Deal volumes are down, and the sector has slipped in funding rankings, even as the market heads towards $37 Bn+ by 2030

Marquee rounds like Innovaccer and PharmEasy have kept total funding steady, but early and growth stage activity has thinned significantly

While AI, deeptech and fintech dominate, dedicated healthtech funds are returning, backing integrated care models, wellness, and affordability-led plays

The Indian healthtech sector is in its transition phase, with VCs rethinking their bets. In the Covid era, the likes of PharmEasy, Practo, and 1mg (now Tata 1mg) soaked up capital, driven by a surge in digital adoption, telemedicine, and epharmacy. But this has now changed, with companies returning to a customer-first approach while integrating technology across the healthcare ecosystem.

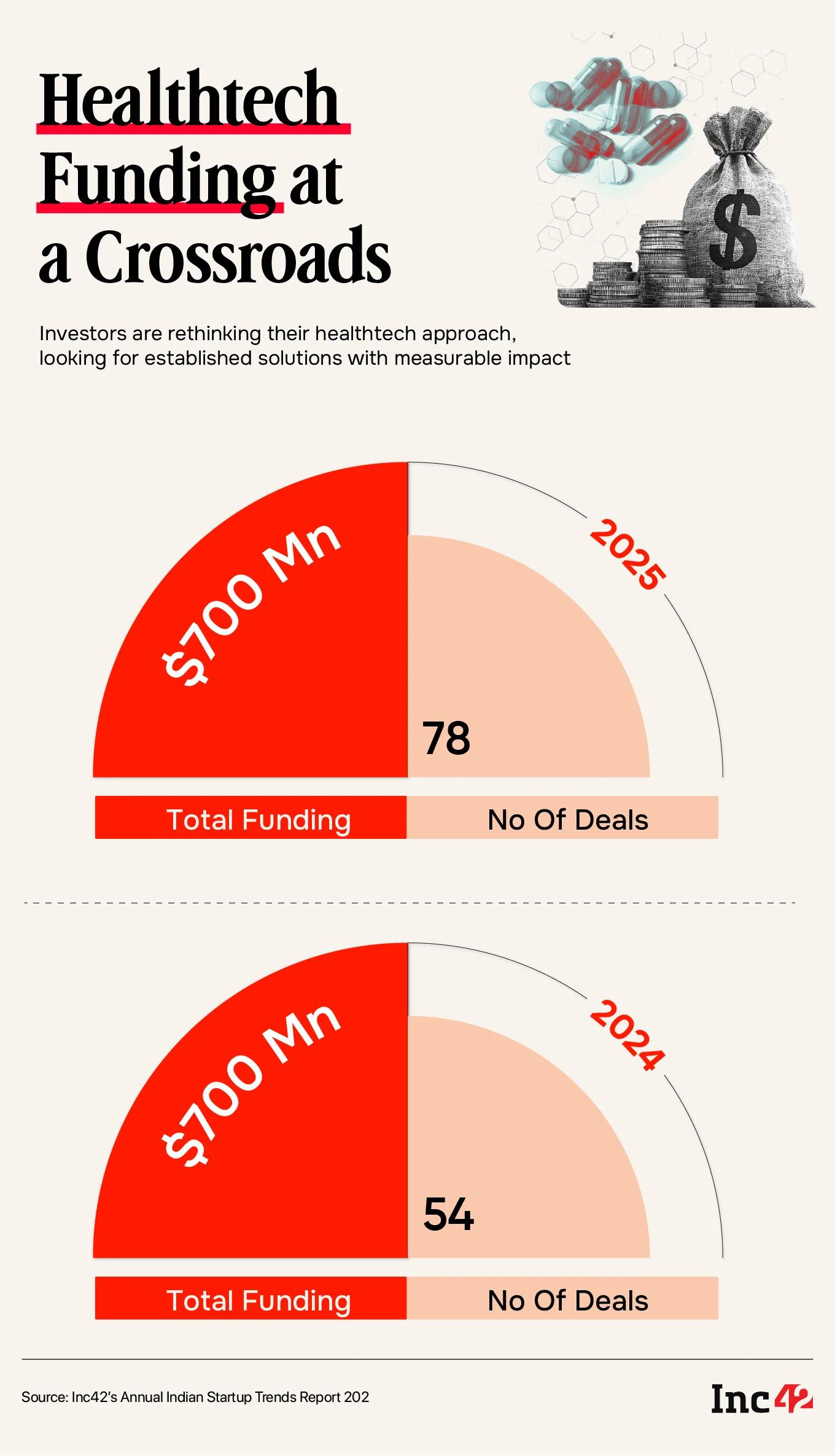

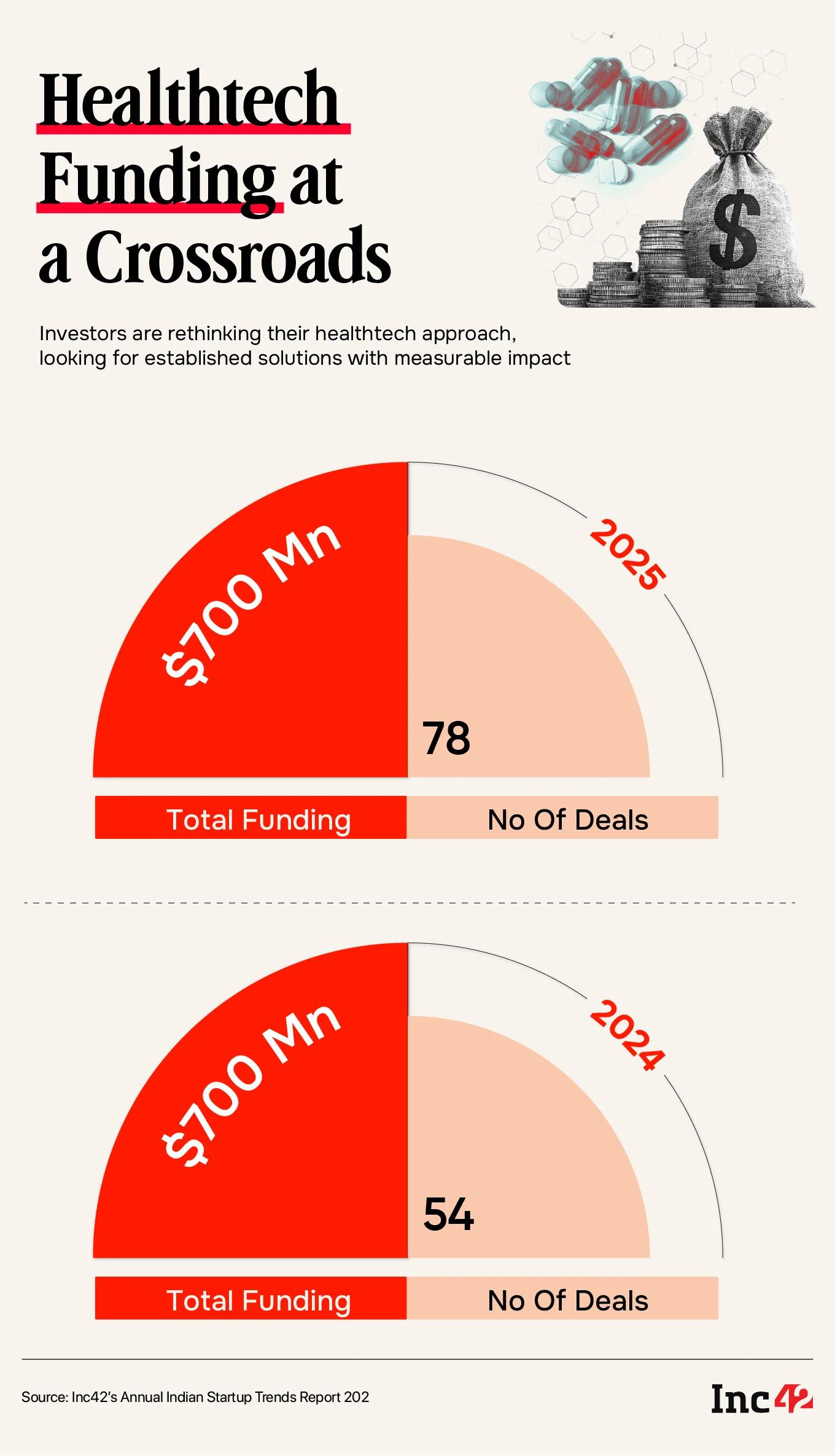

This shift is also visible in the numbers.

According to Inc42’s ‘Annual Indian Startup Trends Report, 2025’, the market for healthtech is projected to grow at 39% CAGR from 2025 to breach the $37 Bn+ mark by 2030. Yet, healthtech is no longer the investor darling that it used to be.

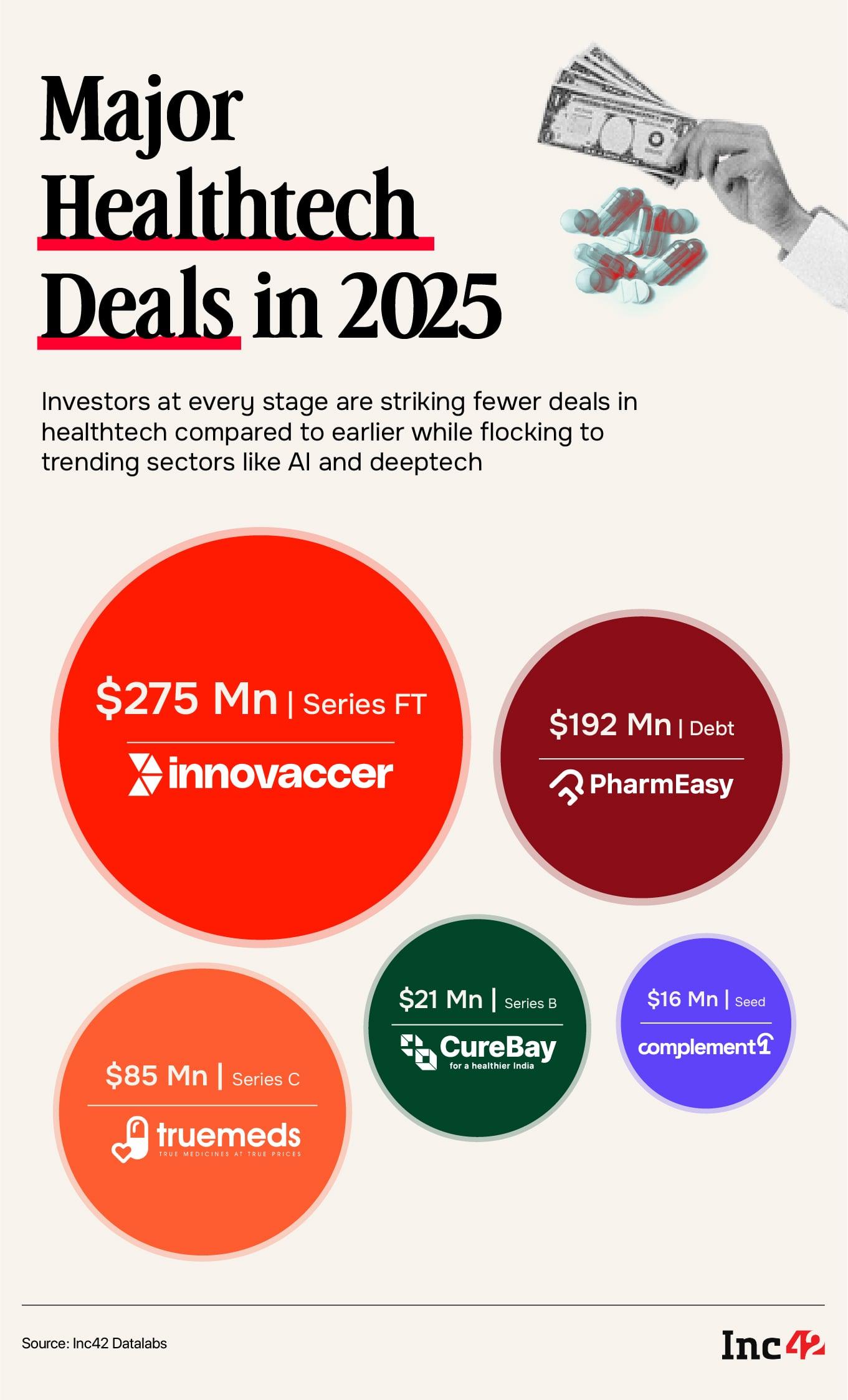

The number of deals declined from 78 in 2024 to 54 deals last year, with the sector plunging from the fourth spot to eighth. While the total funding amount remained roughly the same at around $700 Mn, it’s worth looking more closely at some of the major deals.

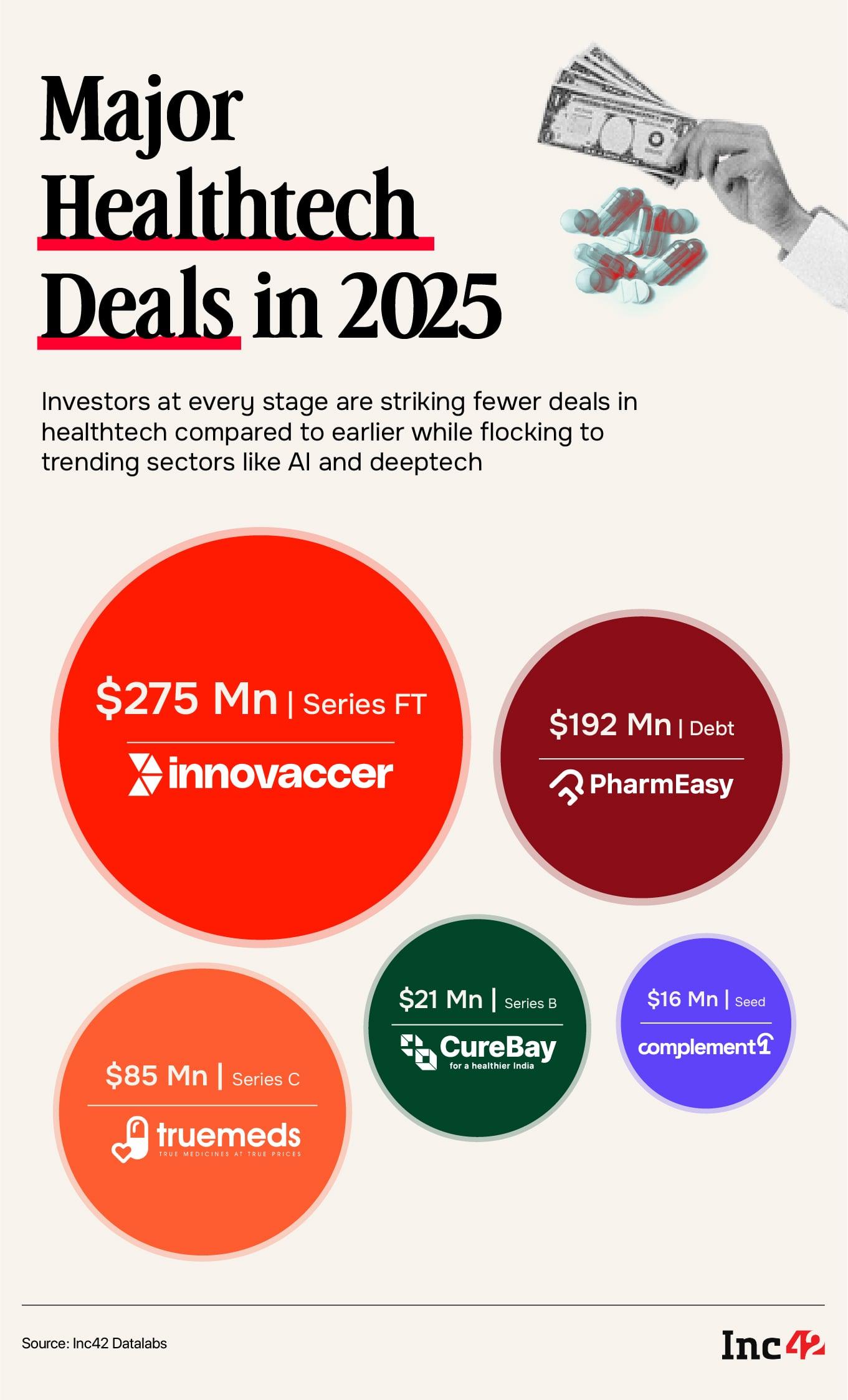

Health data platform Innovaccer managed to close a $275 Mn Series F round in January, which marked the fourth-largest round last year. PharmEasy bagged the next big deal, raising $192 Mn. This was a major debt infusion that came as the online pharmacy startup struggled to control its cash burn and its existing liabilities. Not to mention, it took a steep 90% haircut on its valuation, down to just $456 Mn compared to $5.6 Bn at its peak.

Access Free ReportSeed Funding Dries Up

A deeper dive into the stage wise data shows a slightly more nuanced picture. Healthtech doesn’t feature in the top five sectors in which early stage investors were most active in 2025. Yet, there’s Complement – the startup focussed on personalised lifestyle coaching for cancer patients founded by Karan Bajaj, the founder of WhiteHat Jr. Its $16 Mn seed funding round was the third-largest early stage fundraise last year.

But then, healthtech overall ranked fifth in terms of seed stage investments with just 35 deals. That’s a marked difference compared to 10 years ago, when it ranked fourth, with 47 seed deals. Even when it comes to growth stage investments, healthtech no longer features in the top five sectors, as it did in 2015 with $231 Mn in capital raised.

Get The Full Report For FreeZooming out, early stage investors today are far more enthralled with AI and deeptech startups, while enterprise software and ecommerce continue to remain popular picks. As for growth stage funding, investors are flocking to more proven categories. Fintech, in particular, has taken a commanding lead with over $1.4 Bn deployed, while ecommerce and enterprise technology lag behind.

Late Stage Deals Come To Rescue

The data further shows that late stage healthtech funding saw a slight increase from $400 Mn to $600 Mn – even as it fell out of the top five in terms of the number of deals. Hence, the story suggests that investors are still eyeing healthtech but far more selectively.

“Healthtech investing has moved from idea-led to execution-led. Five years ago, investors backed broad platforms and pilots; today, they look for solutions with proven adoption, repeat usage, and measurable clinical or operational impact,” concurred Ravindranath Kancherla, founder at Global HealthX and Global Hospitals.

Meanwhile, 16% of new funds launched in 2025 were focussed on channelling capital into the sector, making it the third most targeted area after deeptech and fintech. This is especially notable at a time when new fund launches have just begun to pick up again after a downturn. The total new fund corpus last year stood at $13.6 Bn, up 56% from 2024. That includes W Health Ventures’ $70 Mn Fund II, Quadria Capital’s $300 Mn HealthQuad Fund III, and a $300 Mn fund raised by HealthKois.

“Looking ahead, capital will increasingly back startups that integrate seamlessly into healthcare workflows, expand affordability and access to care, and selectively apply frontier technologies including embodied AI and quantum computing where they translate into real-world, scalable healthcare outcomes,” said Kancherla.

Pankaj Jethwani, managing partner at W Health Ventures, is also of the view that more venture money will increasingly flow into care models in aesthetics and wellness.

[Edited By Shishir Parasher]

Source link