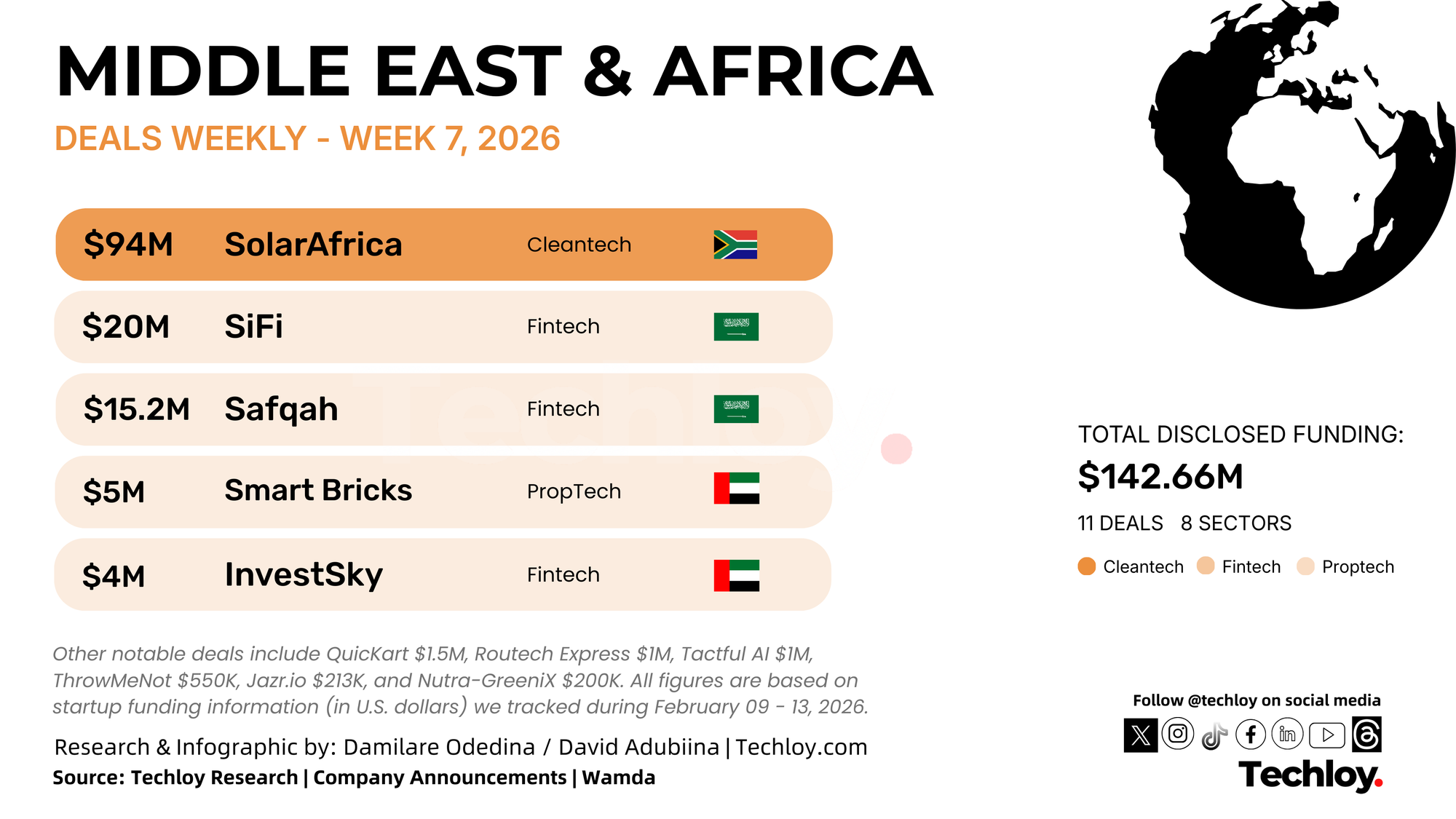

Startups across Africa and the Middle East raised a combined $142.66 million this week, based on disclosed funding rounds tracked by Techloy, with investor money flowing primarily into renewable energy and financial technology. One large infrastructure deal accounted for more than half of the total capital deployed.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding rounds across Africa and the Middle East this week.

/1. SolarAfrica, $94M, Cleantech, South Africa

SolarAfrica builds utility-scale solar plants that sell power to businesses through wheeling deals using the national grid. RMB and Investec Bank provided R1.5 billion in debt to build SunCentral 2, a 114 MW solar project in the Northern Cape. The funding will deliver first power in 2026 as part of a 1 GW solar program addressing South Africa’s electricity crisis.

/2. SiFi, $20M, Fintech, Saudi Arabia

SiFi gives businesses AI tools to manage spending through virtual corporate cards, automated expense reports, and vendor payments. Ra’ed Ventures led the Series A, joined by QED Investors, Breyer Capital, MEVP, and Sanabil Investments. The funding will open offices in UAE, Qatar, and Kuwait beyond the 3,500 organizations already using the platform in Saudi Arabia.

/3. Safqah Capital, $15.2M, Fintech/PropTech, Saudi Arabia

Safqah Capital runs a debt crowdfunding platform where individual investors fund SME real estate developers in Saudi Arabia through Shariah-compliant structures. Shorooq led the seed round with anb Seed Fund, Rua Growth Fund, Sharaka Capital, COTU Ventures, and others joining. The funding will increase the lending pool to finance more projects and build AI credit scoring to assess developer risk after the platform financed 70+ projects worth $800 million in 18 months.

/4. Smart Bricks, $5M, PropTech, UAE

Smart Bricks is building an “agentic AI” infrastructure layer that autonomously analyzes global real estate markets to identify high-yield investment opportunities. Andreessen Horowitz (a16z) led the pre-seed round through its Speedrun program. The funding will be used to scale their AI reasoning engine, which automates underwriting and due diligence, and to expand coverage to markets in London, New York, and Miami.

/5. InvestSky, $4M, Fintech, UAE

InvestSky operates a platform giving UAE residents access to global stocks, ETFs, and financial instruments. The funding will open operations in Saudi Arabia, apply for regulatory licenses in Kuwait and Bahrain, and build Arabic-language investor education content.

/6. QuicKart, $1.5M, E-commerce, UAE

QuicKart delivers groceries and essentials across UAE cities within hours. The funding will open three new fulfillment centers in Dubai, add 50 delivery vehicles, and build route optimization software to cut delivery times from 2 hours to under 60 minutes.

/7. Routech Express, $1M, Logistics, Saudi Arabia

Routech Express handles logistics and last-mile delivery optimized for Saudi markets. The funding will add 100 delivery vehicles to the fleet, open warehouses in Jeddah and Dammam beyond the existing Riyadh hub, and hire 50 drivers.

/8. Tactful AI, $1M, AI/CX, Egypt/Cambridge

Tactful AI, developed between Cairo and Cambridge, built an Agentic AI platform to autonomously resolve customer requests. The funding will scale R&D for end-to-end automation and fuel expansion across Egypt, Saudi Arabia, and the UAE following its recent management buyout.

/9. ThrowMeNot, $550K, Sustainability, UAE

ThrowMeNot connects surplus food from restaurants and businesses with consumers at discounted prices. The funding will open operations in Abu Dhabi and Sharjah beyond Dubai, add 200 restaurant partners, and build real-time inventory tracking so restaurants can list surplus food minutes before closing.

/10. Jazr.io, $213K, Fintech/AI, Saudi Arabia

Jazr.io automates accounting and inventory management for restaurants and cafés using AI. The funding will build Zakat calculation tools that comply with Saudi religious tax requirements and add invoice processing for suppliers.

/11. Nutra-GreeniX, $200K, Agritech, Syria

Nutra-GreeniX develops sustainable nutritional solutions and feed technologies for livestock to improve animal health and feed efficiency. EBLA Ventures led the seed round with participation from Syrian and Saudi angel investors. The funding will be used to increase production capacity, expand operations across Syria, and provide technical support to livestock breeders.

Conclusion

With $142.66 million raised this week, most investor money in Africa and the Middle East went to renewable energy and fintech. SolarAfrica’s $94 million debt facility alone accounted for 66% of total capital. Early-stage rounds stayed small compared to growth deals.

Week 6’s Biggest Startup Funding Rounds in Africa & the Middle East, Led by Kitopi, as FoodTech Draws the Biggest Check

Cloud kitchens and SME financing captured nearly 80% of the week’s funding.