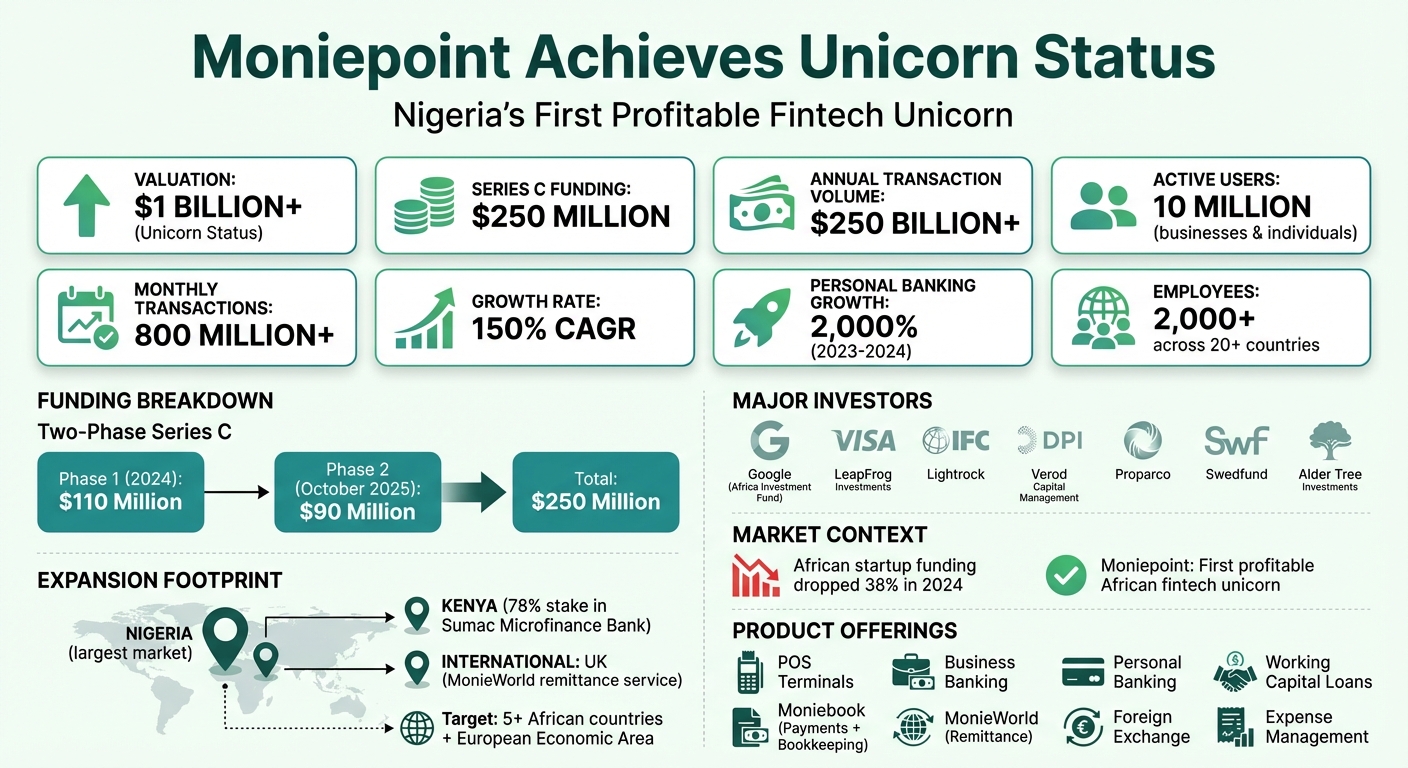

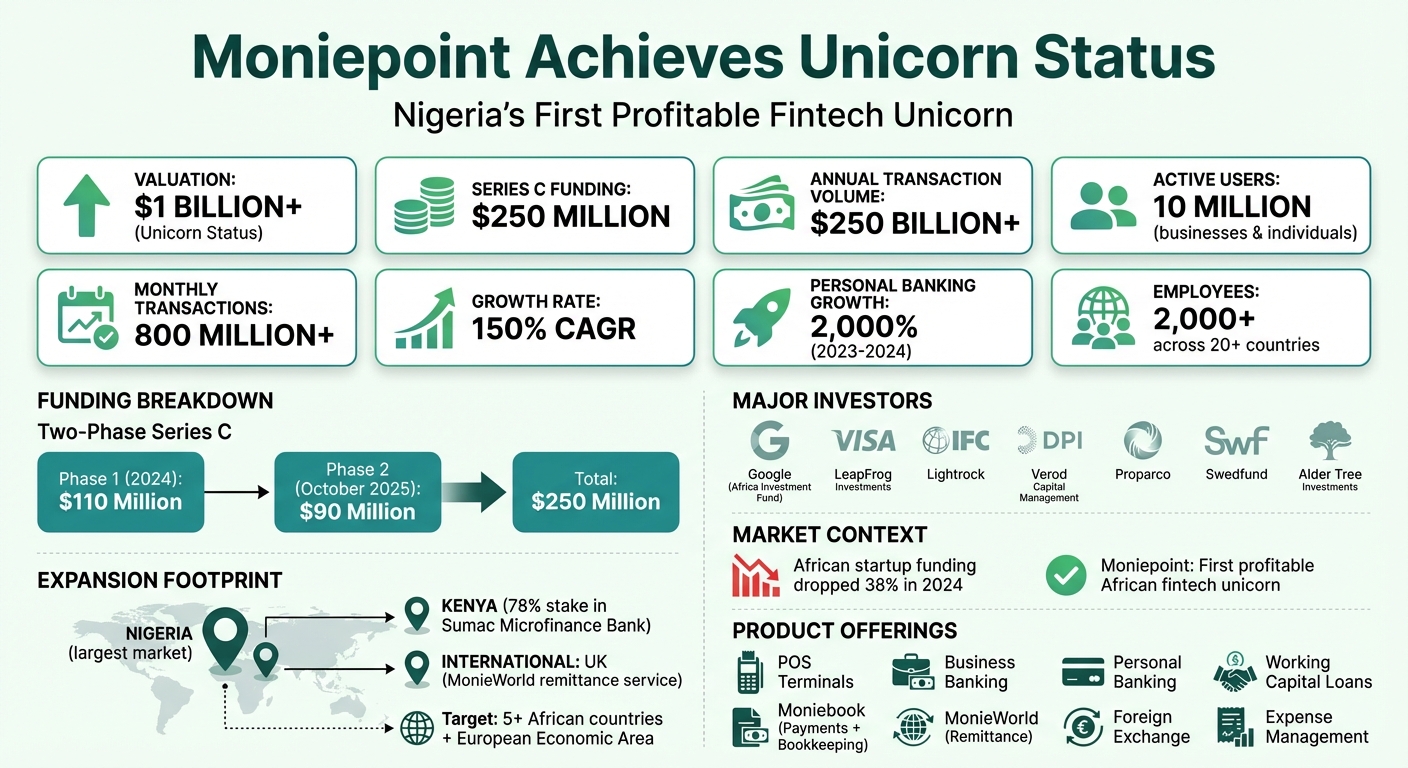

Moniepoint, a Nigerian fintech company, has officially reached unicorn status by raising $250 million in Series C funding, pushing its valuation beyond $1 billion. This milestone is especially notable as African startup funding dropped by 38% in 2024. Moniepoint stands out as the first African fintech unicorn to achieve profitability, processing over $250 billion annually and serving 10 million active users, including businesses and individuals.

Key details:

- Funding: $250M Series C, finalized in October 2025.

- Investors: Google, Visa, IFC, DPI, LeapFrog Investments, and others.

- Focus: Agency banking and MSME financial services.

- Expansion Plans: New markets in Africa and Europe, plus product innovations like Moniebook (a payment and bookkeeping tool).

Moniepoint’s journey highlights its strong growth (150% CAGR) and resilience, especially during Nigeria’s 2023 cash crisis. By addressing MSME banking needs and expanding globally, the company is reshaping financial access across Africa and beyond.

Moniepoint’s Journey to Unicorn Status: Key Metrics and Milestones

Moniepoint CEO: This is the Future of Fintech in Nigeria

The $250M Series C Funding Round

Moniepoint has taken a major step forward with its $250M Series C funding round, finalized in October 2025. This funding came in two phases: an initial $110M raised in 2024 and an additional $90M announced in October 2025.

Lead Investors and Their Contributions

Development Partners International (DPI) spearheaded the funding round through its African Development Partners (ADP) III fund, while LeapFrog Investments played a key role in the final phase. Other prominent investors included Google’s Africa Investment Fund, Visa, the International Finance Corporation (IFC), Lightrock, Verod Capital Management, Proparco, Swedfund, and Alder Tree Investments.

Each investor brought unique insights and resources to the table. DPI concentrated on scaling Moniepoint’s growth and driving innovation. LeapFrog Investments highlighted the importance of empowering micro, small, and medium-sized enterprises (MSMEs) with digital tools to create a broader social impact. The IFC aimed to enhance digital payment adoption among underserved MSME retailers in Nigeria, while Visa continued to deepen its involvement in Africa’s fintech sector following earlier investments in the region.

Adefolarin Ogunsanya, Partner at DPI, shared: “DPI is proud to have anchored this round, reaffirming our conviction and support for the business and its leadership team”.

With these funds secured, Moniepoint is ready to execute its ambitious growth strategies.

Strategic Allocation of Funds

The $250M investment will fuel three main priorities: expanding into new African and international markets, launching innovative financial products, and bolstering infrastructure to support a growing customer base. A key focus is developing an all-in-one platform that integrates digital payments, banking, foreign exchange, credit, and business management tools.

Geographic expansion plans include reaching more African countries and serving the global African diaspora. Moniepoint recently introduced MonieWorld, a remittance service for Africans in the United Kingdom, with plans to scale it further. On the product front, the company will enhance Moniebook, a payment and bookkeeping solution tailored for MSMEs.

Founder and CEO Tosin Eniolorunda remarked: “Funds from the Series C will drive further growth to accelerate growth and enhance financial inclusion across Africa”.

Moniepoint’s Products and Market Reach

Services and Customer Numbers

Moniepoint operates an integrated financial platform that caters to over 10 million active business and personal banking customers across Africa. Impressively, the company handles more than $250 billion in digital payments annually.

Its platform offers a range of services, including point-of-sale (POS) terminals, working capital loans, business expansion credit, and expense management through payment cards designed for businesses. A notable milestone came in December 2025 with the launch of Moniebook, Nigeria’s first solution to combine payments and bookkeeping for micro, small, and medium enterprises (MSMEs). This tool provides business owners with a unified view of their sales, customers, and payments, seamlessly integrated with their POS systems. Expanding beyond business services, Moniepoint entered the personal banking sector in August 2023, achieving 20x customer growth within just one year (2023–2024).

Moniepoint’s reach isn’t limited to Nigeria. In June 2025, the company secured regulatory approval to acquire a 78% stake in Kenya’s Sumac Microfinance Bank, extending its proven business model to East Africa. Additionally, in April 2025, it introduced MonieWorld, a remittance service aimed at the African diaspora in the United Kingdom. This marked the company’s first significant step into international markets. Together, these services highlight Moniepoint’s commitment to expanding its footprint and improving financial accessibility across Africa.

Improving Financial Access in Africa

Moniepoint plays a critical role in addressing Africa’s financial inclusion challenges, particularly for MSMEs, which often lack access to traditional banking and formal credit. Through its extensive agency banking network, Moniepoint has brought essential financial services to underserved areas, becoming Nigeria’s largest merchant acquirer and powering the majority of the country’s POS transactions.

By focusing on underserved MSMEs, Moniepoint supports economic growth and job creation across the continent.

Karima Ola, Partner at LeapFrog Investments, stated: “MSMEs are the heartbeat of African economies – creating the majority of jobs and driving innovation. However, the vast majority have no access to digital banking and formal credit. Moniepoint has become an indispensable partner to MSMEs by empowering them with the digital tools and trust they need to transact, grow, and employ others at scale.”

The company has also introduced an automated refund system that processes failed transactions within 24–48 hours – much faster than the industry standard of 5–10 working days. By offering affordable POS devices alongside loans, bookkeeping, and business management solutions, Moniepoint enables merchants to expand their operations, particularly in cash-dominated sectors.

sbb-itb-dd089af

Expansion Plans and Growth Targets

New African Markets

Moniepoint is making strides to broaden its footprint across Africa, with plans to establish operations in at least five African countries in the coming years. Potential markets for expansion include Ghana, South Africa, and French-speaking nations like Côte d’Ivoire and Senegal. To drive this ambitious growth, the company has built a workforce of over 2,000 employees spread across more than 20 countries.

Entering International Markets

Beyond Africa, Moniepoint is setting its sights on global opportunities. In April 2025, the company introduced MonieWorld, a service tailored for the Nigerian diaspora in the UK. Shortly after, it acquired Bancom Europe, gaining FCA-regulated licenses that extend across the European Economic Area (EEA). This move strategically positions Moniepoint to expand its reach into European markets beyond the UK.

The UK launch came with substantial upfront costs. In 2025, Moniepoint reported a $1.2 million loss tied to establishing its UK operations. However, this investment underscores the company’s long-term vision to serve Africans wherever they are in the world.

Tosin Eniolorunda, Founder and Group CEO, shared: “The proceeds from our landmark Series C will be deployed judiciously to generate even more momentum as we enter the next chapter of Moniepoint’s story – with financial happiness for Africans everywhere remaining our ultimate goal”.

Building Engineering Teams and New Products

As part of its growth strategy, Moniepoint is scaling up its engineering capabilities and diversifying its offerings. The company is channeling its Series C funding into talent acquisition, compliance measures, and infrastructure to support its entry into regulated international markets. Moving beyond its origins in agency banking, Moniepoint is evolving into a full-fledged business operating system, introducing tools for accounting, bookkeeping, and expense management.

With an impressive 2,000% growth in personal banking over the past year, Moniepoint is developing unified platforms that integrate digital payments, banking, foreign exchange, and credit solutions for both businesses and individual users. These engineering initiatives are designed to help the company navigate diverse regulatory landscapes while maintaining the high service standards that proved critical during Nigeria’s 2023 cash crisis.

Effects on Africa’s Tech and Fintech Sector

How Moniepoint Compares to Other African Unicorns

Moniepoint has carved out a distinct niche in Africa’s fintech landscape by focusing on micro, small, and medium enterprises (MSMEs) rather than the more common emphasis on consumer payments. This strategy has proven particularly effective, especially during Nigeria’s 2023 cash crisis. While traditional banks struggled with system failures, Moniepoint’s infrastructure remained reliable, showcasing its resilience and operational strength.

| Feature | Moniepoint | Typical African Unicorns |

|---|---|---|

| Profitability Status | Profitable at unicorn scale | Often pre-profit or in high-burn phases |

| Primary Focus | MSMEs and business banking | Consumer payments and P2P transfers |

| Transaction Volume | $250B+ annually | Varies by company |

| Market Strategy | Hybrid (app + physical POS agents) | Primarily digital-first |

| Investor Profile | Global giants + impact investors | Primarily VC-led |

These strengths set Moniepoint apart, making it a standout example of how a focused and profitable business model can redefine success in the African fintech space. Its success is also drawing attention from global investors, highlighting the potential of the region’s tech ecosystem.

Attracting More Investment to African Startups

Moniepoint’s rise to unicorn status has become a beacon for global investors eyeing opportunities in Africa. Harry Clynch, a journalist at African Business, noted:

Moniepoint achieving unicorn status was read by many as a sign of the growing maturity of the market.

The numbers back this up. With over 800 million monthly transactions and biometric identification now accessible to more than 115 million Nigerians, the foundation for large-scale digital finance is firmly in place. For African entrepreneurs, Moniepoint’s journey underscores a key lesson: focusing on profitability and building sustainable businesses can be far more appealing to global investors than merely pursuing user growth.

Conclusion

Moniepoint’s $250 million Series C funding marks a pivotal moment for African fintech. By serving over 10 million active business and personal banking users, the company has shown that offering dependable infrastructure and integrated tools – ranging from payments to bookkeeping – can lead to both profitability and a meaningful impact. As Tosin Eniolorunda, Founder and Group CEO, aptly put it:

We founded the company out of a genuine passion to widen financial inclusion and to help African entrepreneurs realise their potential.

The numbers speak for themselves. Moniepoint’s high transaction volumes and consistent profitability reinforce its position as a market leader. These achievements highlight the growing interest from global investors in businesses that balance impact with sustainability.

For the wider ecosystem, Moniepoint’s journey underscores a major shift in African fintech. The involvement of major players like Google and Visa, alongside development finance institutions, demonstrates that businesses can successfully align purpose with profit. Karima Ola from LeapFrog Investments emphasized this point:

MSMEs are the heartbeat of African economies… Moniepoint has become an indispensable partner to MSMEs by empowering them with the digital tools and trust they need to transact, grow, and employ others at scale.

Moniepoint’s transformation from a payment infrastructure provider to a full-fledged financial platform shows the power of focusing on underserved markets with customer-first solutions. With over 800 million monthly transactions and a growth rate exceeding 150% CAGR, the company is setting itself up as a key player in shaping Africa’s financial future. Its blend of proven technology and a customer-focused approach positions Moniepoint to expand its impact and redefine financial services on a broader scale.

FAQs

Why is Moniepoint reaching unicorn status a big deal for African fintech?

Moniepoint’s rise to unicorn status – achieving a valuation of over $1 billion – marks a significant moment for African fintech. It proves that a locally built, profit-driven payments platform can reach the kind of scale and acclaim typically associated with global tech leaders. The company’s recent $250 million Series C funding round, led by Development Partners International’s ADP III fund and backed by key players like Google’s Africa Investment Fund, Visa, and the International Finance Corporation, underscores the growing global belief in Africa’s ability to produce thriving, high-growth fintech companies.

What makes this achievement stand out even more is Moniepoint’s consistent profitability while expanding into multiple markets. In a period where startup funding across Africa has slowed, Moniepoint’s story shows that large-scale financial services companies can not only survive but also attract diverse investment and drive progress. With its expanding suite of offerings – including digital payments, banking, FX, credit, and business tools – it’s well-positioned to boost financial inclusion and spark further investment in the African fintech landscape.

How does Moniepoint plan to use the $250 million raised in its Series C funding round?

Moniepoint hasn’t shared exactly how it plans to use the $250 million raised in its Series C funding. However, looking at its track record from earlier funding rounds, the company has prioritized expanding into new regions and improving its product lineup. This latest funding will likely help Moniepoint grow its operations further and push forward its efforts to bring new ideas to financial services across Africa.

What challenges does Moniepoint face when expanding into international markets?

Expanding into international markets presents a series of challenges for Moniepoint. One of the biggest obstacles is dealing with complex regulatory requirements. Each country has its own set of rules, from licensing procedures to data protection laws and compliance standards. These differences can drive up operational costs. For instance, Europe’s stricter anti-money laundering regulations demand a higher level of compliance compared to what’s required in many African countries.

Another significant hurdle is adapting Moniepoint’s technology to fit the needs of new markets. The company’s systems are built for regions that rely heavily on mobile broadband and USSD-based transactions. Moving into markets with different smartphone adoption rates, payment methods, and network infrastructures means reworking these systems. This includes integrating with local ID frameworks, supporting various currencies, and ensuring compatibility with regional telecom networks.

Finally, establishing trust and partnerships is essential for success. Expanding into new territories often means working with local financial institutions or forming alliances with established players. This process involves navigating local systems, securing regulatory approvals, and building customer confidence. Overcoming these challenges will play a crucial role in Moniepoint’s ability to grow internationally.

Related Blog Posts

Source link