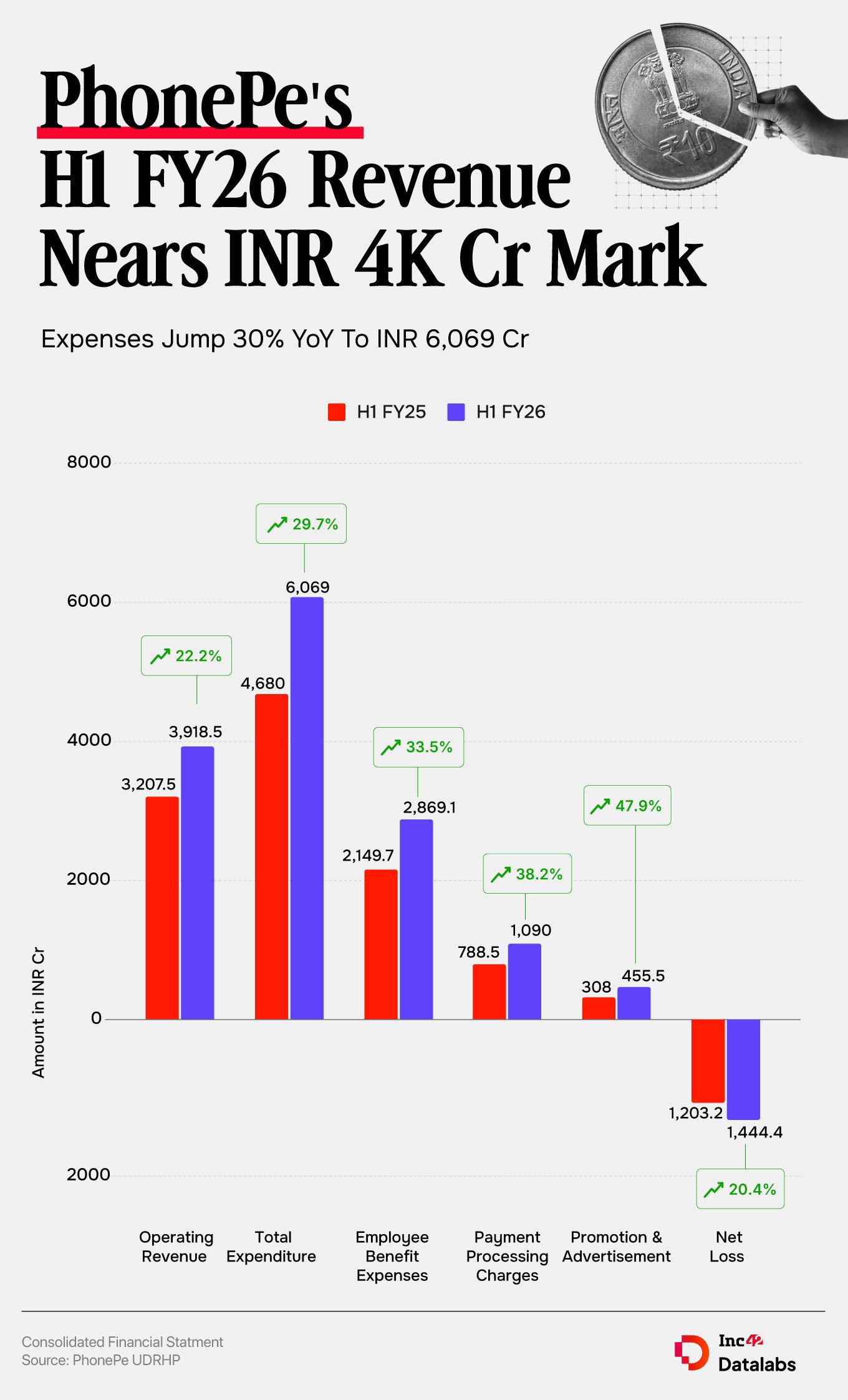

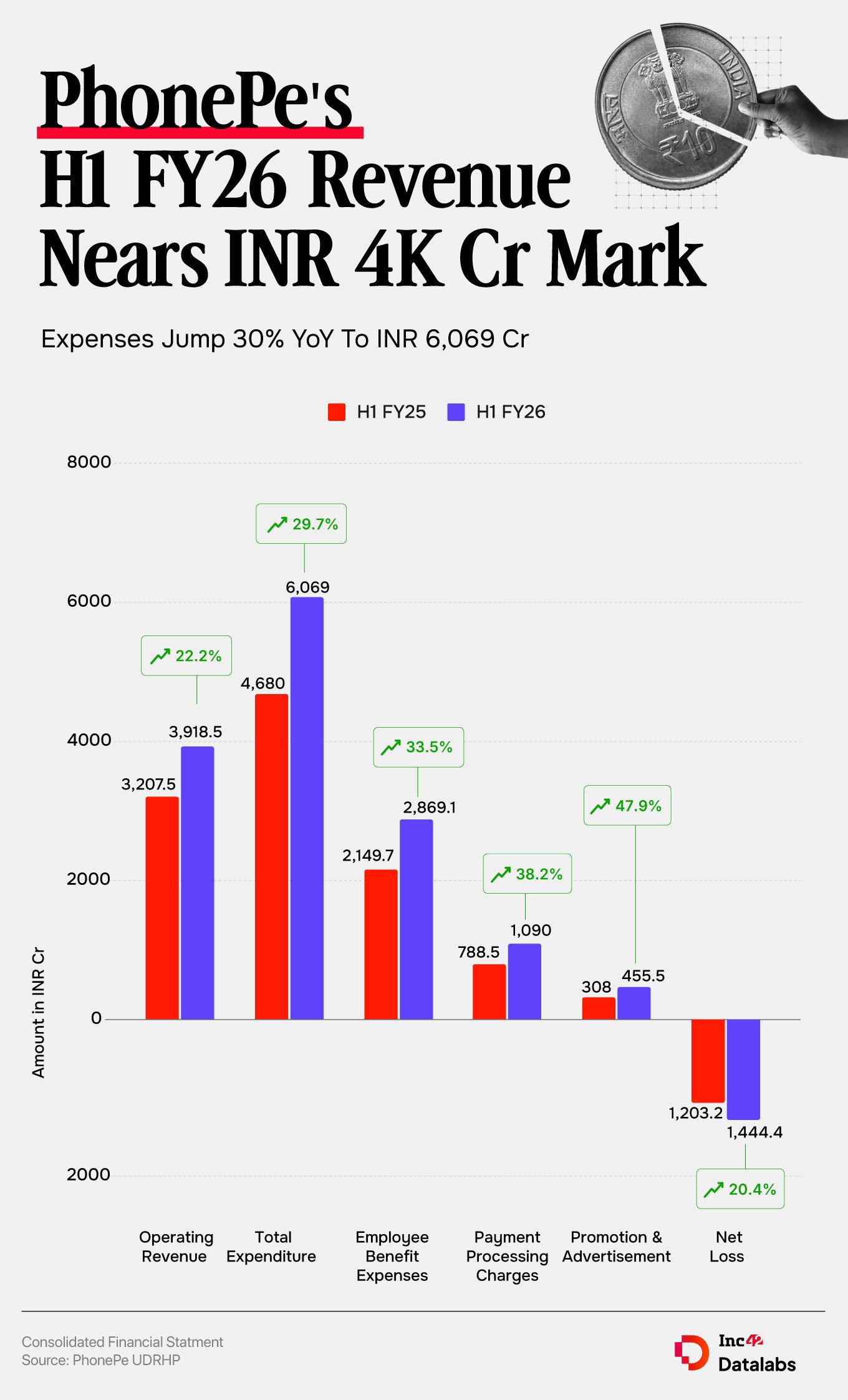

PhonePe’s operating revenue jumped 22.2% to INR 3,918.5 Cr in H1 FY26 from INR 3,207.5 Cr a year ago

Its total expenditure increased 29.7% to INR 6,069.2 Cr in H1 FY26 from INR 4,680 Cr in the year-ago period

The fintech startup filed an updated draft red herring prospectus (UDRHP) with SEBI for its IPO, which will comprise only an offer for sale (OFS)

IPO-bound fintech major PhonePe’s net loss zoomed over 20% to INR 1,444.4 Cr in H1 FY26 from INR 1,203.2 Cr in the same period of the prior year, as margins contracted.

The company’s loss would have been even higher if not for an exceptional gain of INR 434.5 Cr due to its divestment of a 5% stake in geotech company MapmyIndia during the period under review. PhonePe

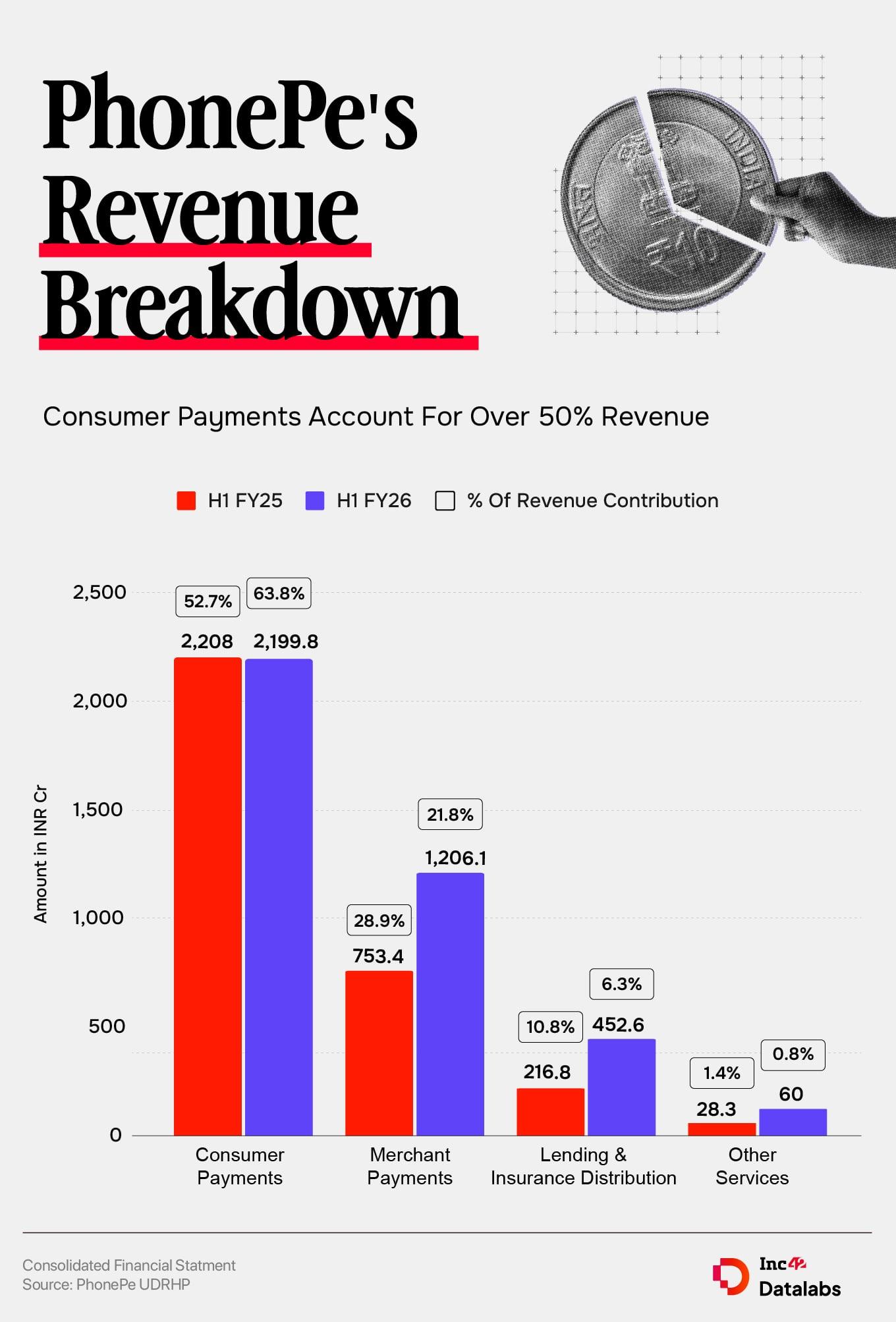

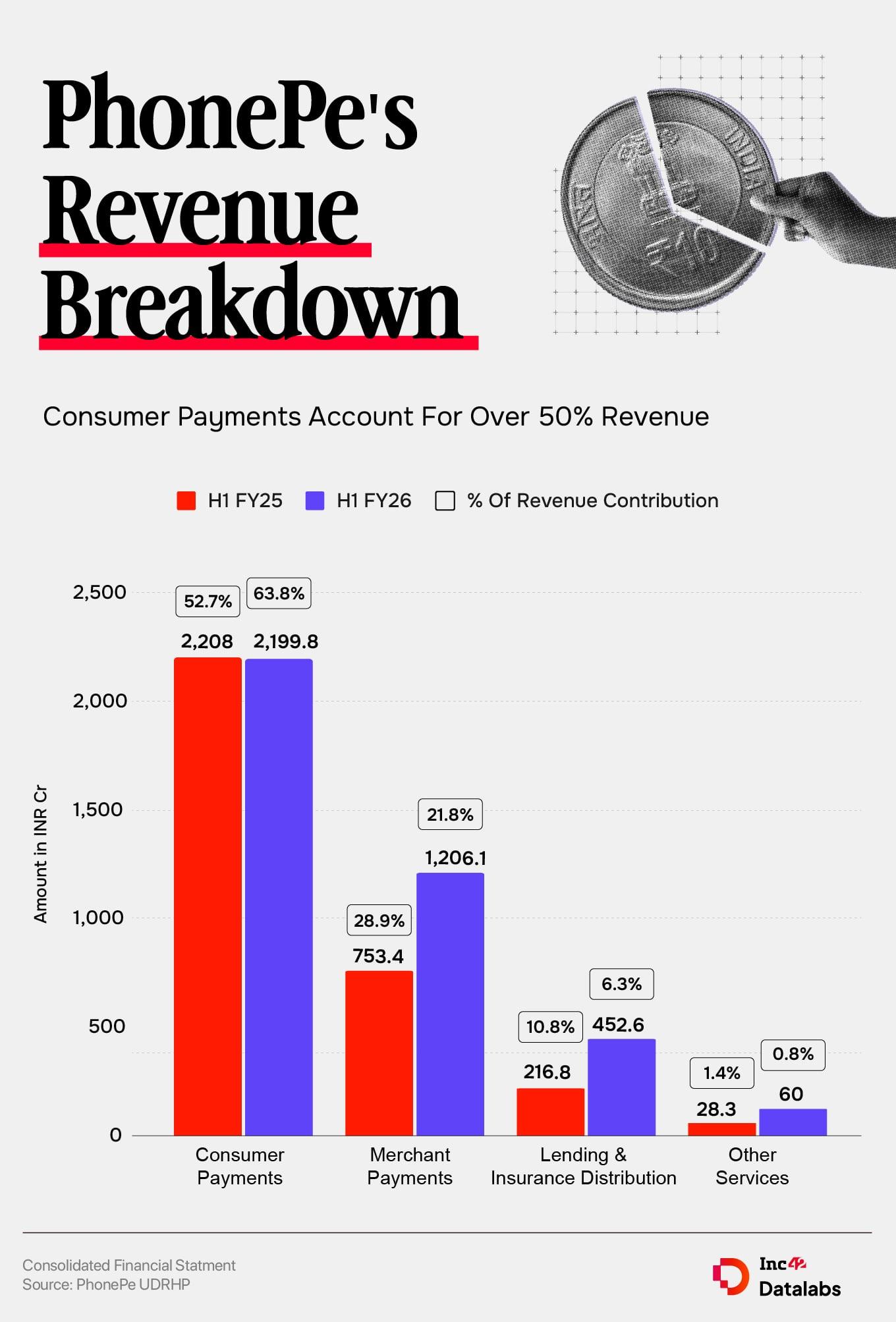

Meanwhile, PhonePe’s operating revenue jumped 22.2% to INR 3,918.5 Cr in H1 FY26 from INR 3,207.5 Cr a year ago.

Payments continued to be the biggest revenue source during the period under review. The company earned INR 3,231.7 Cr from payments services in H1 FY26, up 10.2% from INR 2,932.25 Cr in the previous year.

Revenue from insurance and lending saw the biggest increase, albeit at a much lower base. The segment’s revenue surged 108.8% to INR 452.63 Cr from INR 216.8 Cr in H1 FY25.

Notably, the company discontinued facilitation of credit card transactions for rent payments, following RBI’s directive, in September 2025.

“… We discontinued the payment services for rent and related categories. Our results of operations from October 2025 onwards will exclude any further impact from rent & related categories, as these categories were discontinued in September 2025,” PhonePe said.

This category was a key revenue source for PhonePe. It earned a revenue of INR 518.5 Cr from rent and related categories in H1 FY26, accounting for 13.4% of operating revenue of the platform. The category contributed 21% of the total revenue in H1 FY25 at INR 668.3 Cr.

PhonePe’s EBITDA loss jumped 57.6% to INR 858.8 Cr during the period under review from INR 544.7 Cr in the previous year.

The Bengaluru-based fintech startup filed an updated draft red herring prospectus (UDRHP) with SEBI for its IPO, which will comprise only an offer for sale (OFS). Promoter Walmart, Tiger Global and Microsoft will together offload shares up to 5.06 Cr via the OFS.

Breaking Down PhonePe’s Expenses

The fintech company’s total expenditure increased 29.7% to INR 6,069.2 Cr in H1 FY26 from INR 4,680 Cr in the year-ago period.

Here’s a breakdown of PhonePe’s expenditure during the year under review:

Employee Benefit Expenses: Employee costs continued to be the largest expense for the company, rising 33.5% to INR 2,869.1 Cr from INR 2,149.7 Cr in H1 FY25.

Advertising & Promotional Expenses: PhonePe’s marketing expenses climbed 47.9% to INR 455.5 Cr from INR 307.6 Cr in H1 FY25.

Payment Processing Charges: The spending under this head increased 38% to INR 1,090 Cr in H1 FY26 from INR 788.5 Cr a year ago.

IT Infrastructure Expenses: The company’s IT expenses for the period under review increased 26.9% to INR 283.8 Cr from INR 223.7 Cr in H1 FY25.

In FY25, PhonePe’s revenue surged 40.5% to INR 7,114.8 Cr from INR 5,064.1 Cr in the previous year. Net loss narrowed 13.5% to INR 1,727.4 Cr from INR 1,996.2 Cr in FY24.

Source link