Latin America’s startup funding this week may not have come with billion-dollar headlines, but the region’s early-stage deals tell a more revealing story. From compliance software to parametric insurance and digital credit, smaller cheques are quietly backing companies solving very local, very real problems, and signalling where investors still see momentum.

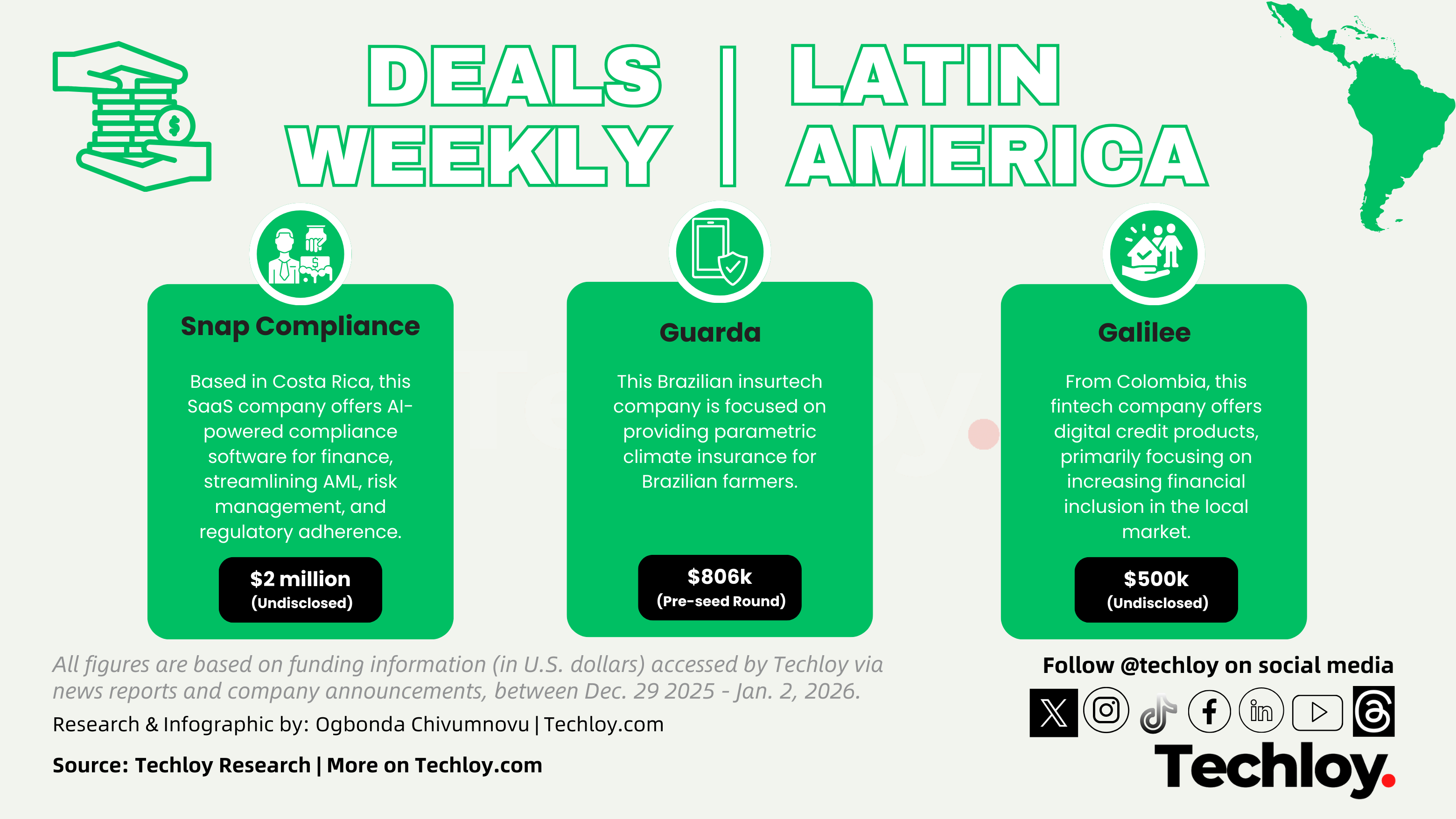

Snap Compliance, a Costa Rica-based compliance technology startup operating actively in Chile, leads this round-up after securing a $2 million funding round. Founded by Alex Siles and Gabriela Herra Arroyo, the company builds tools that help businesses meet regulatory obligations more efficiently. The fresh capital is expected to support product development and expansion across Latin America, particularly in markets where regulatory demands are increasing, and compliance has become harder to manage at scale.

Further south, Guarda, a Brazilian parametric insurance fintech, raised about $806,000 in a pre-seed round. The startup plans to use the funding to scale and validate its model, with a target of covering up to 10,000 hectares in the first months of 2026. Parametric insurance remains a relatively young segment in the region, but Guarda’s focus reflects growing interest in data-driven insurance products tailored to climate and agricultural risks.

Rounding out the list is Galilee, a Colombian digital credit fintech, which announced it has secured $500,000 from a US-based fund with Silicon Valley roots, promoted by Y Combinator. While smaller in size, the raise marks a strategic step for the company as it strengthens its position in Colombia’s increasingly competitive fintech landscape. It also adds to the steady stream of early-stage capital flowing into one of Latin America’s most active fintech ecosystems.

Taken together, these deals highlight a shift in how capital is flowing across Latin America. Investors appear less focused on rapid expansion at all costs and more interested in startups addressing regulatory complexity, financial inclusion, and sector-specific risks. While the funding amounts may be modest, they reflect a region where early-stage innovation continues to attract conviction, even in a more cautious global investment climate.