- ■

Varaha raises $20M as first close of $45M Series B led by WestBridge Capital, with RTP Global and Omnivore participating, bringing total equity raised to $33M

- ■

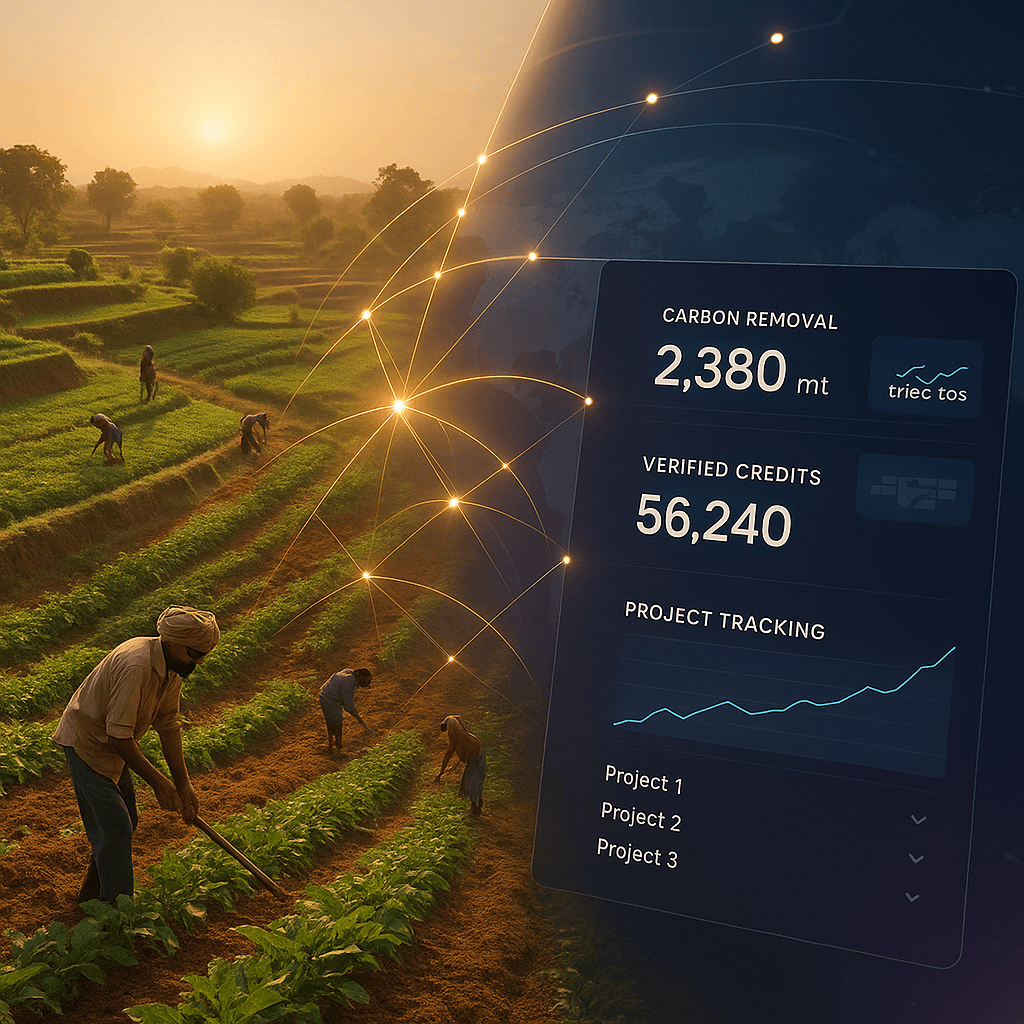

Company removed 2M+ tons of CO2 across 14 projects, expects revenue to jump from $4.76M to $22.15M this year while staying profitable

- ■

Varaha’s cost advantage: execution in emerging markets delivers carbon removal at 1.5x-3x lower prices than European and North American competitors

- ■

Expansion into Vietnam and Indonesia next as startup scales Industrial Partners Program with agribusinesses and steel producers

India-based climate tech startup Varaha just closed $20 million in fresh funding, the first portion of a $45 million Series B round led by WestBridge Capital. The deal marks the venture firm’s inaugural climate tech investment and positions the three-year-old company to scale carbon removal projects across Asia and Africa at costs significantly below competitors in wealthier markets. With major offtake deals already signed with Google and Microsoft, Varaha is betting its execution-focused model can deliver verified emissions reductions at prices that make economic sense as corporate demand accelerates.

Varaha is making a bold bet that India can become the global hub for cost-effective carbon removal. The Bangalore-based climate tech startup just secured $20 million in fresh capital, kicking off a planned $45 million Series B round led by WestBridge Capital, with participation from existing backers RTP Global and Omnivore.

The funding comes as corporate buyers face mounting pressure to secure verified carbon removals, particularly tech giants whose energy consumption is skyrocketing thanks to AI workloads and expanding data center footprints. Google and Microsoft have already signed long-term offtake agreements with Varaha, joining Lufthansa, Swiss Re, and Capgemini in backing the startup’s model.

What sets Varaha apart isn’t breakthrough technology – it’s ruthless execution in markets where costs run a fraction of what developers face in Europe or North America. Co-founder and CEO Madhur Jain told TechCrunch that his company can deliver carbon removal credits at prices 1.5x to 3x lower than competitors in wealthier geographies while meeting identical international verification standards.

“If carbon credit is a cost to the businesses that are buying these carbon credits, it’s a cost on their balance sheet. It’s not a CSR item,” Jain explained. “And hence, if the cost of a certain geography is going to be so high by an order of magnitude of like, 1.5x to 3x credit production, it is going to be extremely hard for those companies to survive.”