Meta buys China’s Manus AI: Meta founder/CEO Mark Zuckerberg zigged and added a new move to Meta’s mega AI strategy redo. He is supplementing its aggressive AI Data Center infrastructure and AI Talent moves with a $2,5 AI ‘acqui-hire’ in Butterfly Effect/Manus, a startup that was birthed in China, but now cleverly and diligently executed Singapore transplant. It’s a template that is likely to be emulated by other China Tech/AI Startups. The transaction, if it musters clearance at the senior government/regulatory levels in the US and China, could set a new roadmap in 2026 for US companies as well, to do more with Chinese originated AI tech companies. And could be a boon for US tech investment efforts by companies and investors in AI Robots, AI cars, AI Drones, AI Devices and many other adjacent areas with companies out of China. The Manus acquisition particularly bolsters Meta’s ability to develop more enterprise focused AI software tools and services around AI Reasoning and Agents. And potentially boost Meta’s efforts to empower Advertisers to use AI Agents and Reasoning in ad products across Meta’s global platforms. More here.

Memory Chips Big AI Headwind in 2026: Memory chips both in AI data centers and local devices like PCs and Phones, are the new multi-billion dollar bottleneck for the AI Tech Wave in particular. And it’s more of a zero sum game for the handful of global companies like SK Hynix, Micron and others who have over 90% of the global market share. Both supply and prices are constrained and going up respectively on both ends of the AI Data Center/Local Devices barbell. And it’s increasingly a zero sum game. In fact some of the memory chip companies are opting to either shut down and/or de-emphasize their consumer facing memory chip capacity in favor of the higher margin, larger opportunities on the AI Data Center fronts globally. This is a new headwind for AI Devices in particular, which ironically was a potential way to DECREASE the pressure on rolling out more AI Data Centers with critically curtailed Power Supplies in the US in particular. Big trend to watch in 2026. More here.

AI in 2026, 2025 but ‘bigger’: This new year is poised to be a bigger and louder expansion of the AI Tech Wave. Last year’s Mag 7 Capex of over $400 billion is likely to be at least 15% higher, with heightened investments in ‘World Models’ and ‘Physical AI’ domains like humanoid robots, self-driving car fleets, drones and more regulatory tensions will expand between federal and state jurisdictions. And US/China tech trade and tariff tussles are likely to accelerate. Meantime Gigawatt plus AI data centers at $50 billion a pop are likely to see Power and Memory chip shortage issues be new headwinds in addition to other supply chain issues around AI GPU chips and related infrastructure. As was memorably stated in the classic movie ‘This is Spinal Tap’, it’s just going up to 11. More here.

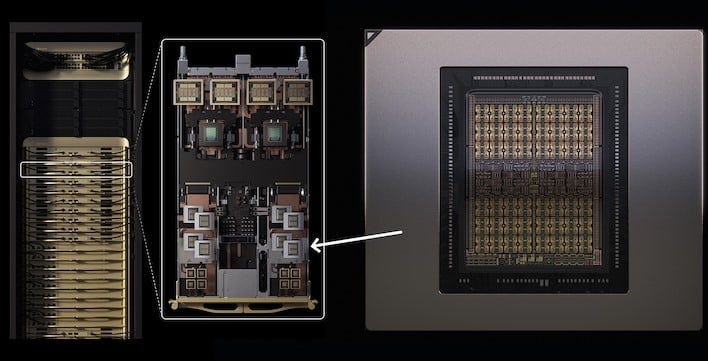

Nvidia’s bigger role in 2026: Nvidia remains in the key kingmaker role in 2026 as in 2025. Founder/CEO Jensen Huang continues to relentlessly execute on his ‘Accelerated AI Computing’ roadmap from Nvidia’s industry leading Blackwell GPUs to Rubin and Feynman beyond 2026. Nvidia is also leveraging new AI Research innovations in AI Inference and Reasoning techniques with certain versions of its Rubin architectures with lower cost memory chips away from SK Hynix’s lock on HBM (high bandwidth memory). Nvidia also is relentlessly focused on expanding its AI chips at key customers despite their ‘Frenemies’ driven effort to diversify away from Nvidia chips in certain applications. Nvidia’s $20 billion ‘licensing aqui-hire’ deal with AI Inference company Groq. is a step in this direction. Nvidia also continues to balance geopolitical priorities between the US and China. Overall Nvidia continues to be well positioned with a strengthened ‘moat’ vs key customers and other global market forces. More here.

Year end efforts to bolster AI Health & Safety. The push for the AI/tech companies and regulators to enhance AI’s safety and health impacts continue into 2026, with efforts at the corporate, state and international levels. In particular, efforts in late December by OpenAI, New York State, and in China, highlight these priorities. These of course supplement efforts by other peer companies like Anthropic and many others, as well as dozens of US States that are rolling out their own AI Safety regulations against the wishes of White House to have that effort led more at a Federal level. The new year is going to see all of the above in the AI regulatory stew, with similar efforts in major markets abroad like China, Europe and beyond in this AI Tech Wave. More here.

Other AI Readings for weekend:

AI Guru Andrej Karpathy on LLM AI Software in 2025. More here.

Nvidia’s technical AI GPU roadmap is deeply diversified. More here.

(Additional Note: For more weekend AI listening, have a new podcast series on AI, from a Gen Z to Boomer perspective. It’s called AI Ramblings. Now 35 weekly Episodes and counting. More with the latest AI Ramblings Episode 35 on AI Outlook for 2026 As well as our latest ‘Obsessions’ of 2026. Co-hosted with my Gen Z nephew Neal Makwana):

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

Source link