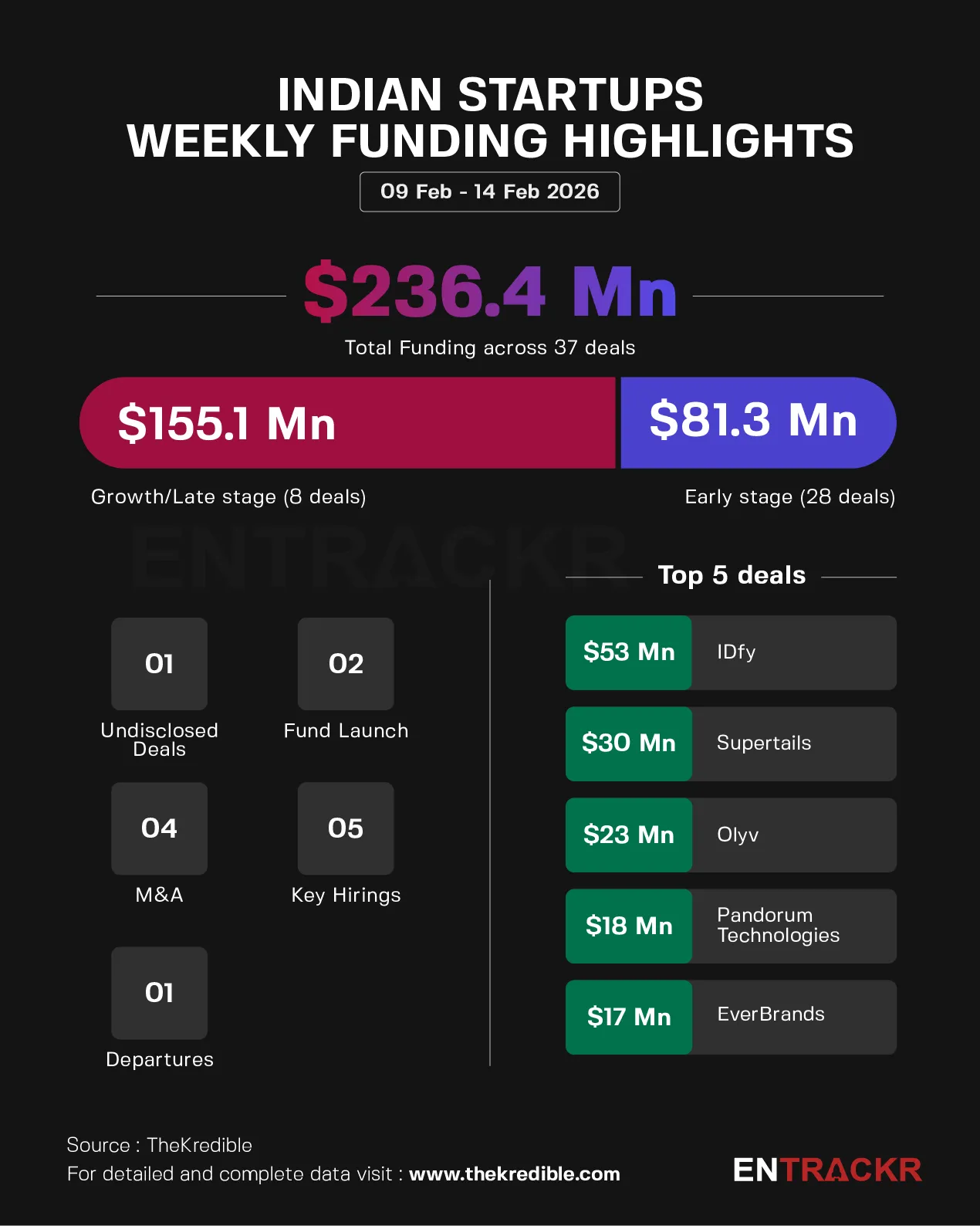

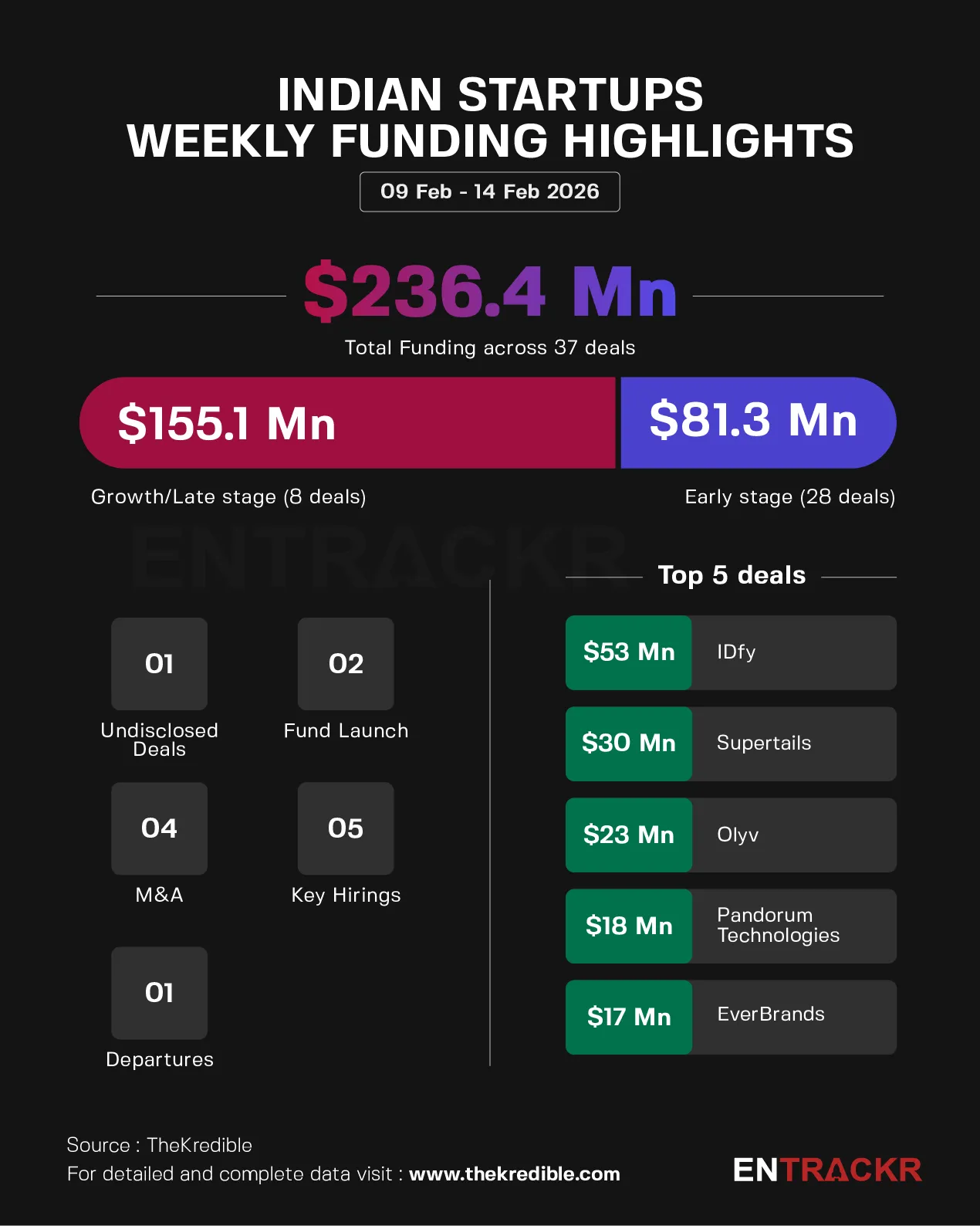

This week, 37 Indian startups raised around $236.38 million, comprising 8 growth-stage and 28 early-stage deals, while a startup kept its funding undisclosed.

In contrast, 25 startups had collectively secured about $215 million in the previous week.

[Growth-stage deals]

Growth-stage startups raised $155.10 million across eight deals this week, led by identity verification startup IDfy’s $53 million Series F round backed by Neo Asset Management and existing investors. Petcare startup Supertails secured $30 million from Venturi Partners, while personal lending platform Olyv (formerly SmartCoin) raised Rs 207 crore in a Series C round led by Fundamentum Partnership Fund with participation from SMBC Asia. Other deals included fundraises by biotech Pandorum Technologies, EverBrands, BigHaat, Slurrp Farm and GoDesi.

[Early-stage deals]

Early-stage funding this week totalled $81.28 million across 28 deals. Fashion tech Showroom B2B led the early stage funding with a $17 million funding round led by cactus partners followed by D2C ethnic wear brand Amanya parent DSLR and omnichannel grocery platform Elixiir Foods both securing $9 million funding. Other early stage deals included healthcare-focused fintech startup Care.fi, manufacturing startups Six Sense Mobility, Indigrid Technology, battery Tech e-TRNL, deeptech ThirdAI, cleantech startup PadCare Labs.

For a detailed funding breakdown, visitTheKredible.

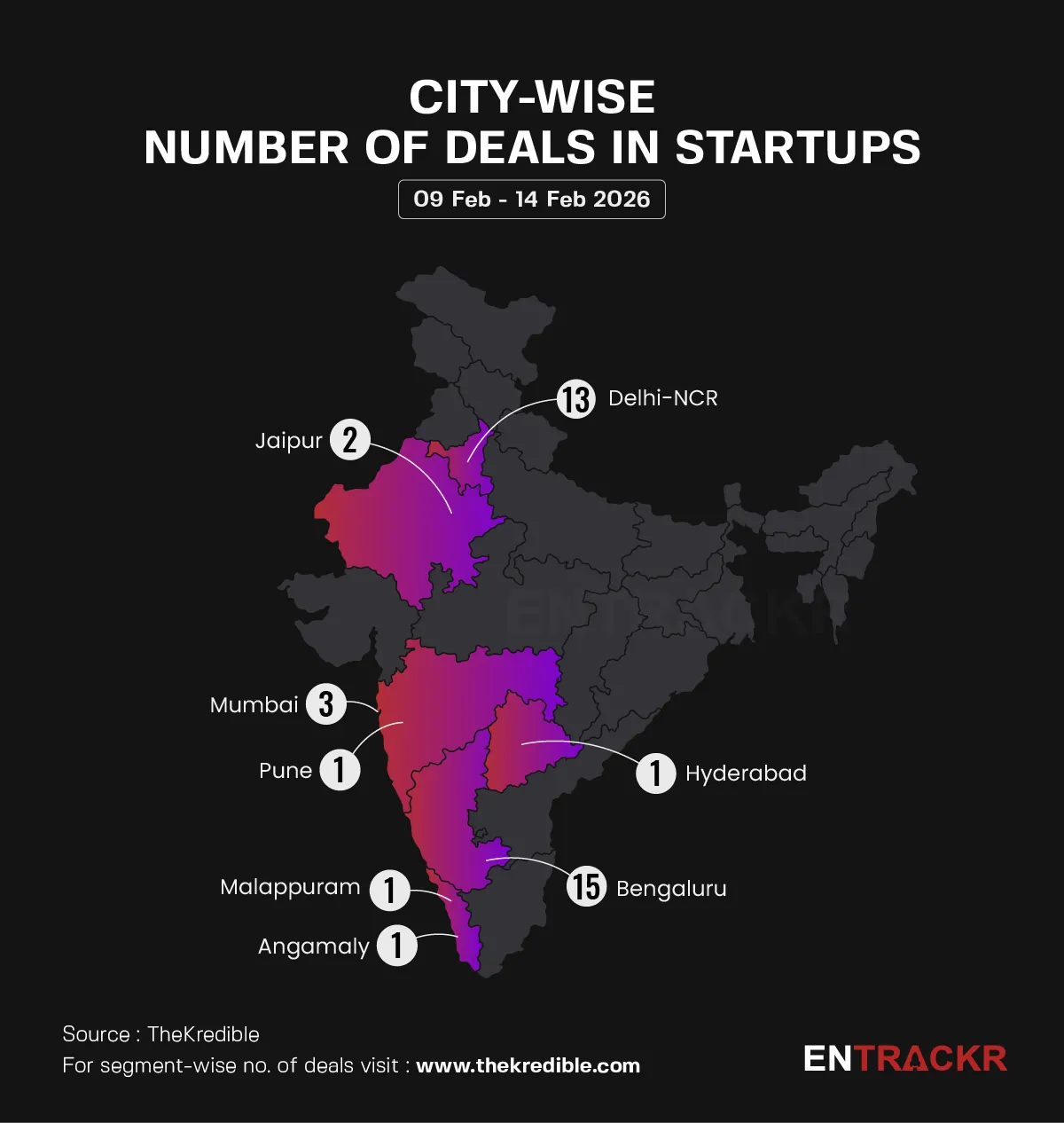

[City and segment-wise deals]

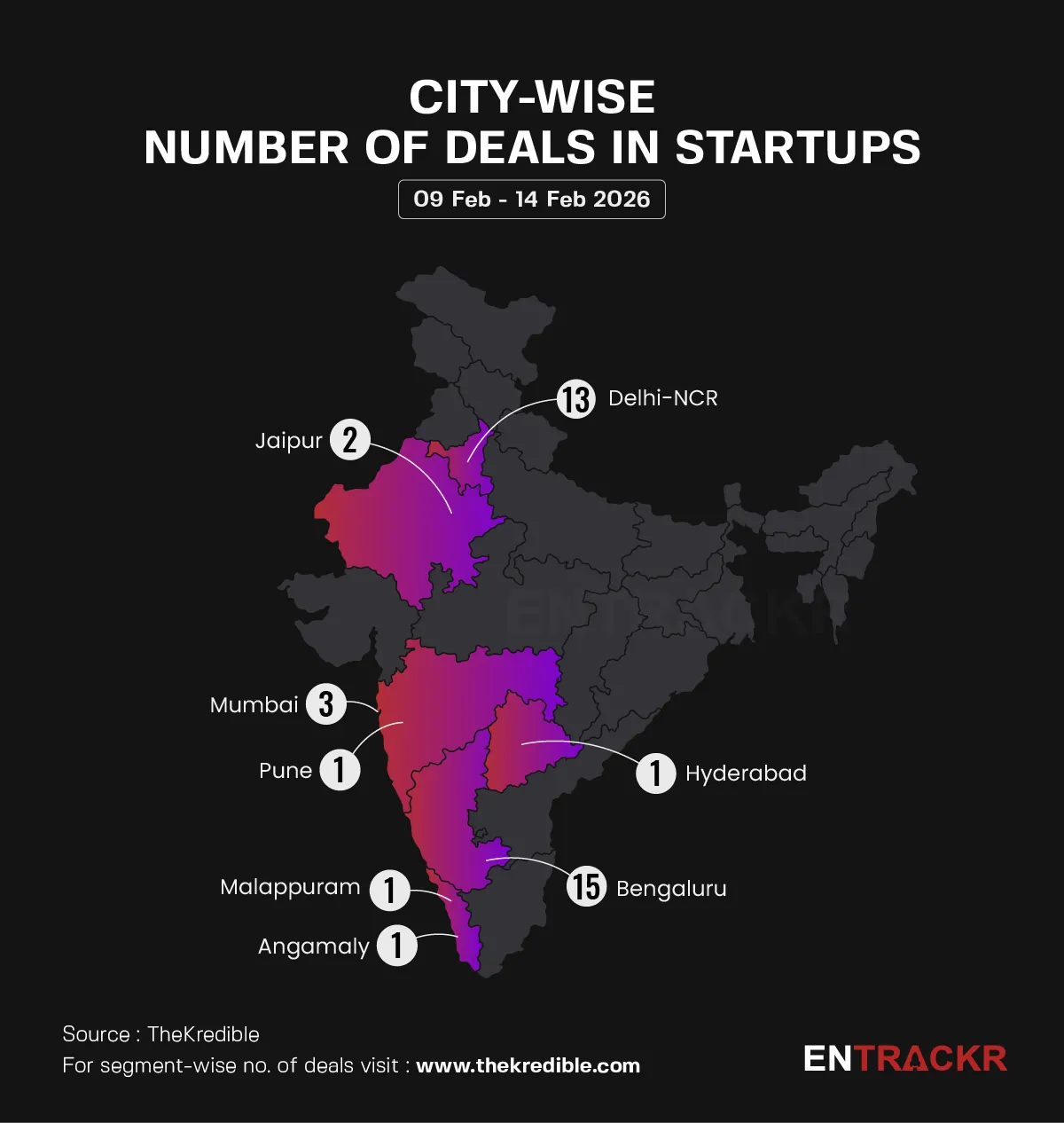

Delhi-NCR topped the city-wise deal count with 15 deals, while Bengaluru led in total funding, raising $93.57 million across 13 deals. Mumbai, Jaipur, Hyderabad, Pune, Anngamaly and Malappuram also secured deals during the week.

Segment-wise, e-commerce startups led the week with 6 deals each, followed by manufacturing and healthtech startups with 3 deals each. Pet Care, fintech, EV, battery tech, deeptech, and others also recorded funding during the period.

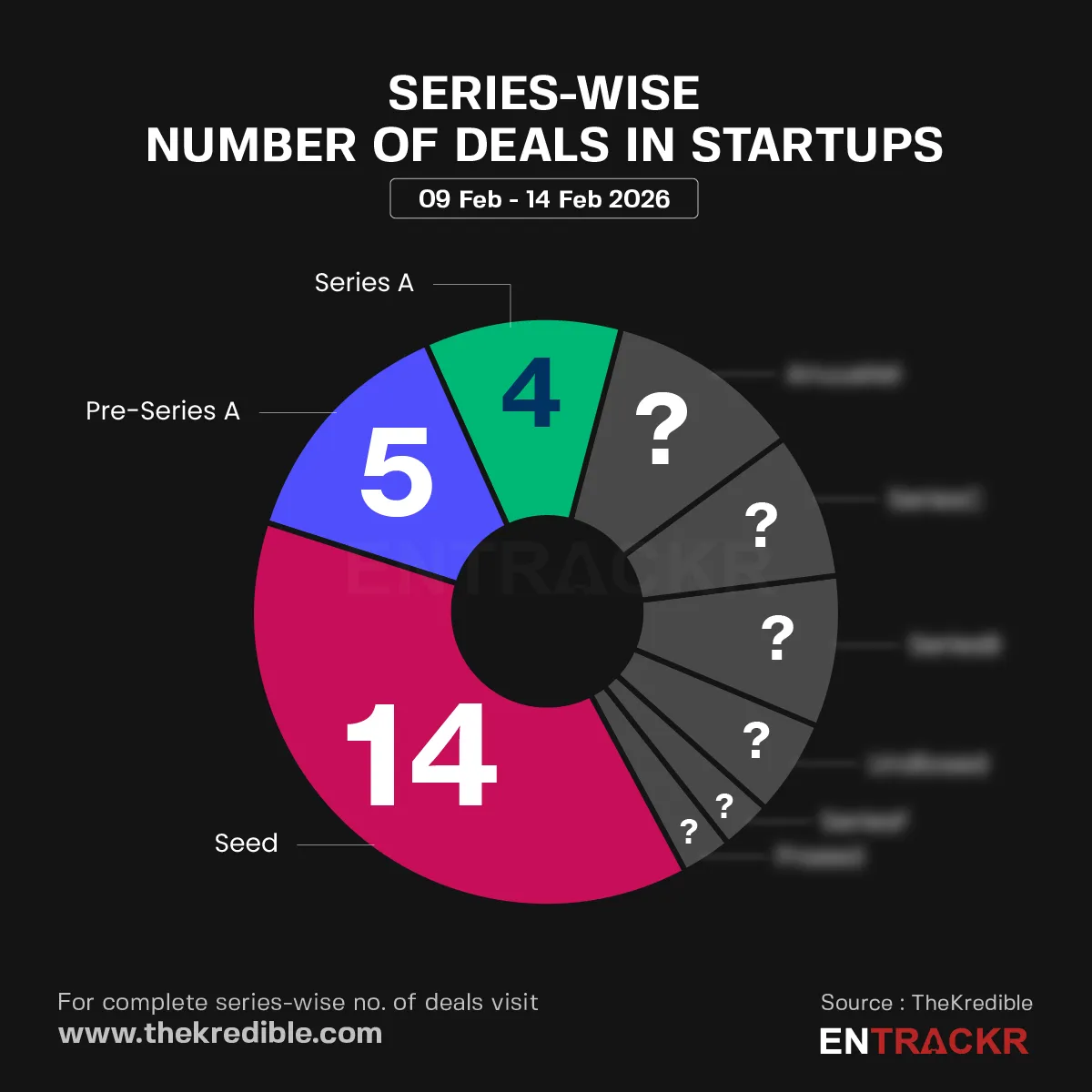

[Series-wise deals]

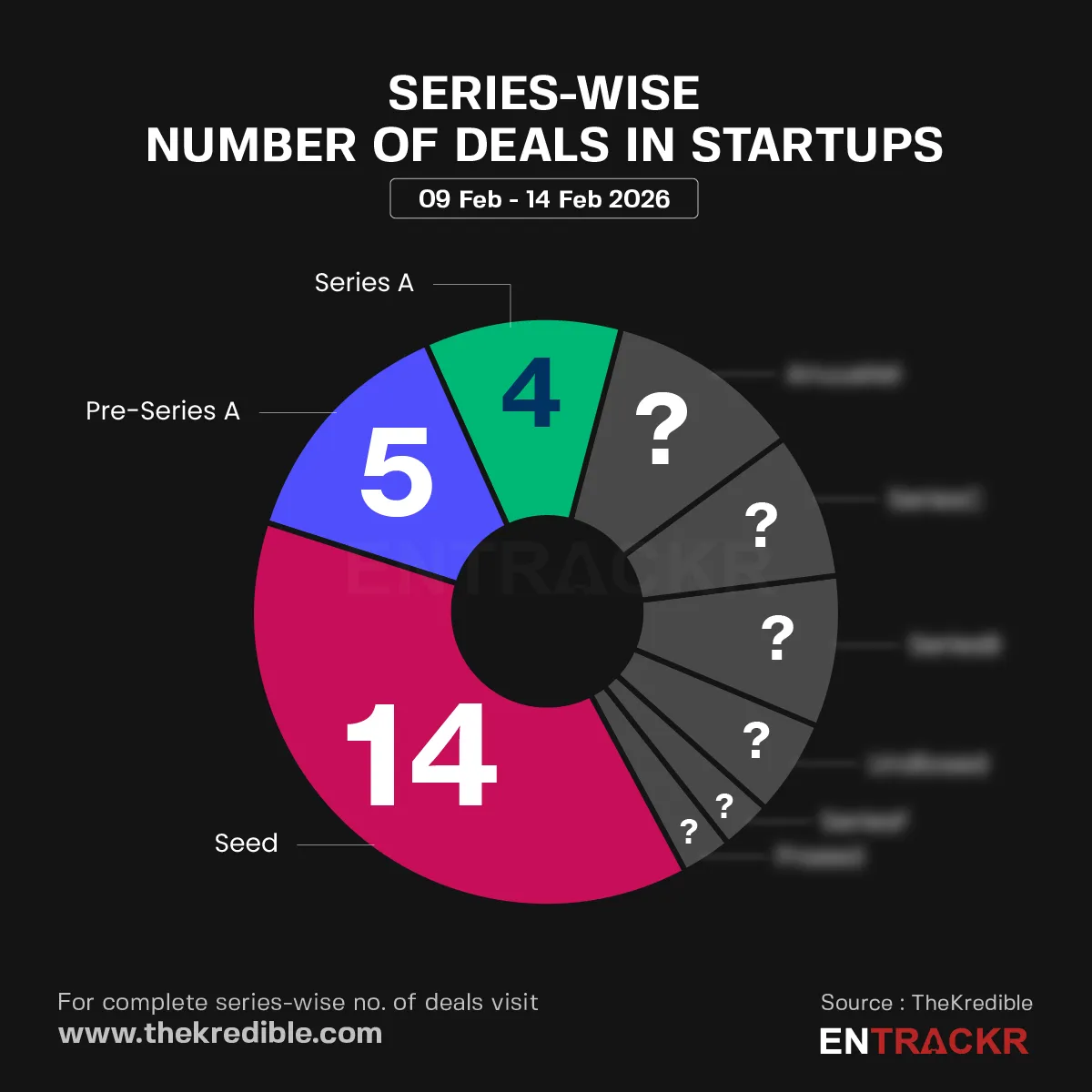

This week seed rounds led the funding with 14 deals, followed by pre-Series A and Series A with 5 and 4 deals respectively. Angel, Series C, Series B, Series F also recorded deals.

[Week-on-week funding trend]

On a weekly basis, startup funding increases nearly 10% to $236.18 million as compared to around $215 million raised during the previous week.

The average funding in the last eight weeks stands at around $185.97 million with 25 deals per week.

[Key Hirings/ Departures]

Wakefit Innovations Limited has appointed Parul Gupta as its Chief Financial Officer. Myntra named Pramod Adiddam as Chief Technology Officer, while CureBay appointed Siddharth Agrawal as Chief Operating Officer. Niyo reappointed Sai Sankar as Chief Business Officer for its forex business, and Mudrex brought in Rakhesh Raghunath to strengthen compliance.

Josh Foulger, president of the electronics division at manufacturing unicorn Zetwerk, has exited the company

[Mergers and Acquisitions]

Bertelsmann Investments has acquired an 80% stake in trucking aggregator LetsTransport for an undisclosed amount. Rainmatter Investments, backed by Zerodha, picked up a majority stake in digital pension app PensionBox through a mix of primary and secondary transactions for $2 million. Meanwhile, pharmaceutical major USV has signed a definitive agreement to acquire a 79% stake in Nutritionalab Private Limited, the parent company of Wellbeing Nutrition, marking its entry into India’s fast-growing D2C nutraceutical and wellness market. Online travel aggregator ixigo has approved the acquisition of a majority stake in Spain-based online train ticketing platform Trenes for a total investment of around Rs 125 crore. As part of the transaction, ixigo will acquire an upfront 60% stake in Trenes

[Fund Launches]

W Health Ventures has announced the first close of its second fund at Rs 550 crore against a target corpus of Rs 630 crore, with plans to invest in 8–10 early-stage healthcare startups with cheque sizes of Rs 30–50 crore. Java Capital has launched a Rs 400 crore deeptech fund, with a Rs 150 crore greenshoe option, to invest in 15–20 seed-stage startups across sectors such as semiconductors, aerospace, defence, AI, robotics, climate tech, and advanced manufacturing.

[New Launches and Partnerships]

▪️Nirav Mody backs SportsSkill Ladder, launches beta platform

▪️Formula Group secures strategic investment from Relo Group

▪️Hexaware launches new agentic AI platform

▪️CynLr launches new robotic platform

[Financial result this week]

▪️FirstCry parent records Rs 2,424 Cr revenue in Q3 FY26, loss spikes 2.5X

▪️AvenuesAI revenue jumps 2.2X to Rs 2,381 Cr in Q3 FY26

▪️Ola Electric revenue declines 55% to Rs 470 Cr in Q3 FY26

▪️MapMyIndia’s revenue declines to Rs 94 Cr in Q3 FY26, profit falls 41%

▪️Uber India’s ride-hailing losses soar 4X to Rs 1,407 Cr in FY25 with flat gross revenue

▪️GIVA’s revenue jumps 89% to Rs 518 Cr in FY25

▪️Honasa posts Rs 602 Cr revenue in Q3 FY26; profit doubles

▪️Shadowfax revenue grows 65% to Rs 1,159 Cr in Q3 FY6; profit spikes 5X

▪️The Man Company’s revenue declines to Rs 154 Cr in FY25; slips into losses

▪️Yatra posts Rs 257 Cr revenue and Rs 8 Cr profit in Q3 FY26

▪️TBO Tek revenue grows 86% to Rs 784 Cr in Q3 FY26

▪️Lenskart profit jumps to Rs 133 Cr in Q3 FY26; global biz forms 40% of revenue

▪️HUL-owned Minimalist revenue spikes 48% to Rs 515 Cr in FY25

▪️Freshworks posts $223 Mn Q4 CY25 revenue, achieves GAAP operating profit

▪️Indiqube posts Rs 390 Cr revenue in Q3 FY26; losses rise 21%

▪️Wakefit posts Rs 421 Cr revenue and Rs 32 Cr profit in Q3 FY26

▪️Bose-funded Noise revenue declines 24% to Rs 1,048 Cr in FY25

▪️Dream11’s domicile and director benefits lead to Rs 479 Cr loss in FY25

▪️Chaayos crosses Rs 300 Cr revenue in FY25; EBITDA jumps 6.5X

[News flash this week]

▪️Fractal IPO subscribed over 2.6X, QIB led with 4.2X bids

▪️PhonePe records 9.9 Bn UPI transactions in January; CRED slips to 8th position

▪️InCred Wealth crosses Rs 1 lakh Cr in AUM within 6 years of launch

▪️Groww adds over 3.5 lakh stock market users in January

▪️Amid fundraise struggles, neobank Fi pivots to B2B offerings

▪️EximPe gets final PA-CB licence to process UPI cross-border payments

[Summary]

On a weekly basis, startup funding increases nearly 10% to $236.18 million as compared to around $215 million raised during the previous week.

PhonePe led the UPI ecosystem in January with 9.91 billion transactions, commanding 45.7% share by volume and 48.6% by value. Overall, UPI processed 21.7 billion transactions worth Rs 28,33,481 crore during the month. Google Pay followed with 7.23 billion transactions and a 33%+ share in both volume and value, while Paytm ranked third with 1.66 billion transactions, accounting for 7.7% of volume and Rs 1,81,973 crore in value.

India’s private wealth management market is set to grow from $1.1 trillion in FY24 to $2.3 trillion by FY29, according to Deloitte, fueling new entrants and funding activity. Amid this expansion, InCred Wealth has scaled to over $10 billion (Rs 1 lakh crore) in AUM within six years.

India’s retail broking industry added over 3 lakh active users in January, taking the total to 4.51 crore from 4.48 crore in December 2025. Groww led the gains, adding more clients than the rest of the industry combined. As per National Stock Exchange of India data, Groww added over 3.5 lakh active demat accounts to reach 1.24 crore clients and a 27.66% market share, while ICICI Securities moved to fourth position ahead of Upstox.

Relocation management firm Formula Group has formed a strategic partnership with Japan-based Relo Group Inc., which has acquired a significant minority stake in the company, according to a statement.

Bengaluru-based deep tech company CynLr has unveiled India’s first commercial-ready Object Intelligence Stack for Robotics, built after five years of R&D, enabling robots to learn and adapt to completely unknown objects in just 10–15 seconds without offline retraining.

Source link

![Funding and acquisitions in Indian startup this week [Feb 09 - Feb 14]](https://newsx.io/wp-content/uploads/2026/02/Funding-and-acquisitions-in-Indian-startup-this-week-Feb-09.png)