Something structural is shifting in how African tech companies raise money, and most of the conversation about African startup funding is missing it.

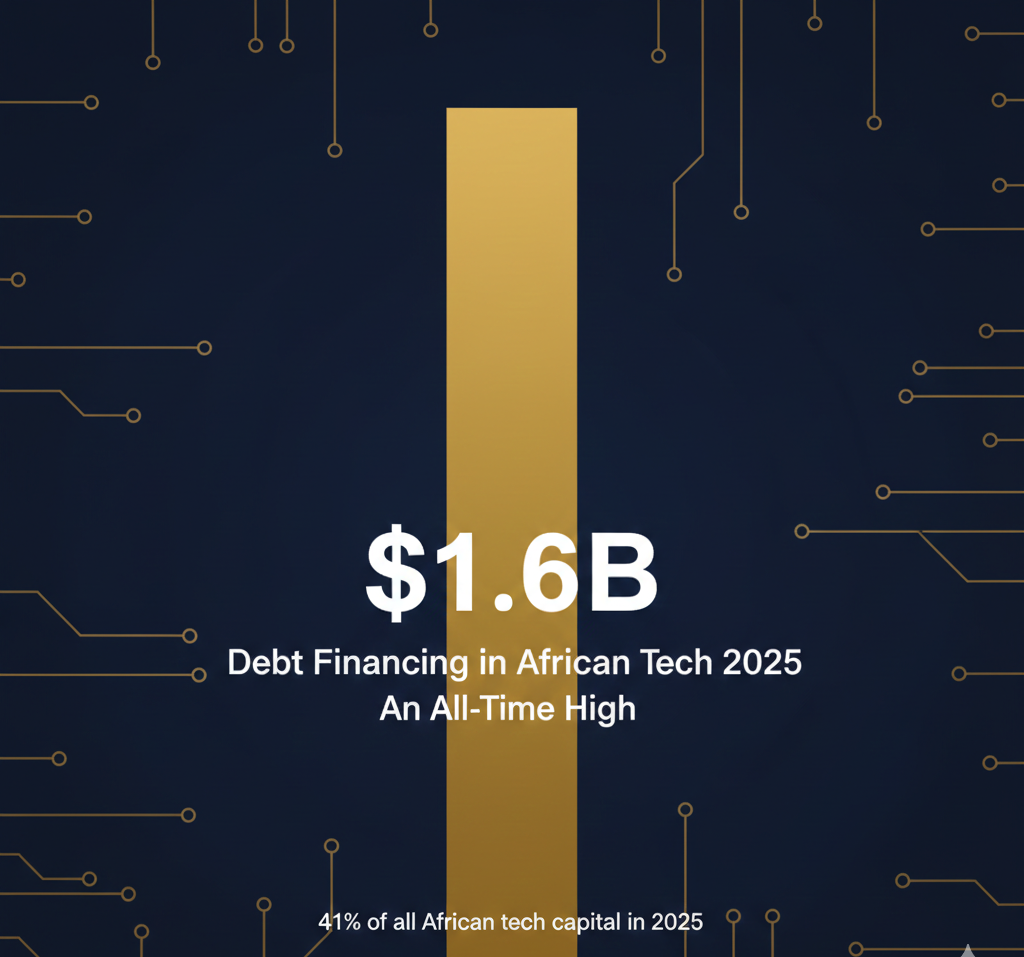

In 2025, African tech startups raised $1.64 billion through debt financing, a 63% jump from $1.01 billion in 2024 and the highest level ever recorded on the continent. The number of debt transactions also hit a record: 108 deals, up 40% from 77 in 2024. Debt now accounts for 41% of all capital deployed in African tech, up from just 17% in 2019.

This is not a blip. It is a structural transformation quietly reshaping the African startup ecosystem and what it means for a company to reach scale.

What Debt Financing Actually Means for Startups

Unlike equity financing, where investors take an ownership stake in exchange for capital, debt must be repaid, typically with interest. For a long time, this made it inaccessible to most African startups, which lacked the predictable revenues and cash flow visibility that lenders require.

That has changed. A growing cohort of African tech companies has now operated long enough, at sufficient scale, to demonstrate the financial stability that makes them bankable. Debt gives these companies a way to raise capital without diluting founders or existing investors, a significant advantage at a time when equity valuations remain under pressure following the 2021-2022 correction.

“It is a sign that African startups are getting more mature and predictable.” — Tidjane Dème, General Partner, Partech Africa

Senegal-based fintech Wave illustrated this clearly in 2025, securing $137 million in debt financing led by Rand Merchant Bank. Wave was not raising debt because it could not raise equity. It was raising debt because it could, and because it was the smarter choice: steady mobile money revenues made the deal possible without giving up ownership.

The Numbers Behind the Milestone

Partech’s data shows that the surge in debt was driven by both volume and breadth. Average debt ticket size sat at around $15.3 million in 2025, broadly consistent with prior years, meaning the increase was not produced by a handful of extreme outliers. The number of transactions grew 40%, indicating more companies are accessing debt, not just a few scaling their facility sizes.

Geographically, Kenya led Africa’s debt market with $498 million raised, nearly a third of all debt capital deployed on the continent. Egypt ($246M, +73% YoY) and Nigeria ($160M, +132% YoY) formed a strong second tier. Senegal ranked fourth at $139 million, driven almost entirely by the Wave transaction, illustrating the outsized impact individual megadeals can have on country-level figures.

By sector, Fintech dominated with $716 million (44% of all debt deployed). Cleantech ranked second with $627 million, the only major sector where debt exceeded equity, driven by capital-intensive solar and clean mobility business models. Together, Fintech and Cleantech accounted for 82% of all debt capital deployed in 2025.

The Rise of Specialized Debt Investors

The supply side of the debt equation is also evolving. A total of 77 unique debt investors were active in African tech in 2025, up 10% from the year before. More significantly, 57% were debt-only players, compared to just 48-49% in 2022-2023. Dedicated debt funds and non-bank lenders are building Africa-specific practices, underwriting deals without requiring an equity co-investment.

The most active debt investors in 2025 included British International Investment, the International Finance Corporation, Lendable, Proparco, and Verdant Capital. Commercial banks are also entering the market, as deals like Sun King’s solar securitization and Egypt’s Nawy demonstrated. When established banks begin writing tech debt tickets, it signals the asset class has become credible far beyond the early-adopter investor base.

Is Debt Replacing Equity or Supplementing It?

This is the key question, and the answer is complicated. Analysis from The Next Africa suggests that while total African startup funding rose in 2025, the equity portion shrank in absolute terms when measured against the prior year, with debt filling the gap. If the average equity deal ticket in Africa is around $3 million, a $700 million decline in the equity pool translates to roughly 233 fewer equity-funded startups.

Partech’s data tells a more optimistic story: total equity funding increased 8% YoY to $2.4 billion. What declined was the investor base, with only 539 unique equity investors active in 2025, down 7%. Seed-stage equity continued to soften, with deal count falling 1% and capital deployed falling 4%.

The picture that emerges is not straightforward substitution but bifurcation. Debt is scaling fastest at the growth stage, where it suits mature companies with cash flow visibility. Equity remains the primary tool for early-stage companies but is increasingly selective and concentrated in fewer deals.

What This Means for Founders

For growth-stage founders with proven unit economics, debt is no longer a last resort. It is becoming a mainstream tool that allows companies to extend runway, fund asset-heavy expansion, or bridge between equity rounds without giving away additional ownership. M-Kopa’s structured debt-equity raise in Kenya is a model that more companies will follow.

But debt is not for everyone. It requires consistent revenues, transparent governance, and the ability to service repayments even through difficult quarters. For earlier-stage companies still finding product-market fit, equity remains more appropriate. The conversation about the shrinking Seed pipeline is one the ecosystem needs to take seriously.

The Bigger Signal

The $1.6 billion milestone is not just a funding record. It is evidence that a meaningful cohort of African tech companies has crossed a threshold where lenders are willing to bet on their future cash flows, not just their potential. That is a different kind of milestone than a unicorn valuation or a megadeal announcement. It is quieter, more structural, and arguably more durable.

Debt has gone from a curiosity to a pillar of African tech finance in less than a decade. How the ecosystem manages that shift, who gets access, which sectors benefit, and whether early-stage equity gaps are filled, will be one of the defining stories of African tech in the years ahead.

Source link