Indian startup funding showed signs of stabilisation in 2025, with startups raising a cumulative $11 Bn across 936 deals during the year, as per Inc42’s Annual Indian Startup Trends Report, 2025. While investor activity continued to show steady signs of recovery for the world’s third-largest startup ecosystem, overall funding still slipped 8% year-on-year, down from the $12 Bn mobilised across 993 rounds in 2024.

Even as overall funding remained muted, 2025 threw up clear shifts in investor strategy. Institutional capital continued to gravitate towards seed-stage rounds, which accounted for 433 deals and a cumulative $793 Mn raised during the year.

By contrast, just 144 late stage deals were recorded, although these rounds together pulled in a sizable $6 Bn. The divergence reflects a broader pivot from volume to value, with investors writing fewer but larger cheques as median ticket sizes climbed, even as deal counts normalised from the excesses of the 2021 bull run.

This early stage bias is also reflected in fund strategies. Nearly 70 of the 90 startup-focussed funds announced in 2025 are prioritising early-stage investments, with about $4.5 Bn funds earmarked specifically for seed stage investments.

Founders, meanwhile, recalibrated their late stage funding playbooks, increasingly tapping public markets rather than venture capital to fuel their next phase of growth. In 2025, 18 new-age tech companies debuted on the bourses compared to 13 in the previous year. These companies raised an astonishing INR 41,000+ Cr via fresh issue and offer for sale via their IPOs this year.

This IPO momentum is expected to continue as more startups are planning to launch their public offerings in the coming one and a half years.

For late stage startups that didn’t go public in 2025, debt financing continued to be a reliable source of capital. Many mature startups used debt as a way to source working capital, optimise balance-sheets and prepare for IPOs through restructuring, rather than focus on aggressive expansion that was earlier facilitated through equity investments. In fact, the three top institutional investors this year were venture debt financiers.

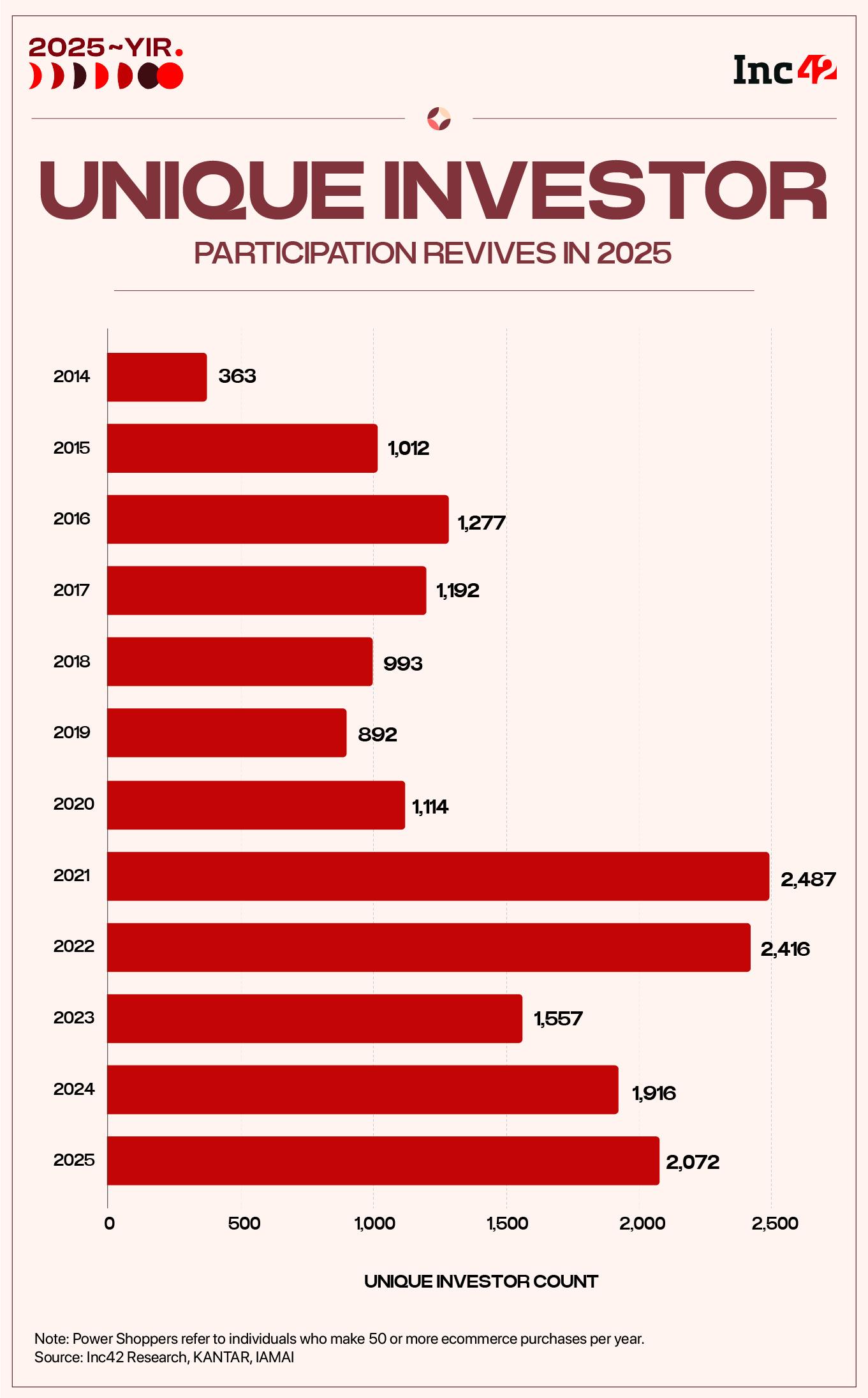

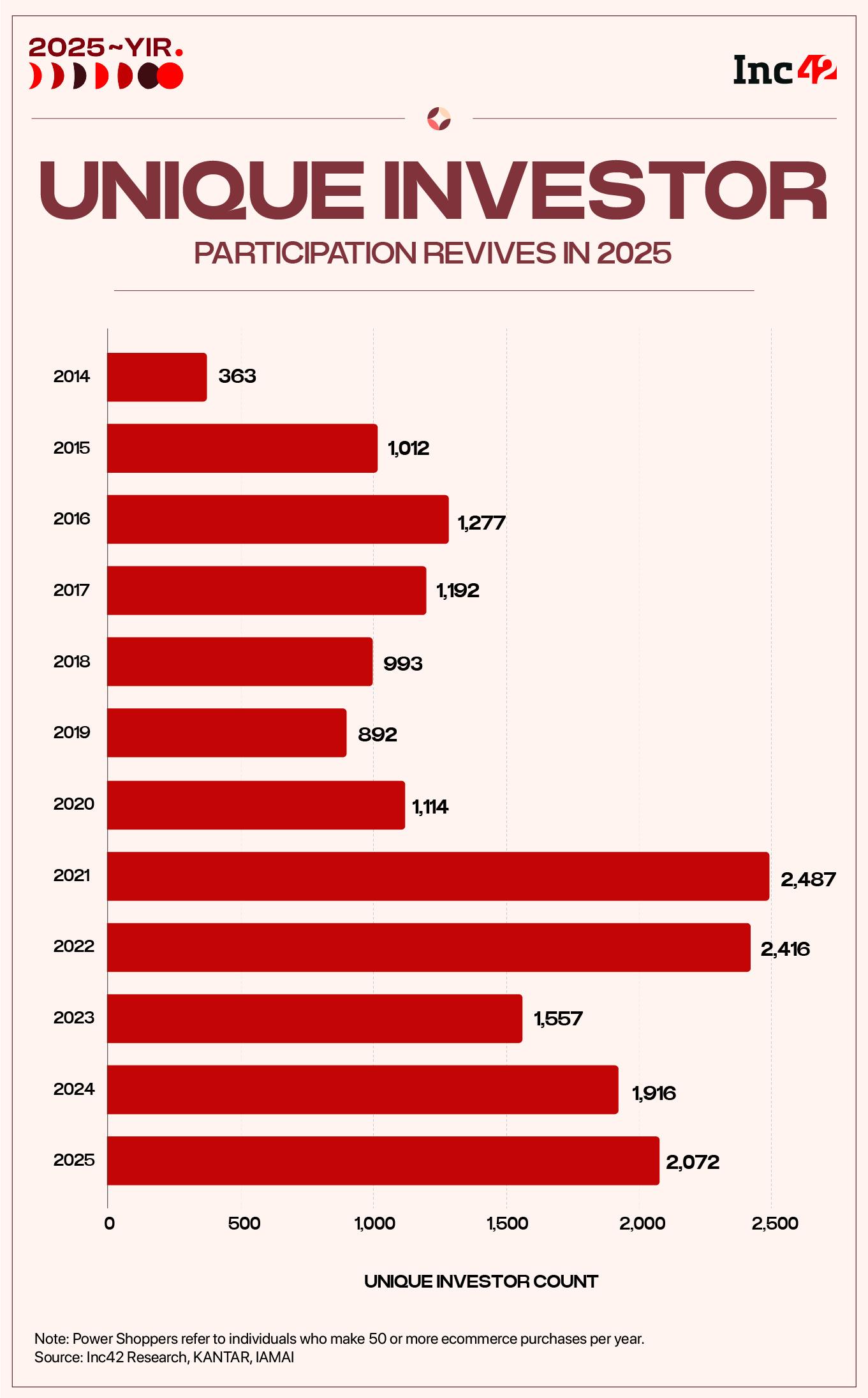

Overall, unique investor participation increased by 8% YoY in 2025, with 2,072 investors partaking in the ecosystem for a piece of the pie.

VC firms continued to dominate the market by undertaking over half the deals made over the year, followed by angel investors that contributed to over 20% of the deal making activity.

Looking ahead, investors appear poised to step up capital deployment, with renewed confidence emerging after a prolonged phase of uncertainty in the startup ecosystem. Over 90% of investors that participated in Inc42’s annual investor survey said they are planning to sign cheques in the new year, especially as startup valuations stabilise, removing friction points from deal making. As a result, Indian startups are expected to raise $11.5 Bn – $13.8 Bn in 2026, a measured but meaningful growth.

While the ecosystem waits to see which investors step up in 2026 and how they shape the ecosystem through their deals, let’s take a look at which ones topped the charts in 2025 in terms of the total number of startup deals.

Note: This ranking is based on data consolidated from Inc42’s Annual Indian Startup Trends Report, 2025, and deals recorded in the Inc42 database.

Get The Full Report For FreeTop Startup Investors of 2025

Stride Ventures

Venture debt firm Stride Ventures continued to remain one of the most active startup investors in 2025, backing 121 startups this year. It came up at second position in 2024 with 76 deals.

In 2025, the firm backed fintech startups Finnable and Smartcoin, consumer protection and assistance services provider OneAssist, fast food chain Wow Momos, and grocery delivery platform ApnaMart, among others.

This year, Stride Ventures entered the Saudi Arabian market in September by launching a $200 Mn fund there. It also floated its fourth fund in India with a $300 Mn (about INR 2,545 Cr) target corpus in December 2024 and is aiming to close $600 Mn across three funds in India, GCC and UK by March 2026.

The firm’s venture debt commitments crossed $1 Bn, underlining its leadership in the segment, while leadership additions and team strengthening reflected efforts to build capacity for future expansion.

The sector-agnostic investor boasts of 16 unicorns in its portfolio, including Zepto and Ather Energy, along with soonicorns like SUGAR cosmetics and Lohum.

Alteria Capital

The second most active startup investor this year was also a debt firm. Alteria Capital closed 76 deals in 2025, backing startups like Ultrahuman, OneCard, Giva, Agrostar and Haber.

Founded in 2017 by Vinod Murali and Ajay Hattangadi, the Mumbai-headquartered company invests in both early and growth stage startups across sectors like food and agritech, fintech, deeptech, EV and retail that are already backed by institutional investors or large VC firms.

Apart from fresh investments, a key milestone for the debt firm was International Finance Corporation (IFC) coming in as an anchor investor in Alteria’s Shorter Duration Scheme. This marked IFC’s first exposure to India’s SME and startup credit segment.

The move strengthened Alteria’s institutional credibility and expanded its ability to offer structured, short-tenure credit products alongside traditional venture debt.

Its portfolio includes unicorns like Zepto, Ola Electric and Bluestone, soonicorns including Cashfree Payments and Healthify Me, along with IPO-bound Fab Hotels and Furlenco, among over 200 investments it has made in India’s startup ecosystem.

Trifecta Capital

Another venture debt firm Trifecta Capital, which counts Atomberg, BigBasket, and Cars24 among its portfolio startups, participated in 70 startup funding deals in 2025. Some of its notable investments in the year included agritech startups Kissth, Dehaat and FreshToHome, along with fintech startups BharatPe and StockGro.

Founded by Rahul Khanna and Nilesh Kothari, Gurugram-based Trifecta Capital was launched in 2014 and has since invested in over 180 early and growth stage startups in India. In 2025, Trifecta Capital made significant strides in strengthening its institutional backing and expanding its venture debt platform. A major development was the IFC committing up to $25 Mn to Trifecta’s fourth venture debt fund.

Besides, earlier in the year, Trifecta achieved the first close of its INR 2,000 Cr Trifecta Venture Debt Fund IV, its largest to date, enabling deployment across high-growth sectors including fintech, EVs, climate tech and deep tech startup.

Notably, three of its portfolio companies debuted on the bourses in 2025: NephroPlus, Meesho and Urban Company.

Rainmatter

Zerodha’s startup investment arm Rainmatter closed 65 deals in 2025, making it the fourth most active investor this year. Notable investments in the year included Naxatra, Sukino Healthcare, Capitalmind, Aurassure and SuperYou.

Rainmatter continued to focus on its early-stage investment strategy in 2025. The Bengaluru-based venture capital firm backs startups across sectors such as fintech, healthtech and media, among others. To date, Rainmatter has built a portfolio of around 142 investments and manages assets worth approximately INR 1,600 Cr.

It has become particularly active in the climate tech space, where it has made 43 investments totalling INR 350 Cr till date, backing startups like Alt Mat, Amwoodo, Aurassure, Climes and Ossus Bio.

Its notable investments in the fintech space include CRED, smallcase, Jupiter and Ditto.

Antler India

Early-stage focussed VC firm Antler India closed 57 deals in India in 2025, up from 30 deals closed in 2024. Last year, the firm backed startups such as AI startup Navana AI, defence tech startup Armory, data privacy startup Redacto and deeptech startups Aspera and Green Aero, among others.

The global VC giant runs its India office from Bengaluru and has added over 100 Indian startups to its portfolio since starting operations in the country in 2020. Its maiden fund, closed in 2023, was worth INR 500 Cr.

It works with over 150 liquidity providers and many of the startups that it invests in are developed in its startup accelerator Antler Residency. The company also launched an AI programme in October that provides an initial commitment of INR 4 Cr that can go up to $30 Mn in follow-up capital.

LVX (LetsVenture)

Bengaluru-based Venture Capital firm LVX, formerly known as LetsVenture, closed 50 deals in 2025. It invested in multiple sectors, including in the agritech space through investments in Kissan Konnect and Farmdidi, along with spacetech firm Galaxeye, enterprise tech startup Samaaro and fintech startup Gullak.

Founded in 2013 by Sanjay Jha and Shanti Mohan as LetsVenture, the company rebranded to LVX in 2025 to showcase its interest in growth-stage investments. As part of the rebranding, the investment firm was bifurcated into three verticals, Start, Grow and School, respectively catered to early stage angel investments, growth stage VC investments, and financial and growth advice for industry stakeholders.

It launched a debt financing marketplace called LV Debt in 2024, and the company also offers a full-stack marketplace for angel startup investments where it claims to have onboarded more than 900 portfolio companies and 14,000 investors. It has also invested in over 250 companies to date, with INR 1,100 Cr raised for investments. Its backers include Accel, Chiratae Ventures, Ratan Tata and Mohandas Pai.

Some notable investments made by the VC firm include Stockgro, Kenko, Giva, Fasal, Yulu and FarMart.

Get The Full Report For FreeTogether Fund

AI-focussed VC firm Together Fund participated in 50 deals in 2025. The Bengaluru-based VC firm invests exclusively in startups building AI-native technology, and some of its investments in the year included vibe coding platform Emergent, AI research startup Gibran, natural language query engine Coreworks, chip design lab Architect Chips and AI healthcare startup Confido Health.

Together Fund was set up in 2021 by Freshworks founder Girish Mathrubootham and Eka Software founder Manav Garg. It follows an operator-led model of investing, where fund partners have operational experience putting operating discipline ahead of aggressive financial growth.

The firm primarily participates in seed and Series A rounds, backing companies building for global markets, with a particular focus on the US–India corridor. In 2025, it was in the process of closing its second fund, targeting $150 Mn by June. During the year, it also launched Together SwarmSpace, a dedicated launchpad announced in October to support early-stage AI startups with up to $1 Mn in funding, along with access to mentorship and shared resources.

3one4 Capital

Bengaluru-based early-stage focussed VC firm 3one4 Capital closed 40 deals across sectors in 2025. Notable investments made in the year included those in online brokerage startup Dhan, AI gaming studio Felicity Games, fintech startups Rezolv and Jupiter, legaltech startup Nyayanidhi and baby products retailer R for Rabbit, among others.

3one4 Capital was founded by brothers Siddharth and Pranav Pai in 2016. Key focus sectors for the firm include fintech, SaaS, AI, consumer internet, enterprise tech and SMB digitisation.

It has committed $570 Mn in capital till date to over 100 startups, and some of its portfolio companies include unicorns Licious and DarwinBox, fintech firm LoanTap, OTT soonicorn Kuku FM and mobility startup Yulu. The combined enterprise value of its portfolio companies has crossed $9.4 Bn.

3one4 has a notable track record for profitable exits from early investments with 26 recorded so far from its first and second fund through secondary sales, M&As, IPOs and buybacks. As of date, 3one4 Capital has four funds under management, with its most recent Fund IV launched in 2023 with a corpus of $225 Mn.

Marwari Catalysts

Jodhpur-based startup accelerator Marwari Catalysts also announced 40 deals in 2025, backing watch maker Jaipur Watch Company, apparel startup uTURMS and B2B construction marketplace Mad Over Building.

Founded in 2019 by Sushil Sharma, the company focuses on early stage funding and mentorship for startups incubated in non-metro cities in India. Marwari Catalysts has invested in over 100 early stage startups till date, with 10 reported exits. It has particular interest in impact-focussed startups and 35% of its portfolio is made up of female-led startups.

It recently announced plans to build an INR 4,000 Cr (about $500 Mn) impact-focussed portfolio by 2027. It also conducts an accelerator programme called Thrive to provide early stage startups with small-ticket funding, mentorship and resources. Its ninth cohort was announced in December.

All In Capital

Early stage VC firm All In Capital was part of 35 startup investment deals in 2025. The firm wrote cheques for healthtech startups Plazza and Superliving, nursing edtech platform Nprep, quick commerce fashion retailer Knot and deeptech startup Defendron, among others.

Founded in 2022 by Kushal Bhagia and Aditya Singh, the Bengaluru-based VC firm has partnered with several prominent startup founders from the Indian tech ecosystem for investments and entrepreneurship guidance. These include Meesho founder Vidit Aatrey, Dhan founder Pravin Jadav and RocketLane founder Srikrishnan Ganesan.

All In Capital launched a second fund in March, with an initial corpus of INR 200 Cr and an INR 100 Cr greenshow option. It is aiming to make 50 investments through it by FY27 end with individual funding of INR 5 Cr or less. It will prioritise investments in consumer tech, deeptech, fintech, and consumer brands. Some of its noteworthy portfolio companies include Magma, NewMe, Giva and PierSight.

Get The Full Report For Free[Edited by: Akshit Pushkarna]

Source link