As PhonePe moves closer to its initial public offering (IPO), attention is turning to the company’s technology backbone and whether it can support a path to profitability.

The fintech firm, which dominates India’s UPI payments market, is betting that years of heavy investment in an in-house technology stack will help it shift from scale-led growth to sustainable earnings.

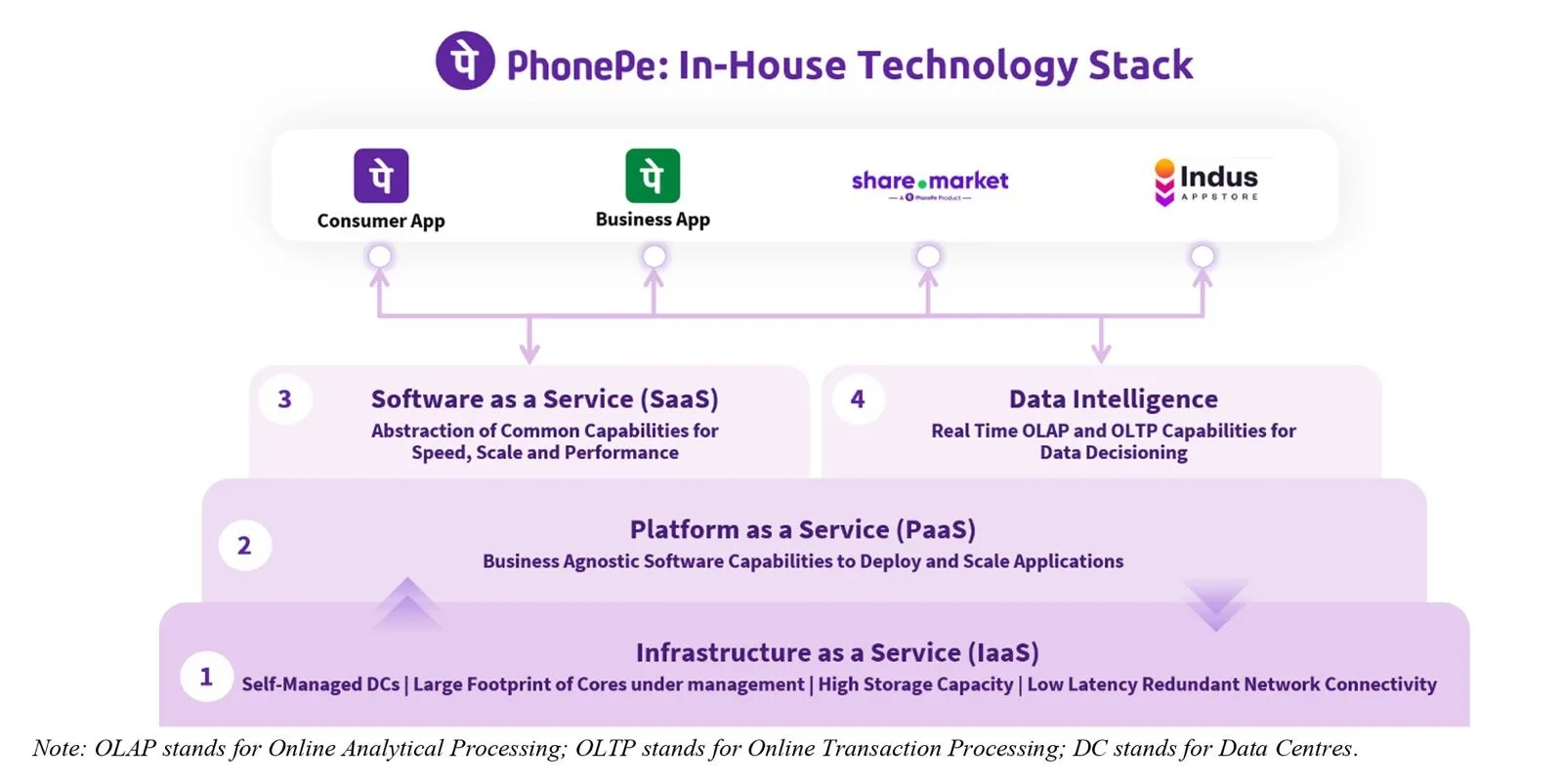

According to the Redseer report mentioned in PhonePe’s UDRHP, app experiences are becoming commoditised and indistinct. In this environment, the report said fintech companies will survive only if they can build and control their complete technology stack. PhonePe has responded by developing a proprietary four-layer architecture, which it describes as a powerful competitive moat.

Since 2016, PhonePe has invested Rs 33.73 billion in its technology infrastructure. At the base of this setup is a self-managed, on-premises Infrastructure-as-a-Service (IaaS) layer. Instead of depending on third-party cloud providers, the company runs its own data centres. These centres support a compute layer with 1.04 million cores.

In the UDRHP, PhonePe said this sovereign infrastructure is important for governance and data localisation. At the same time, the cost of maintaining 30.95 petabytes of storage and hardware-level redundancy across multiple locations is very high. The company is banking on the cost efficiencies of this model in the long term, claiming a current server cost per transaction of Rs 0.06.

Scaling the Growth Flywheel

The middle layers of the technology stack include Platform-as-a-Service or PaaS and Software-as-a-Service or SaaS. These layers are designed to work as a flywheel for launching new and higher-margin business segments.

By abstracting infrastructure into reusable software components, PhonePe allows its new regulated businesses to inherit audit-ready systems. This approach is meant to reduce the time needed to launch products such as insurance and lending.

PhonePe expects these businesses to eventually support the high-volume and low-margin payments business. The scale of this technology is already visible. During the first half of FY26, the platform handled a peak of 22,369 transactions per second.

Automation Driving Efficiency

At the top of the technology structure is the Data Intelligence layer. According to the company, this is responsible system for transforming large-scale data flows into actionable insights and is used to drive automation across operations.

In September 2025, PhonePe reported a 94.37% resolution rate for its 12.82 million monthly customer support tickets. The company also uses its Yatra engine to send nearly 595 million real-time nudges every day to improve user engagement. However, there is still debate on whether such contextual decision-making can significantly reduce cash burn in a market where customer acquisition costs remain high.

PhonePe’s Edge Machine Learning or EML models are now being used to optimise marketing return on investment. This is seen as an important step for a company that has focused on scale for many years instead of immediate profits.

The IPO Verdict

With a workforce of 1,880 engineering and product professionals, PhonePe is presenting itself as a deeptech company and not just a payments app.

Its IPO story is built around four main pillars: governance, cost optimisation, flexibility, and speed. As stated in the draft prospectus, the technology foundation is already in place. The real test for PhonePe will be whether this technology engine can successfully convert its diversified financial businesses into sustainable profitability.