.jpg)

.jpg)

.jpg)

.jpg)

Total investment into the African tech startup ecosystem increased by 46.2% to $1.64 billion in 2025, as the sector began to slowly recover from the impacts of global capital shortages previously coined the “funding winter.”

This is according to the eleventh edition of the annual African Tech Startups Funding Report published by startup news and research portal Disrupt Africa, with support from partners TVC Labs and Opus.

A total of 178 startups raised a combined total of $1.64 billion over the course of the year, which represented a slight decline in terms of the number of funded ventures, but an increase in total funding raised.

This comes after two years of decline, which saw startup funding fall to almost $1.2 billion in 2024 – compared to $2.4 billion in 2023 and $3.3 billion in 2022.

.jpg)

(Source: Disrupt Africa’s 2025 African Tech Startups Funding Report)

In 2025, the number of active investors – individual or institutional – fell by 4.6% to 330 compared to 346 in 2024.

However, the report’s authors said this represented a stabilization of sorts, after two years of major decline.

In 2022 there were 987 investors, and in 2023 there were 527.

.jpg)

(Source: Disrupt Africa’s 2025 African Tech Startups Funding Report)

“2024 was a very difficult year indeed for African tech from a funding perspective, with a significant decline in investment for the second year in a row. Yet we’ve seen a big boost in 2025, and though funding levels have by no means ‘recovered,’ it seems like we are seeing light at the end of the tunnel from an investment perspective,” commented Disrupt Africa Co-founder Gabriella Mulligan.

Big four continue dominance

Each of the so-called “big four” of African tech – Nigeria, Egypt, Kenya and South Africa – raised more funding than in 2024, when steep declines occurred because of the global capital shortage.

This meant these four countries accounted for much of the continent’s growth in 2025.

Researchers said that although there are signs the “funding winter” is coming to an end, capital remained focused on markets perceived as being less “risky.”

The share of funding heading into the big four countries was 88% in 2025, similar to 88.8% in 2024, but down from 90.4% in 2023.

Egypt had the highest number of startups funded in 2025, at 43, followed by South Africa with 42.

.jpg)

(Source: Disrupt Africa’s 2025 African Tech Startups Funding Report)

Meanwhile, Nigeria took the largest portion of funding, at around $464.8 million (28.4% of the African total).

Outside of the big four, Morocco, Tunisia and Ghana had the next highest number of startups funded, and the biggest portions of funding went to the ecosystems in Ghana, Togo and Morocco.

Overall startups receiving investment remain rather young, with over 35% of 2025’s funded startups launching their businesses in the last four years.

Fintech future remains strong

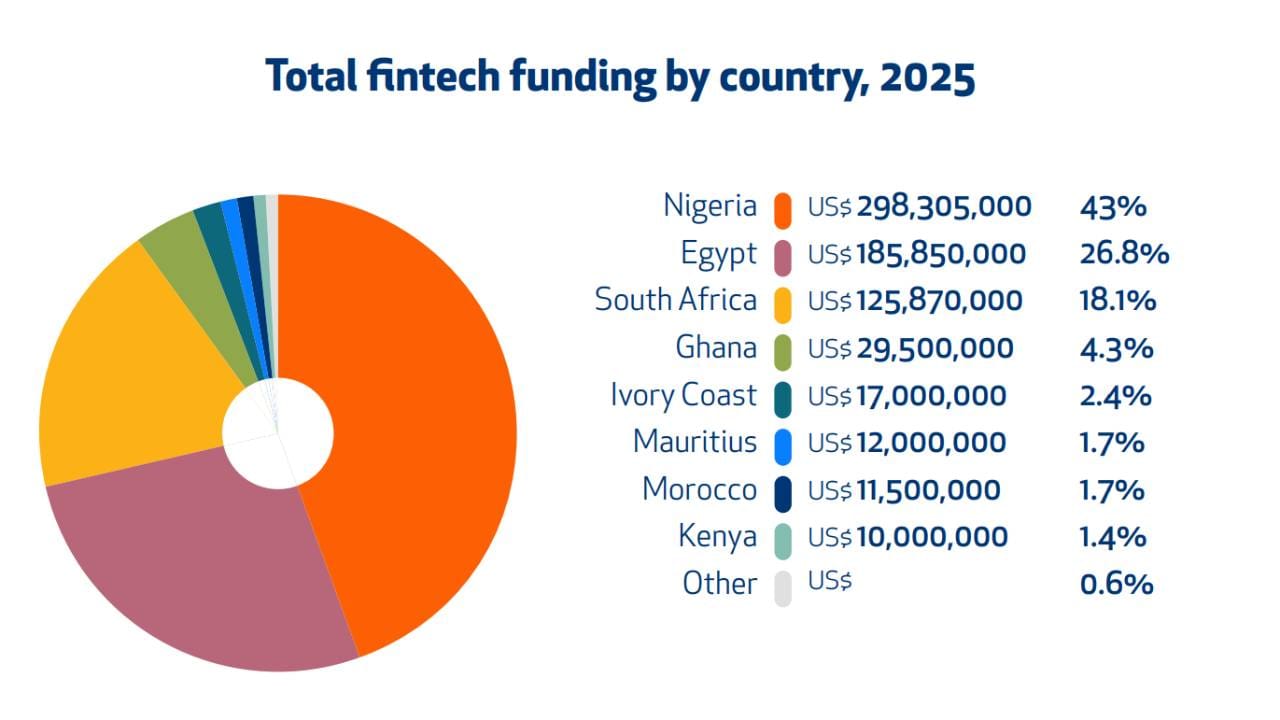

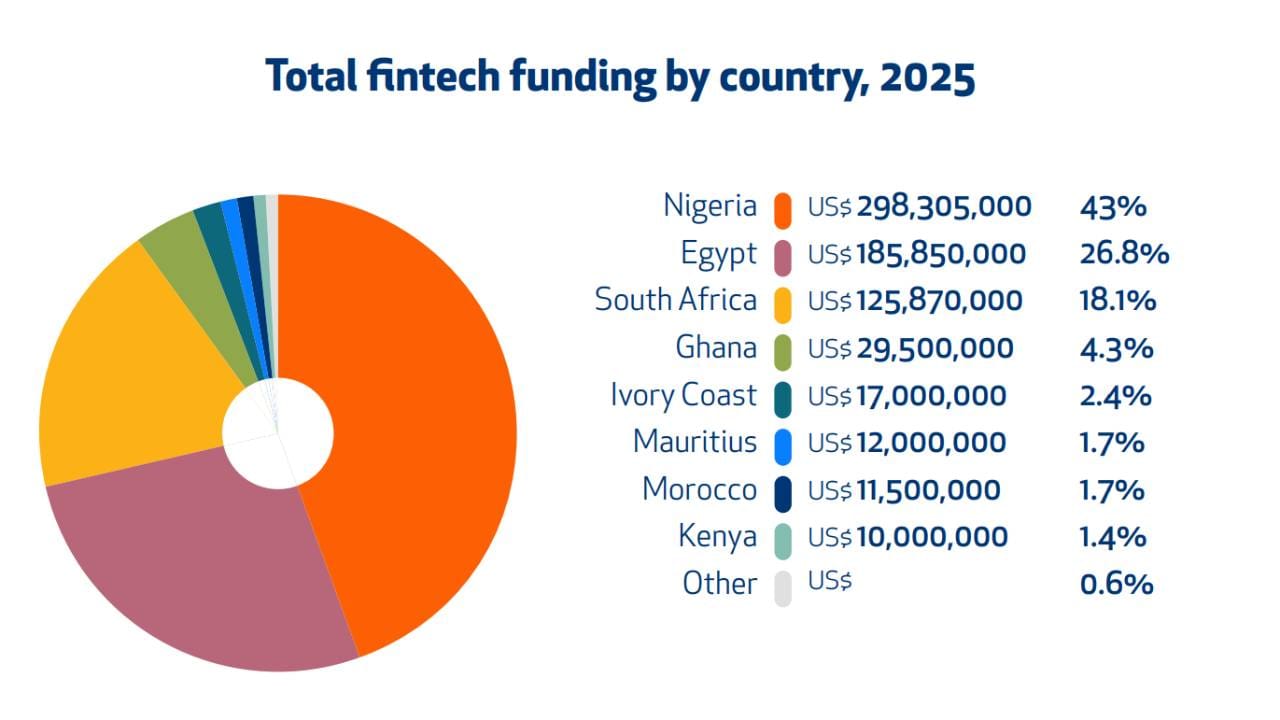

When it comes to funded sectors, fintech yet again proved to be by far the most popular for investors in 2025, increasing its share of funded ventures and generally matching its proportion of total funding from 2024.

Fifty-four fintech startups raised funding in 2025, almost one-third of the continent’s total.

Those fintech ventures raised a combined total of almost $694 million, which represented a significant leap from 2024.

.jpg)

(Source: Disrupt Africa’s 2025 African Tech Startups Funding Report)

Energy, mobility, e-commerce and retail-tech, and AI recorded significant increases to make up the top five sectors for total investment last year.

Sectors that had previously proven attractive to investors, such as edtech and recruitment, had a disappointing year.

Fintech startups in Nigeria took the lion’s share of fintech investment in 2025, at 43% of the total, followed by Egypt and South Africa at 26.8% and 18.1% respectively.

(Source: Disrupt Africa’s 2025 African Tech Startups Funding Report)

Gender diversity remains a challenge

Even as startup funding begins to stabilize, gender diversity remains a challenge in the ecosystem.

Disrupt Africa’s data shows that only 16.9% of funded startups in 2025 had a woman on their founding team, down considerably from 26.3% in 2023.

“This was a further setback after what had been a few years of progress,” the authors said.

In addition, only 20.2% of funded ventures in 2025 were led by a female CEO.

Source link