Union Budget 2026-27: From massive tax holidays for cloud infrastructure to strategic pushes in semiconductor and AI domains, here is the complete list of key takeaways for the Indian tech and startup ecosystem

The Union Budget 2026 introduces a series of transformative measures aimed at positioning India as a global hub for manufacturing, services, and deeptech innovation.

Finance Minister Nirmala Sitharaman’s 90-minute long address did not specifically call out Indian startups as a key focus area (mentioned just twice), but there was a clear emphasis on AI, data centre economy and manufacturing, which will undoubtedly have a ripple effect on the Indian startup ecosystem.

From massive tax holidays for cloud infrastructure to strategic pushes in semiconductor and AI domains, here is the complete list of key takeaways for the Indian tech and startup ecosystem from the Union Budget 2026.

India Semiconductor Mission (ISM) 2.0 Takes Flight

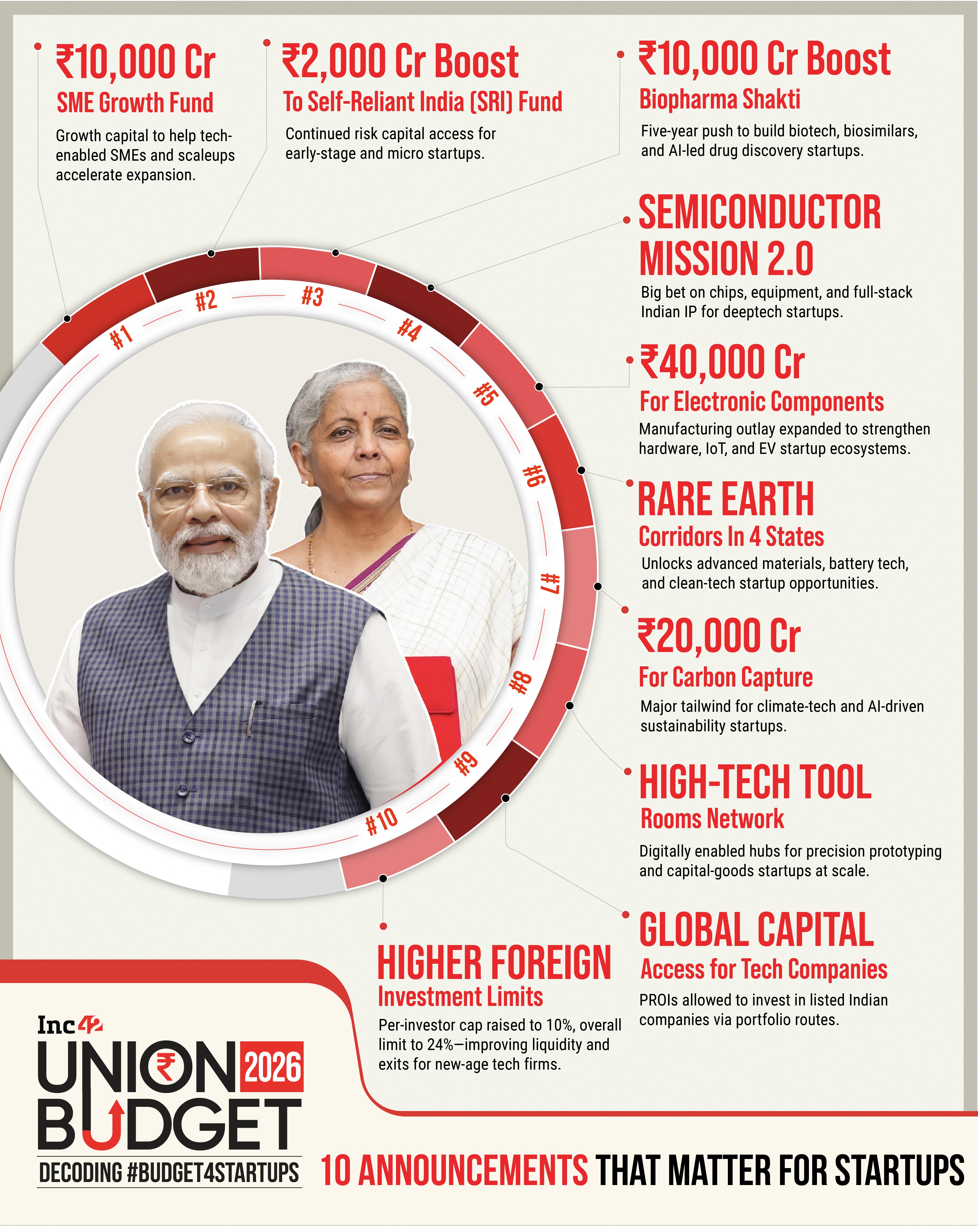

The Union Budget 2026-27 has proposed expanding the India Semiconductor Mission, with a bigger focus on the hardware manufacturing ecosystem and a transition to the next phase with bigger allocation.

The FM proposed to increase the outlay of the existing Electronics Component Manufacturing Scheme (ECMS) to INR 40,000 Cr.

- What This Means:

- Accelerated funding and infrastructure support for domestic fabless startups and outsourced semiconductor assembly and test (OSAT) units.

- Encourages domestic design and manufacturing, reducing reliance on global supply chain fluctuations.

- The proposed ISM 2.0 plans delve deeper into the push towards an IP-centric ecosystem and shift from semiconductor assembly and production-led incentives to IP ownership, thanks to the push for fabless and OSAT setups

Tax Holidays For Cloud, Data Centre Giants

To bolster India’s digital infrastructure, foreign companies providing cloud services through India-based data centres will receive unprecedented tax benefits.

When it comes to AI-native startups, unit economics are skewed towards compute costs and this proposed tax holiday can change who captures margin, but will it be startups?

Provision of tax holidays until 2047 for global cloud providers operating via Indian data centres.

- What This Means:

- A 15% safe harbour provision on costs for related entities providing data centre services, likely lowering the cost of cloud credits for local startups.

- The proposed changes will pull global cloud workloads into India, but the benefits may accrue to hyperscalers and resellers before startups see any boost in their compute needs.

- Drastically reduces the long-term tax litigation uncertainty that many cross-border SaaS and IT startups face.

- Increased speed in tax settlements makes India a more attractive destination for global tech giants to set up Global Capability Centres (GCCs).

AI Governance Push & Clarity For IT Services

The budget proposes a significant hike in the safe harbour threshold for IT Services, moving from INR 300 Cr to INR 2,000 Cr.

Sitharaman’s budget address framed AI as a force multiplier for governance, and pushed for strong platforms and rails within the various government units including in customs duty, agritech and other key areas.

However, the budget speech was relatively quiet on startup-specific de-risking, besides talking about the plans to improve compute capacity through the data centre push.

Besides this, the government aims to conclude the unilateral Advance Pricing Agreement (APA) process for IT services within a strict two-year timeframe, to improve tax certainty, reduce litigation, mitigate double taxation, and ease compliance.

- What This Means:

- Mid-sized IT startups and SaaS companies gain greater tax certainty and reduced litigation.

- A common safe-harbour margin of 15.5% for IT Services companies simplifies compliance for large multinationals across IT and tech services

- While the government’s focus is on boosting the services economy and catapulting it to 10% of the global market, there was a clear gap between this ambition and the wave of AI startups that are building products for the global market.

- Non-resident experts staying for up to 5 years under notified schemes will be exempt from global income tax. This should ideally make it easier for Indian startups to hire top-tier global CTOs and specialised consultants

- Accelerates net talent addition in key AI and frontier tech fields by incentivising high-skill experts to move to India.

Bharat-VISTAAR: Agriculture Gets A Dose Of AI

The Union Budget 2026-27 announced the launch of “Bharat-VISTAAR,” a multilingual AI-powered platform for farmers to leverage AI for agricultural practices, improve market linkage and enhance farm productivity.

- What This Means:

- New opportunities for agritech startups to collaborate with the Indian Council of Agricultural Research (ICAR) and utilise AgriStack portals.

- Increased demand for AI-driven predictive modelling for crop yields, soil health, and post-harvest processing.

- One potential red flag for agritech startups: if the government owns the agritech interface and builds on top of the AgriStack, can agritech startups actually build moats and differentiation?

Eliminating Barriers For Ecommerce Exports, Logistics

The government has removed the current value cap of INR 10 Lakh per consignment on courier exports.

Plus The expenditure chart reveals a staggering INR 5,98,520 Cr allocation for Transport and INR 74,560 Cr for IT and Telecom.

Plus, the rollout of a Customs Integrated System (CIS) over the next two years and a digital window for cargo clearance approvals should streamline imports, in addition to the emphasis on exports and cross-border flow of goods.

- What This Means:

- A massive win for D2C startups, allowing them to ship high-value products globally without restrictive caps.

- Simplifies the logistics and scaling process for Indian brands looking at international markets.

- Increased spending on transport infrastructure will drive demand for logistics tech startups specialising in fleet management, autonomous delivery, and supply chain AI.

- IT and telecom spending ensures continued 5G/6G connectivity, benefiting startups building high-bandwidth digital services.

- Hardware and electronics startups will benefit from faster turnaround times and lower friction for imported components.

- Improves “Ease of Doing Business” for startups involved in global trade and cross-border manufacturing.

Easing Public Markets Investment For Indians Abroad

Individual Persons Resident Outside India (PROIs) will now be permitted to invest in equity instruments of listed Indian companies through the Portfolio Investment Scheme (PIS).

- What This Means:

- Opens up a new channel of foreign capital for listed tech companies and startups that have recently gone public or are looking to list

- Broadens the investor base for the Indian markets, potentially increasing liquidity and valuation stability for the tech sector.

Budget 2026 Brings Push For ‘Biopharma Shakti’

Mirroring the success of the electronics PLI, the budget introduced the Biopharma Shakti initiative to encourage high-end biological manufacturing and build an ecosystem for domestic production of biologics and biosimilars. Sitharaman’s budget proposes an allocation of INR 10K Cr for the biopharma push.

- What This Means:

- Provides a dedicated framework for healthtech and biotech startups to move from R&D to large-scale domestic manufacturing.

- Enhanced focus on “frontier sectors” ensures long-term venture capital interest in deeptech, life sciences.

Clean Energy Gets A Clear Mandate

The Union Budget 2026-27 extends Basic Customs Duty (BCD) exemptions on capital goods used for manufacturing Lithium-Ion cells and critical mineral processing.

Sitharaman also announced a new scheme to adopt Carbon Capture Utilisation and Storage (CCUS) has been announced with a massive outlay of INR 20,000 Cr.

The FM also announced new Rare Earth Corridors in states such as Odisha, Kerala, Andhra Pradesh and Tamil Nadu. The corridor will help unearth new models, strategic depth in electronics manufacturing as well as next-gen technologies in EVs, semiconductors and more.

- What This Means:

- A massive opportunity for clean tech and sustainability startups to develop indigenous carbon-scrubbing technologies.

- Positions India as a leader in industrial decarbonisation, attracting specialised global ESG funding.

- Reduces the cost of production for EV startups and battery energy storage system (BESS) manufacturers such as Ola Electric, Waaree, Amara Raja.

- Exemptions on capital goods for processing critical minerals will help secure the upstream supply chain for Indian hardware startups.

Share Buyback Taxation Gets Budget 2026 Clarity

The budget proposes a significant change in how buybacks are treated, moving them into the “Capital Gains” category for all shareholders.

- What This Means:

- This provides a clearer and more beneficial exit framework for early investors and employees with ESOPs during secondary sales.

- While promoters will pay an additional buyback tax, the shift to Capital Gains for other shareholders simplifies the tax structure for the startup ecosystem.

Capital Boost For MSME, Startups At Budget

To address the “funding winter” for early stage startups, smaller enterprises, the government has announced dedicated equity support of INR 10K Cr.

Plus, as Sitharaman announced, the government is making the TReDS (Trade Receivables Discounting System) platform mandatory for all MSME purchases by central government units and public sector enterprises.

- What This Means:

- A dedicated INR 10,000 Cr SME Growth Fund will provide much-needed capital to high-potential tech MSMEs.

- An INR 2,000 Cr top-up for the Self-Reliant India Fund (2021) ensures continued support for scaling startups.

- Drastically improves cash flow for B2B startups by ensuring quicker invoice settlement.

- The introduction of credit guarantees for invoice discounting and linking government e-marketplace with TReDS will lower the cost of short-term capital.

- The Budget 2026-27 proposes to reduce the “hidden cost” of compliance for early-stage startups, MSMEs in Tier-II and Tier-III towns through Corporate Mitras

Fuel For The AVGC, Creator Economy

In a bid to bolster India’s growing animation, visual effects, gaming and comics (AVGC) market, Sitharaman announced support for Indian Institute of Creative Technologies in Mumbai to set up AVGC and content creator labs across 15,000 secondary schools and 500 colleges across the country.

The FM claimed that the move will aid the sector meet the growing manpower demand and provide employment to 2 Mn professionals by 2030.

The budget also proposed establishing a new National Institute of Design and Development to upskill individuals with cutting-edge design education.

-

- AVGC is being positioned as an employment engine, and startups that cater to this wave will be able to fill the gap that the government has envisioned.

- Given the current environment in the gaming industry, the focus on design and development of creative technologies can turn India from a market of game consumers to game developers

Futures & Options Volumes Under Scanner

In a move to curb excessive speculation in the financial markets by individual traders, the Securities Transaction Tax (STT) on derivatives has been raised at the Budget once again after a similar move in 2024. This could have implications on startups such as Groww, Zerodha, Dhan and others that cater to professional traders.

- What This Means:

- STT on Futures raised from 0.02% to 0.05%; Options premium raised to 0.15% (from 0.1%) and exercise of options to 0.15% (from 0.125%).

- Fintech startups and brokerage platforms may see a shift in trading volumes or user behavior toward long-term equity investments.

TCS Eased For Overseas Travel And Edtech

The Tax Collected at Source (TCS) rate on overseas tour packages and LRS (liberalised remittance scheme) for education/medical purposes has been slashed as per proposals at the Union Budget 2026.

- What This Means:

- TCS reduced from 5% and 20% down to a uniform 2% without amount stipulations, which will increase foreign travel for tourism, education and medical purposes

- A major boost for travel startups and edtech companies facilitating study-abroad programs, as the upfront cost for consumers decreases.