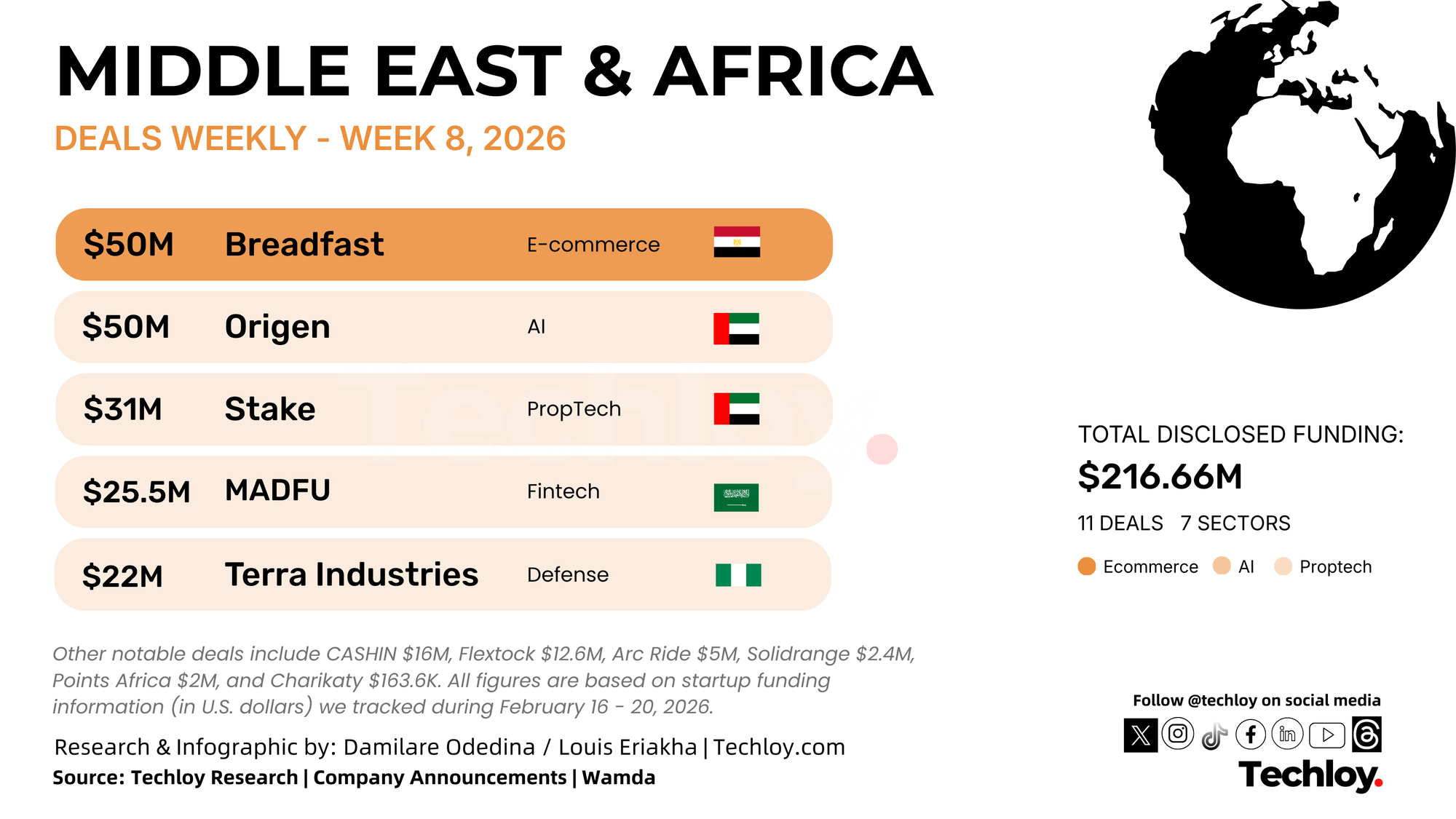

Startups across Africa and the Middle East raised a combined $216.66 million this week, based on disclosed funding rounds tracked by Techloy, with investor capital flowing primarily into e-commerce infrastructure, artificial intelligence, and financial technology platforms. A handful of larger growth-stage deals accounted for most of the week’s funding activity.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding rounds across Africa and the Middle East

/1. Breadfast, $50M, E-commerce, Egypt

Breadfast operates a vertically integrated supply chain platform delivering groceries and essentials across five Egyptian cities in under 60 minutes. Mubadala Investment Company, IFC, EBRD, SBI Investment, Novastar Ventures, AAIC, Olayan Financing Company, Y Combinator, and 4DX Ventures backed the pre-Series C.

The funding will expand warehouses and fulfillment centers across Egypt, develop private-label products that already account for 40% of grocery sales, and prepare for entry into North and West African markets ahead of a larger Series C expected in H1 2026.

/2. Origen, $50M, AI, UAE

Origen builds artificial intelligence systems tailored for practical, real-world use in commercial and public environments. BlueFive Capital backed the strategic investment. The funding will fast-track product development, grow their technical teams, and scale AI deployments across government services, advanced manufacturing, and consumer smart home ecosystems.

/3. Stake, $31M, PropTech, UAE

Stake runs a regulated digital real estate investment platform where users buy fractional property ownership starting from AED 500 ($136). Emirates NBD led the Series B, joined by Mubadala’s MENA Venture Capital Fund, MEVP, Property Finder, STV NICE, Wa’ed Ventures, GFH Partners, and Ellington Properties.

The funding will expand regulated operations in Saudi Arabia where Stake closed three real estate funds attracting 7,000 international investors and channeling SAR 416 million ($111 million) into the sector, advance tokenization work with Property Finder, and grow new products like StakeOne.

/4. MADFU, $25.5M, Fintech, Saudi Arabia

MADFU provides buy-now-pay-later services for Saudi consumers across retail and e-commerce transactions. Afaq Capital led the pre-Series A round, with participation from a group of angel investors. The funding will expand merchant partnerships, build AI-powered credit assessment tools, and scale operations across Saudi Arabia.

/5. Terra Industries, $22M, DefenseTech, Nigeria

Terra Industries designs and manufactures autonomous defense systems including surveillance drones, sentry towers, and unmanned ground vehicles protecting critical infrastructure. Lux Capital led the funding extension, joined by 8VC, Nova Global, Silent Ventures, Belief Capital, Tofino Capital, and Resilience17 Capital.

The funding will expand the 15,000-square-foot manufacturing facility in Abuja, add new production lines for air and land-based systems, and accelerate deployments across Nigerian government and commercial contracts protecting assets valued at $11 billion.

/6. CASHIN, $16M, Fintech, Saudi Arabia

CASHIN operates a digital payments platform providing cash management and transaction services for businesses and consumers. Impact46 led the Series A. The funding will expand product offerings, build technology infrastructure, and scale operations across Saudi markets.

/7. Flextock, $12.6M, E-commerce/Logistics, Egypt

Flextock provides supply chain and logistics infrastructure for e-commerce companies handling inventory management, warehousing, and fulfillment operations. TLcom Capital led the Series A round. The funding will build new fulfillment centers, expand warehouse capacity, and develop technology for faster order processing across Egypt.

/8. Arc Ride, $5M, E-mobility, Kenya

Arc Ride operates an electric motorcycle taxi network across Kenyan cities providing affordable transport for commuters. IFC provided the investment. The funding will expand the electric vehicle fleet, build charging infrastructure, and scale operations into new Kenyan cities beyond Nairobi.

/9. Solidrange, $2.4M, AI/Cybersecurity, Saudi Arabia

Solidrange provides AI-powered governance, risk, and compliance software for enterprises automating regulatory reporting and compliance workflows. Sharaka Capital led the seed round, joined by Sadu Capital, SEEDRA Ventures, and Tali Ventures. The funding will accelerate regional expansion beyond the 50 current enterprise customers, advance product development, and deepen AI integration across the platform serving government entities and publicly listed companies in Saudi Arabia.

/10. Points Africa, $2M, Fintech, Ghana

Points Africa is building a shared loyalty network where consumers earn and redeem a single reward currency across multiple merchants including telecoms, supermarkets, banks, and fuel retailers. VestedWorld led the round. The funding will complete the Ghana rollout, strengthen infrastructure, and expand into Nigeria, Uganda, Rwanda, and Kenya over the next 18 months.

/11. Charikaty, $163.6K, RegTech, Morocco

Charikaty operates a legal technology platform providing fully digital company formation services in Morocco handling legal structuring, documentation, and government registration.

Ilan Benhaim and Karim Amor invested MAD 1.5 million ($163.6k) through Morocco’s television show “Qui Veut Investir Dans Mon Projet?” The funding will enhance technology, expand operations serving the 90,000+ companies registered annually in Morocco, and scale services for SMEs and Moroccans living abroad.

Conclusion

With $216.66 million raised this week, most investor money in Africa and the Middle East went to e-commerce infrastructure, AI, and fintech platforms. Breadfast and Origen’s combined $100 million accounted for 46% of total capital, while payment and PropTech companies pulled another $72.5 million. Early-stage rounds stayed smaller compared to growth deals.

Week 7’s Biggest Startup Funding Rounds in Africa & the Middle East, Led by SolarAfrica, as Energy and Fintech Drew the Biggest Checks

One South African solar project grabbed more than half the week’s funding. The rest went mostly to payment platforms and property tech.