Eternal’s Action-Packed Q3

Much happened as Eternal announced its Q3 results yesterday. Deepinder Goyal is stepping down as Eternal’s group CEO, while the foodtech major reported blockbuster profits during the quarter. Blinkit and Hyperpure also hit their first quarter of adjusted EBITDA profit.

Dhindsa’s Ascent: The biggest takeaway from the Q3 announcements was Goyal relinquishing day-to-day control of the company to chase his moonshot ventures like aviation startup LAT Aerospace, longevity research firm Continue Research and wearable brand Temple. Albinder Dhindsa, who steered Blinkit from acquisition to breakeven, will take over daily operations. However, financial numbers were the star of the show.

Here’s a quick look at Eternal’s Q3 FY26 show:

- Consolidated net profit soared 73% YoY to INR 102 Cr

- Operating revenue zoomed 3X YoY to INR 16,315 Cr

- Adjusted EBITDA, excluding ESOP expenses, improved 28% YoY to INR 364 Cr

- Blinkit’s operating revenue surged 776% YoY to INR 12,256 Cr

- Blinkit clocked an adjusted EBITDA profit of INR 4 Cr

- Zomato’s operating revenue rose 29% YoY to INR 2,676 Cr, while operating profit jumped 27% YoY to INR 547 Cr

- District’s operating revenue shot up 16% YoY to INR 300 Cr, while losses grew to INR 114 Cr

- Hyperpure’s operating revenue declined 36% YoY to INR 1,070 Cr, but adjusted EBITDA profit stood at INR 1 Cr

Blinkit Hits Profitability: The quick commerce major turned adjusted EBITDA positive for the first time as top line soared on the back of inventory-led pivot, supply chain efficiencies and improving operating leverage. Dark store expansion missed the 2,100 target (settling at 2,027) due to Delhi NCR pollution curbs and festive bandwidth constraints. It remains on track to end March 2027 with 3,000 stores.

The Rest Of Eternal: The core food delivery vertical continued to be the biggest profit driver for Eternal on the back of improving demand and higher investments in customer activation cohorts. Meanwhile, Hyperpure also clocked its maiden adjusted EBITDA profitable quarter despite revenues dipping, primarily on account of Blinkit’s inventory pivot.

However, going-out arm District’s operating losses ballooned, as it poured cash into live events and growing memberships. For now, here’s how Eternal fared on the financial front in Q3.

From The Editor’s Desk

💊 VCs Rethink Healthtech Bets

- In 2025, healthtech VCs pivoted from digital adoption bets (like PharmEasy and 1mg) to execution-led models. This was reflected in the deal count, which declined to 54 from 78 in 2024, while capital remained flat at $700 Mn due to selective late stage transactions.

- Seed stage deals settled at 35 last year, losing early stage primacy to AI and deeptech, while growth stage healthtech funding evaporated as investors demanded affordability over unproven pilots.

- While there is no dearth of the addressable market in the healthtech space, investor caution stems from PharmEasy-type crises, regulatory uncertainties (telemedicine guidelines), and subdued return on investment.

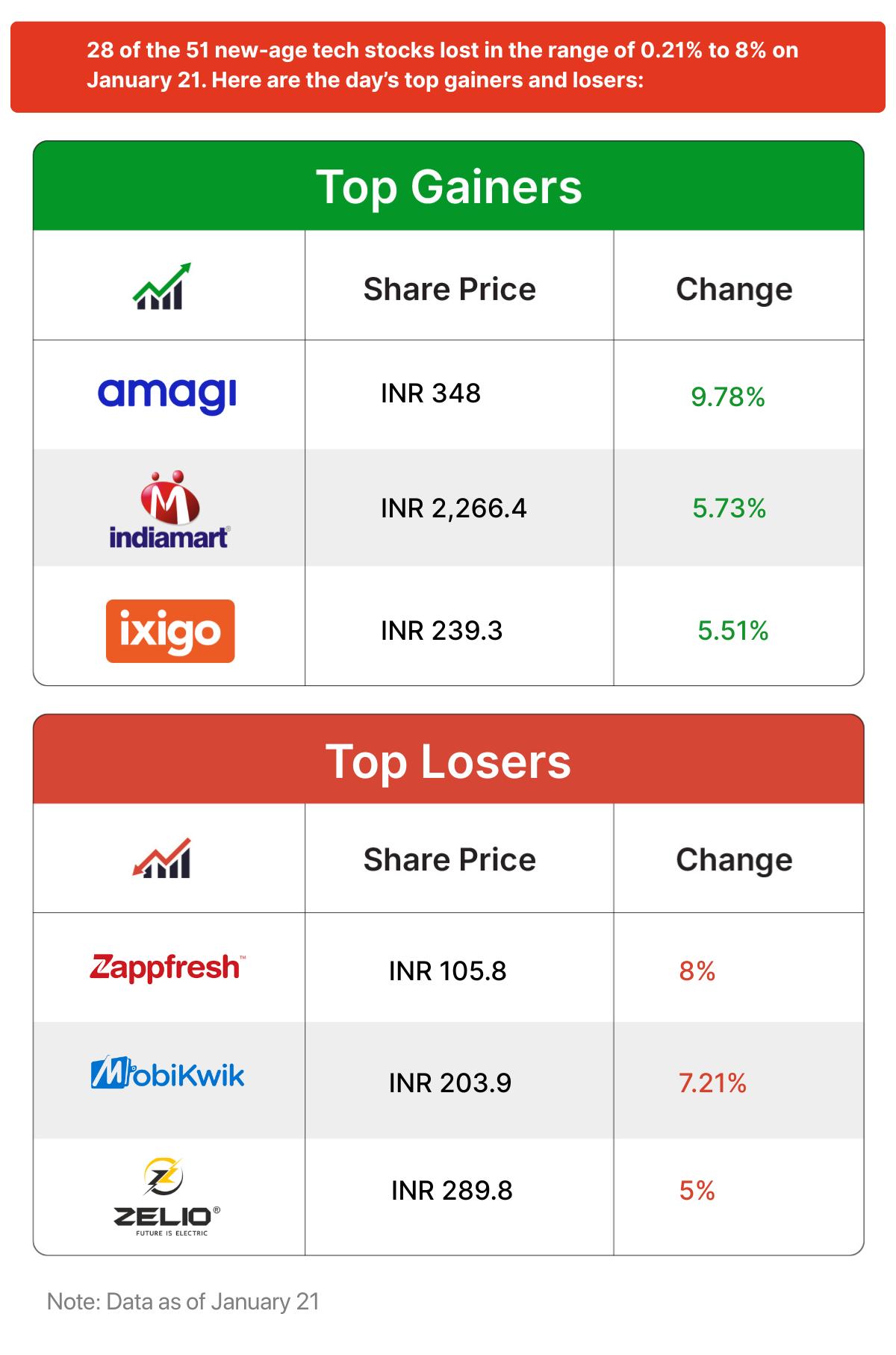

🔔 Amagi’s Lukewarm Debut

- The media-focussed SaaS firm listed on the BSE at a 12% discount to its issue price of INR 361. On the NSE, it debuted at INR 318, a 11.9% discount. The stock pared some of the losses to close the day at INR 348 on the BSE, 3.6% below the issue price.

- Despite 30X oversubscription and an INR 805 Cr anchor book, the listing discount signals investor caution about adtech valuations. The lukewarm IPO response is in contrast with 2025’s eighteen listings, where median first-day gains exceeded 10%.

- The SaaS startup’s public issue comprised a fresh issue of shares worth INR 816 Cr and an OFS of 2.69 Cr shares.

📊 Finance Costs Sting MMT’s Q3

- MakeMyTrip’s profit collapsed 73% YoY to $7.3 Mn in Q3 FY26 despite an 11% YoY jump in revenues to $295.7 Mn.

- The bottom line sank as finance costs exploded 5.7X YoY to $27.7 Mn, driven by a $24.2 Mn interest expense on the $3.1 Bn zero-coupon convertible notes due in 2030.

- Going forward, the company is banking on AI initiatives to optimise user conversion and reduce costs. MMT also sees its diversified portfolio offsetting aviation headwinds.

💵 Aerem’s $15 Mn Funding Push

- The solar financing startup has raised INR 137 Cr in its pre-Series B round led by SMBC Asia Rising Fund to strengthen its installer partner network.

- Founded in 2021, the Mumbai-based fintech startup offers financing solutions to businesses and homeowners for solar installations. It also operates a B2B solar marketplace and enables supply chain loans for EPC firms.

- Aerem is looking to fix India’s solar penetration, which is marred by issues such as high upfront costs, low quality and trust issues. It is eyeing a piece of the Indian solar energy market, which is projected to grow to $34.7 Bn by 2033.

🌱 Kapiva Floats INR 50 Cr Fund

- The D2C brand has launched an INR 50 Cr fund to support research, product development and AI applications in Ayurveda. The fund will offer grants worth INR 50 Lakh each and INR 4-6 Cr investments in late stage startups.

- The fund targets clinical validation gaps in Ayurveda, historically plagued by insufficient trials and anecdotal efficacy claims. Meanwhile, AI integration will likely focus on tech-led formulations and personalised dosing algorithms.

- Founded in 2016, Kapiva sells 100+ Ayurvedic products, including supplements, gummies, capsules and skincare via online marketplaces and offline retail. It plans to go public in the next two to three years.

Inc42 Markets

Inc42 Startup Spotlight

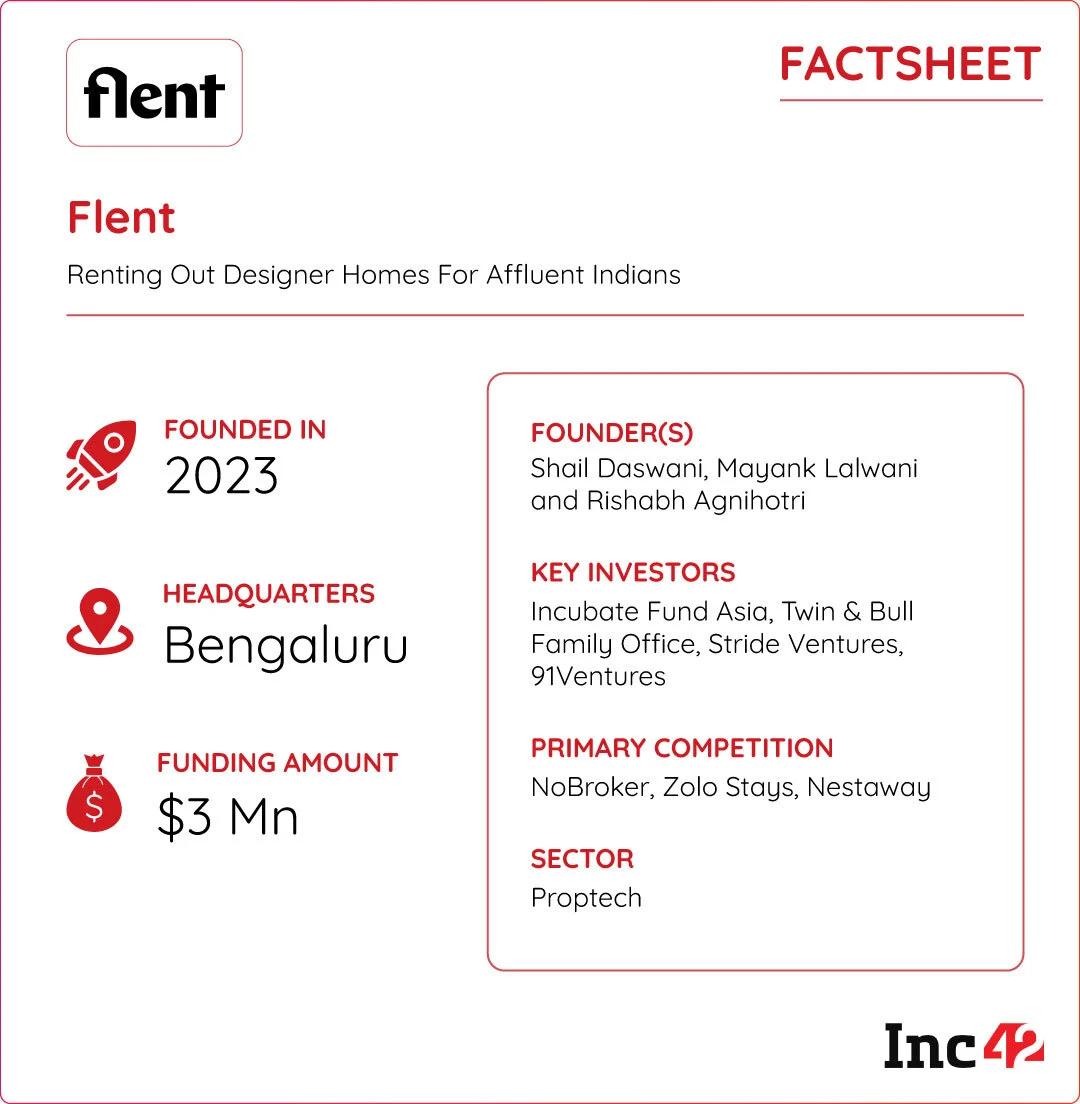

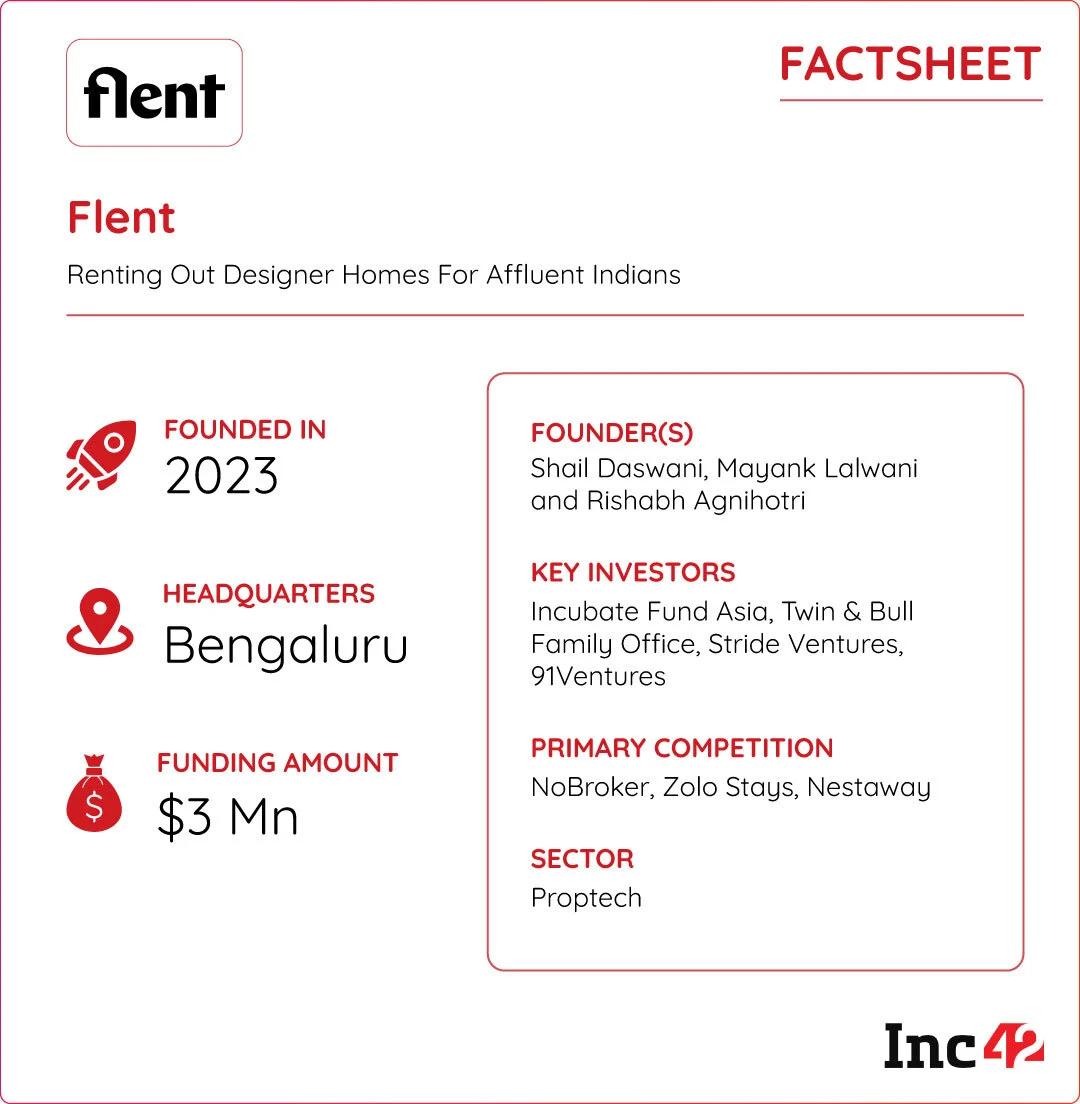

How Flent Is Tackling The Trust Gap In Urban Renting

Renting in India remains marred by issues. Social media listings hide brokers, online photos mislead and trust deficit remains the norm. Bengaluru-based Flent is trying to change this.

Founded in 2023, Flent offers fully furnished designer rental homes for young professionals. Its full-stack approach combines managing properties for owners while streamlining tenant experiences. With INR 1 Cr in monthly GMV, the startup targets tenants looking for sub-INR 33,000 rents and lower deposits.

Scaling Beyond Bengaluru: Flent claims to have so far onboarded 350+ tenants and 150+ landlords in the startup hub. It is now eyeing expansion into Mumbai, Hyderabad and Gurugram within two years as India’s rental market surges on the back of rising per-capita income.

Going forward, the startup also plans to roll out features like flatmate matching and vacancy protection. But, can Flent really clean up India’s urban rental mess?

Infographic Of The Day

India’s agritech ecosystem is scaling fast, and many early stage startups are shaping the sector’s next growth chapter. Here are some of the budding trailblazers…

Source link