Also in the letter:

■ IDTA bets big

■ ElevenLabs CEO interview

■ Amazon cheers tax break

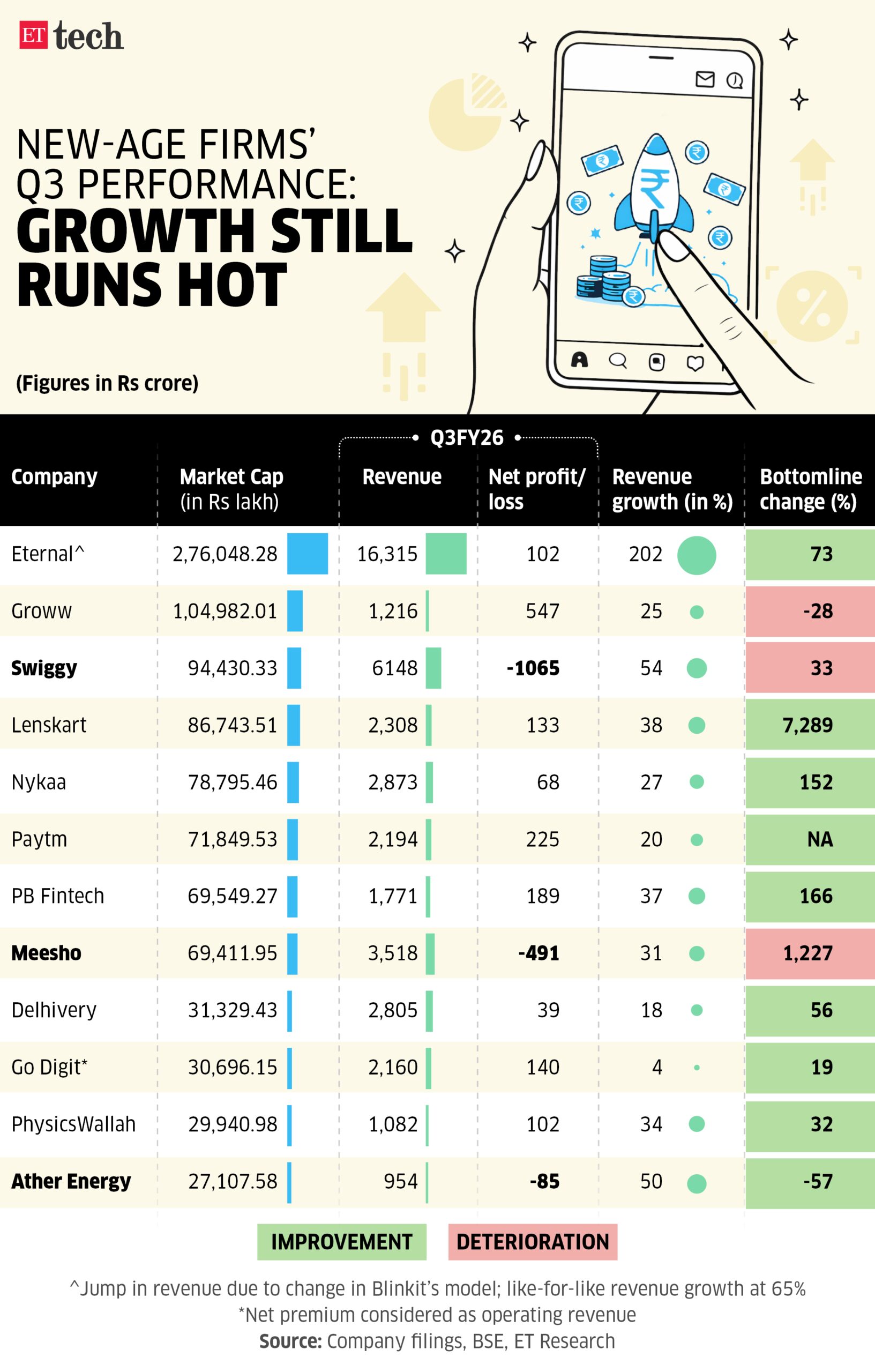

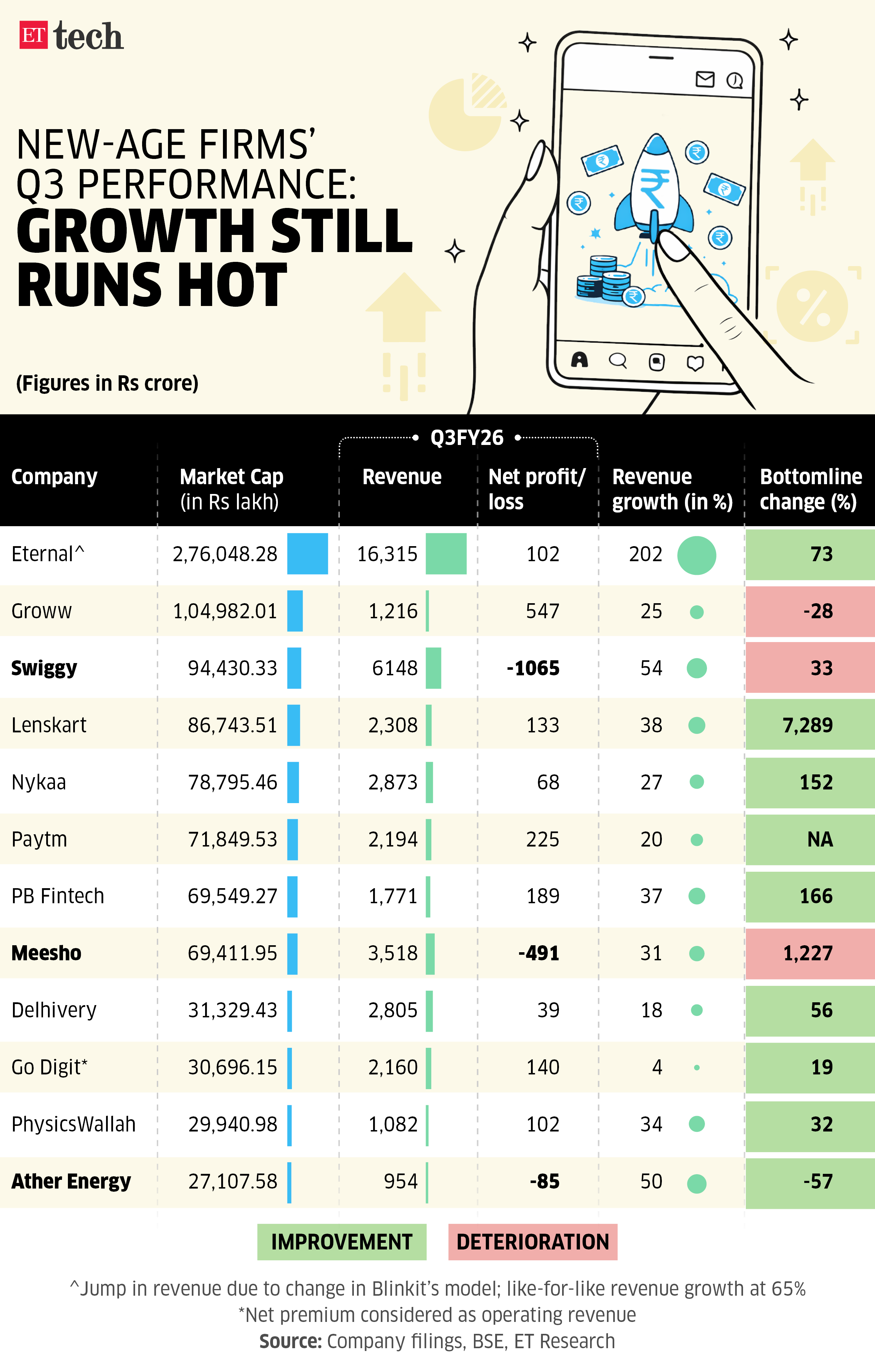

D-Street’s new-age firms strike a profit note

New-age listed tech companies delivered a strong December quarter, with nine of the 12 large players posting steady revenue growth and net profits.

Driving the news:

- Large consumer internet firms like Eternal (parent entity of Zomato), Swiggy, Ather Energy, PB Fintech and Meesho pushed up their revenues in the December quarter compared to a year ago.

- Large fintech companies like Paytm and Pine Labs grew their revenue by 20% and swung from losses in the December quarter of last year to profits this year.

- Nykaa saw revenues jump while net profit grew much faster.

Going deeper:

- Privately-funded startups, known for chasing growth over profitability, have changed tack after listing.

- Most have started clamping down on expenses and chasing revenue in their core business.

- Swiggy, which saw ballooning losses this quarter, said it will stop waiving fees and chasing inducement-led volume gains.

Major VCs line up top dollars for coordinated AI capital push in India

Leading venture firms are poised to pump $300-500 million each to India’s AI ecosystem at the ongoing India AI Impact Summit, marking one of the largest coordinated capital pushes the sector has seen.

Where the money goes: Allocations will span the full stack — from GPU and compute infrastructure to enterprise software and vertical AI use cases in financial services, healthcare, and manufacturing.

Why now: Even five or six such commitments could together channel over $1 billion into AI startups, blowing past last year’s total AI fundraising in India. Investors say limited partners are pushing for deeper exposure as AI shifts from a niche theme to a core allocation.

Also Read: AI Summit 2026: The govt’s focus is on scalable and efficient AI models: Jitin Prasada

Global contrast: Indian AI startups raised about $643 million in 2025, a sliver of the $121 billion deployed in the US, where frontier model companies hoover up late-stage funding.

Momentum building: Recent big-ticket deals — from Emergent to Neysa’s $1.2 billion round — signal that deployment is picking up speed.

Also Read: India can lead the world by aligning AI transformation with mass employability: CEA Nageswaran

India Deep Tech Alliance pencils $1 billion for AI as members plan $2.5 billion play

The India Deep Tech Alliance (IDTA) will announce higher investment plans for India’s AI and deep tech sector on Tuesday.

Investment details: Its members have pledged more than $2.5 billion over five years, including $1 billion specifically for AI deployment within the next three years, according to IDTA chair Arun Kumar.

Also Read: TCS, AMD to expand AI partnership to take on Nvidia in India

The funding push is also being strengthened by new strategic partners. Applied Materials, CG Power and Industrial Solutions, Lam Research, Larsen & Toubro, and Micron Technology have joined the alliance, after Nvidia came on board earlier as a founding member and strategic and technical adviser, he said.

Also Read: American chipmaker Micron to begin commercial production in India by month-end: Meity official

Voice AI will shift from reactive support to proactive AI agents: ElevenLabs CEO

As more businesses adopt voice AI across customer service, sales and operations, India is becoming a key growth driver, said ElevenLabs’ cofounder and chief executive Mati Staniszewski.

The country is now ElevenLabs’ second-largest and one of its fastest-growing markets.

On voice AI: As voice AI improves, it will move beyond basic customer support and become proactive agents that can handle tasks across industries such as ecommerce and banking, Staniszewski said.

Also Read: ElevenLabs raises $500 million in round led by Sequoia; valuation jumps fourfold to $11 billion

ElevenLabs already manages around 60,000 support calls for one client in English, Hindi and other Indian languages, and makes nearly 50,000 outbound calls a month for IDFC Bank — showing that companies are now using voice AI in core operations, not just trials.

Also Read: India revenue run rate has doubled over the last four months: Anthropic CEO Dario Amodei

Other Top Stories By Our Reporters

‘Tax breaks offer legal certainty for companies’: India’s recent tax incentives for data centre operators, extending through 2047, provide what Zapolsky described as much-needed “legal certainty” for hyperscalers such as AWS. Long-term infrastructure investments, he added, require predictable regulatory environments that outlast political cycles.

Progcap eyes $100 million round: New Delhi-headquartered supply-chain financing startup Progcap is in advanced talks to close a $100 million equity funding round, sources told us. The round could be led by global alternate assets manager TPG, they said.

Motilal Oswal Alternates closes fifth private equity fund: Motilal Oswal Alternates has closed its fifth private equity fund at Rs 8,500 crore, marking the largest fundraise in the firm’s history, amid increasing investor appetite for India-focussed mid-market deals.

Fractal Analytics’ flat market debut: AI firm Fractal Analytics made a subdued stock market debut Monday, its shares listing at a discount to the issue price despite robust global investments into the technology that’s tipped to hasten the mothballing of legacy IT systems.

Global Picks We Are Reading

■ Inside the app where queer gooners run free (Wired)

■ How the sound of sport is being reimagined for deaf fans (BBC)

■ Trump leans on Utah Republicans to scrap AI safety bill (FT)

Source link