-

Nigerian fintech startup Clea launched in 2024 to simplify cross-border payments for African businesses.

-

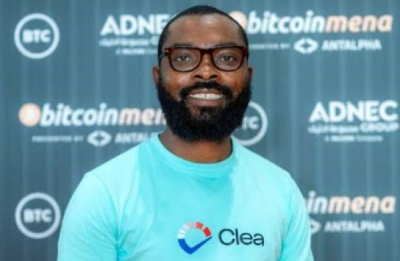

Founder Sheriff Adedokun positioned Clea as a faster and cheaper alternative to traditional banking channels.

-

Clea targeted importers, exporters, and logistics providers amid growing African trade integration.

African companies continue to face structural barriers when paying foreign suppliers. Clea positioned itself as a simplified cross-border payment solution designed for importers operating across international markets.

Clea operates as a fintech solution developed by a Nigerian startup. The platform allows businesses to pay international suppliers directly and transparently. The company removes delays and high costs associated with traditional banking channels. Sheriff Adedokun founded the startup in 2024.

“We simplify international payments for importers, exporters and logistics providers by offering fast, compliant and cost-effective transactions to global suppliers,” the startup said. “Our mission is to energize African trade through modern financial infrastructure by eliminating friction related to foreign exchange, settlement and compliance.”

Clea provides a mobile application available on iOS and Android. The platform operates as a technology-driven financial intermediary. The system connects African businesses to overseas suppliers by facilitating foreign-currency transfers, including U.S. dollar payments.

The platform allows users to fund a digital wallet and execute international transfers in a few steps. The system offers competitive foreign exchange rates. Clea designed the user experience to reduce operational friction. The platform requires users to complete registration and verification only once. Businesses then initiate payments quickly based on operational needs.

African economic integration continues to accelerate, particularly through initiatives such as the African Continental Free Trade Area (AfCFTA). Solutions such as Clea address a major friction point in international trade for small and medium-sized enterprises and importers. The platform enables secure, fast and cost-efficient cross-border payments. Clea strengthens the African fintech ecosystem. The company helps businesses reduce operational costs. The platform enhances corporate competitiveness in global markets.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum