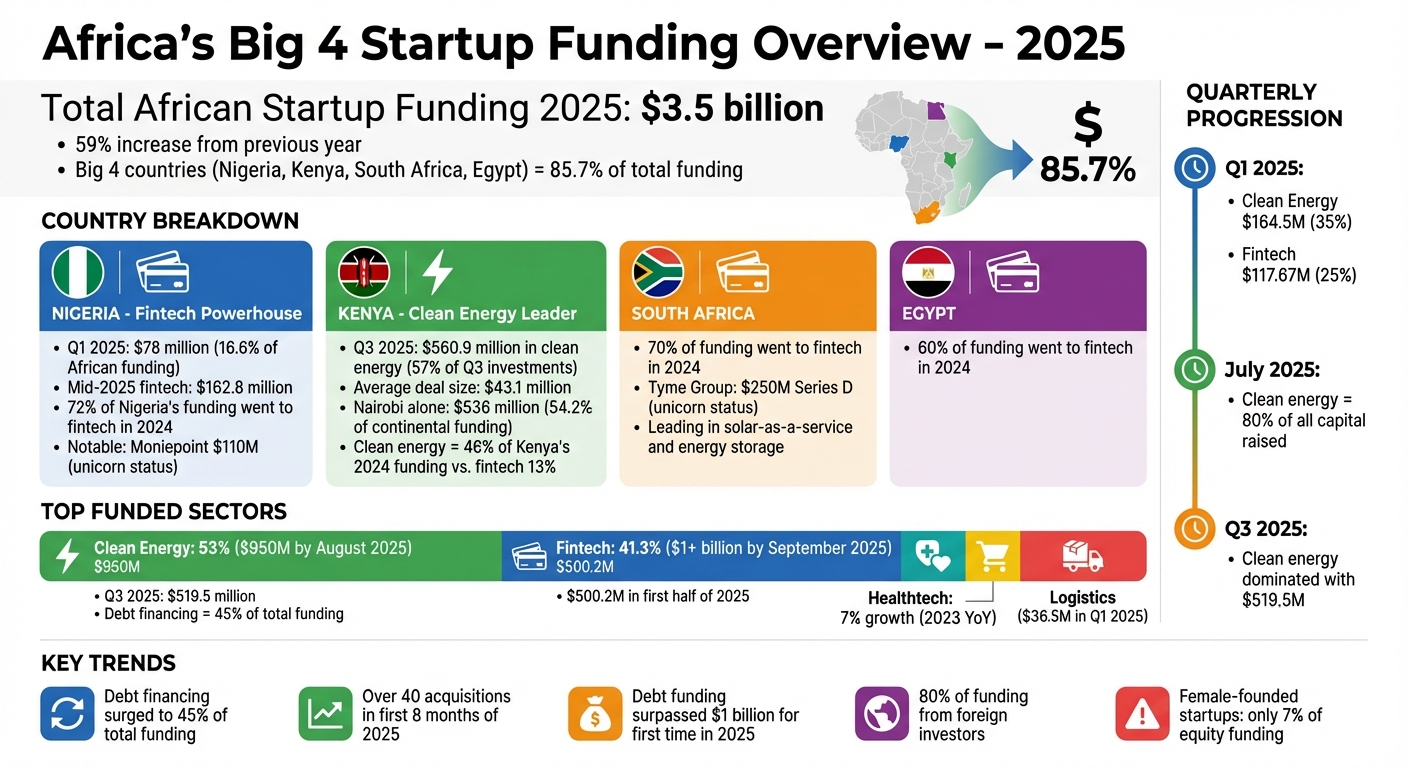

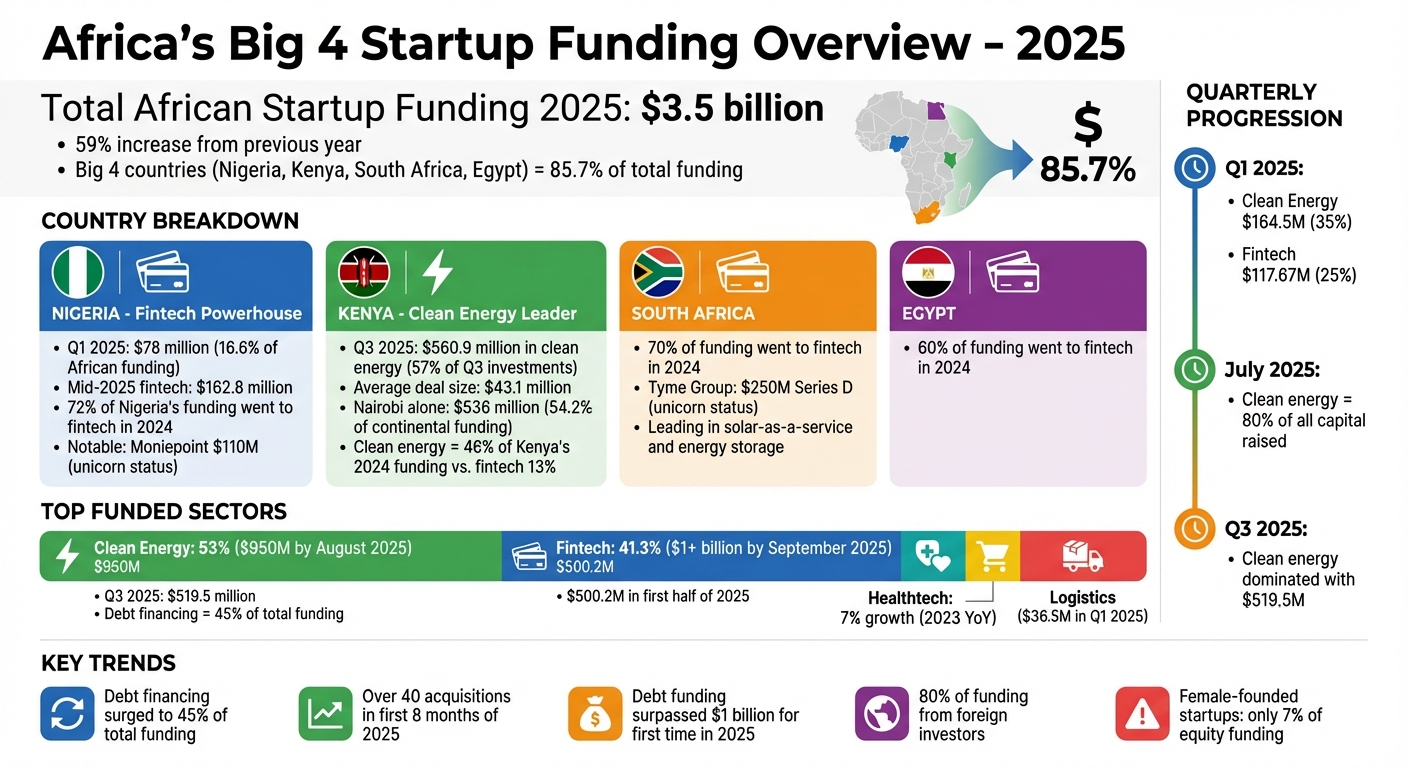

In 2025, startups in Africa raised over $3.5 billion, marking a 59% increase from the previous year. This growth was driven by Nigeria, Kenya, South Africa, and Egypt, which collectively accounted for up to 85.7% of total funding. Key highlights include:

- Clean energy surpassed fintech as the top-funded sector, drawing 53% of investments by Q3.

- Debt financing surged, making up 45% of total funding, reflecting the ecosystem’s maturity.

- Nigeria maintained its lead in fintech, while Kenya excelled in clean energy and healthtech.

This shift toward infrastructure-focused sectors signals a maturing startup ecosystem in Africa’s Big 4, attracting both local and international investors.

Africa’s Big 4 Startup Funding 2025: Key Statistics and Sector Breakdown

The State of tech in Africa 2025 | A Keynote by Maxime Bayen

Nigeria’s Fintech Strength and Sector Expansion

Nigeria continues to lead as Africa’s fintech powerhouse, with the sector driving 72% of all startup funding in the country during 2024. This trend carried into 2025, with Nigeria capturing 16.6% of total African funding in Q1 – raising an impressive $78 million across multiple deals. By mid-2025, fintech funding in Nigeria hit $162.8 million, even surpassing South Africa’s more established financial sector.

Investor focus has shifted dramatically. Rather than supporting high-spend consumer models, funding now flows to revenue-driven businesses with solid unit economics and models that can withstand the challenges of Naira volatility. Fintech is increasingly seen as essential infrastructure, with attention on payment systems, cross-border solutions, and API tools that fuel the broader economy.

“Fintech is infrastructure, not discretionary spend, high retention, clear monetization, continent-wide demand.” – Afritech Biz Hub

This shift highlights the transformation of Nigeria’s fintech sector and sets the stage for its diversification into other critical industries.

How Fintech Drives Nigeria’s Funding Numbers

Nigerian fintechs have evolved far beyond basic payment systems to create advanced financial infrastructure. A standout moment came in late 2024 when Moniepoint secured a $110 million deal, pushing its valuation past $1 billion and earning it unicorn status. This milestone underscored the potential for Nigerian startups to achieve billion-dollar valuations through disciplined growth.

In January 2025, LemFi raised $53 million to extend its remittance and financial services into Asian and European markets. By leveraging stablecoin infrastructure, LemFi facilitates global money transfers and provides credit-building tools for African immigrants. This international expansion mirrors a growing trend of Nigerian companies exporting their technologies and services worldwide.

The fintech ecosystem has matured significantly. In the first half of 2025, Nigerian fintech Bankly was acquired by C-One Ventures, part of a broader consolidation wave with over 40 acquisitions across Africa during the first eight months of the year. These strategic acquisitions highlight the increasing viability of successful exits for founders and early investors.

“The companies getting funded aren’t competing in basic payments or lending anymore; they’re building regtech, embedded finance, B2B trade finance infrastructure that benefits from fintech’s maturation.” – Uwem Uwemakpan, Head of Investment, Launch Africa Ventures

These developments signal a fintech sector that’s not only thriving but also paving the way for Nigeria’s expansion into other critical industries like cleantech and construction tech.

Nigeria’s Growth in Cleantech and Construction Tech

While fintech dominates, Nigeria is also making strides in other essential sectors. Cleantech has emerged as a significant funding category, accounting for 35% of all African funding ($164.5 million) in Q1 2025. By Q3, clean energy investments surged, capturing 53% of total African funding and reaching $519.5 million. Nigeria’s increased focus on cleantech aligns with a broader continental push toward clean energy solutions.

One example is Carrot Credit, a Nigerian cleantech startup that raised $4.2 million in equity funding to support its sustainable credit and energy operations. Meanwhile, construction technology is also gaining momentum. Cutstruct secured $1.5 million to scale its platform, which streamlines the digital management of the construction and building materials supply chain.

“Investors are prioritising ventures that address Nigeria’s biggest challenges, like energy access and sustainability.” – Zimuzo Nwabueze Ofor, CEO, Eco-Green Solar Systems

This diversification is no accident. With high inflation and Naira volatility, startups are increasingly focused on local sourcing and alternative energy to maintain profitability. Investors are backing businesses that tackle fundamental issues in energy, housing, and infrastructure development.

Kenya’s Clean Energy and Healthtech Funding Success

Kenya has emerged as a leader in African startup funding for clean energy, securing 57% of Q3 2025 investments, amounting to $560.9 million. This shift reflects a strategic focus on cleantech, which accounted for 46% of Kenya’s 2024 funding, compared to just 13% for fintech. Notably, Kenya stands out as the only “Big Four” African nation where financial services do not dominate the funding landscape.

The country’s clean energy deals have set new benchmarks. In July 2025, two Kenyan startups claimed 83% of Africa’s $550 million in clean energy investments, with 89% of this funding coming through debt financing – highlighting investor trust in asset-backed models. Sun King finalized a $156 million (20.1 billion Kenyan shillings) securitization deal, structured by Citi and supported by Stanbic Bank Kenya Ltd, alongside five commercial banks and three development finance institutions. Similarly, d.light expanded its receivables financing by $300 million to further its off-grid solar projects.

“Cleantech overtook fintech as the most-funded sector, highlighting investor interest in sustainable innovation over traditional African fintech bets.” – Jesutofunmi Adedoyin, Funding Tracker

Kenya’s regulatory framework has played a pivotal role in this growth. The Energy Act Amendment, passed in April 2025, mandates prioritizing cheaper renewable energy sources for national grid integration. Additionally, the Net-Metering Regulations, introduced in June 2024, allow households and businesses to feed surplus renewable energy back into the grid, receiving credit for half of the exported kilowatt-hours. These policies create a stable environment that attracts large-scale investments, further diversifying Kenya’s tech landscape.

Kenya’s Clean Energy Funding Leadership

Kenya’s clean energy ecosystem extends beyond solar power. For instance, BURN Manufacturing raised $12 million in March 2024 to scale up its electric and biomass stove distribution across the region. Founder Peter Scott shared that the company’s stoves have already impacted over 24 million lives, with plans to reach an additional 1.5 million people.

Electric mobility is also gaining momentum. BasiGo, an electric bus company, secured $42 million in funding, which unlocked an additional $10 million credit from the US Development Finance Corporation and a $7.5 million loan from British International Investment to support regional expansion. Meanwhile, SunCulture raised approximately $27 million in April 2024, backed by investors such as the Acumen Fund, InfraCo Africa, and the foundations of Netflix co-founder Reed Hastings and former Google CEO Eric Schmidt.

Kenya’s average deal size in Q3 2025 reached an impressive $43.1 million – double South Africa’s average. Nairobi alone attracted $536 million across 10 deals, accounting for 54.2% of all startup funding on the continent. This trend underscores investor confidence in Kenya’s mature, asset-heavy ventures that tackle critical infrastructure challenges.

While clean energy takes center stage, Kenya’s healthtech sector is also gaining traction, addressing urgent healthcare needs.

Healthtech Startups Contributing to Kenya’s Growth

Africa’s healthtech sector was the only industry to see year-on-year funding growth in 2023, with a 7% increase. This progress is crucial, as Africa bears 24% of the global disease burden but has just 3% of the world’s healthcare workforce.

Field Intelligence has made significant strides with its “Shelf Life” inventory management and financing service. By June 2024, it had supported over 3,200 community pharmacies across Kenya and Nigeria, improving health outcomes for more than 1.5 million patients. Zipline, known for its drone delivery service, has integrated into Kenya’s national health system, delivering over 10 million health products and 15 million vaccine doses by mid-2024. This effort has contributed to a 75% reduction in maternal mortality due to hemorrhage in serviced areas. Meanwhile, Helium Health has digitized over 3 million patient records in more than 1,000 hospitals across five countries, including Kenya, streamlining hospital billing processes by 200%.

Despite these advancements, healthtech still faces hurdles. In 2023, health startups received only 6% of Africa’s total venture capital funding, compared to over 40% allocated to fintech. However, Kenya’s regulatory landscape is evolving. For instance, Benacare partnered with Jomo Kenyatta University of Agriculture and Technology in 2024, with funding from the International Development Research Center, to validate home-based renal replacement therapies. The resulting monitoring tool has been adopted by Muranga County to prevent renal failure in high-risk diabetes and hypertension patients.

These strategic advancements in clean energy and healthtech not only strengthen Kenya’s market resilience but also open up promising opportunities for investors and entrepreneurs across the continent.

sbb-itb-dd089af

Key Sectors Receiving Funding Across the Big 4

In Africa’s Big 4, certain sectors have emerged as funding magnets, each playing a vital role in shaping the region’s innovation landscape. While fintech and cleantech dominate the funding scene, e-commerce and logistics, though receiving smaller shares, remain essential for advancing regional trade and delivery systems.

Why Fintech Continues to Lead African Funding

Fintech remains the heavyweight in African funding, pulling in over US$1 billion by September 2025 and US$500.2 million in the first half of the year, accounting for 41.3% of total funding [10, 14]. In 2024, the sector claimed 72% of Nigeria’s funding, 70% in South Africa, and 60% in Egypt. This dominance reflects a shift toward “utility-first” solutions like regulatory technology (regtech), embedded finance, and B2B trade finance – core services that drive growth across industries [6, 14].

Deals like Moniepoint’s US$110 million funding round highlight fintech’s adaptability, even in the face of currency volatility [29, 8]. Meanwhile, South Africa’s Tyme Group achieved unicorn status after closing a US$250 million Series D round in 2024.

Another notable trend is the sector’s move beyond traditional payments. Fintech firms are now focusing on building critical financial infrastructure, enabling broader economic participation.

Consolidation is also reshaping the landscape. Fintech companies are increasingly acquiring others to expand their reach. For instance, Peach Payments acquired PayDunya to enter Francophone West Africa, while Nedbank bought payments company iKhokha for US$93 million in 2025. Additionally, Senegal-based Wave secured a US$137 million debt facility from Rand Merchant Bank in early 2025 to scale operations across Francophone Africa [10, 14]. These developments underscore fintech’s ongoing transformation and its foundational role in Africa’s economy.

Clean Energy’s Dominant Q3 2025 Funding

Cleantech is quickly catching up to fintech as a top-funded sector, pulling in US$950 million by August 2025, just behind fintech’s US$1 billion. Its rapid growth was evident in Q1 2025, when cleantech secured US$164.5 million – 35% of all funding – outpacing fintech’s US$117.67 million (25%) for that quarter. By July 2025, clean energy deals accounted for nearly 80% of all capital raised that month, largely driven by debt financing.

Debt funding has proven essential for cleantech, particularly for solar energy providers with asset-heavy business models. For the first time in 2025, debt funding across Africa surpassed the US$1 billion mark. A standout example is SolarAfrica, which raised US$98 million in equity to support South Africa’s energy transition efforts. The country continues to lead in climate-focused innovations like solar-as-a-service, energy storage, and grid optimization.

“Cleantech has seen the fastest year-on-year growth, driven largely by debt financing. This year, cleantech deals accounted for nearly half of all funding in February and dominated July, securing almost 80% of capital through debt deals.”

– Briter Intelligence

E-commerce and Logistics Sector Growth

E-commerce and logistics, while smaller players in the funding race, are gaining momentum due to shifting trade and fulfillment needs. E-commerce raised US$32.8 million in the first half of 2025, accounting for just 2.7% of total funding, while logistics pulled in US$36.5 million during Q1 2025 [14, 18]. Though modest, these sectors are benefiting from the African Continental Free Trade Area’s focus on cross-border trade and the growing demand for efficient e-commerce fulfillment.

The funding disparity is striking: cleantech raised about six times more than logistics in Q1 2025 and nearly seven times more than e-commerce in the first half of the year [14, 18]. Still, logistics and mobility startups – especially in Kenya – are drawing investor interest as they build the infrastructure needed for regional commerce. Companies with strong fulfillment networks and last-mile delivery solutions are particularly appealing.

While e-commerce and logistics work to establish clear paths to profitability, clean energy continues to attract capital through asset-backed debt rounds, maintaining its upward trajectory.

Challenges and Future Opportunities for African Startups

Regulatory and Economic Barriers

African startups face a range of hurdles that make scaling a tough climb. One major challenge is currency instability. As currencies like the Naira, Shilling, and Pound weaken, startups struggle to manage costs for essential services like cloud platforms and skilled engineering talent, which are often priced in USD. This currency mismatch eats into profit margins, especially as local currencies continue to lose value. On top of that, high inflation and interest rates drive up operational costs, adding more pressure.

Regulatory inconsistencies across borders create additional complications. Startups must navigate varying licensing requirements and fragmented rules for data compliance and fintech operations, which slows progress. Funding is another sticking point. Investment tends to concentrate in a few key markets, and a staggering 80% of funding comes from foreign investors. This heavy reliance on international capital leaves the ecosystem vulnerable to global market shifts. Alarmingly, female-founded startups received just 7% of total equity funding in 2024, marking a drop from previous years.

Despite these challenges, new policies and financial innovations are beginning to open doors for growth.

Growth Opportunities for Entrepreneurs and Investors

Amidst the obstacles, there are promising signs of progress. Regulatory reforms and domestic capital initiatives are starting to reshape the landscape. For instance, Nigeria’s Startup Act and similar policies in other countries are cutting through bureaucratic red tape and offering tax incentives to encourage innovation. The African Continental Free Trade Area (AfCFTA) is working toward harmonizing regulations across borders, while the Pan-African Payment and Settlement System (PAPSS) is helping startups reduce foreign exchange risks in cross-border trade.

“Streamlining regulations and offering tax incentives could accelerate innovation and growth.”

- Olapeju Nwanganga, Founder, Ploutos Page

Efforts to build domestic capital sources are also gaining traction. Ghana and Nigeria now permit pension funds to invest in private equity, reducing dependency on foreign venture capital. Blended financing – mixing debt and equity – is unlocking opportunities in sectors like logistics and clean energy. Meanwhile, startups that adopt FX-resilient models, such as pricing in USD for B2B SaaS offerings, are drawing investors who value sustainable unit economics over flashy growth metrics.

Funding Projections for 2025 and Beyond

The funding landscape is evolving, driven by these innovative strategies and structural improvements. Between January and August 2025, African startups raised $2.8 billion, equaling the total amount raised in all of 2024. October 2025 alone brought in $442 million. Projections suggest total funding for 2025 will land between $2.5 billion and $3 billion by year’s end.

Debt financing has emerged as a critical driver, surpassing $1 billion for the first time in 2025. Another notable trend is the rise in strategic acquisitions – over 40 deals were recorded by late 2025. This shift shows that successful African startups are no longer just acquisition targets; they are now acquiring other businesses. The ecosystem is maturing, with investors increasingly backing startups that focus on building essential infrastructure like payment systems, energy solutions, and logistics networks, rather than those relying on high-burn, consumer-focused models.

Conclusion: The Big 4’s Role in Africa’s Startup Economy

Nigeria, Kenya, South Africa, and Egypt continue to be the driving force behind Africa’s startup growth. Their dominance through 2025 marks a shift toward creating the infrastructure needed for long-term prosperity across the continent.

Rather than chasing trends like consumer apps, these nations are now channeling investments into critical sectors. Funding is increasingly directed toward payment systems, clean energy projects, and logistics networks, with each country carving out its niche in these areas.

The startup landscape is also evolving. It’s no longer just about attracting investment – successful startups are turning into acquirers themselves. This trend of consolidation is reshaping the ecosystem. As Uwem Uwemakpan, Head of Investment at Launch Africa Ventures, explained:

“We’re no longer just building companies hoping for Series A/B rounds from international VCs. We’re building in an ecosystem where horizontal consolidation and vertical integration are becoming viable exit pathways at much earlier stages”.

This cycle of growth is creating a self-reinforcing system. As these ecosystems grow stronger, they attract even more capital, which fuels further infrastructure development. In the first half of 2025, funding levels surged, with debt financing playing a larger role in supporting this growth.

The continued focus on the Big 4 is essential for Africa’s broader economic progress. These countries act as hubs for scalable innovations that can ripple across the continent. Their ability to draw investment, build infrastructure, and establish successful exit strategies positions them as leaders not just in Africa but on the global stage. Their progress offers a roadmap for other emerging markets in Africa, setting the stage for a continent-wide transformation.

FAQs

Why has clean energy funding surpassed fintech in Africa’s top four economies?

Clean energy has surged ahead of fintech in funding across Africa’s top economies, thanks to a rising wave of investor interest in energy access innovations and climate-focused initiatives. By the first quarter of 2025, clean energy claimed 35% of total funding, propelled by larger deal sizes and the global push toward climate-conscious investments.

In contrast, fintech’s growth has slowed as the sector matures, offering fewer groundbreaking opportunities compared to the dynamic and fast-changing clean energy space. This shift highlights a growing emphasis on funding projects with long-term environmental and economic benefits.

How is debt financing helping African startups grow and mature?

Debt financing has become a key driver in the evolution of African startups, signaling a shift in how these businesses fund their growth. In 2025, debt funding crossed the $1 billion mark for the first time, even surpassing equity financing in several later-stage funding rounds. This trend highlights the increasing ability of startups to secure non-dilutive loans, thanks to stable cash flows and tangible assets, particularly in industries like fintech, cleantech, and PropTech.

For founders, debt offers a way to expand operations, enhance products, or explore new markets without surrendering additional equity. It encourages disciplined financial management while extending the operational runway, paving the way for a more stable and mature startup ecosystem in Africa. By diversifying funding options, debt financing is helping startups transition into growth-stage businesses, reshaping the landscape of entrepreneurship on the continent.

How is Nigeria driving fintech innovation and its expansion into other industries?

Nigeria is leading Africa’s fintech scene, with its vibrant ecosystem driving both innovation and growth. In 2024–2025, nearly half of the country’s total funding went to fintech startups, highlighting their success in developing fresh business models and moving beyond traditional payment systems.

This progress has paved the way for diversification into areas such as mobile money, digital lending, buy-now-pay-later services, insurance, and virtual asset platforms. By advancing these offerings, Nigeria is not just improving financial inclusion but also creating fintech-driven infrastructure that supports sectors like e-commerce, agritech, and renewable energy. These tools provide essential services for payments, credit, and risk management, fueling broader economic growth.

Related Blog Posts

Source link