Flutterwave, Africa’s most valuable fintech firm, has acquired Nigerian open banking startup Mono in an all-stock deal valued between $25 million and $40 million.

Why it matters

The deal signals a major consolidation phase in African fintech. By combining the continent’s largest payment network with its leading data aggregator, Flutterwave is building a “full-stack” financial infrastructure that mirrors global giants like Stripe or Visa.

The Details

The acquisition brings together two heavyweights of the ecosystem:

- The Buyer: Flutterwave operates across 30+ countries, handling local and cross-border payments for enterprises.

- The Target: Mono, often called the “Plaid for Africa,” provides APIs that allow businesses to access bank data and initiate direct payments.

- The Terms: All Mono investors—including Tiger Global and General Catalyst—will at least recoup their capital. Some early backers are seeing returns of up to 20x.

- Independence: Mono will continue to operate as a standalone product under the Flutterwave umbrella.

By the Numbers

- $17.5M: Total capital raised by Mono prior to the sale.

- 8 Million: Bank account linkages powered by Mono (approx. 12% of Nigeria’s banked population).

- 100 Billion: Financial data points delivered to lending companies.

- $50M: Mono’s post-money valuation during its 2021 Series A round.

The Strategic Play

For Flutterwave CEO Olugbenga ‘GB’ Agboola, this is about vertical integration.

The added value: Flutterwave can now offer a seamless suite of services within a single stack:

- Onboarding: Instant identity and bank account verification.

- Risk Assessment: Using Mono’s data to analyze spending patterns for creditworthiness.

- Direct Pay: Moving money directly from bank accounts, bypassing card networks.

The Market Context

The deal echoes Visa’s 2020 attempt to buy Plaid (which was blocked by U.S. regulators). Unlike the U.S. market, Africa’s credit landscape is still nascent.

The hurdle

Most African markets lack robust credit bureaus. Fintechs—especially digital lenders like Moniepoint and PalmPay—rely on Mono’s “deep data intelligence” to decide who is safe to lend to.

What They’re Saying

Commenting on the acquisition, Olugbenga ‘GB’ Agboola, Founder and CEO of Flutterwave, said, “This acquisition reflects how we think about the future of financial infrastructure in Africa. Payments, data, and trust cannot exist in silos.

Open banking provides the connective tissue, and Mono has built critical infrastructure in this space. This acquisition allows us to expand what’s possible for businesses operating across African markets, while staying grounded in security, compliance, and local relevance.”

The pivot

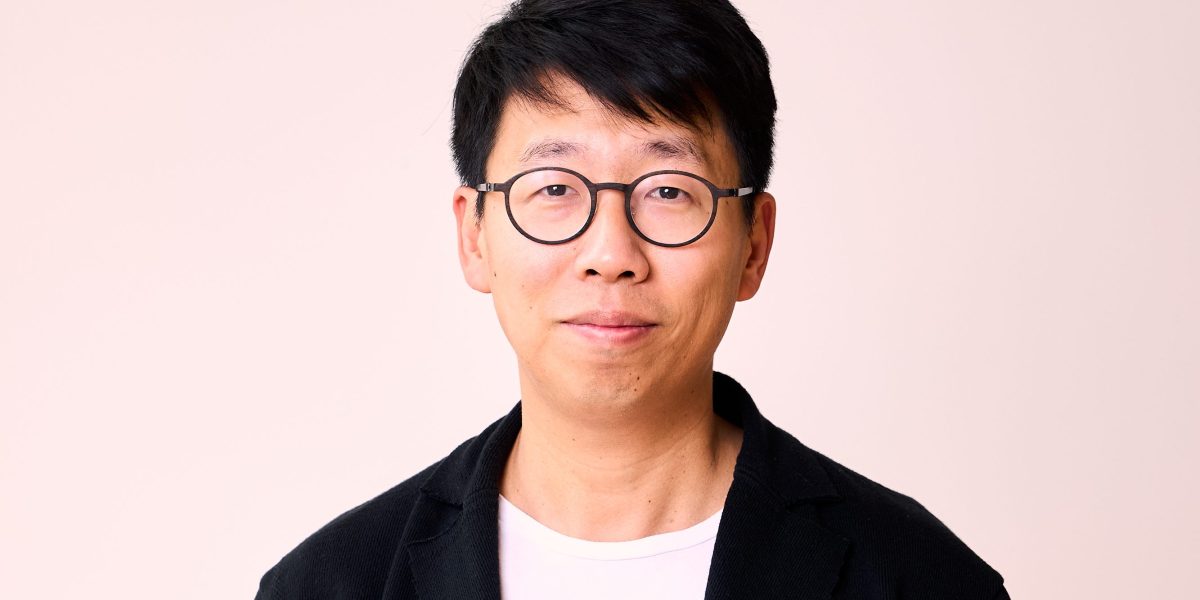

Mono CEO Abdulhamid Hassan notes the company wasn’t forced to sell and was nearing profitability. However, in a “tough funding environment,” merging with a scaled platform like Flutterwave provides a faster path to expansion across the continent.

“We built Mono to unlock Africa’s Open Banking potential, and since our first partnership with Flutterwave in 2021 and working together over the years, we’ve seen the power of a coordinated effort towards this goal.

This acquisition allows us to build the infrastructure layer that powers the next generation of African fintech at the speed and scale the continent deserves.”

The Big Picture

African fintech is moving away from a “growth at all costs” standalone model toward ecosystem consolidation. Similar to the recent Lesaka-Adumo merger in South Africa, we are seeing the emergence of “Super-Platforms” that own both the rails (payments) and the engine (data).

Source: Techcrunch