In recent years, Mali has introduced significant changes to its technology and security policies, affecting internet access, telecom services, and startups. Key developments include:

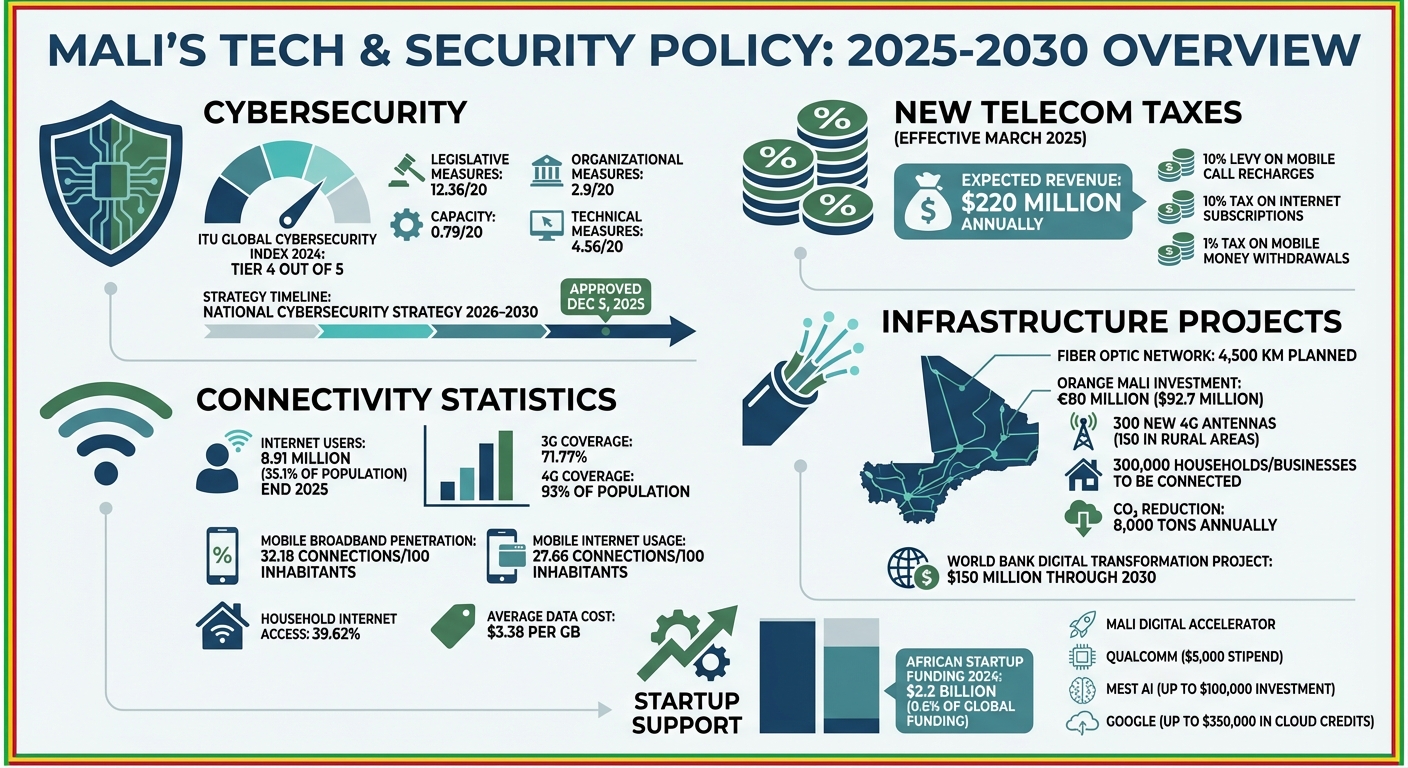

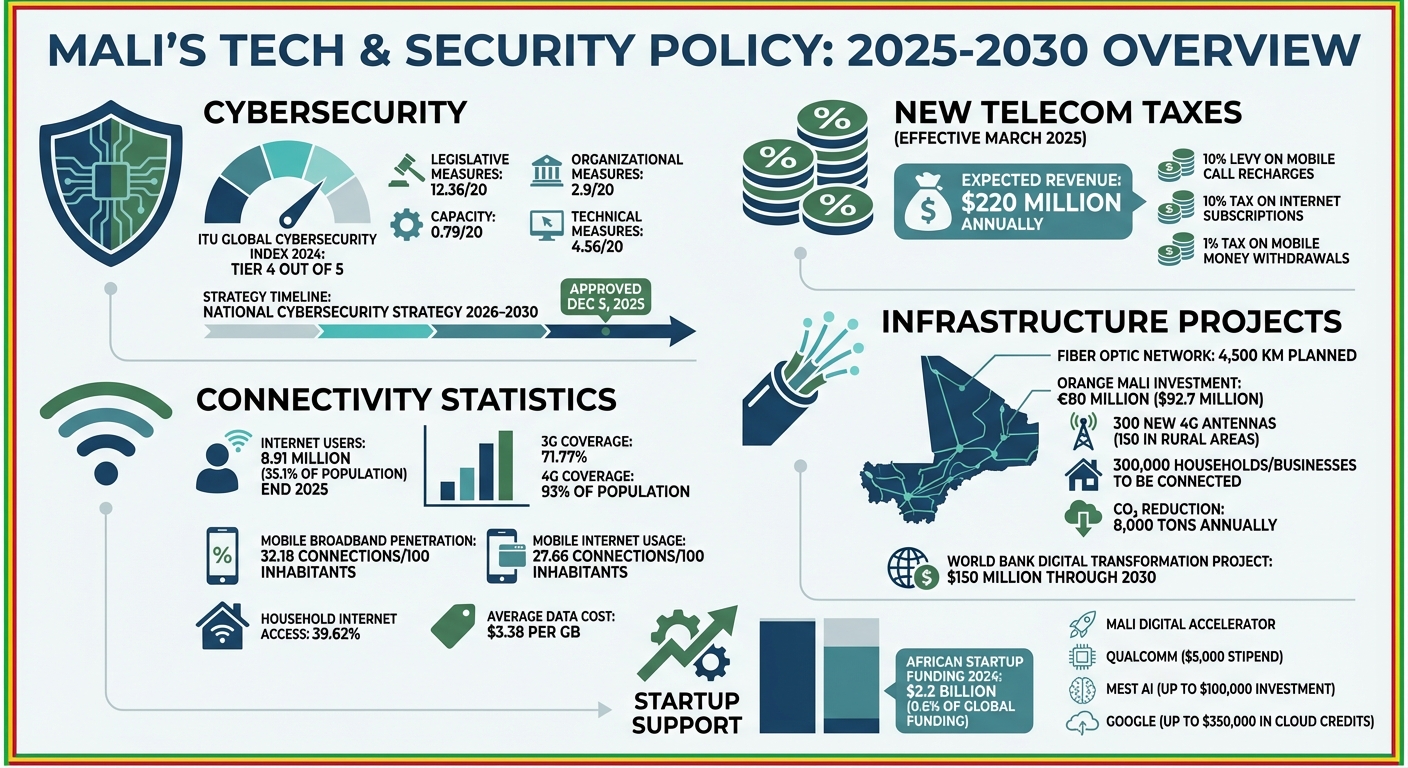

- National Cybersecurity Strategy 2026–2030: Approved in December 2025, it aims to protect critical infrastructure, improve cybersecurity, and address previous gaps in governance.

- Telecom Taxes: New taxes introduced in 2025, including a 10% levy on mobile call recharges and internet subscriptions, and a 1% tax on mobile money withdrawals, are expected to generate $220 million annually.

- Connectivity Upgrades: Projects like a 4,500 km fiber optic network and expanded 4G coverage are underway to bridge urban-rural connectivity gaps.

- Startup Support: Stricter cybersecurity standards and tax incentives aim to attract investment, while programs like the Mali Digital Accelerator and international mentorship initiatives provide resources for tech entrepreneurs.

These reforms aim to modernize Mali’s digital landscape, though challenges like affordability, infrastructure gaps, and compliance costs remain.

Mali’s Digital Transformation: Key Statistics on Connectivity, Taxes, and Cybersecurity 2025-2030

Mali’s New Technology and Security Policies: What Changed

Mali has overhauled its approach to digital governance by introducing unified strategies that replace the fragmented policies of the past. Two key frameworks now guide the country’s digital transformation: the National Strategy for Emergence and Sustainable Development 2024–2033 and a 2023–2027 digital initiative that succeeds the earlier Mali Numérique 2020 plan. By centralizing digital policy under these roadmaps, Mali aims to boost economic growth and address previous gaps in governance. These reforms also set the stage for stronger cybersecurity measures and improved infrastructure, as outlined below.

Mali’s National Cybersecurity Strategy

On December 5, 2025, Mali approved its first coordinated framework for digital security, known as the National Cybersecurity Strategy 2026–2030. This strategy is designed to safeguard critical infrastructure, including government systems, financial institutions, and telecommunications networks. It introduces standardized security protocols and enhances incident-response capabilities to better protect the nation’s digital assets.

Despite this progress, Mali’s current cybersecurity standing shows room for improvement. The country ranks Tier 4 out of 5 on the ITU Global Cybersecurity Index 2024, with scores of 12.36/20 for legislative measures, 0.79/20 for capacity, and 2.9/20 for organizational measures. To address these shortcomings, the strategy includes initiatives such as specialized training programs, public awareness campaigns, and increased funding for technical research.

A key element of the plan is fostering international collaboration, particularly with ECOWAS partners, to combat cross-border cybercrime and align with regional security standards. This aligns with concerns highlighted by the Ministry of Communication, Digital Economy, and Administrative Modernization, which noted:

the rapid pace of innovation in the ICT sector has led to inadequate legislative and regulatory cybersecurity frameworks.

While the cybersecurity strategy focuses on creating a safer digital environment, Mali is also making strides in modernizing its telecommunications infrastructure.

Connectivity and Telecommunications Policy Updates

Upgrading telecommunications infrastructure is central to Mali’s connectivity reforms. The government has set an ambitious goal to develop a 4,500 km (2,795-mile) fiber optic network, connecting regional capitals and extending broadband access to rural areas.

As of 2023, mobile connectivity in Mali shows significant progress: 3G coverage reaches 71.77%, while 4G covers 93% of the population. However, mobile broadband penetration stands at 32.18 connections per 100 inhabitants, and mobile internet usage is slightly lower at 27.66 connections per 100. Meanwhile, the average cost of 1GB of data is $3.38, prompting government efforts to pressure telecom operators to reduce tariffs.

These infrastructure improvements are part of a larger vision to promote e-governance, which aims to streamline administrative processes, combat corruption, and improve public services. The reforms also address the digital divide between urban and rural areas. Currently, only 33.05% of individuals nationwide use the internet, and just 39.62% of households have home internet access. Expanding connectivity is seen as a critical step toward fostering digital transformation across Mali’s economy.

How Policies Affect Internet Access in Mali

Recent reforms in telecom infrastructure are reshaping how Malians access the internet, though progress remains uneven across the country.

By the end of 2025, around 8.91 million people in Mali were using the internet, accounting for just 35.1% of the population. While this marks growth, the disparity between urban and rural areas is becoming more pronounced. Urban centers are advancing rapidly, while rural regions lag behind, posing unique challenges that demand tailored solutions.

The government’s drive for digital transformation has spurred major investments in infrastructure, often in collaboration with international lenders. These efforts aim to expand connectivity beyond city hubs, which already have fiber networks linking them to neighboring countries. However, the middle- and last-mile connections remain key bottlenecks.

Expanding Internet Access to Rural Areas

In November 2025, Orange Mali SA secured an €80 million ($92.7 million) loan from the International Finance Corporation and the West African Development Bank. This funding will support the installation of 300 new 4G antennas, with 150 specifically allocated for rural areas. Additionally, the project includes deploying a fiber network to connect 300,000 households and small businesses.

“This partnership strengthens our commitment to digital inclusion and broader telecom access. With the IFC’s support, we will extend network coverage, improve its resilience and enable more Malians to benefit from the opportunities of the digital economy.” – Aboubacar Sadikh Diop, CEO, Orange Mali

Orange Mali has also partnered with Intelsat to bring internet access to 360,000 residents in remote areas. These initiatives align with the government’s ambitious plan to develop a 4,500 km (2,795-mile) fiber optic network connecting regional capitals. To tackle power supply issues in areas with unreliable electricity, Orange Mali is replacing diesel generators with solar-powered systems, reducing CO2 emissions by 8,000 tons annually.

Meanwhile, the World Bank launched the Mali Digital Transformation Project in April 2023, allocating $150 million through 2030 to enhance broadband access and improve digitally enabled public services. These public-private partnerships represent a shift from traditional government-led projects, allowing private companies to reach areas where profitability alone wouldn’t justify investment.

Despite the progress in infrastructure, economic and logistical challenges continue to hinder widespread adoption.

Affordability and Infrastructure Barriers

Even with expanding infrastructure, the cost of internet access remains a major hurdle. Mobile data costs $3.38 per GB, which is unaffordable for many Malians. As a result, mobile internet usage is limited to just 27.66 connections per 100 inhabitants. This highlights that affordability, not just availability, is a critical barrier.

Security issues further complicate the situation. Instability in northern and central Mali deters investment and increases operational costs. Fiber optic cables are frequently cut, towers are vandalized, and equipment theft is common, all of which drive up expenses for telecom providers and, consequently, for users. Additionally, frequent power outages from the national utility company (EDM) disrupt connectivity, as cell towers require consistent electricity, and users face difficulties keeping their devices charged.

Device affordability is another issue. In 2021, the average smartphone cost $363, well above the average monthly salary of $796 in Mali. As 2G networks are being phased out, many low-income users risk being left behind unless affordable devices or financing options are made available.

Mali also faces stiff competition for development funding, with Africa’s annual infrastructure financing gap estimated between $68 billion and $108 billion. To attract more investment, Mali must address its cybersecurity challenges. The National Cybersecurity Strategy 2026–2030 aims to create a safer digital environment, but Mali’s Tier 4 ranking on the ITU Global Cybersecurity Index – indicating only “basic” capabilities – needs improvement to build investor confidence. Strengthening cybersecurity will be a critical step toward fostering growth in Mali’s digital economy.

Recent policy changes are shaking up the telecom industry with stricter security requirements and higher taxes for operators. Starting March 5, 2025, telecom companies in Mali will face new taxes: 10% on wireless revenue, 10% on phone credit top-ups and internet subscriptions, and a 1% tax on mobile money withdrawals. These changes are set to tighten profit margins, forcing companies to rethink pricing strategies and invest in operational adjustments, including significant security upgrades.

New Security Standards for Telecom Providers

Telecom operators are now required to adopt standardized security frameworks to safeguard critical infrastructure and strengthen their response to cyber threats. The Autorité Malienne de Régulation des Télécoms/TIC et des Postes (AMRTP) is tasked with ensuring compliance with these new measures, which apply to all telecom policies and SMS traffic.

Under Law n° 2019-056, providers must detect and report network threats. Failure to comply could result in penalties ranging from six months to two years in prison and fines of up to CFA 2,000,000 (approximately $3,280). Additionally, operators are required to enable real-time surveillance and intercept communications as mandated by the law.

Currently, Mali ranks Tier 4 out of 5 on the ITU Global Cybersecurity Index 2024, reflecting only a “basic” level of cybersecurity commitment. Its score for “Technical Measures” is just 4.56 out of 20. This highlights the urgent need for telecom companies to invest heavily in security infrastructure, not only to meet regulatory standards but also to support the government’s efforts to enhance Mali’s international cybersecurity standing.

| New Telecom Taxes (Effective March 2025) | Rate |

|---|---|

| Wireless Operator Revenue | 10% |

| Phone Credit & Internet Subscriptions | 10% |

| Mobile Money Withdrawals | 1% |

Telecom’s Role in Digital Transformation

Telecom operators are not just navigating regulatory hurdles – they are also central to advancing Mali’s digital transformation goals outlined in the National Strategy for Emergence and Sustainable Development 2024–2033. The government expects providers to modernize infrastructure, extend connectivity to rural areas, and contribute to digital skills training programs.

Orange Mali’s recent initiatives demonstrate how operators are adapting to these pressures. In November 2025, the company secured €80 million ($92.7 million) in financing to roll out 300 new 4G antennas, with half of them dedicated to rural areas, and to deploy fiber networks connecting 300,000 households and small businesses.

“This partnership strengthens our commitment to digital inclusion and broader telecom access. With the IFC’s support, we will extend network coverage, improve its resilience and enable more Malians to benefit from the opportunities of the digital economy.” – Aboubacar Sadikh Diop, CEO, Orange Mali

The project also includes a shift to solar-powered systems, replacing diesel generators and reducing CO2 emissions by 8,000 tons annually. These efforts underline telecom’s critical role in bridging the digital divide and supporting sustainable development in Mali.

sbb-itb-dd089af

How Policies Affect Startups in Mali

Mali’s startup scene is navigating a landscape shaped by regulatory changes in telecom and internet access, alongside new security policies. The introduction of the National Cybersecurity Strategy 2026–2030, approved in December 2025, marks a shift from fragmented security efforts to a more unified approach. While this brings rising compliance costs for startups, the structured framework is also making Mali more appealing to investors who previously deemed the market too risky.

Better Cybersecurity Builds Investor Confidence

The new cybersecurity strategy is transforming how investors perceive Mali’s tech sector. In the past, major security breaches created uncertainty, but this coordinated approach reduces risks, fostering trust among potential investors.

“Cybersecurity has become a global concern due to the growing sophistication of attacks and the financial damage they cause to states and companies. Despite several legislative and regulatory texts adopted in recent years, Mali did not yet have a coordinated national strategy, forcing each actor to undertake isolated actions.” – Government of Mali

The government views a secure digital environment as essential for driving local innovation and attracting investment into the digital economy. This focus is especially timely, given that African startups secured just 0.6% of global startup funding in 2024, amounting to $2.2 billion. Paired with telecom reforms, these cybersecurity measures are laying the groundwork for a more dynamic startup ecosystem.

Meeting New Compliance Requirements

Startups in Mali are now navigating more stringent regulatory demands, which can strain their limited resources. The cybersecurity strategy mandates standardized security frameworks and incident-response protocols. Companies must also register through the API-Mali portal, which promises a 72-hour processing time, though occasional delays have been reported. Additionally, startups in mining or industrial sectors must comply with the Law on Local Content, requiring detailed reporting on local hiring and procurement practices. For businesses handling customer data, stricter data protection laws limit international data transfers unless specific security measures are in place.

While these regulations can be burdensome, startups have options to offset some of the costs. The API-Mali portal offers potential tax benefits based on investment size, and firms exporting at least 80% of their production qualify for tax exemptions and duty-free equipment imports. Entrepreneurs should also keep an eye on the Startup Act, which has been under discussion since 2019, as it’s expected to ease tax burdens and reduce operational costs once enacted.

Training Programs for Tech Skills Development

To help startups tackle these challenges, several training initiatives have been introduced. Mali’s Tier 4 ranking on the ITU Global Cybersecurity Index 2024, with a capacity development score of just 0.79 out of 20, highlights the urgent need for skill-building programs.

In March 2025, the Malian government launched the Mali Digital Accelerator, providing mentorship, funding, and market access for local startups. For more specialized training, the Qualcomm Make in Africa Startup Mentorship Program runs from April to November 2026, offering masterclasses in advanced technologies like 5G, AI, and IoT. Participants also benefit from 1:1 mentorship and a $5,000 stipend.

The MEST AI Startup Program is another resource, offering a 12-month residential initiative starting in January 2026. It includes seven months of intensive AI software development training and four months of incubation, with perks such as flights to Ghana, healthcare, and the possibility of up to $100,000 in pre-seed investment. Startups at the Seed to Series A stage can also apply for the Google for Startups Accelerator (MENA), a ten-week program that provides mentorship in AI/ML, Cloud, and UX, along with up to $350,000 in Google Cloud credits.

These programs not only help startups meet new cybersecurity standards but also equip them with the technical expertise needed to thrive in Mali’s growing digital economy.

Conclusion: Navigating Mali’s Changing Tech Landscape

Mali’s tech ecosystem is undergoing a transformation, driven by the National Cybersecurity Strategy 2026–2030 and the introduction of new telecom taxes. The government aims to generate $220 million through measures like a 10% tax on mobile call recharges and a 1% levy on mobile money withdrawals. These steps reflect a push toward a more regulated and structured digital environment.

For startups and telecom companies, compliance is no longer optional. Registering with API-Mali, adhering to standardized security frameworks, and aligning with the upcoming Startup Act are now essential steps. These measures not only help businesses avoid penalties but also open the door to potential tax benefits . While these changes present challenges, they also create opportunities for businesses ready to adapt.

On the connectivity front, the six-month window to access Starlink offers a lifeline for remote startups in need of reliable internet while permanent satellite regulations are being finalized. This is particularly critical as Mali currently ranks Tier 4 out of 5 on the ITU Global Cybersecurity Index 2024.

The urgency of these changes is tied to pressing financial needs. Finance Minister Alousseni Sanou highlighted this when he stated:

The shortfall is around 300 to 600 billion CFA. So if the facts are established, it will be a question of re-negotiating what is renegotiable and recovering what is recoverable.

For informal startups, formalizing operations will be key to accessing future incentives and avoiding penalties. These regulatory shifts – from enhanced cybersecurity measures to fiscal reforms – reflect Mali’s determination to build a stronger, more resilient digital economy.

To succeed in this evolving landscape, businesses must stay proactive. Embracing regulatory changes, taking advantage of training programs and tax incentives, and strengthening digital operations will be critical. Companies that adapt to higher operating costs and align with the government’s digital transformation goals will be well-positioned to thrive in Mali’s growing tech ecosystem.

FAQs

How will Mali’s new telecom taxes impact internet affordability?

Mali’s recent telecom taxes are set to make internet access harder to afford for many people. These new taxes will raise the prices of mobile phone credit top-ups and mobile money transactions – services that are crucial for connecting to the internet in the country.

For families and businesses, this could translate into steeper costs to stay online. Lower-income users may find it even tougher to access the internet, and startups that depend on affordable connectivity might face added hurdles. On the flip side, this situation could encourage the development of creative solutions aimed at reducing costs and improving access within the tech industry.

What challenges does Mali face in expanding internet access to rural areas?

Mali faces several hurdles in bringing reliable internet access to its rural communities. One of the biggest challenges is security concerns, especially in areas plagued by conflict and instability. These conditions make it incredibly difficult to set up and maintain the necessary infrastructure.

On top of that, Mali struggles with infrastructure gaps. While mobile networks are widespread, fixed broadband is almost nonexistent outside of cities. This lack of infrastructure leaves rural areas with limited and often unreliable internet options.

The issue is further complicated by regulatory uncertainty. The government is working to create policies that balance the need for security with the push for technological advancement, but political instability and weak cybersecurity systems make this task even harder. Together, these challenges create significant roadblocks to improving internet connectivity in Mali’s rural areas.

How are Mali’s new cybersecurity policies affecting startups?

Mali’s updated cybersecurity policies are changing the game for startups, introducing stricter regulations and heightened security requirements. As part of the government’s national cyber plan for 2026–2030, the focus is on strengthening the protection of digital infrastructure and establishing a solid legal framework for cybersecurity. Startups now face the challenge of meeting these standards to stay compliant and avoid potential penalties.

One notable development is the temporary lifting of the Starlink ban, signaling efforts to expand internet access across the country. While this move opens up opportunities by improving connectivity, it also underscores the importance of implementing strong cybersecurity measures. Operating in a politically and socially complex environment, startups must align with national policies and invest in secure tools to navigate these changes effectively.

Related Blog Posts

Source link