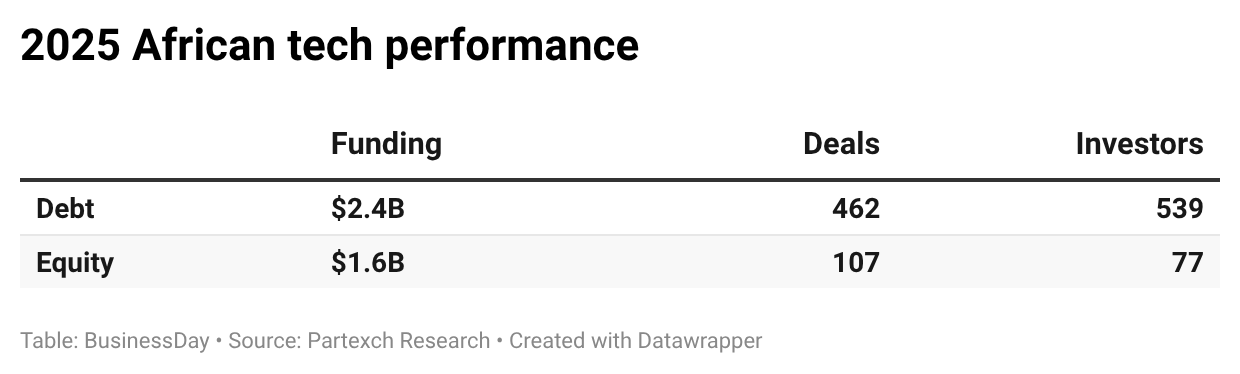

African tech investors piled into debt in 2025, driving total startup funding to a record $4.1 billion, as founders and backers increasingly favoured structured, non-dilutive financing over equity amid a cautious global capital environment.

According to the 2025 Partech Africa Tech VC Report, debt funding jumped 63 percent year-on-year to $1.64 billion, its highest level on record, while the number of debt transactions rose 40 percent to 108 deals, accounting for most of the growth in overall funding activity. By contrast, equity funding grew a modest 8 percent to $2.41 billion, with deal volumes largely flat.

“The acceleration reflects the growing use of structured and non-dilutive financing instruments across African tech, rather than a cyclical rebound,” the report said.

Deal activity followed the same pattern. Overall deal count rose 7 percent to 570 transactions, but the increase was overwhelmingly driven by debt deals, which jumped 40 percent in 2025. Equity deal volume was largely unchanged, edging up just geographically, and reallocation reshapes key markets.

Read also: Japan, Gulf investors invest $180bn in African startups, infrastructure

While participation weakened at the Seed+ stage, investor activity shifted toward later rounds. Engagement at Series A increased, and Series B participation rebounded strongly, reflecting a preference for more mature companies in a cautious funding environment.

“In a more selective cycle, a larger share of active investors is concentrating their equity participation in more mature rounds,” the report said.

Although equity investor participation was recorded across more African markets than in 2024, major hubs experienced sharply different outcomes. South Africa and Egypt attracted more participating investors, while Nigeria and Kenya recorded significant declines.

According to the report, this pattern points to a geographic reallocation of investor attention rather than a uniform pullback, with capital rotating toward markets perceived as offering greater depth or near-term stability.

Fintech dominance eases as investors diversify

Fintech continues to dominate, accounting for 37 percent of total funding, supported by strong volumes across both equity

and debt despite a year-on-year contraction.

It added that Cleantech ranks second, underscoring its capital-intensive nature, with

large transactions driving a near doubling in total capital deployed.

“Beyond these 2 leading sectors, 2025 marks a notable inflection point. E/M/S Commerce, Enterprise, and Healthtech each exceeded $200 million in annual funding for the first time since the 2021-2022 boom cycle.

“Importantly, this resurgence occurs in a market that has largely normalized over the past three years, rather than during an expansionary peak,” it added.

The fact that equity alone exceeded $200 million in each of these sectors suggests a re-emergence of scalable business models and sustained equity investor conviction, rather than a short-term rebound driven by isolated transactions.

Equity vs. debt dynamics across leading markets

Financing structures diverge markedly across leading African tech markets in 2025, with equity and debt contributing unevenly to total funding outcomes and shaping different paths to scale

Nigeria combines the highest overall deal activity (102 deals, –11 percent) with an equity-heavy funding mix, while debt remains secondary but increasingly visible (19 percent of total, +132 percent), contributing incrementally to total volumes without altering the market’s equity-driven nature.

Kenya’s funding profile is debt-weighted but not debt-exclusive, with large transactions playing a central role across both instruments. Debt accounted for 48 percent of total capital deployed in Kenya. It grew 30 percent, while half of the megadeals recorded in Kenya in 2025 were equity-funded, indicating that funding leadership reflects a concentration of large transactions across both equity and debt rather than relying on a single financing channel.

South Africa displays the clearest equity-led profile among large markets, combining the highest equity funding volumes (90 percent of total, 40 percent) with strong equity deal activity (5 percent), while debt plays a comparatively marginal role in overall funding (10 percent of total, -45 percent in debt volumes).

Egypt presents a more balanced structure, with debt contributing a meaningful share of total funding (20% of total, +73 percent) alongside sustained equity activity (80% of total, +21 percent), supporting its position among the top three markets by capital deployed.

Read also: How manufacturers can use backward integration to beat FX crunch

Debt investing spread into new markets in 2025, including countries where no debt investors had been active a year earlier, pointing to a broader continental footprint. While cleantech and fintech remained the largest sectors for debt activity, growth was strongest in mobility and commerce-related segments.

The report also highlighted a more specialised investor base, with debt-only investors now forming the majority of participants.

“This shift is consistent with an ecosystem where debt investing is increasingly supported by specialised players operating on the continent,” it said.