As Atlanta native Arnab Khan navigated his own divorce, he learned quickly that “the world wasn’t built for single parenting.”

That was particularly true when it came to finances. As he spoke with more co-parents, a clear pattern emerged. Managing child-related expenses falls to one parent, often the mother, who is responsible not only for tracking costs but also for pursuing reimbursement from the other parent. The issue, many said, is not an unwillingness to pay, but the emotional and logistical burden and the distrust that comes from having to repeatedly interact with a former spouse.

With divorce impacting roughly one-third of American children, these dynamics are far from uncommon.

While the pain point was everywhere, there wasn’t a solution. So Khan set out in 2024 to build on. Now in 2026, he’s looking to scale his FinTech solution, Blended App, to help shape the financial infrastructure of co-parenting.

The FinTech Solution To Co-Parenting Finances

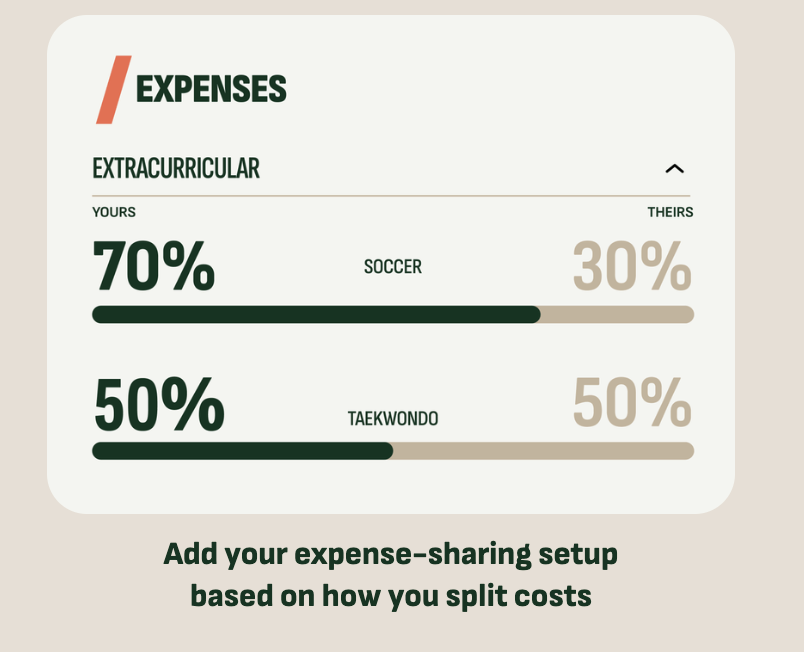

Blended App allows co-parents to track expenses in one place, eliminating the need to hunt down receipts and send messages back and forth for each reimbursement. The app allows users to track expenses manually, or to link a credit or debit card to do that process automatically.

Importantly, the app applies the rules of the divorce agreement around expense sharing, ensuring that all court-ordered rules are implemented. To decrease financial conversations between co-parents, Blended automatically sends an invoice over to a parent, and is integrated with Venmo for more seamless transactions.

The app works on a freemium model, with the free version allowing parents to track expenses and send one invoice per month. Its paid version, priced at $8.99 a month, includes automatic tracking, unlimited expenses and invoices, enhanced payment features, and priority access to Blended Mediators, a new service that helps parents “resolve financial disagreements in a structured, expert-led way” without going straight to hiring a lawyer.

“We are also building the Blended Card. This lets a parent pay for child-related expenses on a dedicated card inside the app,” he added. “Transactions sync automatically, and the other parent’s share can be repaid directly back to that card. It creates a more automated and structured system and supports partnerships with financial institutions that want to better serve modern families.”

Early Signs of Traction

The startup has already found traction in the market.

Khan told Hypepotamus that Blended has had more than 3,500 signups and over 2,500 app downloads. The startup has also seen strong community growth online, garnering 7,4000 Instagram followers in under three months.

“What has been especially encouraging is that families are responding strongly to our authentic, story-driven approach. We talk openly about real experiences, challenges, and lessons from modern family life, and that has helped build trust and a real sense of community around the brand,” Khan added.

Blended is also in “active conversations with financial institutions, legal and court technology companies, employer benefit platforms, and lawyer and mediation firms,” which Khan said will help expand the startup’s reach.

Khan also just went through the inaugural cohort for Pinnacle Atlanta Innovation Accelerator, a 12-week fintech-focused program created in partnership with Pinnacle Financial Partners, Tarkenton Companies, and the nation-wide startup program gener8tor. Through the cohort, Blended received $100,000.

Building Tech For Parents

Khan, who earned his undergraduate degree in mechanical engineering from Georgia Tech and his MBA from Emory University, built his career at new innovation groups inside larger corporations like thyssenkrupp, Kimberly-Clark, Koch Industries, and Nationwide before joining the tech startup world in 2020.

While building Blended, he told Hypepotamus he learned that after a separation, financial products can’t assume both parents are aligned or willing to participate.

“A lot of tools assume two people are aligned, responsive, and willing to sign up together. That is not the reality. So we built Blended as what we call a one-player system,” he added. “Once there is a neutral system in place, the dynamic changes. The conversation shifts from “you said, I said” to “this is what the system shows.” Structure makes cooperation easier.”

But Khan also said he’s learned that co-parents don’t just need help with expense tracking.

“They need a system for handling conflict before it turns into court or legal bills. Money disagreements are one of the most common reasons families end up back in front of a judge. Often over relatively small issues that spiral,” he added. That insight helped Blended roll out its latest product offerings.

Long term, Khan wants Blended to be the place where divorced and separated families have all of their money conversations, becoming the “ financial infrastructure through how the Modern Family manages shared finances.”

Quick Facts on Blended App

HQ: Atlanta, Georgia

Founded: 2024

Industries: Fintech, consumer app

Funding status: investment through accelerator

Related Stories

New Accelerator Backs Local Fintech Startups & “Hidden Gems” with $100K

The Average American Has Nearly $6,000 In Credit Card Debt. This Atlanta Entrepreneur Could Help Them Pay It Off.