Japan’s DIC Corporation partners with Emerald Technology Ventures to build a cross-border startup portfolio in sensing, robotics and automation — signalling a deeper industrial push into AI-driven hardware.

Japanese chemicals group DIC Corporation has partnered with Emerald Technology Ventures to launch a $62 million investment platform focused on what the companies describe as “Physical AI.” The initiative aims to back startups developing technologies that integrate artificial intelligence into real-world systems such as robotics, sensors and automation.

Under the agreement, Emerald will act as DIC’s strategic venture partner, managing startup sourcing, due diligence, investment execution and post-investment support across Europe and North America. The platform represents a structured move by DIC to expand its exposure to emerging industrial technologies beyond its core materials business.

What Is “Physical AI”?

While much of today’s AI conversation focuses on software models operating in digital environments — such as generative AI tools and data analytics platforms — Physical AI refers to intelligent systems that interact directly with the real world.

Physical AI combines artificial intelligence with hardware components that can sense, process, and respond to physical conditions. Instead of generating text or analysing digital data alone, these systems translate AI decision-making into real-world actions.

In practical terms, this includes technologies such as:

- Smart sensing and embedded intelligence, where sensors collect real-time environmental or operational data and AI algorithms process it for predictive or automated responses.

- Wearable technologies, which integrate AI-driven feedback into devices that monitor movement, health, or performance.

- Robotics and soft robotics, where machines are equipped with adaptive learning capabilities to operate safely and efficiently alongside humans.

- Industrial automation platforms, which combine AI, robotics, and connected systems to optimise production lines, logistics operations, or energy management.

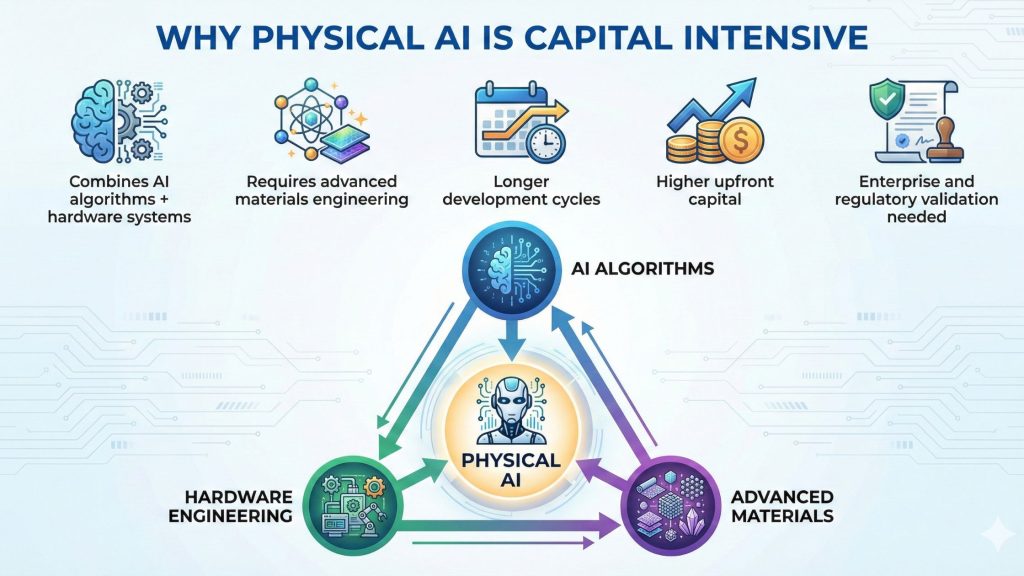

What differentiates Physical AI from software-first AI is the complexity of integration. These systems sit at the intersection of three critical layers:

- AI algorithms and data models

- Hardware engineering and system design

- Advanced materials and sensor technologies

Because they operate in real-world environments, Physical AI applications must meet higher standards of durability, safety, and regulatory compliance. Development cycles are typically longer, capital requirements are higher, and commercial deployment often depends on pilot testing and enterprise adoption rather than rapid consumer uptake.

For investors and corporates, this means Physical AI represents a more industrial, execution-heavy segment of the AI landscape — one where technological breakthroughs must be matched with manufacturing capability, supply chain integration, and long-term strategic partnerships.

In short, Physical AI extends artificial intelligence beyond screens and cloud systems into machines, devices, and infrastructure — embedding intelligence into the physical fabric of industries.

Why DIC Is Expanding Its Venture Strategy

DIC operates in more than 60 countries and reports annual consolidated sales exceeding ¥1 trillion. Traditionally known for pigments, resins and advanced materials used in packaging, electronics and automotive applications, the company is now seeking new growth vectors aligned with industrial transformation.

The investment platform ties into DIC’s “Direct to Society (D2S)” framework, which guides its approach to identifying long-term societal challenges and translating innovation into commercial businesses. Physical AI is positioned as a core pillar of that strategy, particularly where sensors, flexible components and intelligent materials converge.

Takashi Ikeda, Representative Director, President and Group CEO of DIC, said:

“The physical AI domain has the potential to reshape the relationship between people and technology, making it more natural and intuitive. Our partnership with Emerald represents a major step toward gaining world-class expertise and networks in this field.”

Zurich as a Strategic Base

To strengthen its global venture operations, DIC plans to establish a startup investment management subsidiary in Zurich in spring 2026. Switzerland has emerged as a European deep-tech hub, supported by strong research institutions and industrial ecosystems in AI, robotics and advanced materials.

Emerald, headquartered in Zurich with offices across Europe, North America and Asia, will support DIC’s local presence and facilitate cross-border investment activity. The move reflects a broader corporate trend of situating venture arms closer to innovation clusters rather than operating solely from domestic headquarters.

A Broader Corporate VC Shift

The partnership highlights a wider shift among industrial corporates toward structured venture investing. Rather than relying solely on in-house R&D or acquisitions, established manufacturers are increasingly collaborating with venture capital firms to gain early visibility into emerging technologies.

For Emerald, founded in 2000 and focused on industrial technology and cleantech investing, the partnership adds another corporate mandate in hardware-led innovation themes.

Gina Domanig, Managing Partner and CEO of Emerald, said:

“With physical AI, the real opportunity lies in technologies that work alongside people, enhancing human capability rather than replacing it.”

Her remarks underline the emphasis on human-centric AI systems — a positioning that contrasts with narratives focused solely on automation-driven displacement.

Over the next five years, the platform is expected to build a diversified portfolio of more than a dozen companies operating at the intersection of AI, hardware and materials science. Emerald will manage deal flow and post-investment engagement, while DIC will contribute industrial expertise and strategic collaboration opportunities.

However, Physical AI investments come with inherent complexity. Hardware development cycles are longer, capital requirements are higher, and commercial adoption often depends on regulatory clearances and enterprise validation. The partnership’s success will depend not only on deal sourcing but also on the ability to convert pilot deployments into scalable industrial contracts.

Industrial AI Moves from Concept to Capital Allocation

At $62 million, the platform is small compared to multi-billion-dollar AI funds raised by global asset managers. Its importance, however, lies less in scale and more in positioning. The partnership is a shift in how industrial companies are approaching artificial intelligence — not as a standalone software opportunity, but as an embedded capability within physical systems.

Over the past two years, much of the AI narrative has centred on generative models and cloud-based applications. Yet for industrial groups, the commercial opportunity increasingly lies in applying AI to machines, materials and manufacturing environments. Intelligent robotics, sensor-driven systems and adaptive automation platforms are expected to reshape production lines, supply chains and mobility infrastructure over the next decade.

For companies like DIC, whose historical strength lies in materials science and industrial manufacturing, venture investing offers a structured way to access early-stage innovation without relying solely on internal R&D. By partnering with an experienced venture firm such as Emerald, DIC gains exposure to emerging technologies in Europe and North America while maintaining strategic flexibility. This reduces the risk of being technologically outpaced as AI capabilities become embedded in hardware and materials.

The move is also a broader corporate trend. Large industrial players are increasingly using venture platforms to secure early insight into frontier technologies — particularly in robotics, automation and advanced sensing — where integration with materials and manufacturing processes can create defensible competitive advantages. Rather than waiting for technologies to mature, corporates are seeking upstream access through minority stakes and structured collaboration.

That said, hardware-centric AI investments are inherently complex. Development cycles are longer than software startups, capital intensity is higher, and scaling often depends on industrial partnerships rather than rapid consumer adoption. Cross-border portfolio management adds another layer of execution risk. Returns will depend on whether startups can convert pilot projects into repeatable industrial contracts.

In that context, the DIC–Emerald platform can be viewed as an early positioning strategy in a segment that may define the next phase of AI deployment. If generative AI captured the digital imagination, Physical AI represents the operational layer — embedding intelligence into equipment, materials and infrastructure.

Quick Takeaways

- $62M Physical AI Platform: DIC Corporation has set up a $62 million investment vehicle focused on sensing, wearables, robotics and automation.

- Strategic VC Partner: Emerald Technology Ventures will lead sourcing, due diligence, investment execution and post-investment support across Europe and North America.

- Industrial AI Focus: The platform targets “Physical AI” — technologies that embed AI into real-world hardware systems rather than purely software applications.

- Zurich Expansion: DIC plans to establish a venture subsidiary in Zurich in 2026 to strengthen its presence in Europe’s deep-tech ecosystem.

- Materials Meets AI: The initiative aligns with DIC’s materials science capabilities and its “Direct to Society” framework for long-term business creation.

- Execution Is Key: Hardware-heavy AI startups require longer cycles and deeper capital; portfolio performance over the next five years will determine impact.