- ■

Google Cloud VP warns startup founders about infrastructure ‘check engine light’ moments in TechCrunch video interview

- ■

Cloud credits and free GPU access mask true infrastructure costs until startups scale beyond early stages

- ■

Tighter 2026 funding environment forces startups to confront infrastructure debt as burn rates spike

- ■

Early architectural choices around foundation models creating unforeseen cost consequences at scale

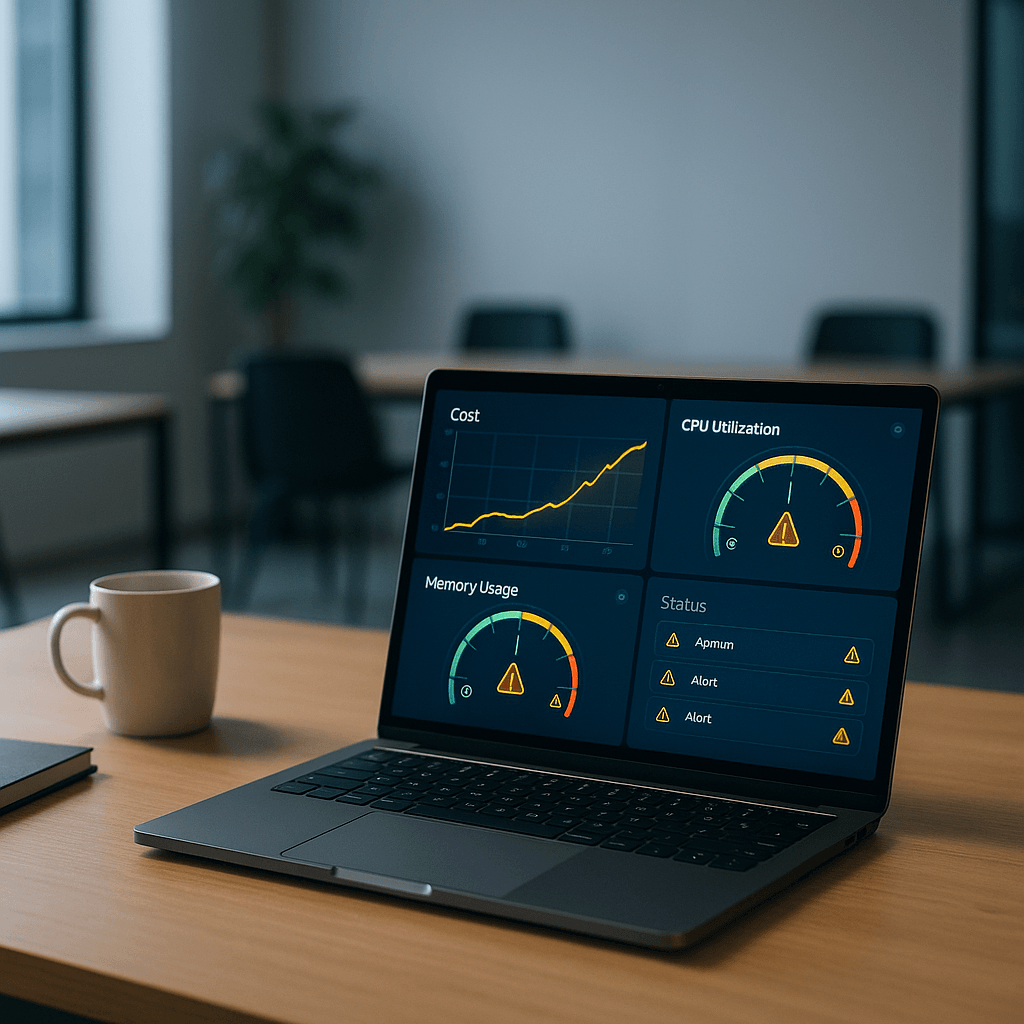

AI startups are hitting a painful inflection point. Google Cloud is sounding the alarm on what it calls the ‘check engine light’ moment – when those generous cloud credits run dry and founders discover their infrastructure bills have ballooned into existential threats. In a new video interview with TechCrunch, a Google Cloud VP breaks down why the easy early decisions around GPUs and foundation models are coming back to haunt companies just as funding gets tighter and investors demand real unit economics.

Google Cloud is trying to save startups from themselves. The company’s VP of startup programs sat down with TechCrunch to deliver what amounts to a tough-love intervention for AI founders racing to ship products without thinking through the math.

The metaphor is spot-on. Just like that dashboard warning light that drivers ignore until the engine seizes, startups are blowing past critical infrastructure red flags in their rush to demonstrate traction. Cloud credits from Google, Amazon Web Services, and Microsoft Azure have made it absurdly easy to spin up AI applications. Need GPUs to train models? Here’s $100,000 in credits. Want access to cutting-edge foundation models? Take your pick from a buffet of options.

But that generosity creates a dangerous blind spot. Founders build on architectures that feel free in the moment but carry hidden costs that only reveal themselves at scale. By the time the credits expire and real invoices start arriving, companies have often locked themselves into infrastructure patterns that weren’t designed for efficiency.

The timing couldn’t be worse. The 2026 funding environment has turned brutal compared to the AI gold rush of 2023-2024. According to recent venture capital data, seed and Series A rounds are taking longer to close, valuations are compressing, and investors are obsessing over burn rates and paths to profitability. That means startups hitting their ‘check engine light’ moment are discovering infrastructure bills ballooning just as they need to demonstrate capital efficiency.