financing Takes the Lead

Out of the $289 million raised in January 2025, $262 million came through equity financing.

This marks a clear shift toward equity over debt, reflecting investors’ growing confidence in the long-term potential of African startups. Rather than relying on short-term loans, backers are placing bets on ventures with strong traction and solid business models. This trend highlights a preference for businesses poised to scale and deliver sustainable returns.

Another key insight is the move toward fewer but larger deals. While the total number of funding rounds (above $100,000) was lower than in the past three years, the number of rounds exceeding $1 million climbed to 26, compared to 21 in January 2024. These patterns underscore a growing appetite for substantial investments in startups with proven potential.

How January 2025 Compares to Past Years

Looking at the bigger picture, January 2025 emerged as the second-strongest January for startup funding since 2019, trailing only January 2022. The month saw startups raise $289 million, a dramatic 3.5x increase compared to the $85 million secured during January 2024.

| Year (January) | Total Funding | Equity Funding | $1M+ Deals |

|---|---|---|---|

| 2022 | $350M+ | $320M+ | 35 |

| 2024 | $85 million | ~$60 million | 21 |

| 2025 | $289 million | $262 million | 26 |

This recovery from 2024’s funding dip signals a return to strong momentum. Notably, the top four deals alone accounted for about 60% of the continent’s total funding for the month. These figures highlight the growing concentration of capital in high-performing ventures, further reinforcing investor confidence in the region’s startup ecosystem.

sbb-itb-dd089af

Largest Deals and Leading Startups

Major Funding Rounds

January 2025 proved to be a strong month for African startups, with four standout funding rounds accounting for 60% of the $289 million raised. These deals highlight where investors are placing their confidence across various sectors. Nigerian fintech LemFi led the charge, securing a $53 million Series B round to expand its remittance and cross-border payment services into Asia and Europe. Kenya’s PowerGen followed closely with over $50 million to scale its distributed renewable energy platform. In South Africa, insurtech company Naked raised $38 million in a Series B round to further develop its AI-driven automated insurance solutions. Meanwhile, Egyptian edtech startup Enko Education secured $24 million to grow its network of international schools across the continent.

Here’s a breakdown of these major deals for a clearer picture.

Deals by Sector and Country

The table below provides a snapshot of the largest funding rounds, categorized by sector, country, and each startup’s expansion plans.

| Startup | Amount | Sector | Country | Expansion Plans |

|---|---|---|---|---|

| LemFi | $53M | Fintech | Nigeria | Expanding remittance and payment services into Asia and Europe |

| PowerGen | $50M+ | Cleantech | Kenya | Scaling distributed renewable energy solutions across Africa |

| Naked | $38M | Insurtech | South Africa | Enhancing automated insurance offerings and expanding market reach |

| Enko Education | $24M | Edtech | Egypt | Growing its network of international schools across Africa |

These major funding rounds underscore the continued investor confidence in Africa’s top startup ecosystems. It’s worth noting that three out of the four largest deals involved startups with plans to expand beyond their home markets. The concentration of capital in Nigeria, Kenya, South Africa, and Egypt further highlights the dominance of these key hubs in driving innovation and growth on the continent.

Sectors Attracting the Most Investment

Fintech Leads the Way, Cleantech Picks Up Speed

Fintech continues to dominate as the most-funded sector across Africa. In January 2025 alone, fintech and cleantech together pulled in over $103 million out of the total $289 million raised. Much of the fintech investment is aimed at cross-border payment systems, reflecting a strong push to support African startups expanding into Asian and European markets.

Cleantech is quickly gaining traction, driven by a global focus on sustainability and green financing. Renewable energy projects, in particular, are drawing significant interest as they tackle energy poverty with sustainable solutions. Investor Pukhraj Prajapat summed it up well: “Fintech + renewables = 50% of this funding? No surprise – these sectors tackle Africa’s urgent needs”. Both sectors are attracting capital for their ability to address pressing challenges while offering promising financial returns.

While fintech and cleantech dominate the funding landscape, other sectors like insurtech and edtech are also starting to make waves, signaling a more diversified startup ecosystem.

Rising Interest in Insurtech and Edtech

Although fintech and cleantech grab the spotlight, insurtech and edtech are steadily gaining investor attention. Recent funding rounds in these areas highlight a growing interest in ventures that address untapped markets and societal needs.

Insurtech is transforming traditional insurance models by integrating automation, with investments aimed at streamlining services and expanding access in underserved regions. Meanwhile, edtech is focusing on scaling school networks and improving access to quality education across the continent. While these sectors don’t yet match fintech in funding volume, their upward momentum suggests they’re becoming increasingly appealing to investors seeking ventures with meaningful impact and strong growth potential.

The State of tech in Africa 2025 | A Keynote by Maxime Bayen

Where the Money Went: Top 4 Countries

In January 2025, four countries – Nigeria, Kenya, Egypt, and South Africa – dominated Africa’s funding scene, collectively accounting for around 60% of the total $289 million raised. What stands out this year is the focus on funding deals aimed at global expansion.

Big names like Nigeria’s LemFi ($53M in fintech), Kenya’s PowerGen (over $50M in cleantech), South Africa’s Naked ($38M in insurtech), and Egypt’s Enko Education ($24M in edtech) drove a significant portion of this total, contributing over $165 million.

These large-scale deals are the result of mature startup ecosystems, government support, and a wealth of talent. For instance, Nigeria’s Startup Act and the creation of Special Economic Zones have streamlined access to capital and resources for entrepreneurs. Meanwhile, investors are shifting their focus from rapid growth at any cost to profitability and sustainable scaling. This evolving mindset is helping startups turn regional advantages into global opportunities.

Equity financing reflects this trend, with a total of $262 million raised in January alone. This signals a clear preference among investors for backing established ventures over riskier early-stage startups.

Startups Expanding Beyond Africa

A key theme among the largest deals in January 2025 is international expansion. With new funding in hand, African startups are setting their sights on competing globally.

Take LemFi as an example. Their $53 million raise is aimed at expanding into Asia and Europe, targeting the remittance and cross-border payment markets. This approach highlights how African startups are leveraging their expertise in tackling local challenges to address similar issues in more developed markets, positioning themselves as serious players in the global fintech space.

This trend aligns with the broader equity financing patterns, showing increased confidence from both founders and investors. Startups in these leading markets have proven their ability to build resilient business models, even in tough conditions. As Davidson Oturu, General Partner at Nubia Capital, pointed out:

“Nigerian startups have substantial opportunities to position themselves more competitively for funding in 2025”.

Now, that competitiveness is no longer confined to Africa – it’s reaching far beyond the continent.

What to Expect in 2025

Recovery from 2024’s Decline

The start of 2025 has brought a much-needed turnaround after a challenging 2024, when African startups managed to raise just $2.2 billion throughout the year. Last year, many startups shifted their focus to survival – cutting costs and proving they could turn a profit. Now, investors are prioritizing companies with solid, sustainable business models over flashy growth promises. Sectors like energy, climate-tech, and healthtech are drawing attention because they offer clearer paths to revenue. Development Finance Institutions and African institutional funds are stepping up in a big way, leading deals over $50 million and providing a stable alternative to traditional venture capital.

Uwem Uwemakpan, Head of Investment at Launch Africa Ventures, summed it up well:

“We sort of expected this rebound after 2024’s correction. What’s more interesting are the quality signals embedded in these trends that suggest we’re entering a more mature exit environment for seed-stage investments”.

This shift in focus is rewarding startups that demonstrate strong unit economics and clear profitability plans. Gone are the days when growth potential alone was enough to secure funding. With these changes, the stage is set for a strong push in funding activity as the year progresses.

Full-Year Funding Forecast

The momentum from January’s rebound has carried through 2025, with funding levels climbing steadily. By midyear, startups had raised between $1.2 billion and $1.4 billion, marking a year-over-year increase of 78–86%. By December, the total funding for 2025 surpassed $3 billion, making it the best year since 2022.

This growth is being driven by a mix of factors. Startups are increasingly exploring alternatives to traditional equity funding, such as venture debt, asset-backed securitization, and blended finance, to support capital-heavy projects. A notable example is Sun King‘s $156 million solar securitization deal in December, backed by Citi, ABSA, and Stanbic – a clear sign that infrastructure-grade financing is becoming more common. Another standout is Wave Mobile Money‘s $137 million syndicated debt facility in June, led by Rand Merchant Bank with contributions from BII, Norfund, and Finnfund.

While fintech remains the leading sector, it’s evolving. In the first half of 2025 alone, fintech startups raised about $640 million. According to Uwemakpan:

“The companies getting funded aren’t competing in basic payments or lending anymore; they’re building regtech, embedded finance, B2B trade finance infrastructure that benefits from fintech’s maturation”.

Healthtech is also making strides, pulling in around $160 million during the first half of the year. A standout deal came from South Africa’s hearX (LXE Hearing), which secured $100 million as part of its merger with U.S.-listed Eargo, supported by Patient Square Capital. These trends highlight a growing investor interest in sectors that address essential needs, not just within Africa but on a global scale.

Conclusion

January 2025 saw a remarkable leap in funding, hitting $289 million – a 240% jump from January 2024’s $85 million. This sharp rise reflects a shift in investor sentiment, moving from cautious approaches to confident backing of ventures with global ambitions and scalability.

Key sectors like fintech, cleantech, insurtech, and edtech led the charge, while the “Big Four” – Nigeria, Kenya, Egypt, and South Africa – secured around 60% of the total funds. Equity financing dominated, making up more than 90% of the capital raised. Startups strategically used these funds to strengthen operations, expand into international markets, and scale across the African continent.

This strong start set the tone for the year’s funding trajectory. By August, ecosystem funding reached $2.8 billion, surpassing $3 billion by December. Debt financing also gained ground, crossing the $1 billion mark and narrowing the gap with equity funding.

FAQs

What led to the 240% increase in funding for African startups in January 2025?

The impressive $289 million raised by African startups in January 2025 represents a staggering 240% jump from the $85 million raised during the same month in 2024. This growth was primarily driven by equity financing, which made up more than 90% of the total funding – about $262 million. This surge underscores a growing trust from investors in the potential of African entrepreneurs.

Four key markets – Nigeria, Kenya, Egypt, and South Africa – dominated the scene, collectively securing around 60% of the total funding. Much of this success came from major funding rounds, which played a pivotal role in boosting overall numbers.

Some standout deals included PowerGen’s $50 million investment in renewable energy, LemFi’s $53 million to fuel its fintech expansion, and Naked’s $38 million Series B round focused on advancing insurtech solutions. Beyond these headline-grabbing rounds, the number of $1 million-plus deals also climbed, with 26 transactions in January 2025 compared to 21 the previous year. This uptick highlights a growing trend of African startups scaling their operations globally and drawing in international investors who are eager to back ventures that promise both growth and meaningful impact.

The funding boom can largely be attributed to a mix of equity-driven investments, the dominance of established ecosystems, and significant large-scale deals that continue to strengthen confidence in Africa’s entrepreneurial landscape.

Why are fintech and cleantech attracting the most investment in Africa?

Fintech is dominating investment in Africa, largely because a huge portion of the population remains unbanked. This has created a massive demand for digital financial tools like mobile wallets, digital payment systems, and credit-scoring platforms. These technologies sidestep the need for traditional banking infrastructure, offering scalable ways to improve financial access. With over a billion potential users across the continent, fintech startups are attracting significant attention. For example, LemFi recently secured $53 million, highlighting the sector’s high-growth potential and promising returns.

Cleantech is another key area drawing substantial funding, driven by Africa’s pressing energy challenges and the global shift toward renewable energy. Investors are backing initiatives like PowerGen, which raised $50 million to develop distributed renewable energy solutions for underserved areas. Africa’s rich natural resources, supportive policies, and the urgent need for sustainable infrastructure make cleantech a sector that delivers both meaningful impact and attractive financial returns.

How are African startups using their recent funding to expand globally?

African startups are making bold moves into international markets, fueled by recent funding successes. Take Nigerian fintech LemFi, for example. With $53 million from its Series B funding, the company has set up operations in Europe and Asia. They’ve been hiring local talent and tailoring their platform to align with regional regulations. This is part of a larger wave of African startups using investments to scale beyond the continent.

Key industries like energy and insurtech are leading the charge. Companies are channeling funds into opening overseas offices, building strategic partnerships, and customizing their offerings for markets in places like Europe, North America, and the Middle East. The record-breaking $289 million raised in January 2025 underscores growing investor confidence and is laying the groundwork for long-term global expansion.

Related Blog Posts

Source link