I’ve long-repeated in these pages, that my thirty plus years as a technology analyst, have all been a dress rehearsal for the AI Tech Wave ahead. Especially when it comes to judging IPOs of the AI type vs other past tech types. Up and down the AI Tech Stack of today.

I re-launched my Goldman Sachs career that started in 1982, in my second decade there. Starting at the bottom again as an ‘Internet Research Analyst’ in 1994. Initially, I had a relatively tough job vs my equity research analyst peers covering established industries with defined metrics and business models for their companies. With well-understood short and long-term prospects. Experiencing changes measured in years vs days for my ‘industry’.

My early job then was to explain what this internet thing was in the broad world of technology. And why would people and businesses even need it around the world. How it would fundamentally change their personal and business habits forever with new things like connectivity in networks across ‘platforms, and new ‘must have’ tools soon online email, messages, and communities. Especially for the dozens of leading IPOs coming up and down the Internet stack back then.

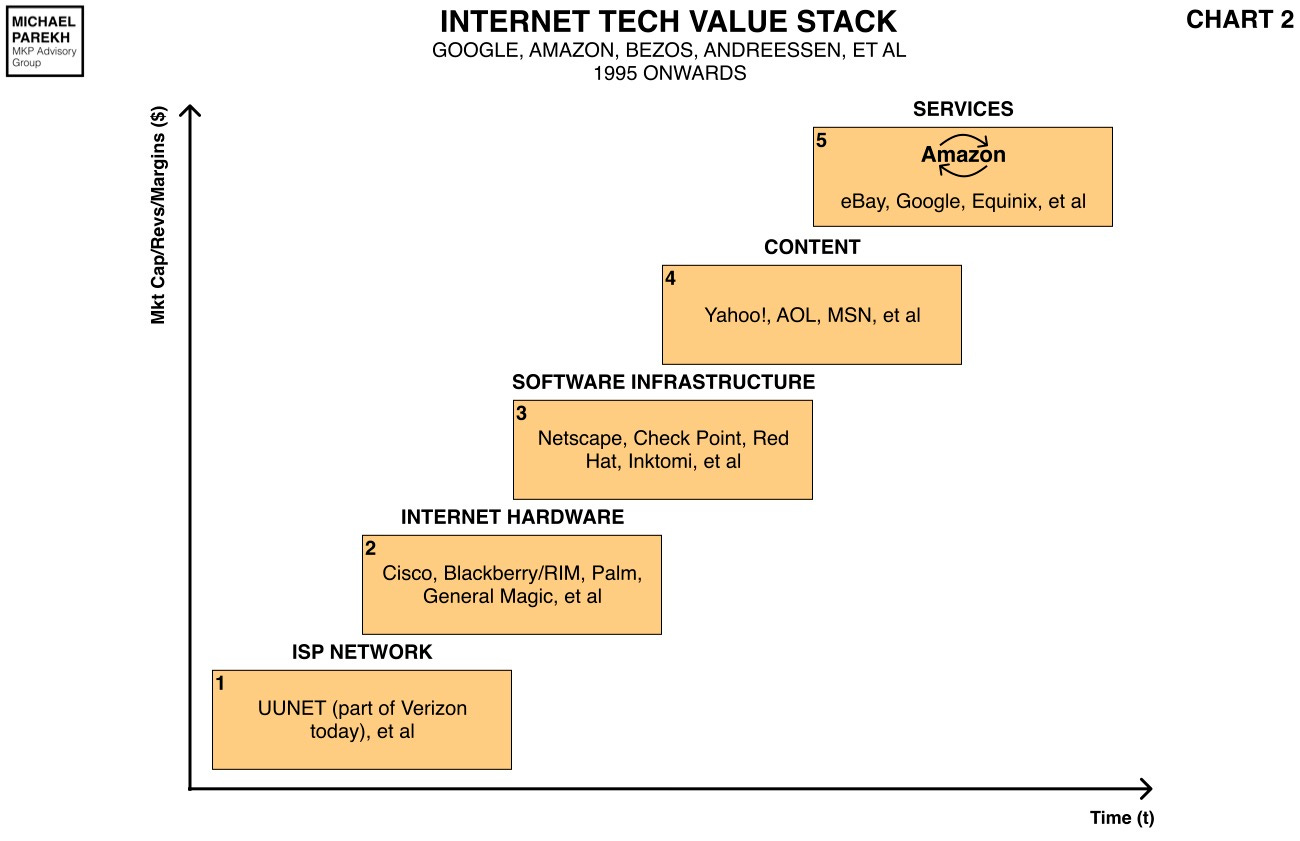

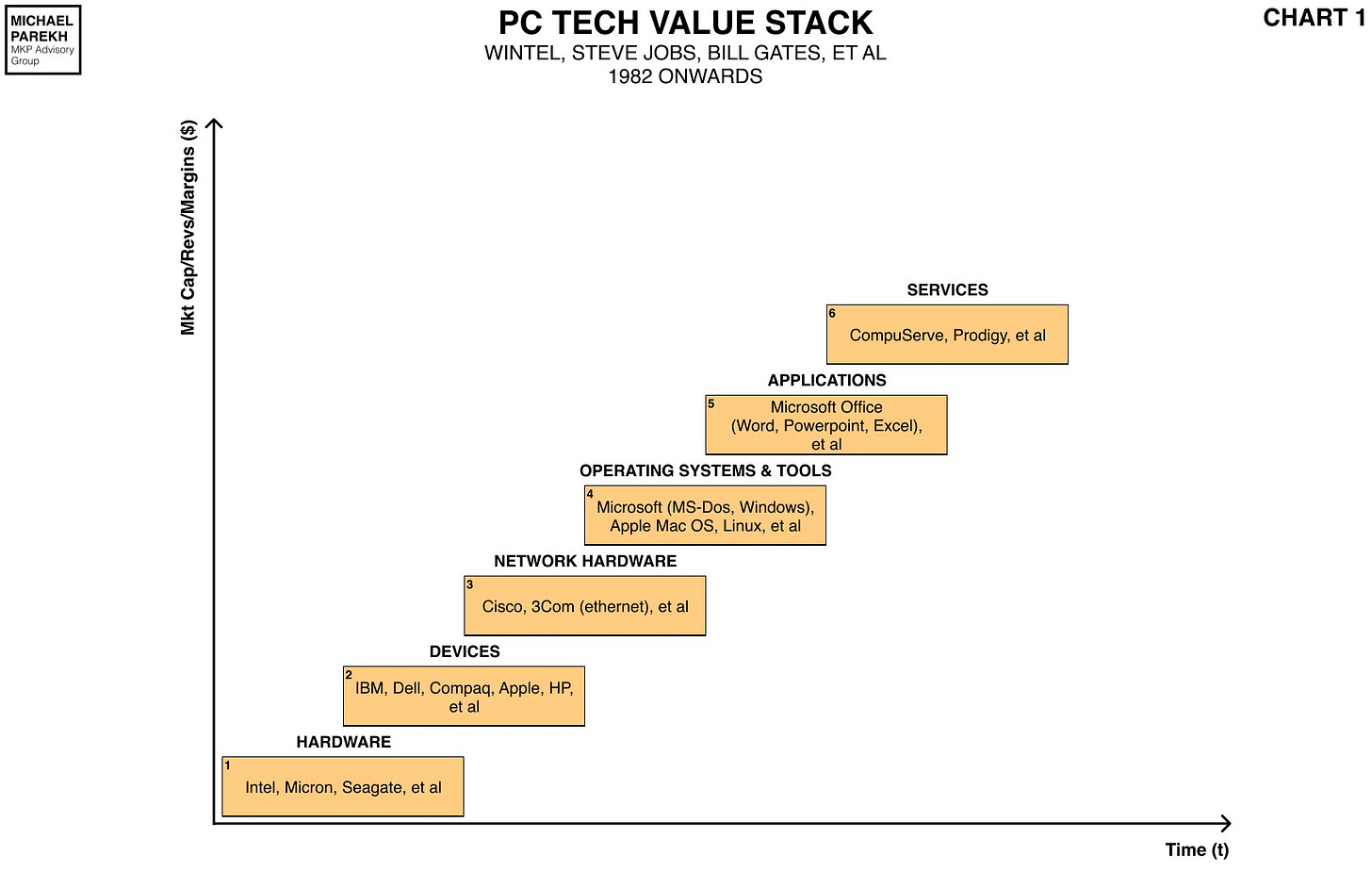

Or going back even to the preceding PC Tech Wave and its winners up and down the stack:

And how then established, incumbent tech businesses like Microsoft with its PC and Windows software/hardware platforms would need to bother to deal with the ‘road ahead’. Against new-fangled entities like ‘AOL’ soon to be countered with their own ‘MSN’.

And why new online startups like America Online (AOL), Netscape and Yahoo! amongst others deserved the attention and investment dollars of the leading global investors of the time. With their barely comprehensible metrics defined by folks like me with terms like ‘sticky eyeballs’, ‘b2b’ and ‘b2c’ markets, and ‘first mover advantages’. Each phrase in quotes in the previous sentence laid out in ‘internet thought pieces’., and countless trips to investment clients around the world, in multi-city marketing slogs to tell and retell the investment narratives of how it was ‘all changing’. Way before today’s world of blogs, and podcasters.

It took at least 2-3 years for the broader institutional investor pool to ‘get it’, even though the investment metrics were barely defined and measurable. This AI Tech Wave everyone’s talking about AI Agents, AI Robots, AI Taxis, as if they were actually here at Scale. And incumbents are no longer skeptics and non-believers. But investing money far ahead of market definition at scales never seen until now.

Switch now to this AI Tech Wave today, and the picture is both markedly similar and yet very different. Global investors private and public have accepted this AI as a ‘new thing’ in the fourth year of OpenAI’s ChatGPT. They’ve all deeply learned the lessons from the past tech waves.

And yet, the world these lessons are being applied to are markedly different in their ‘jagged’ operating environments and geopolitical trade, tariff and supply chain realities.

With alluring new steps towards the AI holy grails of AGI and/or AI Superintelligence however and whenever defined.

The incumbents and investors are all believers now, as earnest as a pilgrim on a once in a lifetime journey.

Bankers, my former firm included, are feverishly readying a slate of ‘meta-IPOs’ for later this year, starting with the three biggest ones of all time. In expected floor valuations, they of course are SpaceX/xAI ($1.25 trillion), OpenAI ($800+ billion), and Anthropic ($380+ billion). None of the founder/CEOs of the three, ironically all three former co-founders, can talk to the other. Sometimes not even clasping hands together as in India this week. The other one litigating against his former co-founder.

All fueled with AI tail-winds, with the first one being boosted by the latest and most ‘fantastic’ AI narrative: ‘AI Data Centers in Space’.

I’ve written at length about all three companies of late. Especially as each finishes their latest massive financing rounds and deals ahead of these impending IPOs. SpaceX merged with xAI to create a $1.25 trillion private entity. Anthropic just closed a $30 billion round at a $380 billion post-money round, and OpenAI is closing a $100 billion ‘who’s who’ round at an $850+ billion round.

I summarize the above because the AI wave this time is different vs the Internet wave for at least five main reasons:

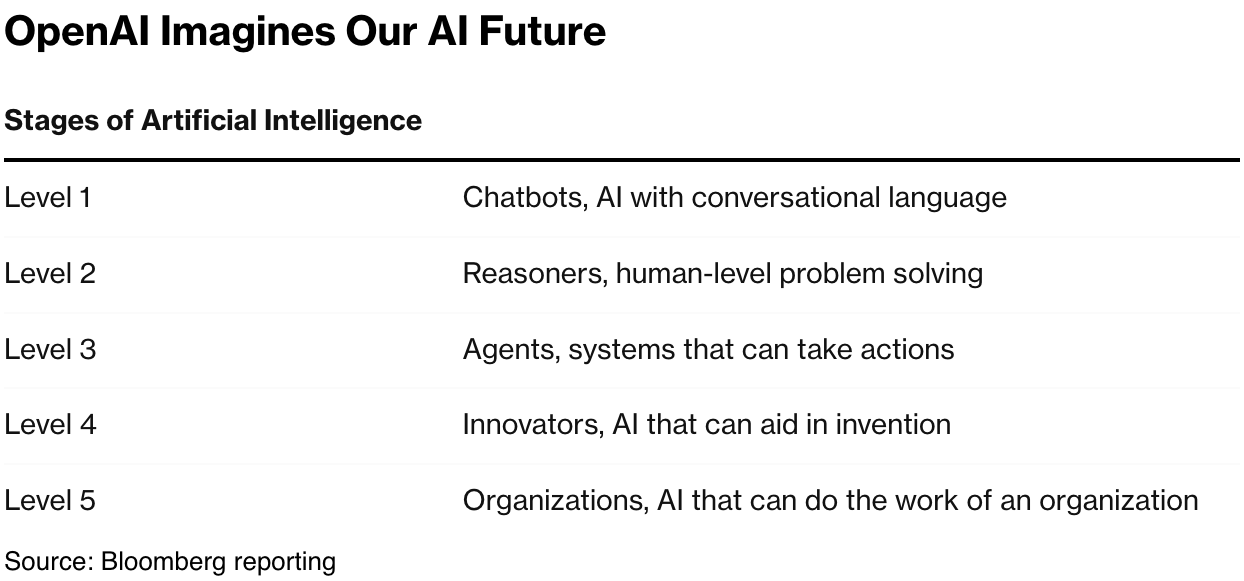

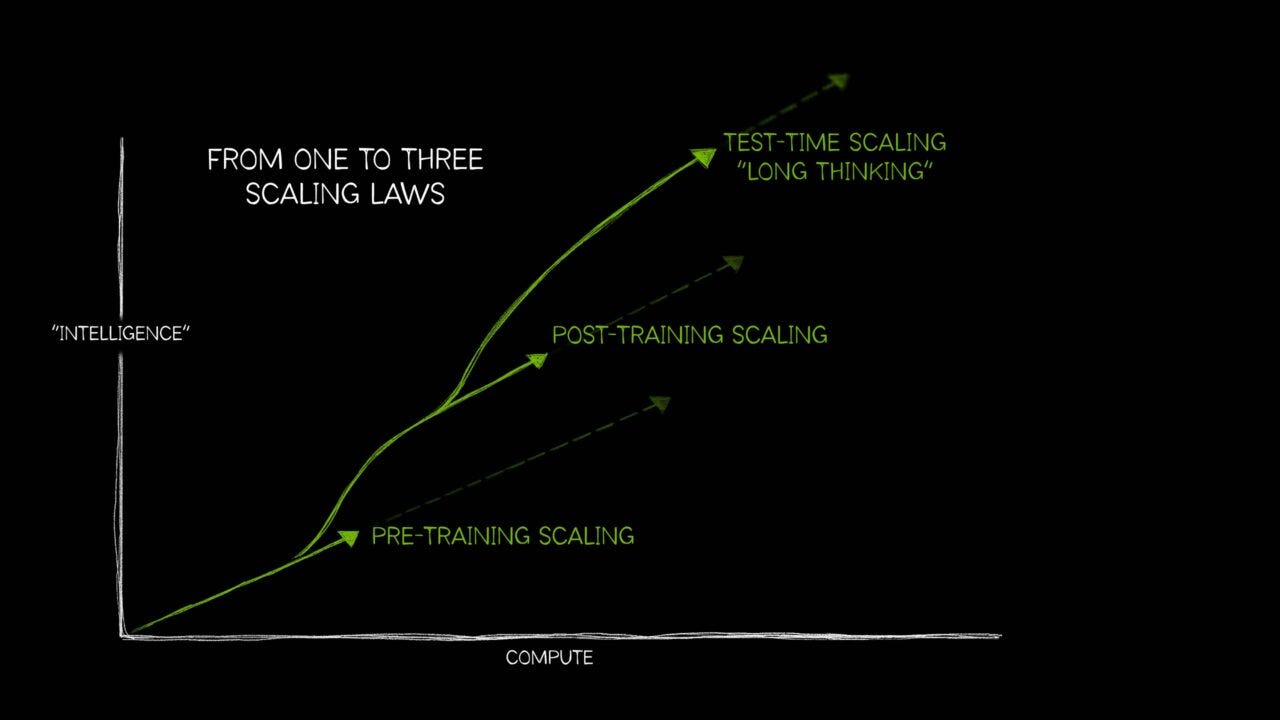

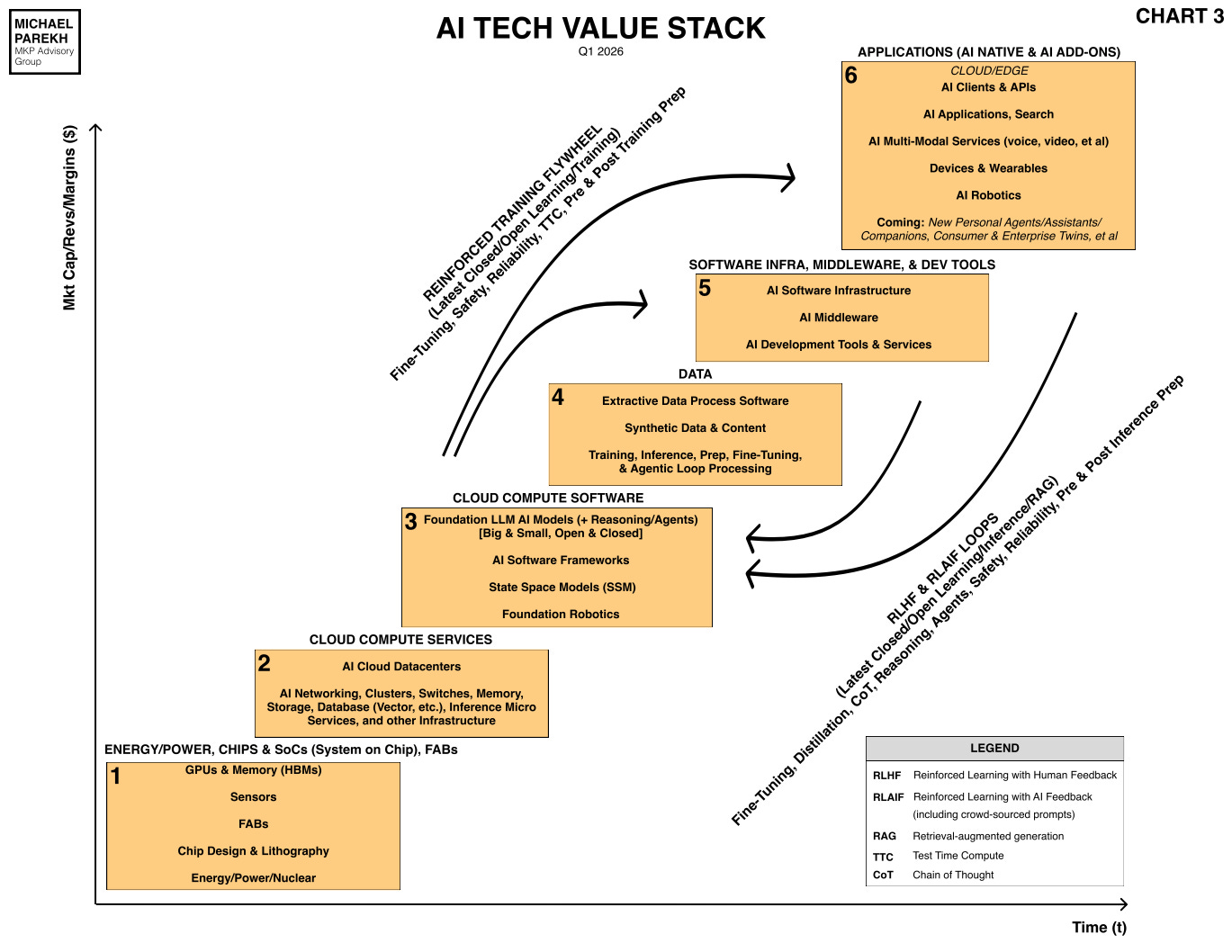

Far more Infrastructure needed at Far Greater, Ongoing Capex: A topic covered at length here. But the headline numbers bear repeating. The top big tech companies this year will invest over $700 billion this year alone. As compared to similar sizes amounts over almost a decade in the internet wave. Far ahead of AI applications to come beyond Chatbots, like AI Reasoning, AI Agents, and AI Devices, amongst others. And the demand picture for it all is far from realization and clear, as the unrelenting efforts to Scale AI continue.

Far more open-ended variable costs with rapidly growing AI Applications: The massive training costs for scaling LLM AIs and their Data, are growing by the billions, while the Inference costs for AI intelligence input and output tokens are growing on a variable cost basis with mainstream users and their usage. This is at a scale far greater than providing online TCP/IP dial-up access for the AOLs and other internet service providers in the nineties. OpenAI alone is Exhibit A here with revenue this year of $20 billion, growing at 50%+ annually, far over-shadowed with AI Capex expenditures of hundreds of billions, growing to a trilion plus through this decade and beyond. As Anthropic founder/CEO Dario Amodei pithily puts it, a miscalculation of supply vs demand of a couple of years, could lead to bankruptcy.

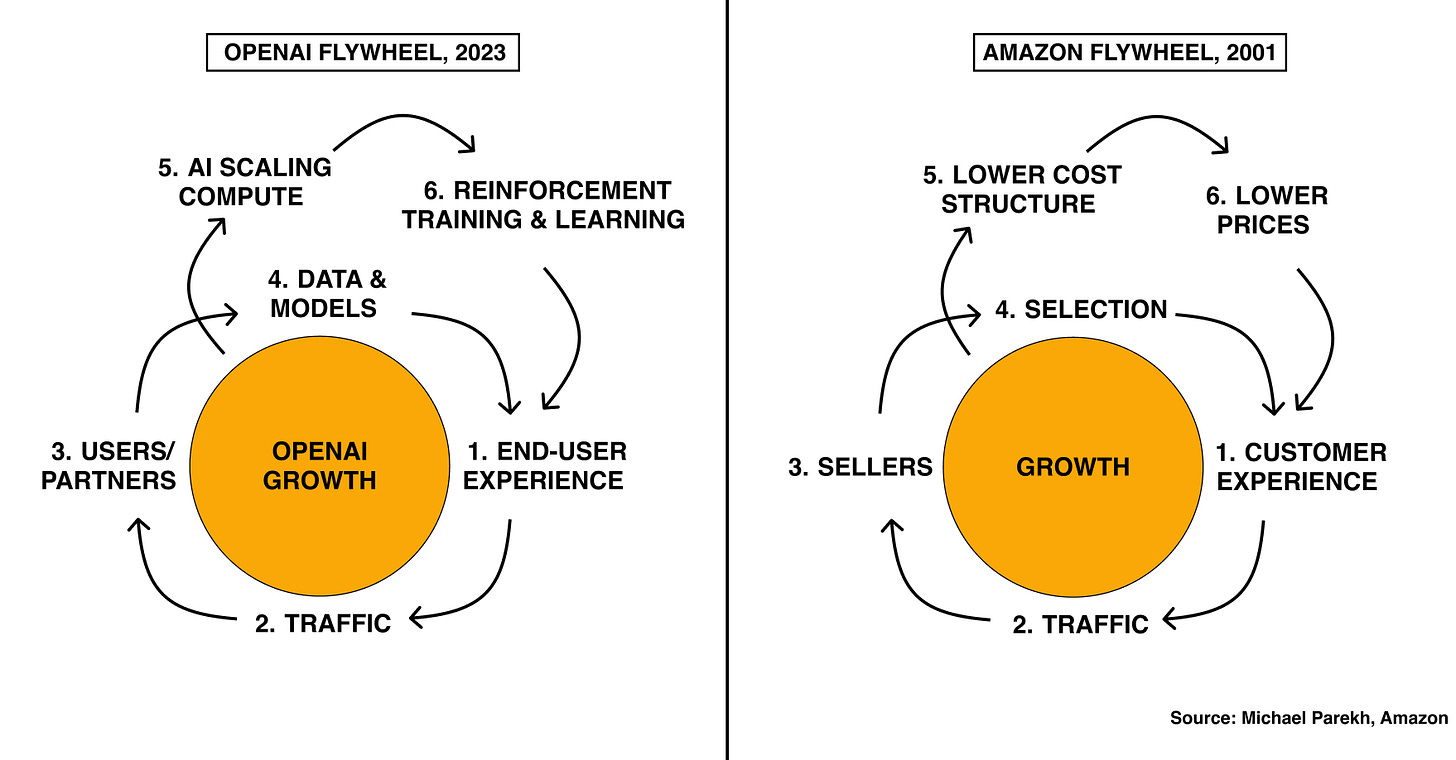

Global and Balkanized Markets in the billions today vs tens of millions in the 1990s: Good news this time, companies and investors have seen these tech wave movie before, and are leaning into to invest ahead of the markets being really established. Bad news is that the markets while global in the billions, are far more balkanized due to geopolitically driven trade and tariff barriers massively reforming supply chains. And regulatory differences across markets that add massive friction points to successfully spinning ‘flywheels’. The ones that could optimize the provision of AI in this tech wave vs earlier ones.

Accelerated Price Efficiencies on core LLM AI applications vs previous cycles: Meanwhile, the good news at this early stage of LLM AI technologies is that the top companies are able to provide massive cost efficiencies in their core products over every few months. Notice Anthropic’s latest 4.6 model providing 50%+ cost efficiencies of their LLM AI model just a few months old. Replicate this globally across the top AI models companies in the US, and especially the open source ones from China, and you have a situation where analysts and investors are rapidly re-checking their financial models for the depreciation schedules of the AI Infrastrucute, and the Revenue, Margins and Profitability forecasts for the burgeoning AI applications and services driving them. All seemingly changing by the month.

Mainstream users far more fearful of AI than any other tech wave that came before: As I’ve discussed at length as well, mainstream users and regulators worldwide are more fearful of AI than other technology waves. Part of it is the scifi driven doomsday existential risks of AI perceived or real. And the more real fears of AI driven job losses, felt both bottoms up and top down by economists and politicians. Both sets of issues are vigorously debated, with no clear binary answers. And the answer as always will be somewhere in the middle, as it oscillates back and forth by the week and month for the rest of the decade before settling into a more stable state of reality.

These are just a few of the top differences this AI Tech Wave vs ones past. With no easy answers one can hang one’s hat on. While making risk/reward determinations as investors private and public under uniquely dynamic environments.

Where there are as many qualitative factors influencing the outcomes as there are quantitative ones. With no letup in sight at least until 2030. Stay tuned.

Additional Links:

The many realities of the OpenAI IPO.

The Jagged AI Realities on mainstream users.

The Cost Efficiencies of Anthropic’s latest models.

OpenAI’s $100 billion raise and the ‘AI Arms Race approaches IPO Reckoning’.

The AI dependency on massive AI Compute Infrastructure.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

Source link