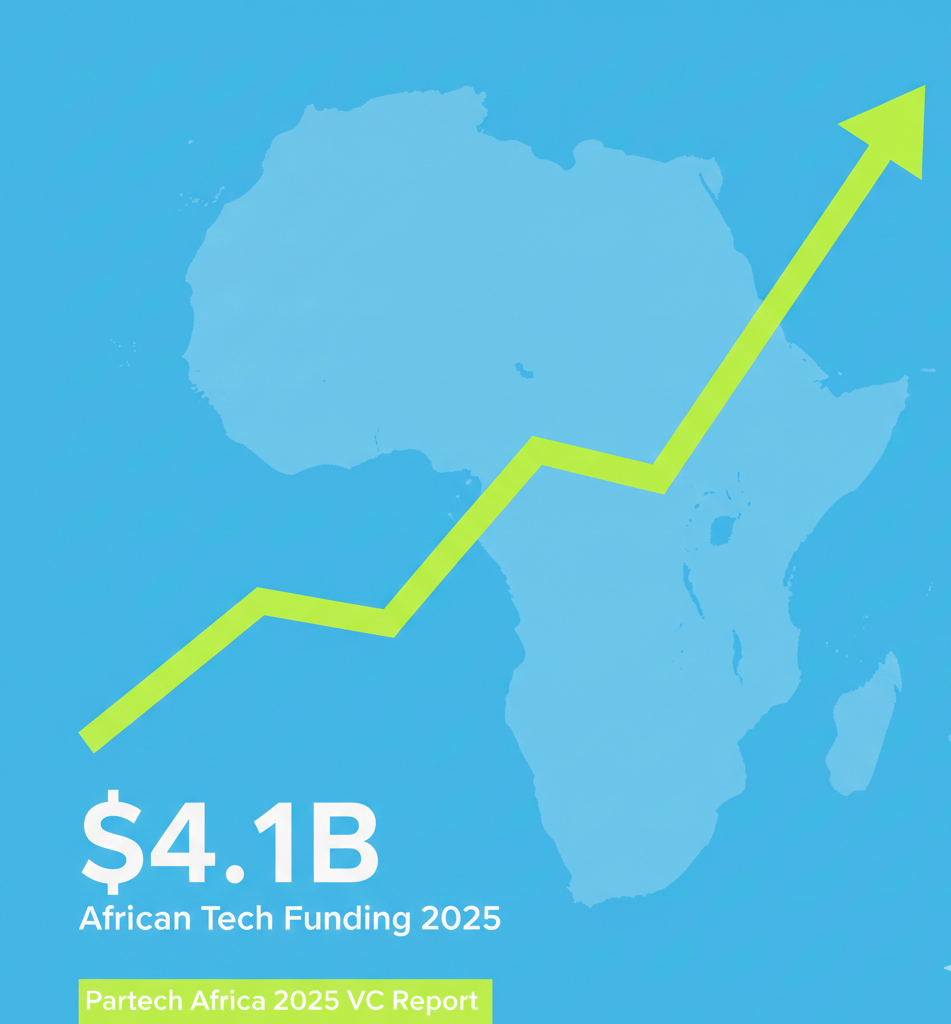

After two bruising years of decline, African tech funding is back. According to Partech Africa’s 2025 Africa Tech VC Report, total investment in the continent’s startup ecosystem reached $4.1 billion in 2025, a 25% jump from the $3.25 billion raised in 2024 and the strongest funding level since 2022. Strip away the headline number, and the real story is more nuanced, more structural, and in many ways more interesting.

This is not a return to the exuberance of 2021. It is something different, and arguably healthier.

The Headline Number Needs Context

The $4.1 billion figure, from Partech Africa’s 10th annual Africa Tech VC Report, combines both equity and debt financing. Equity, the traditional form of venture capital where investors take a stake in a company, grew only modestly: rising 8% year-on-year to $2.4 billion across 462 deals. Deal count was essentially flat at +1% YoY.

So what explains the headline surge? Debt.

African tech startups raised a record $1.64 billion in debt financing in 2025, a 63% increase from the year before and the highest level ever recorded on the continent. Debt alone accounted for 41% of total capital deployed in 2025, up from just 17% in 2019.

“Debt is no longer a cyclical or marginal complement to equity, but a structurally embedded financing layer in the African tech ecosystem.” — Partech Africa, 2025 VC Report

This matters because it changes what the $4.1 billion actually signals. Total funding grew primarily because African startups are maturing, not because investor sentiment swung wildly back to optimism.

Four Markets, One Story

As in previous years, capital remained heavily concentrated. Kenya, South Africa, Egypt and Nigeria captured 72% of total funding in 2025, up from 69% in 2024. Together, they closed 68% of all deals on the continent. Within that top tier, however, the dynamics shifted meaningfully:

– Kenya led the continent with $1.04 billion in total funding (+72% YoY), driven by debt dominance and four of nine African megadeals in 2025. Those four transactions alone accounted for approximately $610 million, or 60% of Kenya’s total. It marks the first time Kenya has led Africa in megadeal concentration.

– South Africa, for the first time since 2017, ranked first in both equity funding ($643M, +41% YoY) and equity deal count (85 rounds, +27% YoY). Only one deal exceeded $100M, confirming that growth was broad-based rather than driven by outliers.

– Egypt sustained a dense pipeline of 100 deals (+4% YoY) with rising ticket sizes, maintaining its position as one of Africa’s most transaction-active markets.

– Nigeria was the only top-four market to record a decline, with equity funding falling 21% YoY and deal count dropping 19%. The market is normalizing after its megadeal-heavy peak in 2021, not collapsing.

Sectors: Fintech Holds On, But Its Grip Is Loosening

Fintech remained the largest sector by both funding and deal count, with $1.49 billion raised across 150 deals. Its share of total equity funding fell sharply though, from 60% in 2024 to 32% in 2025. This is not decline; it is normalization, with other sectors finally attracting meaningful capital alongside it.

Cleantech was the standout performer, nearly doubling in funding to $1.18 billion (+99% YoY). Enterprise software ($274M, +74% YoY), E-commerce ($312M, +74% YoY) and Healthtech ($224M, +232% YoY) each crossed $200 million in annual equity funding for the first time since the 2021-2022 boom. The fact that these sectors are growing in a normalized market, rather than a speculative peak, suggests the business models are maturing and investor conviction is genuine.

What the Data Doesn’t Show

The Seed funding pipeline, the lifeblood of any healthy startup ecosystem, continues to contract. Seed deal count fell 1% YoY to 311 rounds in 2025, down 38% from the 2022 peak. Capital deployed at Seed dropped 4% to $462 million. Today’s Seed startups are tomorrow’s Series A companies. With fewer companies entering the pipeline at the earliest stage, the implications for deal flow at Series A and B in 2027-2028 are real.

Conversion rates reinforce the concern. Of the cohort that raised Seed funding in 2021, only 5.1% successfully raised a Series A within two years. For the 2022 cohort, the figure was 4.2%. Early signs of recovery are visible for 2023 and 2024 cohorts, but the bar remains high.

AI Is Already in the Numbers — Just Not Labeled That Way

One funding trend the $4.1 billion figure obscures is AI. African startups are actively deploying artificial intelligence across credit scoring, fraud detection, health diagnostics, logistics optimization and SME productivity tools. Many of these companies attracted meaningful capital in 2025. The catch is that capital markets classify them as Fintech, Healthtech or Enterprise, not as “AI startups.” As a result, AI-driven funding in Africa does not show up as an AI line in the data, even though the technology is central to the business model. Africa’s AI funding is real. It is simply priced differently.

The Takeaway

African tech funding in 2025 tells a story of measured recovery, not a boom. Equity markets are stabilizing and gradually deepening. Debt has become a structural pillar of the ecosystem. The top four markets continue to dominate, but South Africa’s broad-based return to leadership and the rise of sectors beyond Fintech suggest the ecosystem is widening its foundation.

The funding winter is thawing. What comes next will depend on whether the Seed pipeline, quiet and contracting beneath the headlines, can recover in time to feed the growth stages that follow.

Source link