AI-native startups ate up 40 percent of software deal value in Canada in 2025.

Canadian software investors now see the use of AI as table stakes for the startups they invest in, according to a new market report, as interest in the technology has fuelled the largest fundraises amid a larger downturn in venture funding.

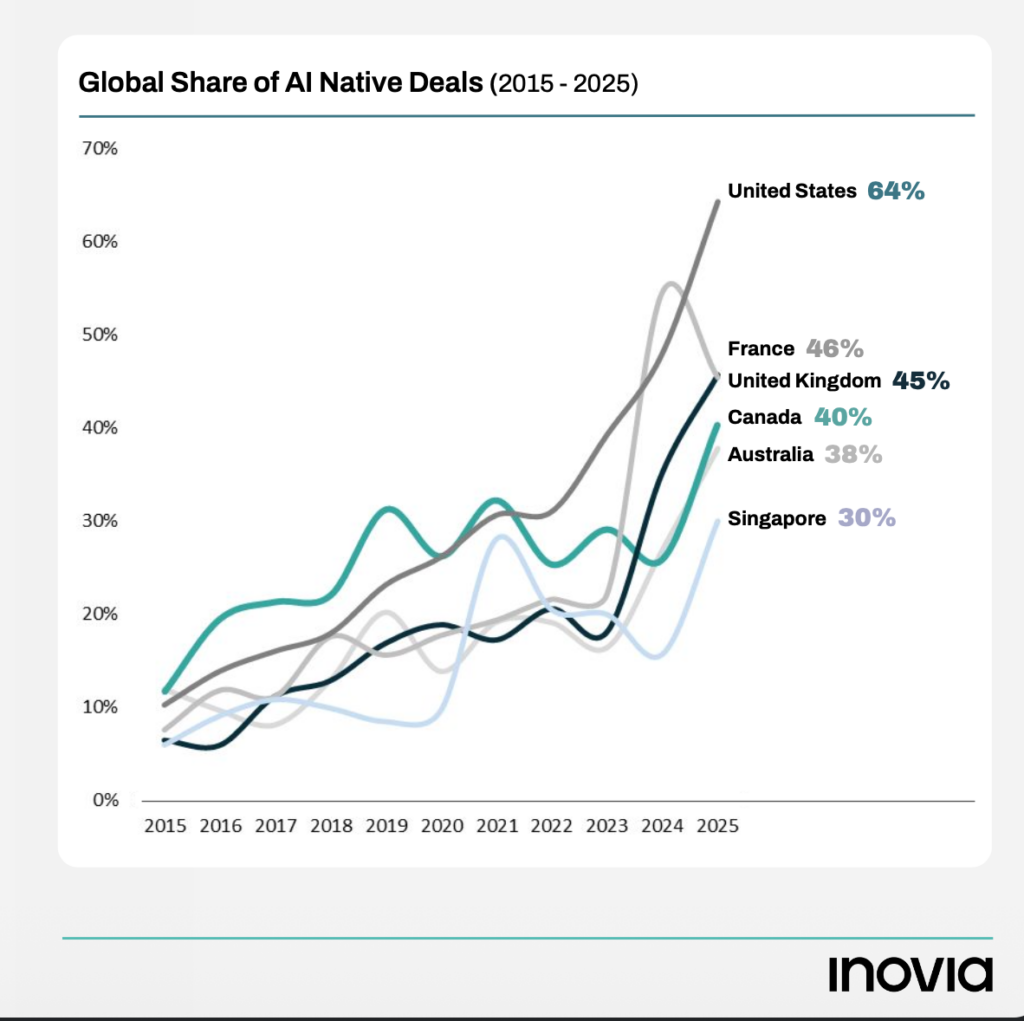

In 10 years, AI-native deals have gone from 12 percent of deal flow to 40 percent in Canada.

Montréal-based Inovia Capital, one of the country’s largest private venture capital (VC) firms, released its 2025 State of Software report on Wednesday, drawing on North American data sources as well as its portfolio companies and funds. The data show that while venture fundraising for firms had a dismal year, the big winners were “AI-native” startups, which ate up 40 percent of software deal value in Canada.

The report helped crystallize what many Canadian founders and investors have said publicly: it’s becoming increasingly uncommon to build a startup without an AI strategy.

“We felt 2025 would be a year of big momentum,” Mia Morisset, a Montréal-based principal at Inovia and author of the report, told BetaKit in an interview on Monday. But when the macroeconomic conditions—largely set off by US President Donald Trump’s trade aggression—slowed down deal activity, “the AI wave more than offset this macro slowdown.”

AI-native, privately held startups—which Inovia defines as companies that have their core product built on AI—are landing larger financing rounds with bigger valuations, the report said. In 10 years, AI-native deals have gone from 12 percent of deal flow to 40 percent in Canada. In the US, that share is far ahead of the rest of the world, at nearly two-thirds of deals.

The AI focus isn’t totally new. In 2024, fundraising activity was largely driven by what Inovia termed the “AI supercycle,” which pushed valuations and revenues of startups working with the technology higher.

What is new is that AI has “shifted from a vertical to a universal standard,” Inovia partner Magaly Charbonneau wrote in the report. “Investors now view deep AI integration as the price of admission: not a differentiator, but an operational necessity. Increasingly, AI is what separates modern software companies from legacy ones.”

Now, AI-native companies—such as AI scaleup Cohere and self-driving technology company Waabi—are landing the largest funding rounds, while equally strong fundraises are going to Canadian companies integrating AI into their products and operations, such as FinTech company Wealthsimple and legaltech giant Clio. This leaves less investor interest for software businesses that aren’t actively adopting AI.

“It’s very challenging if you’re building without an AI story,” Morisset said, adding that non-AI sectors could present opportunities for “consolidation,” or more mergers and acquisitions.

This trend is likely to continue through 2026. When it comes to funding for AI-native companies, “I’m pretty sure it’s going to continue to move like a hockey stick,” Morisset said.

RELATED: Mila and Inovia launch venture fund to turn AI research “diamonds” into startups

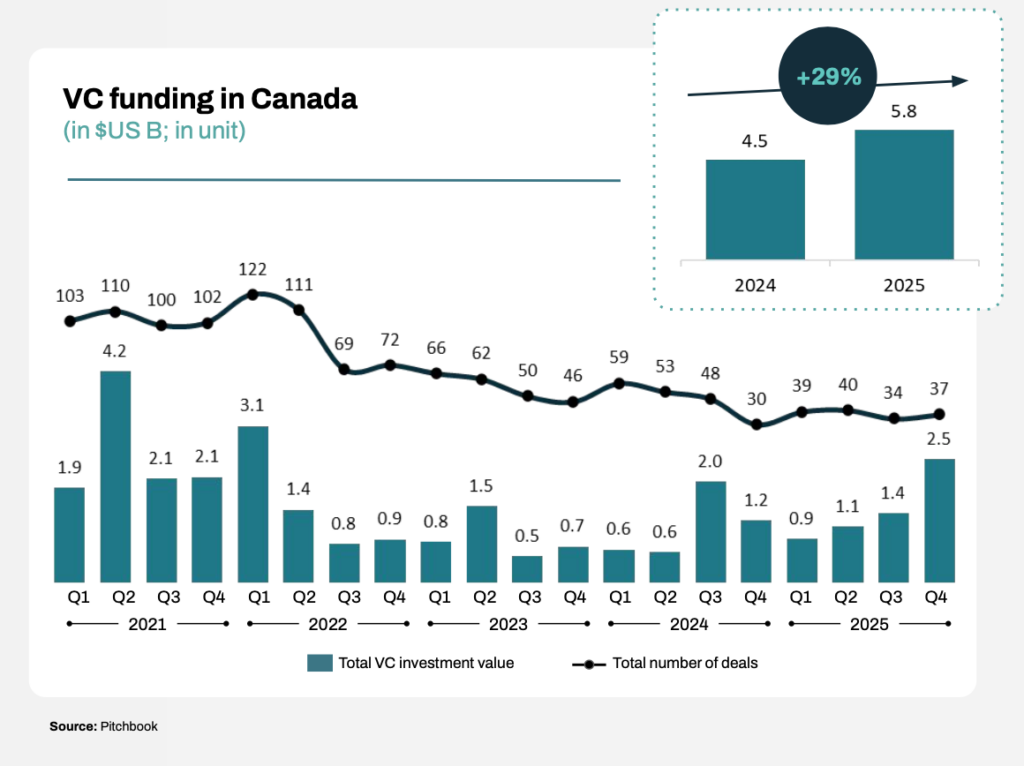

Without counting US megadeals, the report showed that Canada’s venture ecosystem was outperforming other countries on a relative basis. According to Pitchbook data cited in the report, VC funding of companies in Canada grew by 29 percent year-over-year, outpacing other global hubs like the United Kingdom and Singapore. Canada’s acceleration was lifted by AI megadeals, such as Waabi’s $1-billion CAD equity round and Cohere’s $600 million USD in financing this year.

The report’s encouraging notes come as the Canadian fund managers deploying the capital have registered dismal fundraising numbers—especially for those raising their first, second, or third funds. Only a small subset of these emerging managers progress to established franchises, according to US data—but smaller venture funds have tended to outperform their counterparts in the long run. In Canada, limited partners (LPs) in recent years have prioritized established general partners with longer track records and “favoured existing relationships,” the report said. Last year, in Canada, they raised their lowest annual amount on record, securing $249 million.

While Morisset acknowledged that the trend was “alarming,” she predicted that LPs will grow their appetite for VC in the coming year, including emerging managers. She added that she expects secondary deals to continue to be a popular option for profitable companies that are not yet ready to enter the public markets in 2026.

The report’s findings align well with Inovia’s recent fund decisions. It recently co-launched a “venture scientist” fund with Montréal AI institute Mila, through which the managers plan to develop promising scientific AI advances into profitable companies. Inovia also told BetaKit in December that it was readying fundraising for the second edition of its Discovery fund to invest in emerging fund managers.

Image courtesy Unsplash. Photo by Domaintechnik Ledl.net.

Source link