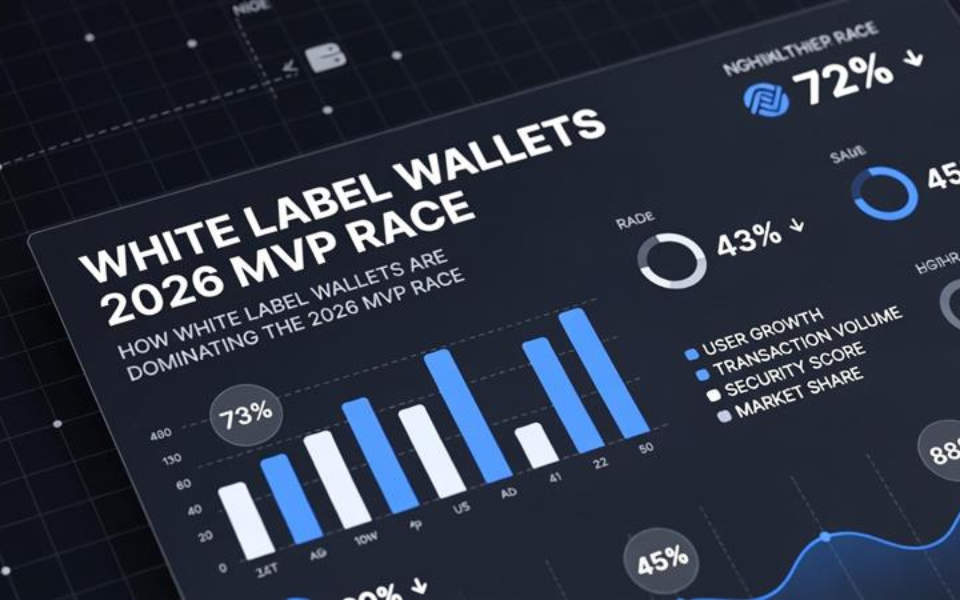

The global fintech ecosystem in 2026 is defined by one decisive factor: speed. As digital payments, embedded finance, and crypto-enabled services continue to mature, startups and enterprises are under intense pressure to launch faster, iterate smarter, and validate market demand early.

In this competitive landscape, the traditional approach of building financial infrastructure from scratch is rapidly losing relevance. Instead, businesses are embracing white label wallet solutions as the strategic foundation for Minimum Viable Products (MVPs).

White label wallets are no longer just a shortcut, they are becoming the default infrastructure layer for digital finance innovation. For Indian and global fintech players alike, they represent a shift from heavy engineering investments to agile, market-driven execution.

What Are White Label Wallets?

A white label wallet is a digital wallet that has been created by a specialized technology provider as a pre-built, customizable digital wallet, then rebranded by a different company as own product.

The MVP Race in 2026

Fintech Minimal viable product (MVP) is not about releasing a bare bones prototype in 2026. Products should be secure, compliant and ready to use even at the MVP stage. Investors want things to be implemented quicker, regulators want them to be implemented at the very start and users want things to be run smoothly in the digital world.

Speed-to-market has been made competitive. Early launch startups are able to validate product-market fit, raise funds, and gain user traction before rivals move into the field. Meanwhile, businesses are in a scramble to roll out wallet-based financial services in order to remain viable in an economy that is becoming more digital.

However, the construction of wallet infrastructure is lengthy, requires integration of regulations and has complicated security systems. These difficulties complicate the speed of deploying MVPs and many organizations are finding themselves looking at solutions that can deploy quicker and be infrastructure ready to keep up with the 2026 fintech race.

Why White Label Wallets Are Leading the MVP Revolution

Faster Time-to-Market

The white label wallets can cut down the development time by providing the ready-made and tested infrastructure. Businesses can roll out a pre-built system in weeks, instead of months to design backend architecture, security layers and compliance modules. This acceleration also enables startups to test product-market fit fast and makes enterprises roll out new financial services without having to spend years in development.

Cost Efficiency

Creating the wallet in-house is a huge investment in terms of labor in developers, cybersecurity professionals, and infrastructure management and compliance consultants. White label solutions reduce such initial expenses by offering an existing framework with acceptable pricing models. This cost-efficiency enables firms to divert resources to marketing, partnerships, as well as customer acquisition, which are key elements of the MVP race victory.

Built-in Compliance and Security

Regulatory preparedness is also necessary in 2026 at the MVP stage. White label wallet development company frequently involves KYC/AML procedures, encryption, and fraud detection framework. Security and compliance are now inherent in the architecture meaning that businesses can start up without fear and reduce the risk of regulatory liabilities and complexities.

Scalability and Customization

The white label wallets of the modern world are constructed on API-based and modular designs. This enables the companies to tailor branding, add new functionality and expand functionality as the number of users increases. Companies have the ability to begin with a narrow MVP and grow to include sophisticated services like cross-border payments, crypto integration, or embedded finance – without having to rebuild the entire system.

Seamless Ecosystem Integration

Digital wallets should be linked to banking APIs and payment gateways, exchanges, and enterprise systems. White label solutions are built to integrate easily with third-party solutions so that they can be integrated in wider financial systems. This will enhance competitiveness of the products and hasten market growth.

Key Features Driving Adoption in 2026

White label wallets are quickly becoming popular not only due to their ability to fast track the launch of MVPs, but also due to their ability to provide feature-rich functionality that meets new financial expectations today. The businesses are no longer searching the basic transaction tools they need for scalable, intelligent and globally adaptable wallet infrastructure.

Multi-Currency Support

The current wallets allow using both fiat and cryptocurrencies, which allows users to store various digital assets in one platform. This is particularly relevant when businesses are located in different regions since they can conveniently do all transactions related to cross-border payments, stablecoins, and local currency without any independent system.

Cross-Border Transaction Capabilities

International trade is still growing and the clients want to experience quicker cheaper international transfer of funds. The use of white label wallets frequently incorporates real-time settlement and multi-region compliance frameworks, which simplifies and makes cross-border payments more efficient to fintech startups and enterprises.

Embedded Finance Functionality

In 2026, wallets will not be produced as independent products, but will belong to larger digital ecosystems. In-app payment, lending, loyalty programs, and micro-investment are all embedded finance capabilities present in white label solutions. This helps companies to provide value added without necessarily establishing a complicated financial framework.

Advanced Analytics and Reporting

Decision-making in competitive fintech markets heavily depends on data-driven decision-making. The current wallet offerings include dashboards that monitor user activity, transaction patterns, risk notification and revenue. These insights can ensure the companies can maximize the user experience, develop pricing models, and see growth opportunities ahead.

AI-Driven Fraud Detection and Risk Monitoring

Cybersecurity threats are on the rise as the number of digital transactions grows. White label wallets are now equipped with AI-powered detection cameras which sense when something suspicious is going on. Smart risk marking, anomaly detection, and dynamic fraud prevention systems increase the level of trust and the reliability of the platform.

Mobile-First User Experience

The expectations of users in 2026 require intuitive, quick and safe mobile experiences. White label wallets value responsive interfaces, biometric authentication, in real-time notifications and simplified onboarding processes. Good mobile-first design will enhance engagement, retention, and user satisfaction.

Strategic Advantages for Enterprises and Startups

White label wallets generate a competitive edge to both startups and established businesses.

For Startups:

- Rapid validation of business models

- Lower burn rate

- Faster investor traction

- Ability to pivot quickly

For Enterprises:

- Expansion into fintech without rebuilding infrastructure

- Faster digital transformation initiatives

- Competitive positioning against agile startups

- Reduced operational complexity

In markets where there is a large number of fintech players, user experience and ecosystem strategy, rather than backend engineering, are becoming differentiators. White label wallets enable the firms to concentrate on the value generation and not on the infrastructure building.

Conclusion

Fintech is fast, secure and scalable in the year 2026. The introduction of a robust MVP is now a strategic necessity rather than an option in a highly competitive environment. White label wallets have become a potent facilitator and both startups as well as businesses have been able to circumvent difficult infrastructural issues and come into the market with confidence.

White label wallets allow the customer experience and ecosystem development to take center stage by integrating rapid deployment, affordability, inbuilt compliance, and scalable architecture. As digital finance keeps unfolding, agility and infrastructure preparedness in organizations will be the driver in the next wave of innovation and white label wallets are coming out to be the engine behind that wave.