Remitly, the Nasdaq-listed digital payments company that acquired Israeli fintech Rewire for $80 million in 2022, is laying off around 110 employees from its Israel office, more than half of the roughly 200 people employed in the country, and closing its local development center. The company will retain only sales and business roles in the country, marking a sharp retreat from the engineering footprint it inherited through the acquisition.

Employees were informed of the decision in a Zoom call led by executives from the United States, according to people familiar with the process.

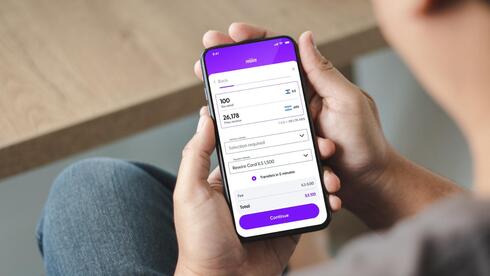

The move signals a significant change in strategy for Remitly, which had previously promoted Israel as a hub for technology serving migrant workers and cross-border payments. Instead, research and development activities are being consolidated in other global locations as part of what the company describes as an effort to streamline operations and reduce complexity.

In a statement, Guy Badichi, chief operating officer of Rewire, said Remitly remained committed to the Israeli market itself, even as it dismantles the engineering operation that powered the local platform.

“Remitly strongly believes in the growth potential of its business unit in Israel, including in the areas of money transfers and payroll cards for migrant workers,” Badichi said. “Based on the leadership, significant growth, and strong performance in the local market, the company will continue to invest in developing its operations, expanding the services offered in the Remitly app, and supporting both individual customers sending money abroad and employers of migrant workers.”

At the time of the acquisition, Remitly described the purchase of Rewire as its largest ever deal and a strategic entry into services tailored for migrant communities. Rewire, founded in 2015 by Guy Kashtan, Saar Yahalom, Adi Ben Dayan, and Or Benoz, had raised $62 million from prominent investors including Glilot Capital, OurCrowd, Viola Fintech, BNP Paribas’s Opera Tech Ventures and former Yahoo chief executive Jerry Yang.

“The company is strengthening its focus and centralizing research and development activities in its other centers of operation,” Badichi said. The goal, he added, is “to enable more efficient operations and reduce operational complexity.”

Remitly said it would support affected employees during the transition. The company framed the cuts as part of a broader global realignment aimed at prioritizing cross-border money transfers and an expanded suite of financial services.

“These adjustments are intended to enable greater focus on the company’s most significant growth engines,” Badichi said, referring to a potential market of some 350 million individual and business customers who require international financial services.