Before we look into the January numbers, let’s be clear: a relatively slow start of the year doesn’t make a bad year. Neither does it signal a downward trend. Actually a MoM dip between December and January is something the ecosystem’s already experienced in 2023, 2024 and 2025…

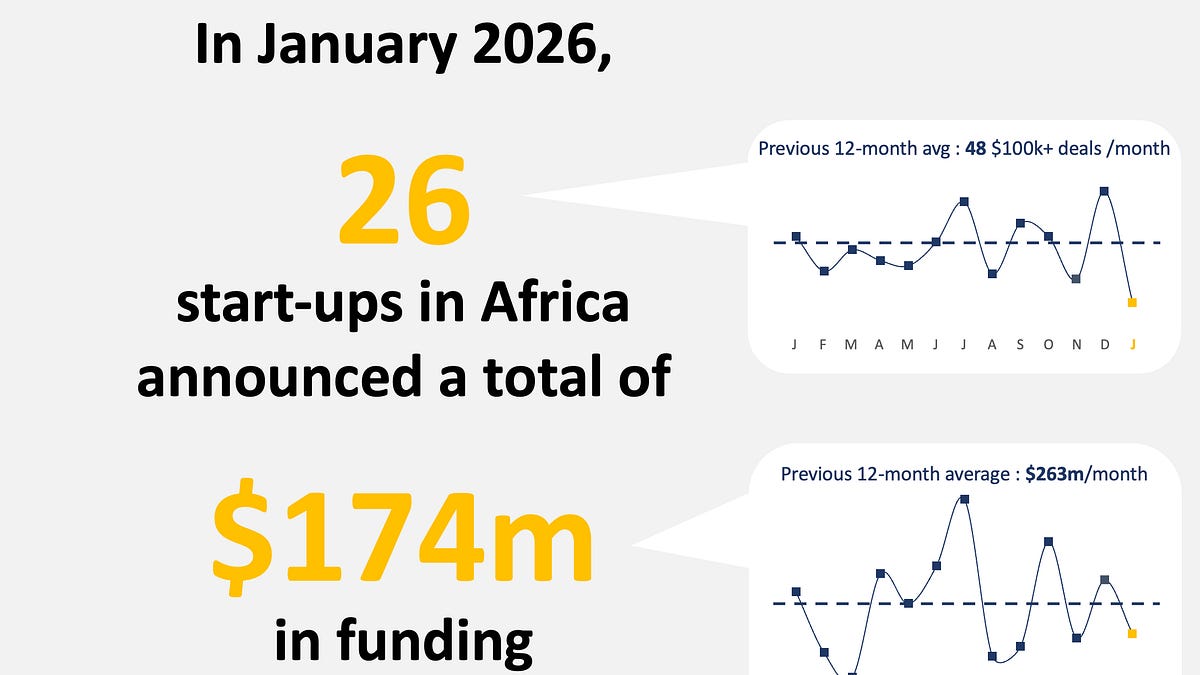

Now, start-ups in Africa have raised a total of $174m in funding in January 2026 through $100k+ deals (equity, debt, grants; exc. exits). This is significantly lower than what was raised in January 2025 ($276m) and also well below the monthly average over the previous 12 months ($263m). It is much higher though than January 2023 ($106m) and 2024 ($85m). What is more concerning however is the fact that only 26 start-ups announced at least $100k in funding in January. That is very low: just above half of the monthly average over the previous 12 months, and of January 2025. As a matter of fact, on this specific metric, this is the lowest monthly tally on record since at least 2020…

The top raisers last month were fintech valU in Egypt who secured $64m in debt from the National Bank and Nigerian mobility financing start-up MAX who raised $24m in both equity and asset-backed debt. Four more raised $10m+ equity rounds: NowPay (Egypt, fintech, $20m), Yakeey (Morocco, proptech, $15m Series A), Terra Industries (defence, $12m) and Cauridor (Côte d’Ivoire, fintech). On the exit front – therefore not counted in the numbers above -, there were three noteworthy announcements in January: flutterwave acquired Mono in Nigeria for around $30m (all-stock deal); tech talent start-up Savannah was acquired by Commit; and Izili Group acquired Qotto (off-grid solar)…

Now: Bring it on, February! ;)… As usual, if you want to run your own analysis, or need data to prepare to raise your next rounds or fund, don’t miss our database which you should really access with this discount code. And actually, if you’re a start-up, you might want to apply to ‘Data for Founders’, our new initiative partnership with FMO Ventures. Have a good week! Max