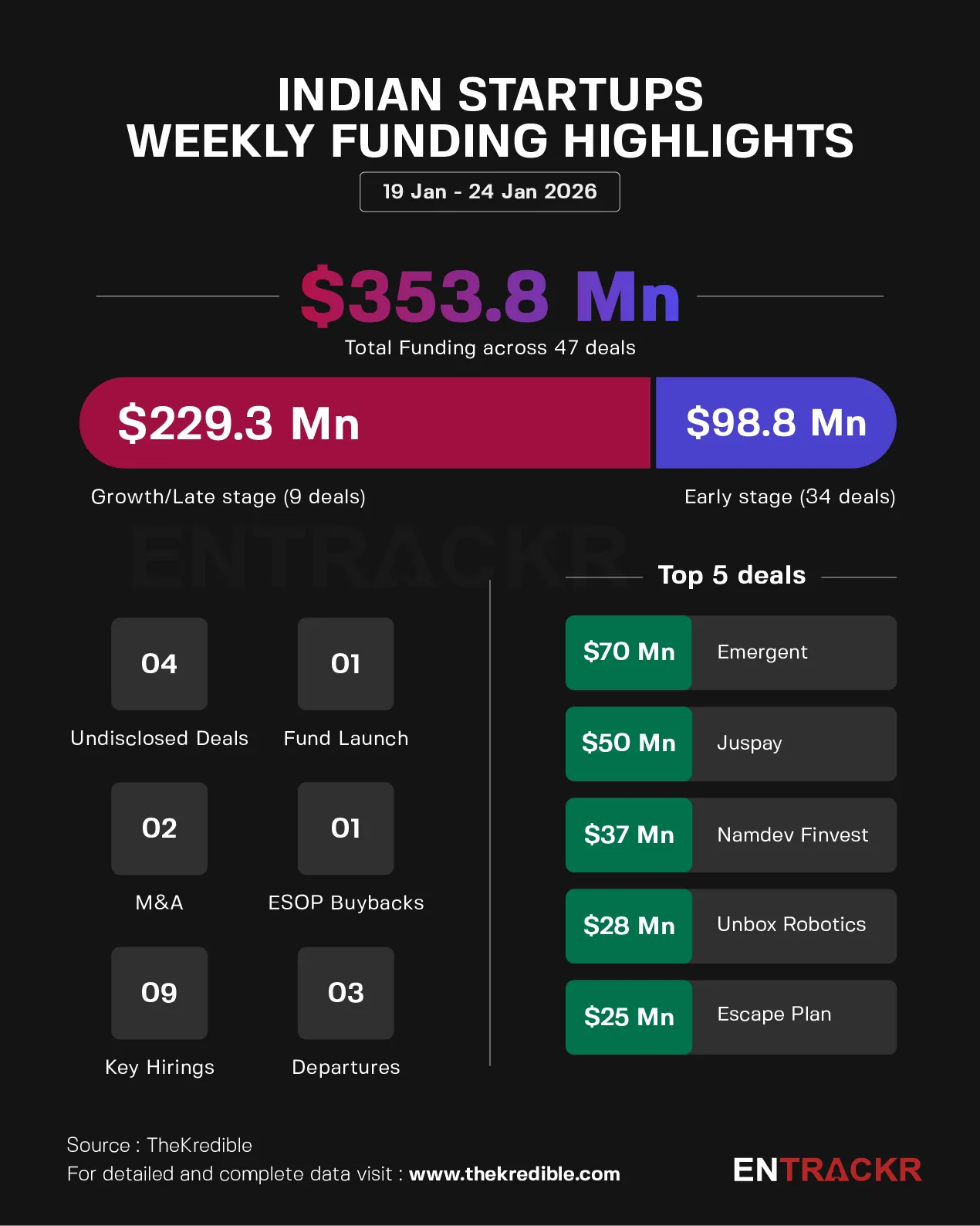

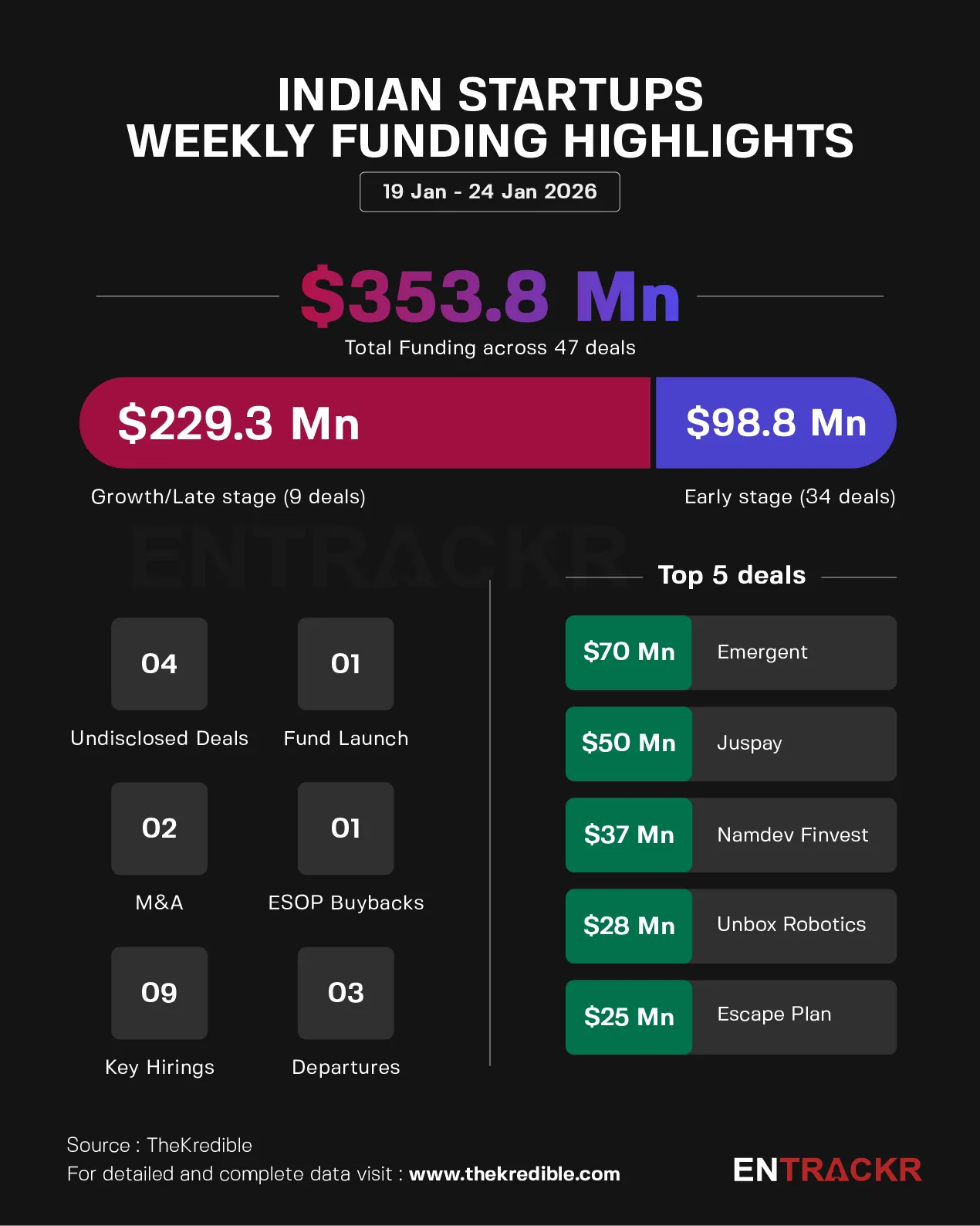

This week, 47 Indian startups raised around $353.81 million, comprising 9 growth-stage and 34 early-stage deals, while 4 startups kept their funding undisclosed.

In contrast, 28 startups had collectively secured about $254 million in the previous week.

[Growth-stage deals]

This week, growth-stage funding totaled $229.3 million across nine deals. Vibe-coding startup Emergent raised $70 million led by Khosla Ventures and SoftBank, while Bengaluru-based payments infrastructure firm Juspay entered the unicorn club after securing $50 million in a Series D follow-on round from WestBridge Capital. Jaipur-based NBFC Namdev Finvest raised $37 million through debt, and supply chain robotics firm Unbox Robotics secured $28 million in a round led by ICICI Venture. Travel products platform Escape Plan, wealthtech startup AssetPlus, solar platform Aerem Solutions, Qure.ai, and PropertyPistol also raised capital during the week.

[Early-stage deals]

Early-stage funding this week stood at $98.81 million across 34 deals. Manufacturing startup Whizzo led the tally with a $15 million Series A round led by Fundamentum, followed by technology-led cooling solutions startup Optimist, which raised $12 million. Other startups that secured early-stage funding during the week include voice AI players Bolna and Ringg AI, travel brand WanderOn, cleantech firm Enerzolve, snack brand Troovy, among others.

Sustainable packaging startup Regeno, circular economy company PolyCycl, healthtech 3TENX and AI firm FireAI also raised funding this week, although the deal sizes were not disclosed.

For a detailed funding breakdown, visitTheKredible.

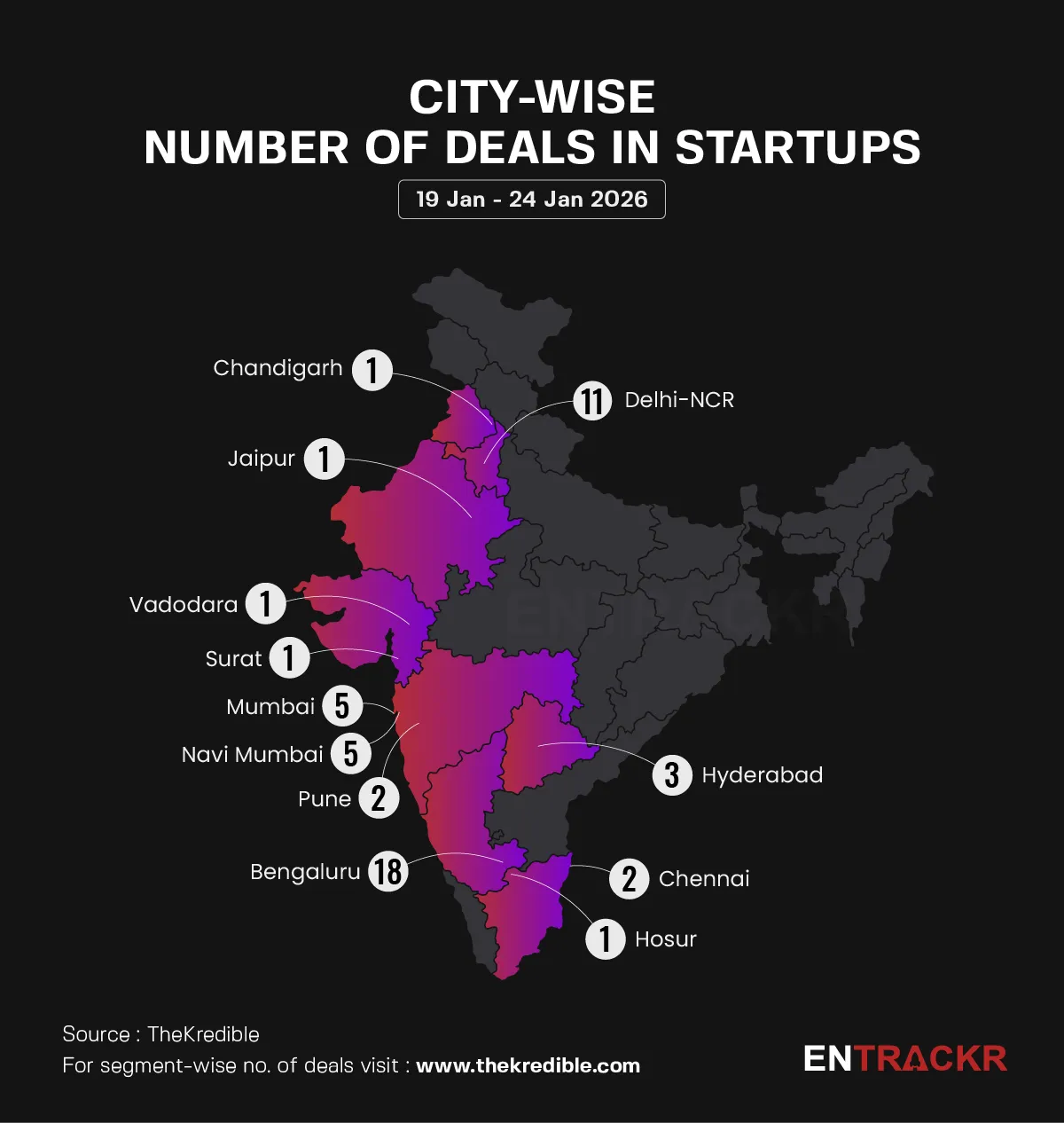

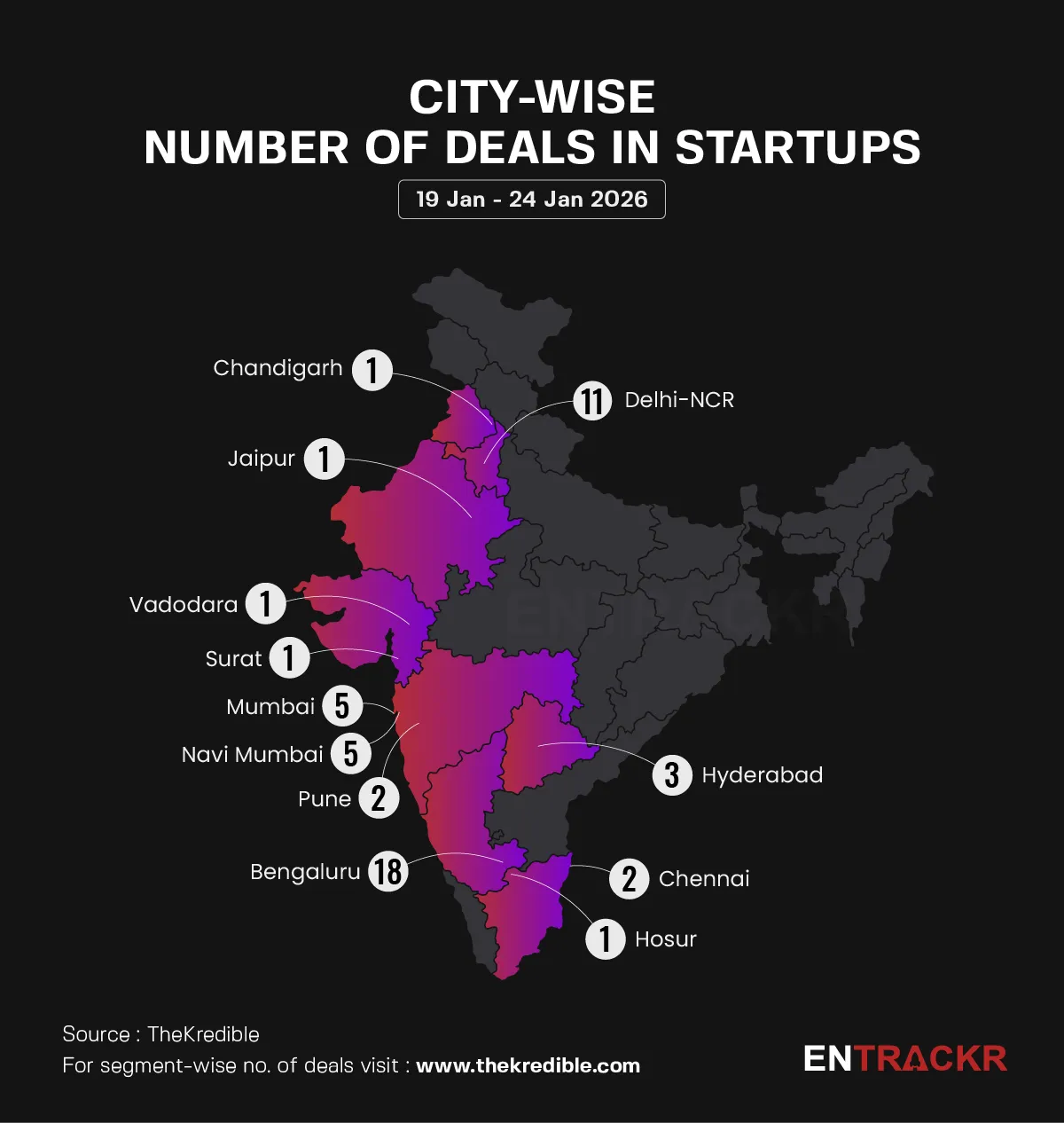

[City and segment-wise deals]

Bengaluru led the city-wise deal count with 18 deals, followed by Delhi-NCR and Mumbai with 11 and 5 deals, respectively. Startups from Hyderabad, Pune, Chennai, Jaipur and others also bagged funding this week.

Segment-wise, AI startups led the week with 7 deals, followed by e-commerce with 6 deals. Fintech, manufacturers, deeptech, Solar tech, and others also recorded funding during the period.

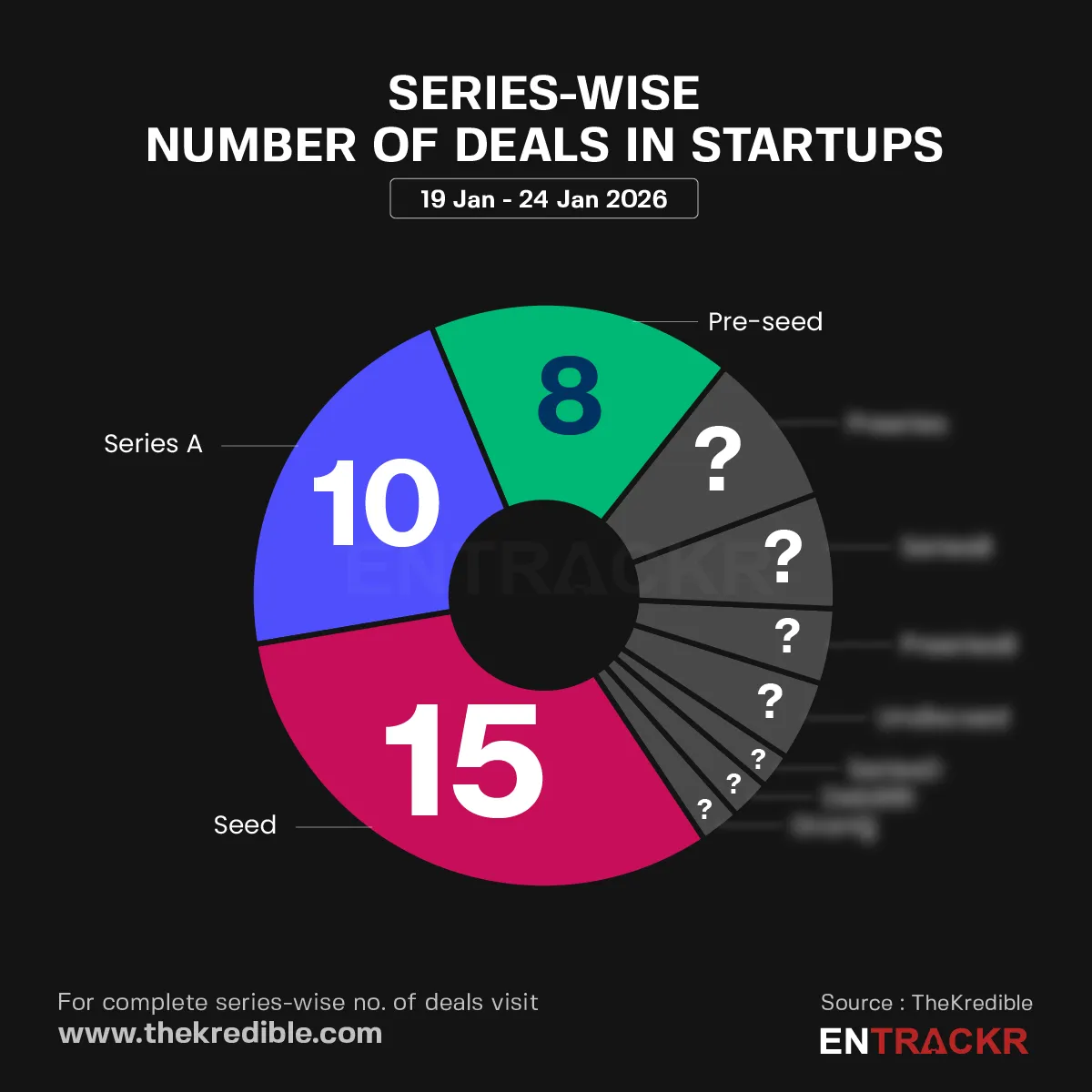

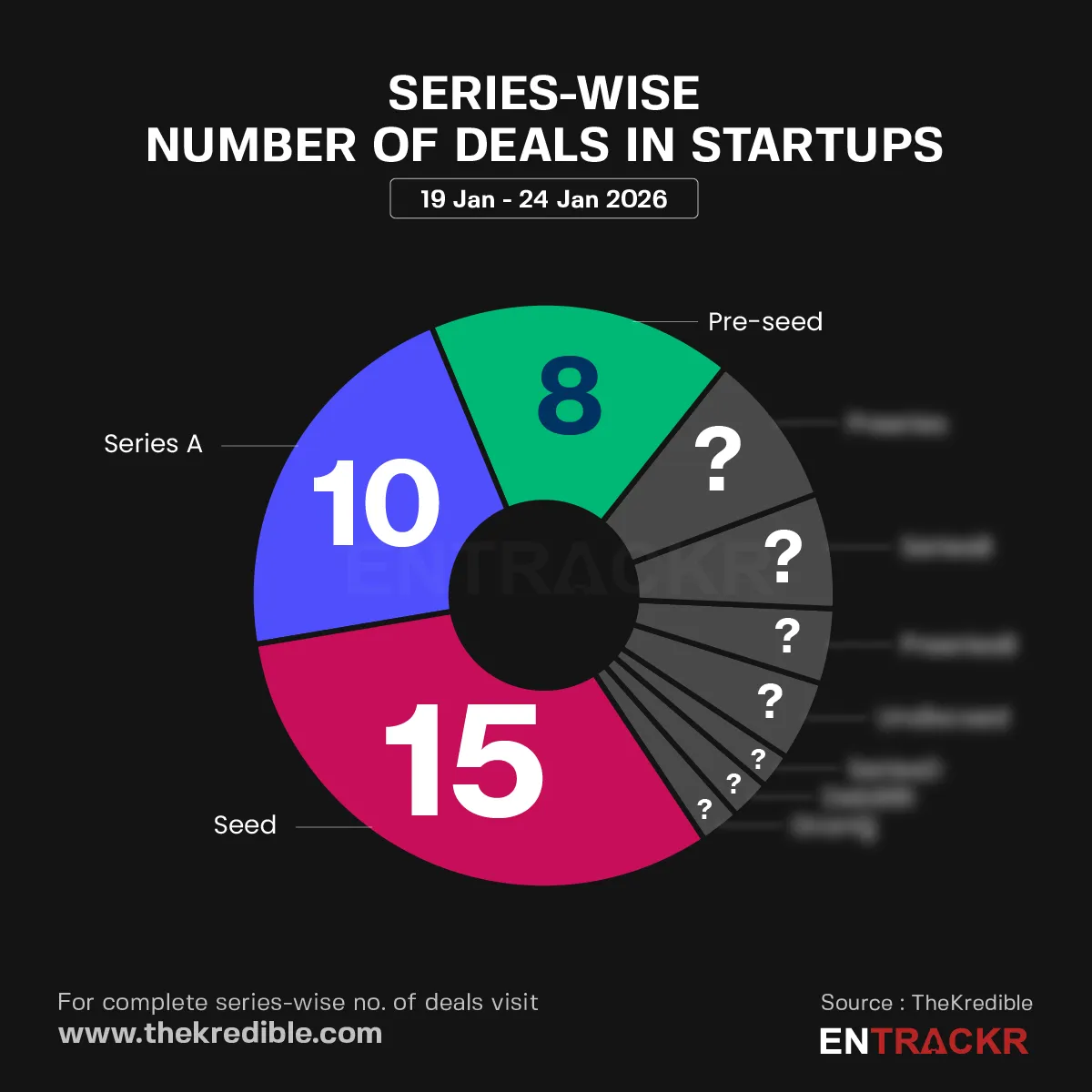

[Series-wise deals]

This week seed rounds led the funding with 15 deals, followed by Series A with 10 deals. Pre-seed, pre-Series A, Series B and others also recorded deals.

Visit TheKredible to see series-wise deals along with amount breakup, and more insights.

[Week-on-week funding trend]

On a weekly basis, startup funding surged 39.3% to $353.81 million as compared to around $253.98 million raised during the previous week.

The average funding in the last eight weeks stands at around $207.82 million with 23 deals per week.

[Key Hirings/ Departures]

Deepak Rastogi has been appointed as the new CFO of Ola Electric following the resignation of Harish Abichandani, while interior design firm Livspace named Abhishek Gupta as its Chief Financial Officer. Avaana Capital elevated Vikas Verma and Shruti Srivastava to partners, Pocket FM appointed Meta AI scientist Vasu Sharma as head of AI, and AI-native data security platform Matters.AI named Ankkit Jain as Director of Sales.

Deepinder Goyal, founder and CEO of Eternal Ltd, has stepped down from his role and will continue as vice chairman, while Albinder Dhindsa has been appointed as the new group CEO. Separately, Mayank Khanduja, partner at Elevation Capital, has also stepped away from the firm.

[Mergers and Acquisitions]

Pine labs owned-Setu to increase its stake to 100% in Agya Technologies Pvt Ltd, which until now has operated as an associate company of Setu. Care.fi, a healthcare-focused fintech startup, has acquired Aldun, a platform specialising in hospital discharge automation.

[ESOP Buyback]

Bengaluru-based fintech firm Cashfree Payments has announced an ESOP buyback programme covering over 400 employees, including 175 former employees.

[Fund Launches]

IIFL Group backed IIFL Fintech Fund has announced the final close of its second fund after raising Rs 500 crore from domestic family offices and high net worth individuals.

[New Launches and Partnerships]

▪️ StartupInvestors.ai Launches AI Platform to Connect Bharat Founders with Global Investors

▪️Credgenics forays into B2C segment with FixMyScore launch

▪️Definedge Securities launches ALGOSTRA, an algo trading platform for retail investors.

▪️Former Google GM and VP Peeyush Ranjan launches AI-first edtech startup Fermi.ai in the US and India

[Financial result this week]

▪️Upstox posts Rs 1,208 Cr income and Rs 215 Cr profit in FY25

▪️Urban Company posts Rs 383 Cr revenue and Rs 21 Cr loss in Q3 FY26

▪️Purplle doubles operating revenue to Rs 1,367 Cr in FY25; losses shrink

▪️Ideaforge posts Rs 31 Cr revenue in Q3 FY26; loss up by 42%

▪️Go Digit posts Rs 2,160 Cr revenue in Q3 FY26; PAT up 18%

▪️Bluestone posts first-ever profit in Q3 FY26; revenue climbs to Rs 749 Cr

▪️Ixigo posts Rs 317 Cr revenue in Q3 FY26; profit grows 55%

▪️MakeMyTrip posts $295 Mn revenue in Q3 FY26; profit down 74%

▪️ Eternal posts Rs 16,315 Cr revenue in Q3 FY26; profit grows 54%

▪️ Exotel turns profitable in FY25; total income crosses Rs 500 Cr

▪️ Rapido joins Rs 1,000 Cr income club in FY25, delivery biz outpaces ride-hailing

▪️ Simplilearn revenue slips to Rs 556 Cr in FY25, cuts losses

▪️ Samunnati posts Rs 2,434 Cr GMV and Rs 5 Cr PBT in FY25

[News flash this week]

▪️ PhonePe pre-IPO reset: Rs 3,937 Cr founders’ secondary; Rs 1,500 Cr hit from credit card rent, RMG exits

▪️ PhonePe files updated DRHP; Walmart to sell 9% stake via OFS

▪️ Amagi lists at 12% discount on stock exchange

▪️ PhonePe hits 9.8 Bn UPI transactions in December; BHIM overtakes CRED

▪️Infra.Market and Purple Style Labs secure SEBI nod for IPO

▪️Karnataka HC lifts bike taxi ban on Rapido, Ola and Uber

▪️Shadowfax IPO closes with 2.7X overall subscription

[Summary]

On a weekly basis, startup funding surged 39.3% to $353.81 million as compared to around $253.98 million raised during the previous week.

Digital payments and fintech major PhonePe has filed its updated Draft Red Herring Prospectus (UDRHP) with the Securities and Exchange Board of India (SEBI). The proposed IPO will be a pure Offer for Sale (OFS), with no fresh issue of shares by the company. The issue size is expected to be around Rs 12,000 crore ($1.5 billion), potentially valuing PhonePe in the range of $14.5–15 billion.

PhonePe strengthened its dominance in India’s UPI ecosystem in December, processing 9.81 billion customer-initiated transactions worth Rs 13.61 lakh crore, as per NPCI data, translating into a 45.35% market share by volume and 48.68% by value. Google Pay remained second with 7.5 billion transactions, holding 34.64% of volumes and 34.25% of transaction value, while Paytm stayed third with 1.65 billion transactions, accounting for 7.65% by volume and 6.32% by value.

Adtech unicorn Amagi Media Labs made a muted stock market debut on Wednesday, listing at a discount despite strong investor interest, with shares debuting at Rs 317 on the BSE and Rs 318 on the NSE, nearly 12% below the IPO issue price of Rs 361.

Building materials unicorn Infra.Market and Purple Style Labs (PSL) have received approval from the Securities and Exchange Board of India (SEBI) to launch their IPOs, as per observations issued by the market regulator.

The Karnataka High Court on Friday set aside the state government’s ban on bike taxi operations, enabling ride-hailing platforms such as Rapido, Ola and Uber to seek permission to restart services.

Source link

![Funding and acquisitions in Indian startup this week [Jan 19 - Jan 24]](https://newsx.io/wp-content/uploads/2026/01/Funding-and-acquisitions-in-Indian-startup-this-week-Jan-19.png)