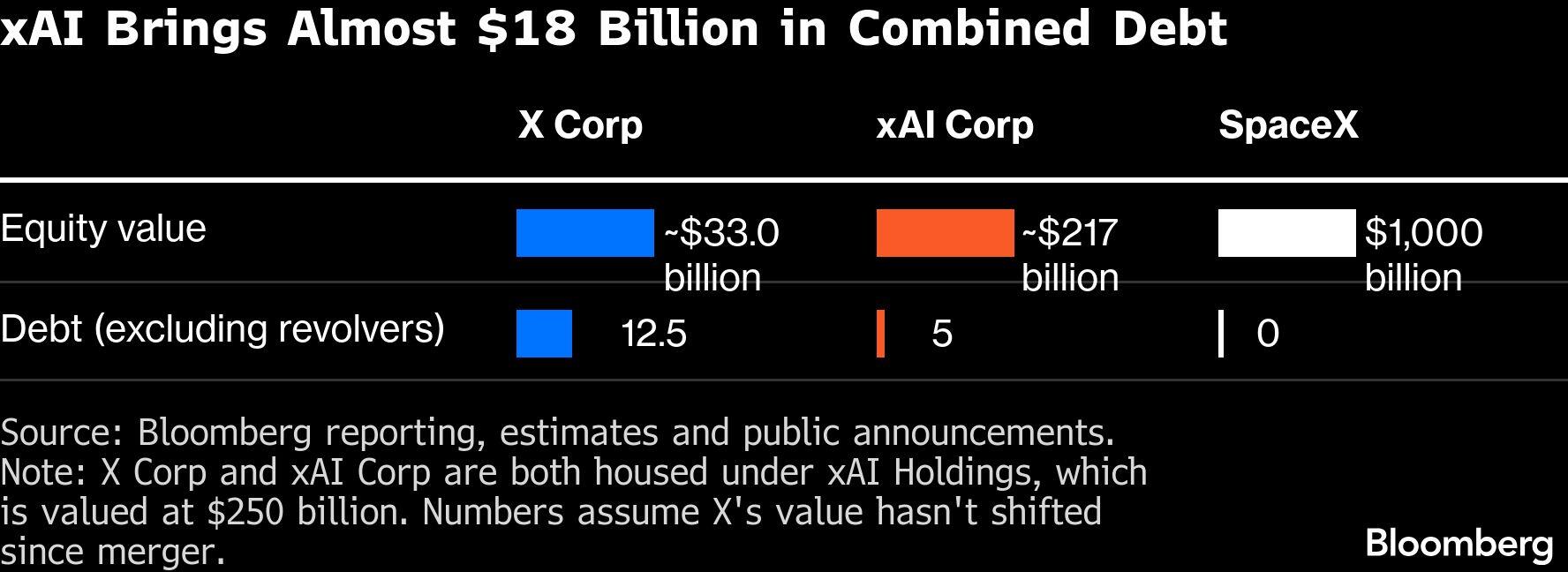

XAI Holdings is not that. The company, which owns Musk’s AI startup and the social network X, is saddled with billions of dollars in debt, besieged by well-funded rivals and faces mounting regulatory scrutiny after its chatbot spread sexualized images. It also brings in scant revenue, compared to SpaceX. Much of what it does generate comes from Musk’s other businesses.

Bloomberg

BloombergOver the past year, xAI has been buoyed by a web of contracts and investments between Musk’s ventures, with echoes of the circular deals underpinning the wider AI sector – except in this case, these arrangements are strictly within the business empire of the world’s richest man. Now, xAI is getting its largest lift to date, courtesy of Musk’s crown jewel, SpaceX.

On Monday, Musk announced plans to merge the two companies in a deal that values the enlarged entity at $1.25 trillion ahead of an expected IPO. To some industry watchers, the combination appears poised to create a juggernaut that appeals to a broader swath of Wall Street investors, and possibly spurs a sci-fi-sounding race to put AI data centers in space. To others, including some insiders, the acquisition looks less like a merger than a rescue mission.

It wouldn’t be the first time one Musk venture has come to the aid of another. X, formerly known as Twitter, was performing so badly after Musk’s $44 billion acquisition that the Wall Street banks that helped finance the deal couldn’t get the debt off their books. Last March, Musk merged X with xAI to value the social network at $45 billion, including debt, even though X’s revenue was down by nearly half from the buyout in 2022. X is still paying tens of millions or more every month to cover the interest on its roughly $12.5 billion in debt commitments.

“X was out of money. Merged with xAI. xAI out of money merge with spaceX,” said Ross Gerber, CEO of Gerber Kawasaki, a shareholder in some of Musk’s firms. Following that logic, Gerber continued, “SpaceX out of money. Merge with …. tesla. When they are all out of money…”

Musk’s ventures had helped fuel xAI’s business long before this week’s merger. Launched in 2023 with the grand, if vague, mission to “understand the true nature of the universe,” xAI is often positioned as a rival to leading AI labs like OpenAI and Anthropic. But the company, and its Grok chatbot, has neither the mass reach of OpenAI’s ChatGPT nor Anthropic’s single-minded focus on cultivating business customers. What it does have is Musk.

Musk’s AI startup leaned on X for distribution and data to power Grok. SpaceX was one of xAI’s first clients, using the startup’s chatbot, Grok, in customer interactions. And soon after, Tesla incorporated Grok into its vehicles. SpaceX and Tesla also invested $2 billion each into different xAI equity fundraises, helping to prop up its valuation to $250 billion.

Now, Tesla has effectively become an investor in SpaceX through the merger, further muddying the waters between Musk’s ventures. XAI is also expected to power Tesla’s humanoid robot, Optimus, in the future, Bloomberg News has reported, another way the AI firm will be able to get some cash.

Of the $90 million in gross profit xAI recorded in the first nine months of last year, at least half was likely tied to the Musk universe, according to a Bloomberg estimate based on investor documents and public announcements. It was only by mid-2025 that the company publicized two other contracts, one with the Pentagon and another one with Palantir Technologies Inc.

Representatives for xAI and SpaceX did not respond to a request for comment.

Even with the business from Musk’s other ventures, xAI’s sales are dwarfed by rivals like OpenAI, which generates billions in revenue annually. XAI reported revenue of $107 million in the three-month period ending in September, according to investor documents viewed by Bloomberg. Meanwhile, the firm was burning through nearly $1 billion each month as it spent on chips, data centers and talent to compete in the global AI race.

To finance those efforts, xAI leaned more heavily on debt than some of its peers. Barely two years into existence, the startup took on $5 billion of debt, a high amount for a nascent firm. Creditors, worried about the company’s profitability and its thirst for cash, asked xAI to not raise similar debt again, Bloomberg has reported. In contrast, OpenAI and Anthropic have not tapped the traditional capital markets, nor has SpaceX, according to data compiled by Bloomberg.

Musk’s firm managed to continue raising debt to secure the costly Nvidia Corp. processors that are key to AI development, but this time via special purpose vehicles so that it wouldn’t impact xAI’s existing shareholders and creditors. The only exposure xAI has is through leasing commitments, but the balance sheet is not impacted.

The company’s debt and cash burn will be part of SpaceX. Musk could decide to refinance the nearly $18 billion in debt against the new combined company and get cheaper rates, market participants said, providing a meaningful lifeline for the business. The reward for SpaceX, meanwhile, is less clear. “xAI shareholders benefit more than SpaceX stakeholders here,” said Dmitry Shlyapnikov, an analyst at Horizon Investments who works with portfolio managers. One day there may be a fleet of data centers in space. For now, some SpaceX engineers are simply testing ways to incorporate a specialized version of Grok into their workflow. It remains a minor effort.