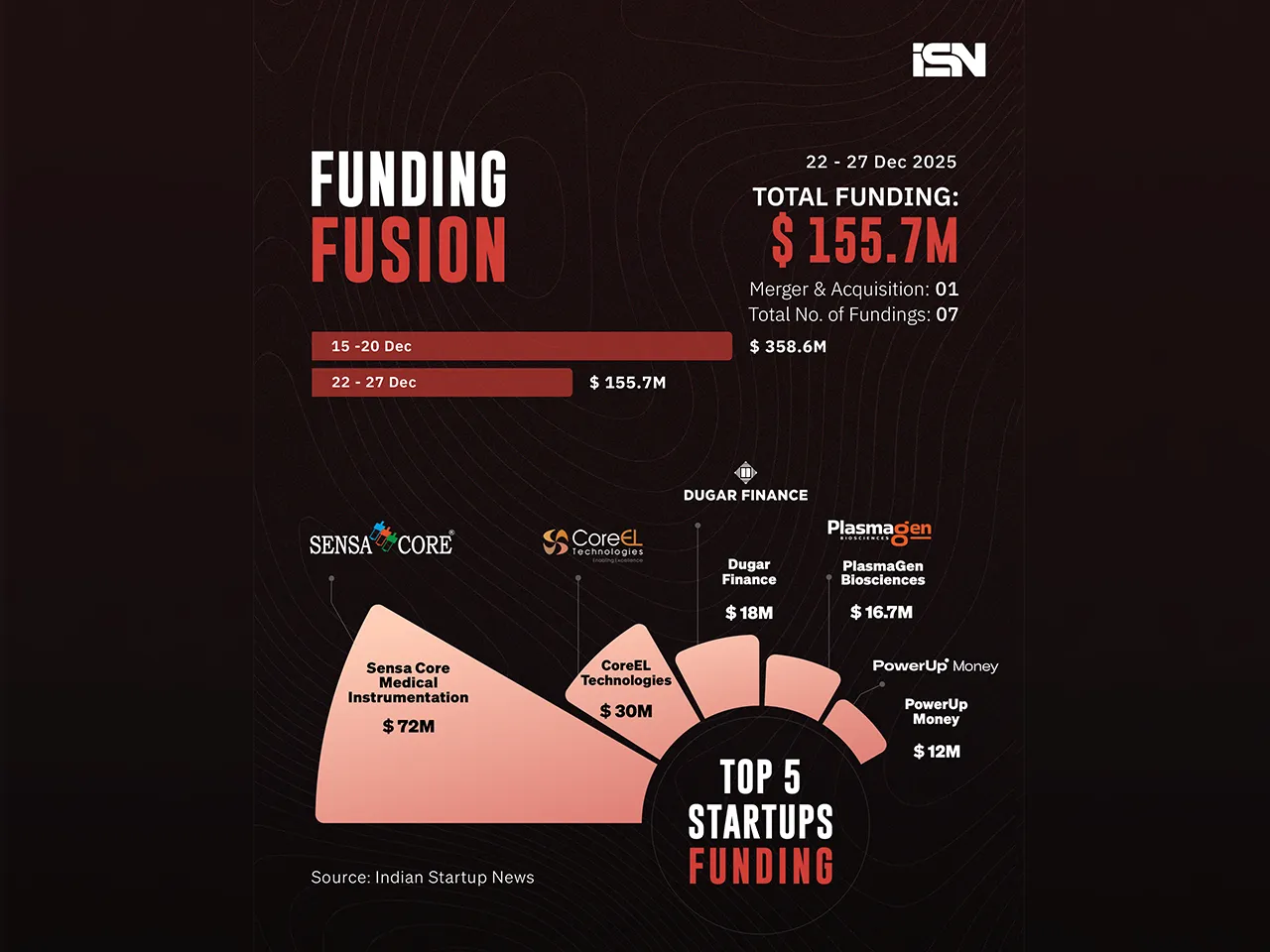

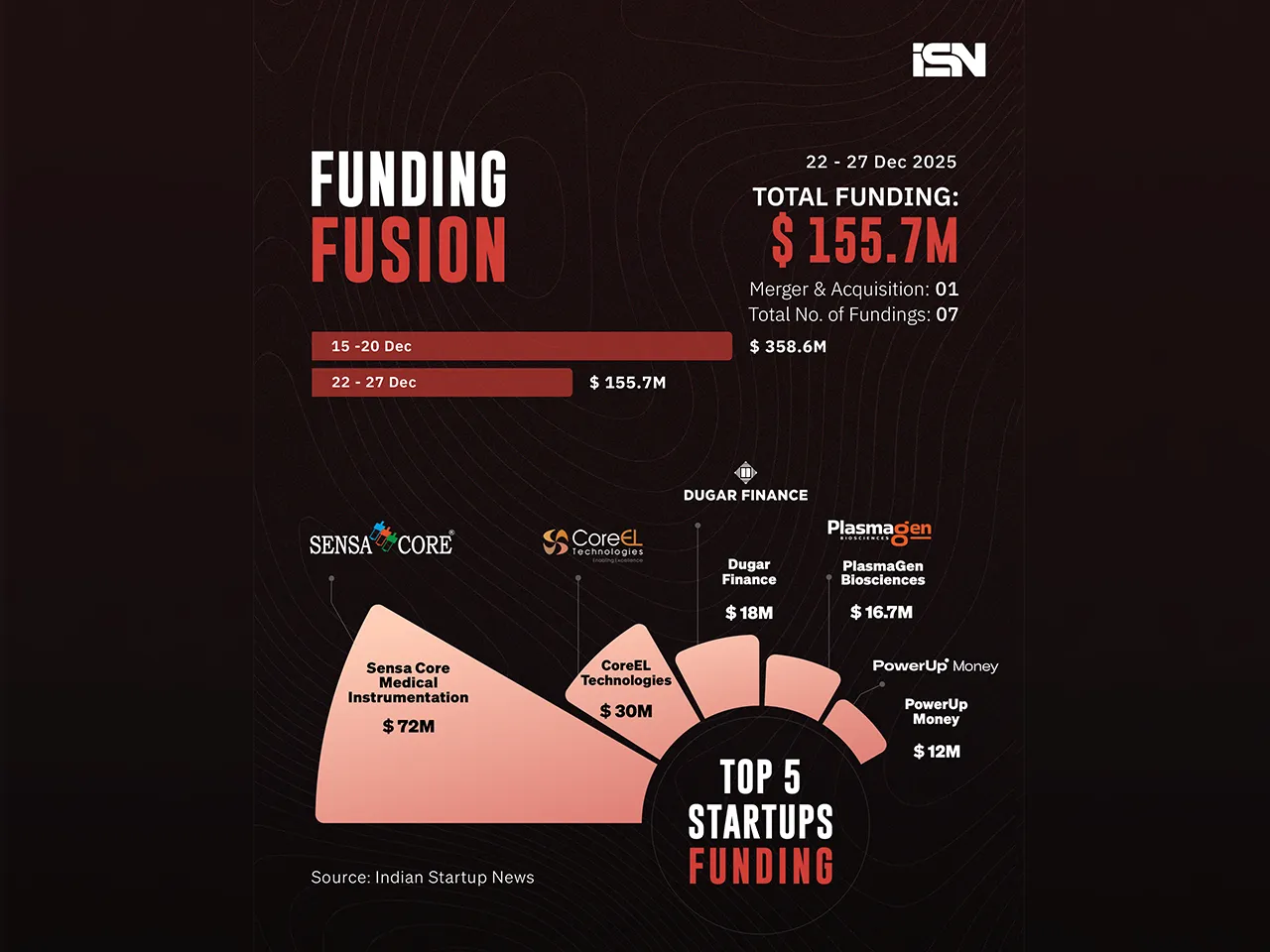

Between December 22 and December 27, 2025, as many as 07 Indian startups from diverse sectors raised over $155 million in funding from investors.

These sectors include Wealthtech, Healthcare, EV, Aerospace, Pharma, Defencetech, and Lending. Last week, Indian startups raised over $358 million,

Between December 22 and December 27, 2025, as many as 07 Indian startups from diverse sectors raised over $155 million in funding from investors.

These sectors include Wealthtech, Healthcare, EV, Aerospace, Pharma, Defencetech, and Lending. Last week, Indian startups raised over $358 million, with SaaS firm MoEngage raising $180 million alone.

High-value deals

A diverse range of sectors attracted investments during the week, with the Healthcare sector leading the pack. Leading this sector was Sansa Core Medical Instrumentation, which raised $72 million. Defence electronics firm CoreEL Technologies raised $30 million.

The list was followed by Lending firm Dugar Finance, Biopharma firm PlasmaGen Biosciences, and Mutual fund advisory platform PowerUp Money, which collectively raised $46.7 million.

Dugar Finance raised $18 million, PlasmaGen Biosciences raised $16.7 million, and PowerUp Money raised $12 million.

Emerging startups

AI-led tax management infrastructure startup Prosperr.io raised $4 million in a seed round and EV startup Naxatra Labs raised $3 million in a pre-Series A funding round.

Mergers & acquisitions

The period also witnessed strategic mergers and acquisitions. Pune-based Brainbees Solutions, the parent of FirstCry, announced the acquisition of K.A. Enterprises (Hygiene) Private Limited through its subsidiary Swara Baby Products Private Limited, marking a deeper push into the hygiene and disposable products segment.