- ■

Life Electric Vehicle Holdings won the auction for Rad Power Bikes’ assets with a $13.2 million bid, edging out e-bike competitor Retrospec’s $13 million offer

- ■

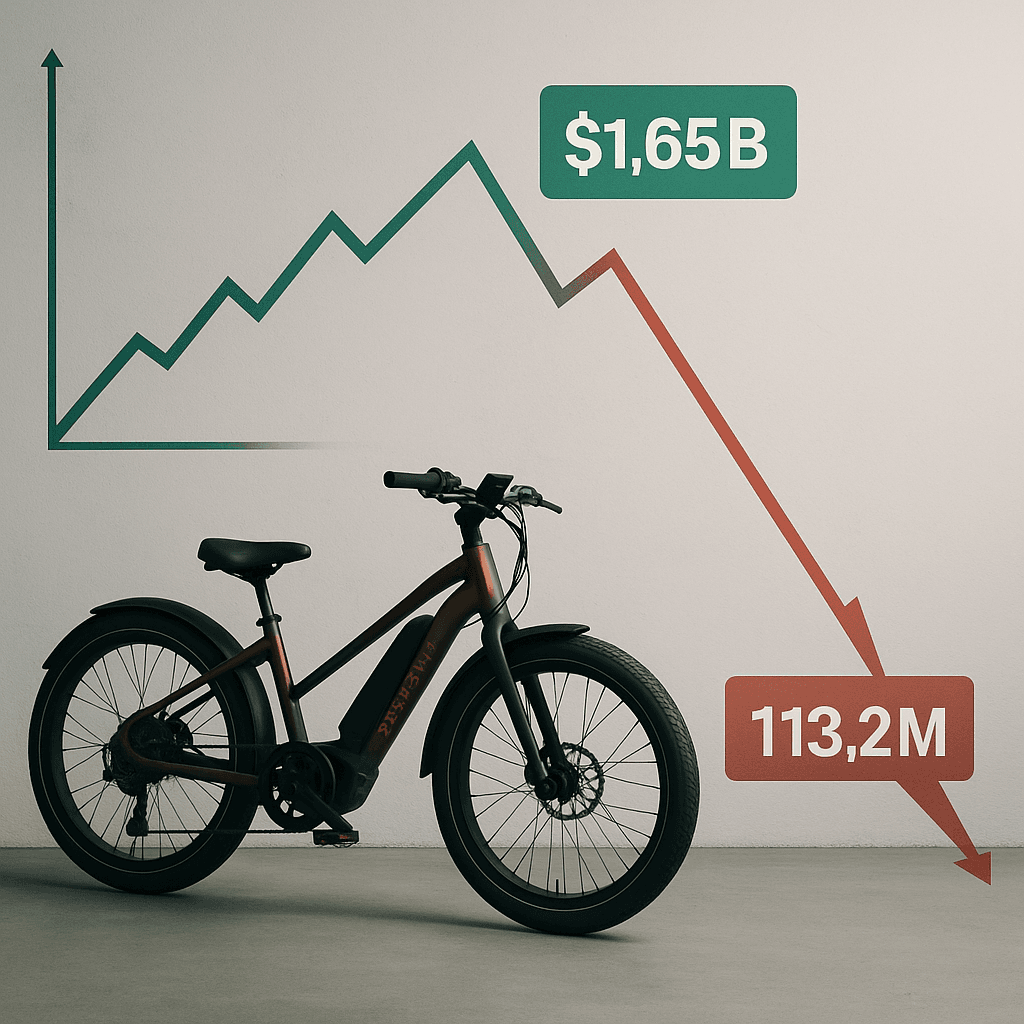

The sale price represents a 99% discount from Rad Power’s October 2021 peak valuation of $1.65 billion, when the company had raised $329.2 million in total funding

- ■

Five companies bid on the assets starting at $8 million during a January 22 auction, with the total deal value reaching $14.9 million when accounting for liabilities

- ■

The acquisition caps a brutal decline for Rad Power, which weathered pandemic boom-and-bust cycles, multiple layoffs, CEO changes, and battery fire recalls involving 31 incidents

The e-bike boom has claimed another casualty. Rad Power Bikes, once valued at $1.65 billion, just agreed to sell itself to Florida-based Life Electric Vehicle Holdings for $13.2 million – a staggering 99% decline that underscores how far the micromobility sector has fallen since its pandemic peak. The deal, struck after a five-bidder auction last week, still needs bankruptcy court approval but marks the end of an era for one of America’s most recognized e-bike brands.

Rad Power Bikes is selling itself for pennies on the dollar. The Seattle-based e-bike company reached an agreement over the weekend to offload its assets to Life Electric Vehicle Holdings for approximately $13.2 million, according to bankruptcy court filings. That’s less than 1% of the company’s peak $1.65 billion valuation from October 2021, when venture capital was still flowing freely into consumer hardware startups.

The deal emerged from a competitive auction held January 22, where five companies battled for control of what remains of Rad Power’s business. Bidding opened at $8 million before Florida-based Life EV emerged victorious. When factoring in Rad Power’s liabilities, the total transaction value climbs to $14.9 million – still a fraction of the $329.2 million the company raised from investors, according to PitchBook data.

Retrospec, another e-bike manufacturer, came in second with a $13 million bid and now stands as the backup buyer if the Life EV deal collapses before the bankruptcy judge signs off. The company’s involvement hints at potential consolidation in the struggling e-bike market, where survivors are picking through the wreckage of pandemic-era overexpansion.

Life EV bills itself as a “developer, manufacturer, and distributor in the light electric vehicle industry” on its website, though most of its e-bike models were listed as sold out at press time. What the company plans to do with Rad Power’s brand, intellectual property, and customer base remains unclear. Life EV CEO Robert Provost deflected questions to Rad Power, telling that “there is still a process underway and there is an exciting future being planned for Rad Power.” The company did not respond to requests for comment.