Also in the letter:

■ Wealthtech: growth vs losses

■ Musk’s bet on space

■ AI eases patient care

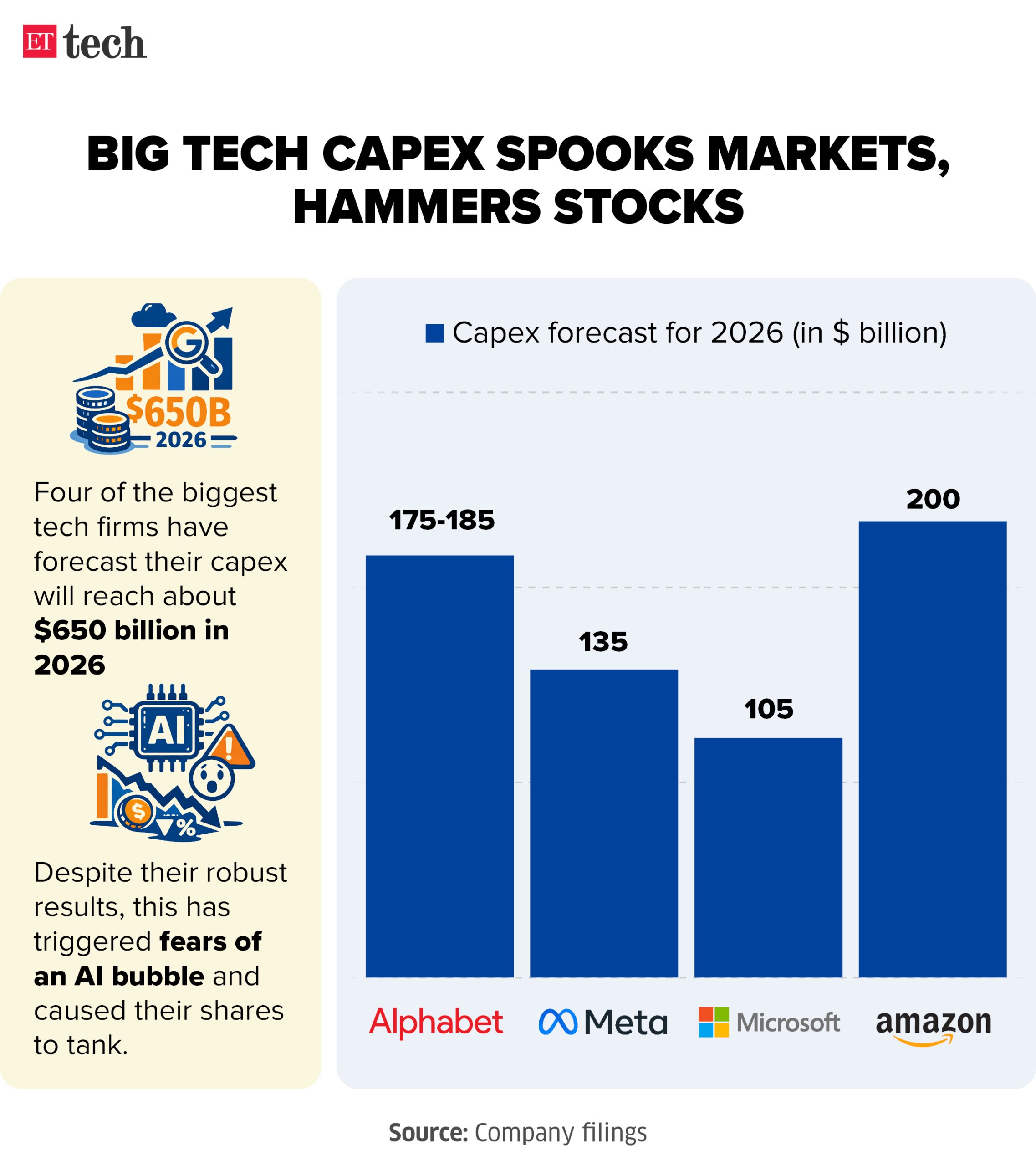

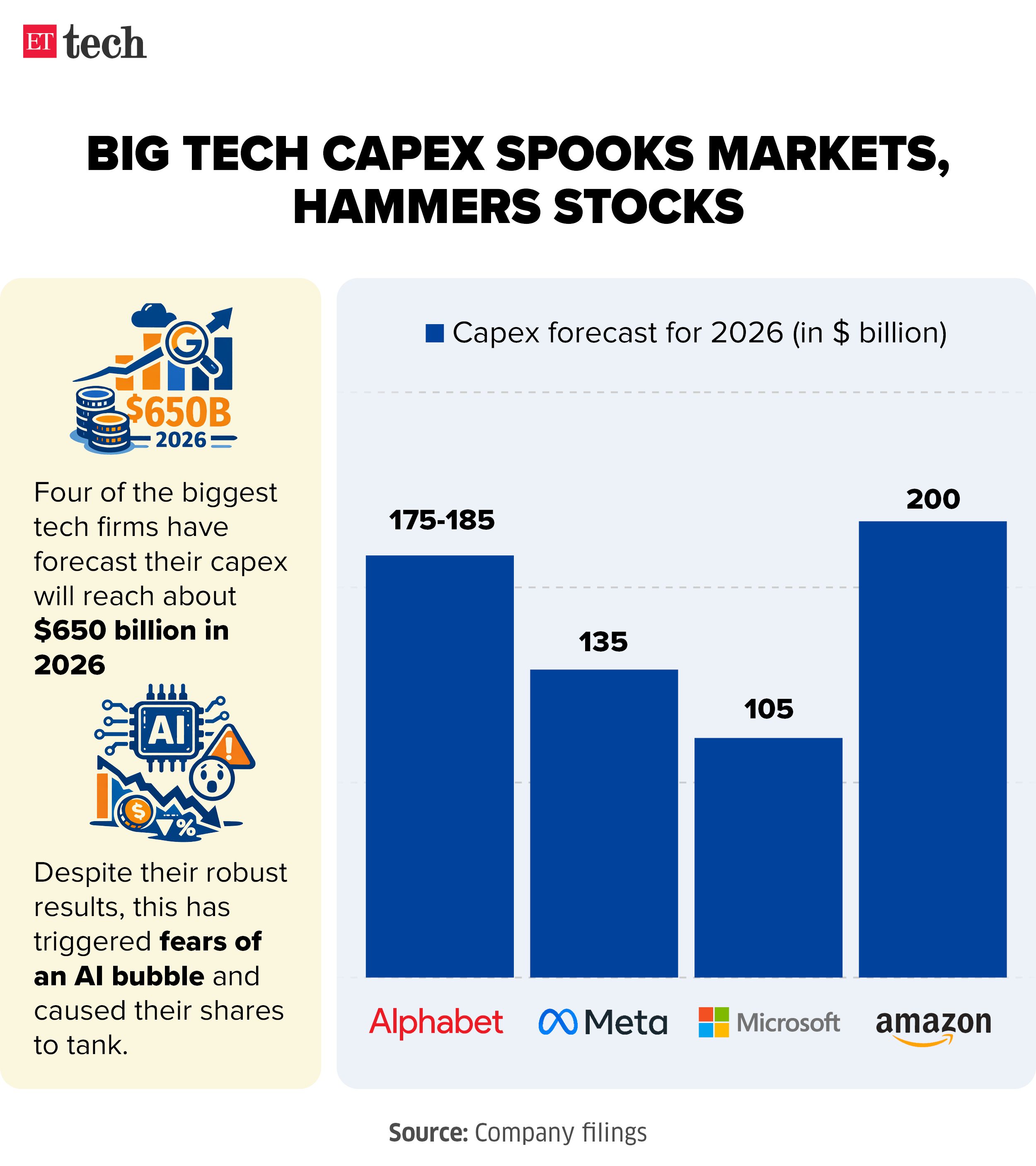

Amazon joins Big Tech in raising capital spending multifold; stocks hit

Ecommerce major Amazon felt Wall Street’s full fury on Thursday, shedding nearly 11% despite reporting a profit of $21.2 billion on net sales of $213.4 billion for the December quarter.

Investors torched tech stocks as fears of an artificial intelligence (AI) bubble revived after Big Tech companies cranked up capex projections for the year ahead.

The big fall: Amazon wasn’t flying solo. Strong financials offered no shelter as technology stocks took massive hits, dragging US markets down.

- Alphabet was one of the heaviest weights on the market and dropped 3%.

- Microsoft fell 3.4%; Meta slid about 3%.

- Semiconductor and chip equipment companies threw a party on AI spending. Broadcom and Lam Research jumped 4.5% and 2% respectively, while Applied Materials climbed 2.5%.

Capex high: As the infrastructure race heats up in the AI arena, where tech giants are scrapping to come out on top, cash reigns supreme. The capital-intensive data centre race has Big Tech flinging its purses wide open. They are expected to collectively pour more than $600 billion into AI this year.

Where does this capital land: This capex surge will likely trigger a wave of colossal data centres – facilities sprawling across vast tracts of land, powering the AI devices and apps sitting in your phone. Every company’s playbook to recoup these costs looks identical: make tools like OpenAI’s ChatGPT, Gemini, and Claude indispensable in workplaces and homes.

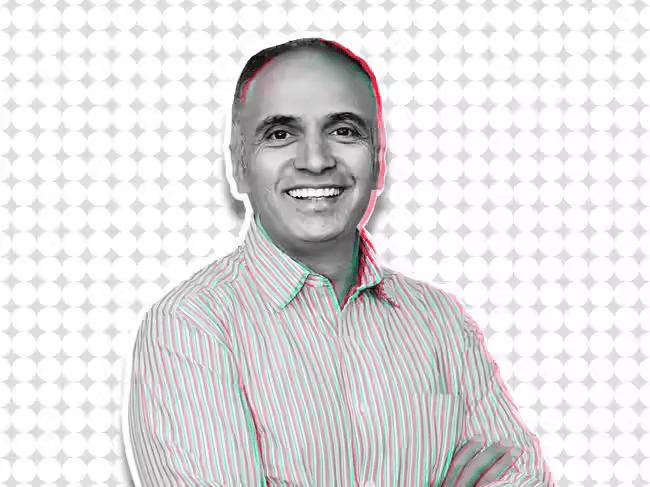

PB Fintech shelves plan to raise funds via QIP

PB Fintech has shelved its plan to raise funds through a qualified institutional placement (QIP), just days after signalling interest in overseas acquisitions.

What’s happening:

- The company told stock exchanges that neither its management nor board is considering a QIP.

- This followed the cancellation of its February 5 board meeting.

- Earlier, management had indicated it was exploring acquisitions abroad and wanted to raise fresh funds for the same.

By the numbers:

- Q3 FY26 profit: Rs 189 crore (+164% YoY)

- Revenue: Rs 1,771 crore (+37% YoY)

Growing inorganically: PB Fintech had made plans of growing its business globally. Yashish Dahiya, group chairman, PB Fintech had said on February 2 that he believed that India should have multiple multi-national companies and PB Fintech could be one such.

Also Read: Pine Labs receives GST tax demand of Rs 37.33 crore

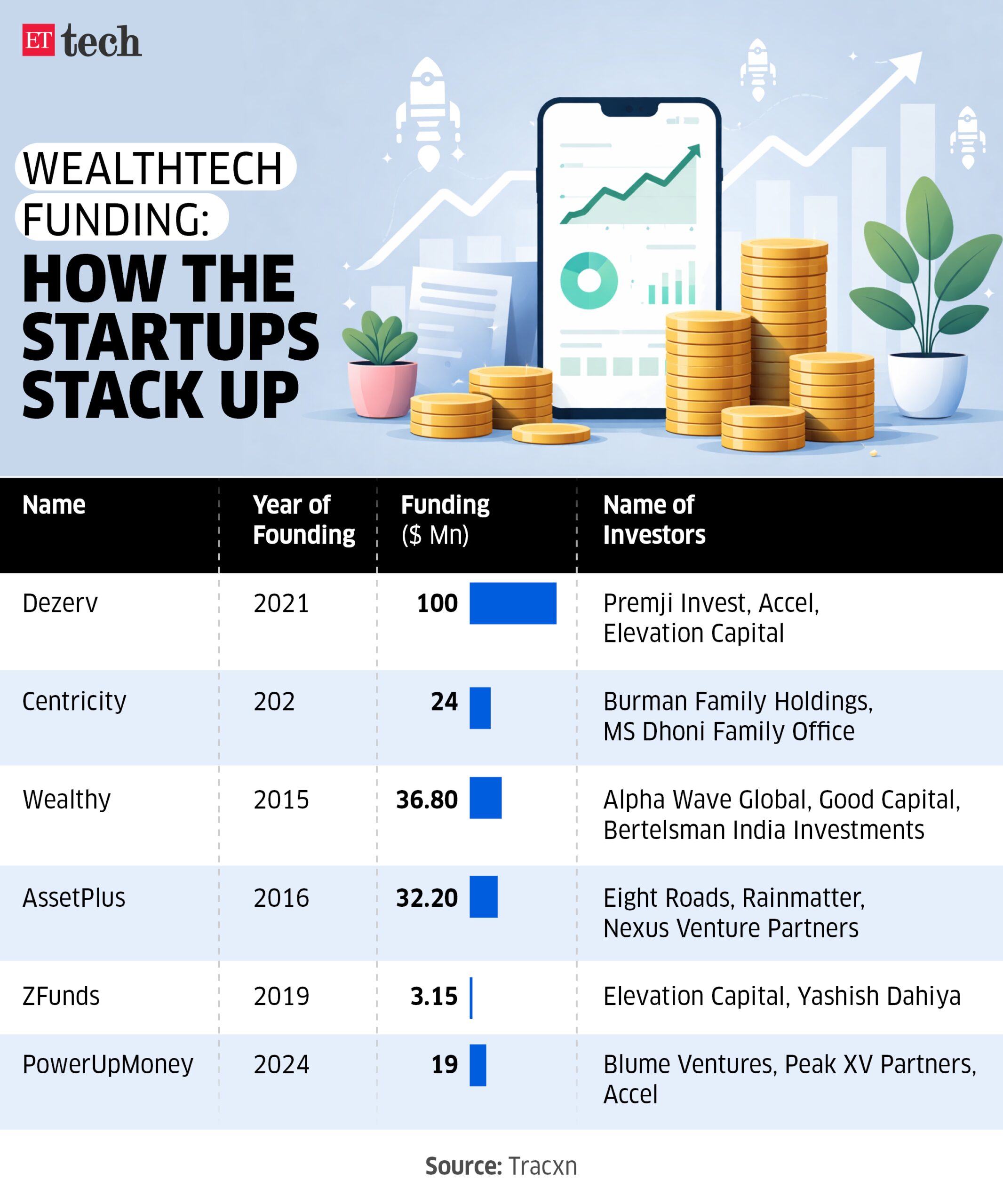

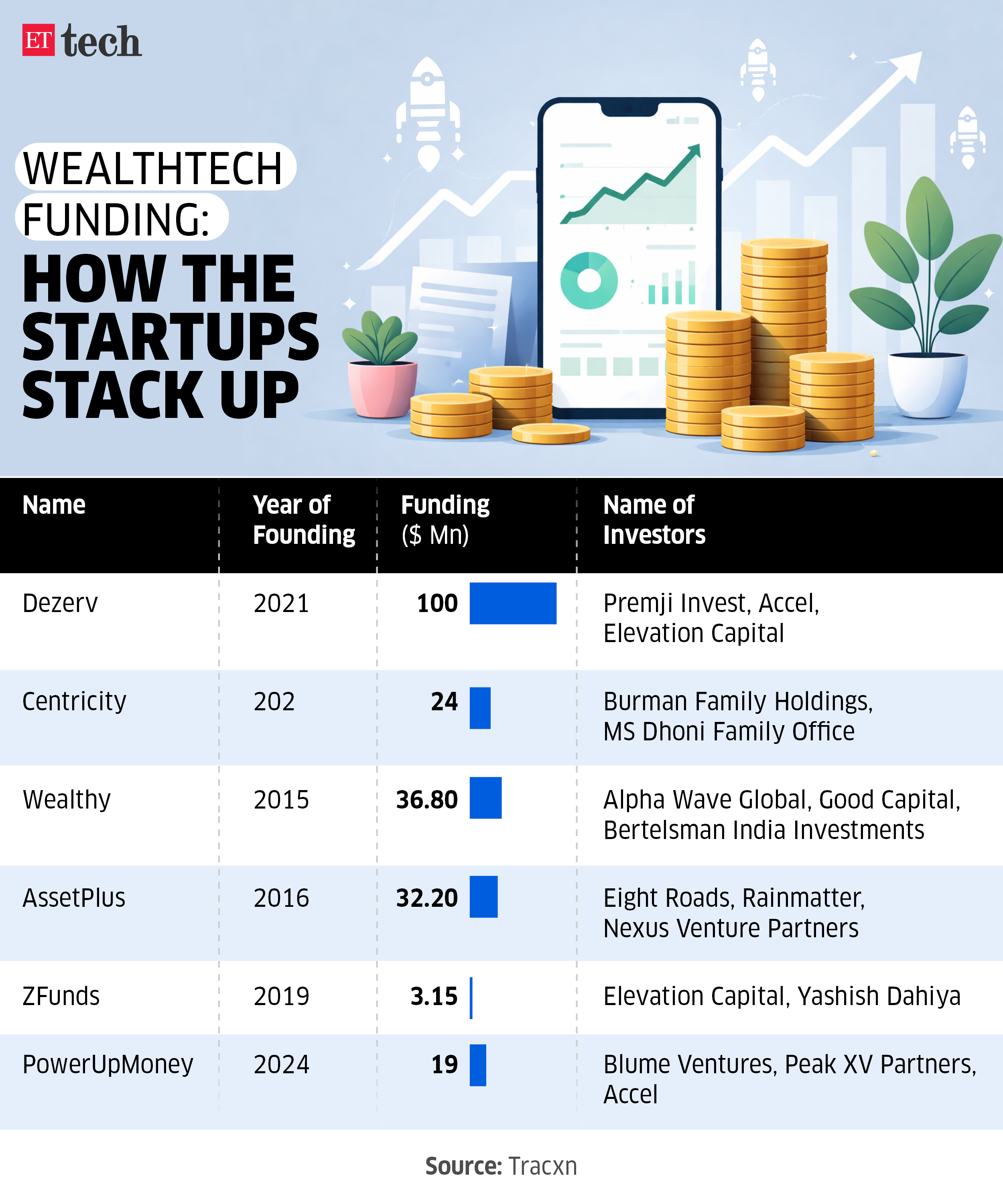

VC-backed wealth management startups see revenue rise, losses widen

India’s buzzy wealthtech ecosystem is drawing strong investor interest, but a look at FY25 numbers shows many new-age players are still deep in the red.

Driving the news: Wealthtech startups that burst into the fintech scene over the last two years raised more than $100 million in venture capital funding over 2024-25. Yet most remain sub-scale, with losses outpacing revenue growth.

- Dezerv reported a net loss of Rs 112 crore, on revenue of Rs 66 crore

- Centricity posted revenue of Rs 10 crore with a net loss of Rs 4 crore

- Wealthy reported total revenue of Rs 35 crore, and an equal Rs 35 crore net loss

Funding euphoria: The financials sit awkwardly against the funding backdrop. Dezerv has raised $100million. Centricity has secured $24 million, while Wealthy and AssetPlus have raised around $30–35 million each.

Challenges ahead:

- Wealth management is a long-term business, unlike broking, where platforms earn on every transaction.

- Trust takes time. Many customers still rely on agents, family advisors, or neighbourhood brokers.

- Retail investors are only beginning to get comfortable with mutual funds through apps. Convincing them to move into PMS products or app-led discovery is the next step – and a slower one.

Elon Musk says space will be the cheapest place for AI data centres in three years

Billionaire Elon Musk believes that within three years, possibly sooner, space could become the most cost-effective location for AI data centres, surpassing Earth due to higher solar efficiency and no need for batteries.

Muskspeak: Speaking on Dwarkesh Patel’s eponymous podcast with Stripe cofounder John Collison, Musk flagged Earth’s energy constraints for AI. “The availability of energy is the issue,” he said, noting global electricity output outside China remains “pretty close flat” while chip production climbs.

Musk laid out the advantages.

- In space, there is no day-night cycle, clouds, seasons, or atmosphere, which he says causes about a 30% energy loss on Earth.

- “Any given solar panel can do about five times more power in space than on the ground. You also avoid the cost of having batteries to carry you through the night. It’s actually much cheaper to do in space,” he added.

Background: The comments landed soon after SpaceX bought Musk’s AI firm xAI to create a $1.25 trillion enterprise, aiming to blend “AI, rockets, space-based internet, direct-to-mobile device communications and the real-time information and free speech platform.”

Also Read: SpaceX merger provides lifeline for Elon Musk’s debt-ridden AI startup

AI firms help patients by making diagnostics faster & way cheaper

AI startups in India are teaming up with hospitals to speed up diagnostics and lighten the load for doctors handling radiology, oncology, and ECG services.

What’s happening? Tricog Health is one of several AI firms working with hospitals and diagnostic centres on radiology, oncology, and ECG scans to save time and cut staff workload.

Hospital chains such as Aster DM Healthcare, Yashoda Hospitals, Manipal Hospitals, Apollo Hospitals, and Global Health are either partnering with or in talks with AI firms. Their tools, used alongside doctors, help accelerate diagnosis and sometimes catch issues humans miss.

Yes, but: Qure.ai, backed by Lightspeed, collects anonymised data from the US, Europe, and Asia. India provides half its data but only a sliver of revenue. However, founder Prashant Warrier expects India’s revenue share to climb over time.

The healthcare sector is also tightening data protection ahead of the Digital Personal Data Protection Act, which takes effect next May, as India lacks a robust data-sharing framework compared with countries such as the US.

Source link