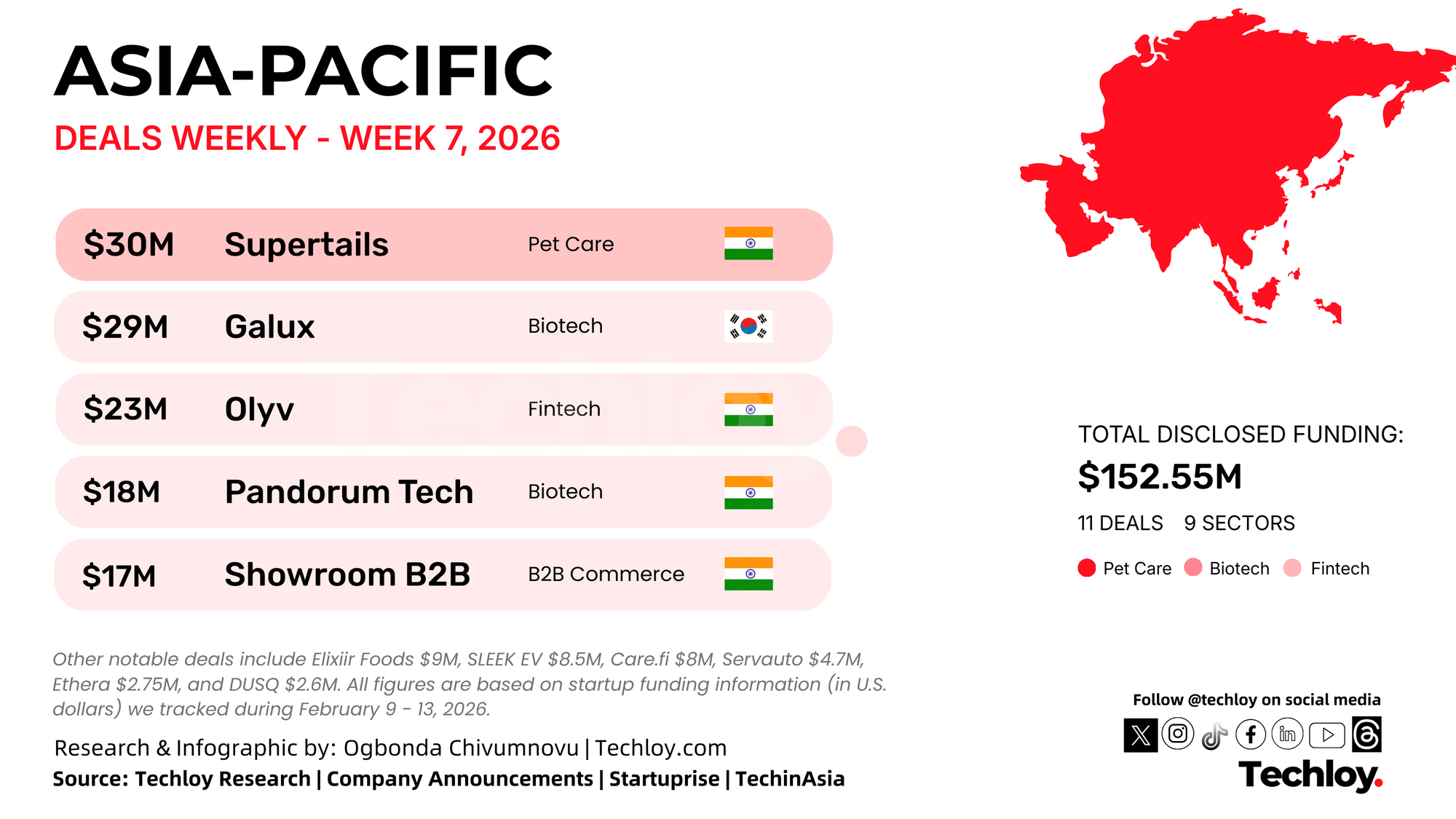

Startups across Asia raised over $152.55 million this week, based on disclosed rounds tracked by Techloy. Funding activity was led by larger Series B and C rounds in pet care, biotech, and fintech, while seed-stage deeptech and consumer brands also attracted fresh capital. India accounted for the majority of deals, alongside notable rounds in South Korea, Malaysia, and Thailand.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding and investment rounds across Asia this week, ranked from highest to lowest.

/1. Supertails, $30 Million, Pet Care, India

Bengaluru-based Supertails, a pet care platform combining veterinary services with rapid product delivery, raised $30 million in a Series C round led by Singapore’s Venturi Partners. The funding will help expand its integrated ecosystem as it works to organize India’s fragmented pet care market.

/2. Galux, $29 Million, Biotech, South Korea

Galux, a biotech startup using AI to design protein-based medicines, secured $29 million in Series B funding. The round included InterVest, Korea Development Bank, Mirae Asset Securities, and other institutional investors. The latest raise brings its total funding to $47 million as it advances AI-driven drug discovery.

/3. Olyv, $23 Million, Fintech, India

Fintech platform Olyv raised $23 million in a Series B round led by The Fundamentum Partnership, founded by Nandan Nilekani. The capital will support its expansion beyond digital lending into insurance products, UPI-based services, and business loans, alongside deeper investments in technology and brand development.

/4. Pandorum Technologies, $18 Million, Biotech, India

Pandorum Technologies raised $18 million in Series B funding led by Protons Corporate. The company plans to scale its clinical programmes, strengthen regulatory operations, expand manufacturing, and enter new markets, including the U.S., Japan, and the Middle East.

/5. Showroom B2B, $17 Million, B2B Commerce, India

Showroom B2B, an apparel sourcing platform for businesses, secured $17 million in a Series A round led by Cactus Partners. The mix of equity and debt will be used to strengthen its tech-enabled supply chain and expand its manufacturing and sourcing network across India.

/6. Elixiir Foods, $9 Million, FoodTech, India

Delhi NCR-based Elixiir Foods raised $9 million in seed funding from 3one4 Capital and Incubate Fund Asia. Founded by FMCG veterans Arvind Mediratta and Ambuj Narayan, the company is building a tech-driven grocery platform for urban India, offering fresh produce, dairy, meat, seafood, and daily essentials positioned as “affordable premium.” The funds will support operational launch, strengthen tech-enabled sourcing and private label supply chains, grow its wholesale and distribution network, and power expansion into new cities.

/7. SLEEK EV, $8.5 Million, Electric Mobility, Thai-Singaporean

SLEEK EV raised $8.5 million in the first close of its Series A round, led by KYMCO Capital. The funding will help expand operations across Thailand and support the country’s ambition to become a regional hub for electric motorcycles.

/8. Care.fi, $8 Million, Fintech, India

Care.fi raised $8 million in a Series A round, combining $5 million in equity led by July Ventures and $3 million in debt from Trifecta and Vivriti. The capital will fuel expansion into new Indian cities and strengthen its AI-powered healthcare financing platform, alongside international growth plans.

/9. Servauto, $4.7 Million, Automotive Services, Malaysia

Servauto, an automotive after-sales platform, secured $4.7 million in funding led by Vynn Capital. The company will use the capital to expand its parts and maintenance solutions business across Malaysia.

/10. Ethera, $2.75 Million, Jewellery, India

Lab-grown diamond jewellery brand Ethera secured approximately $2.75 million in funding from Bluestone, which increased its stake in the company. The capital will support offline retail expansion, in-house design, technology upgrades, and brand building.

/11. DUSQ, $2.6 Million, Sleep Tech, India

DUSQ, formerly known as InnerGize, raised $2.6 million in seed funding led by Fireside Ventures. The company plans to expand its sleep technology platform, invest in neuroscience and hardware talent, strengthen its sleep labs, and prepare for a U.S. market launch.

Conclusion

While late-stage rounds in the region continue to dominate total funding value, early-stage bets in deeptech, sleep science, and next-generation consumer brands signal that investors are still willing to take calculated risks on emerging categories. If this momentum holds, the coming months could see stronger cross-border expansion plays and more AI embedded quietly into traditional sectors across Asia.

Asia’s Biggest Startup Funding Rounds in Week 6, Led by LimX Dynamics, With Big Bets on Robotics and DeepTech

Investors poured fresh capital into embodied AI and cryogenic technology, while climate tech and alternative proteins also attracted major late-stage and growth rounds across the region.