Also in the letter:

■ India joins Pax Silica

■ Agents in fintech

■ Ola Electric’s woes compound

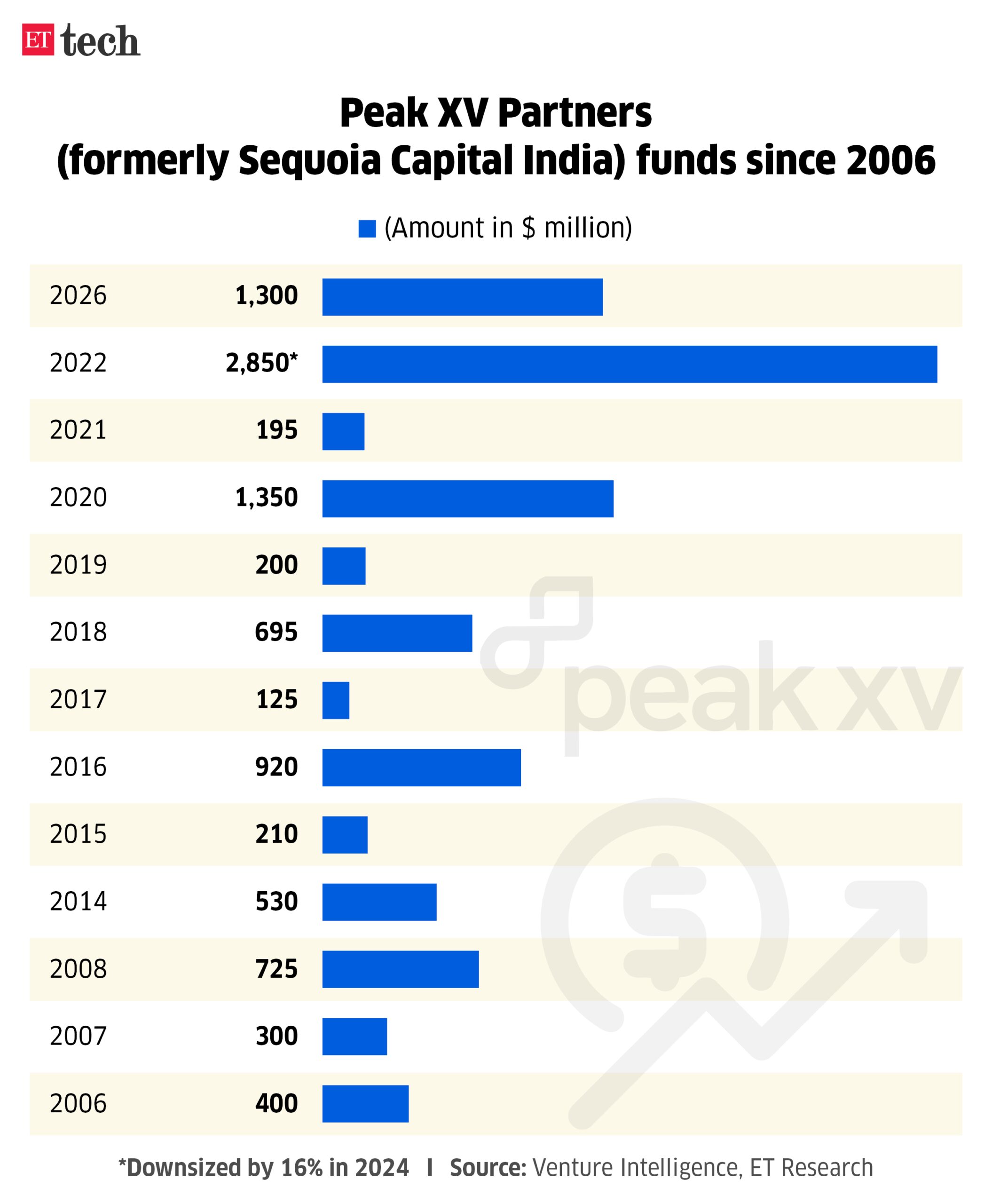

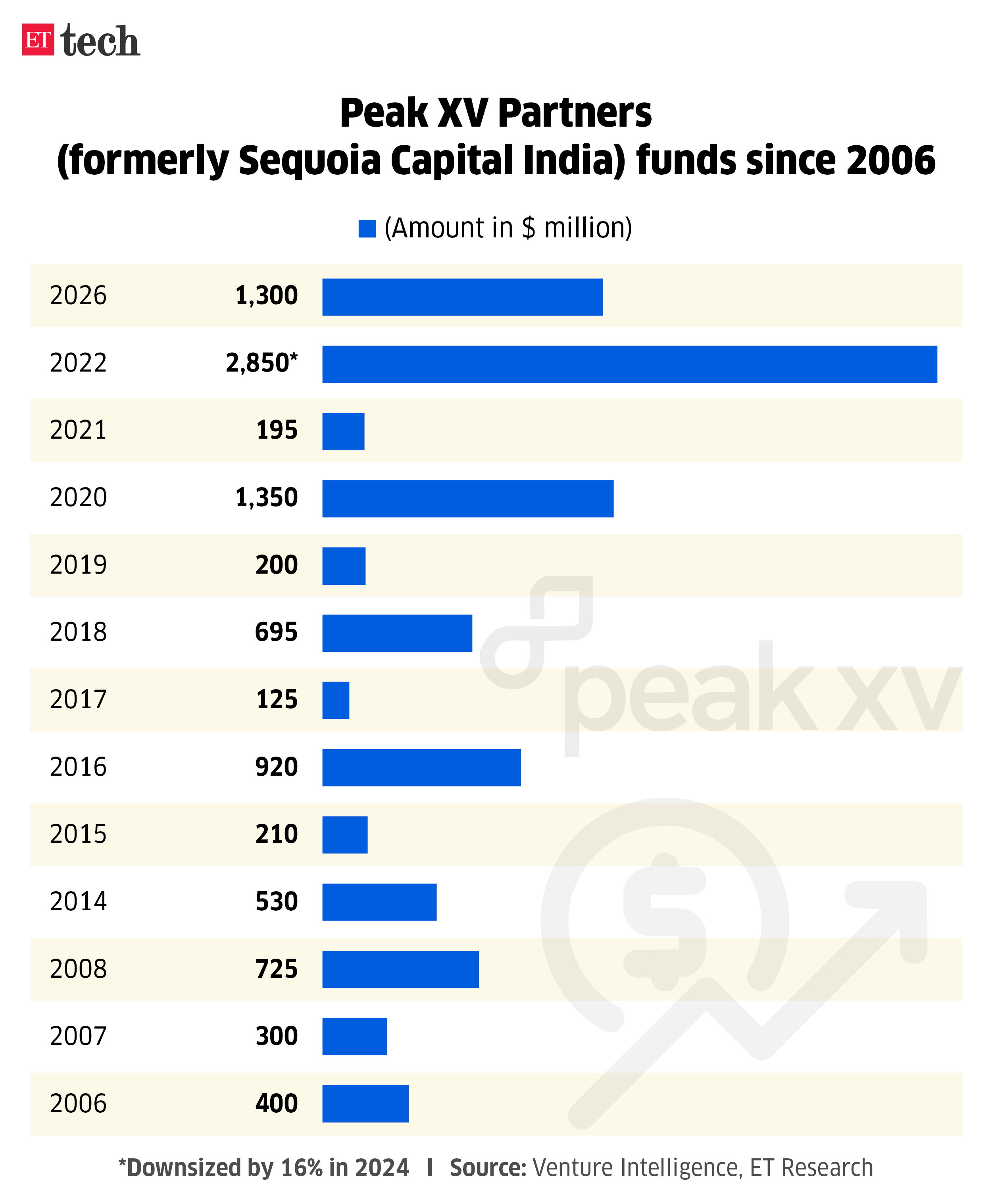

Peak XV Partners raises $1.3 billion for first independent India fund after Sequoia split

Peak XV Partners has closed its first fully independent fund since splitting from Sequoia Capital, raising $1.3 billion across three vehicles spanning India seed, early stage and a dedicated Asia Pacific pool.

ET first reported about Peak XV’s new fundraise last April.

Right-sized fund: The ninth fund since 2006 is roughly half the size of its 2022 predecessor, reflecting a more measured post-boom strategy. The firm had trimmed its last $2.85 billion fund amid a slowdown in growth-stage deployment.

Strategy reset: Peak XV says it will continue investing from seed to growth, writing cheques from single-digit millions up to $100 million, while building a stronger India-APAC corridor. AI will be a core theme across applications, enterprise adoption and infrastructure tooling.

Liquidity moment: The firm generated over $2 billion in exits across 2024 and 2025, helped by IPOs of portfolio companies such as Groww and Pine Labs besides private exits from companies like Minimalist, Porter, Rebel Foods and K 12 Techno Services.

Backdrop: The fund close comes after a year of senior partner exits and leadership reshuffle.

ET Interview: General Catalyst’s Hemant Taneja on $5 billion India bet and its shift beyond venture capital to company creation in the AI age

Silicon Valley venture capital firm General Catalyst has committed $5 billion to India over the next five years, marking one of the largest capital pledges into the country’s startup ecosystem.

In an exclusive interaction with ET, chief executive Hemant Taneja and Neeraj Arora, CEO for India and MENA (Middle East and North Africa), outlined plans to back applied AI, pursue roll-up strategies, and expand beyond traditional venture investing.

Edited excerpts:

Where’s the bet: Taneja said that the firm will invest across AI, defence, healthcare, and industrials — sectors where the Indian economy has the potential to build global market leaders.

“We’re going to get more aggressive. In terms of investment strategy, we’re obviously doing early-stage investing but we also have a strategy around creation, where we roll up companies” he said.

The strategy blends seed and early bets with structured company creation and growth capital.

End of traditional SaaS: “SaaS companies are embedding AI into their products. That’s very different from building something from scratch designed for AI. Some companies will make that transition well. Many will struggle,” Taneja said, warning that traditional SaaS multiples are unlikely to return, as AI is inherently deflationary.

India position: For the $5 billion outlay, Arora said the fund will mimic its global platform, focus on the early stage, “as we do across Europe, the US and India, but support companies all the way through growth”.

“We are actively investing across stages, from seed to growth, and currently have around 50 companies in our fairly diversified India portfolio, which includes firms like Spinny, Farmart, Loop Health, and Zepto,” Arora said.

Best antidote to AI anxiety is action and preparation: Rishi Sunak

Former British prime minister Rishi Sunak spoke to us about India’s standing in terms of AI and looked back at 2023, when the UK held the first AI summit in 2023.

Verbatim: “When I conceived of the first AI summit, it occurred to me that there wasn’t a dedicated forum for leaders to come together and discuss what I believe was the most transformative technology of our lifetimes. I’m really pleased that it’s gone from the UK to South Korea to Paris and now India, which feels like a very natural home for the summit, given India’s digital capabilities and ambitions,” Sunak said.

India formally joins Pax Silica Declaration on sidelines of Global AI Impact Summit

India on Friday signed the Pax Silica Declaration at the Global AI Impact Summit in New Delhi, joining a United States-led technology partnership focused on securing critical supply chains.

What is Pax Silica? Launched in December 2025, Pax Silica aims to strengthen global supply chains in semiconductors, artificial intelligence and critical minerals. The initiative seeks to reduce dependence on China by building a trusted network of partner countries that includes Japan, South Korea, the United Kingdom and India. It is also designed to guard against economic coercion in these sectors.

Tell me more: The declaration was signed in the presence of US Ambassador to India Sergio Gor, Jacob Helberg, United States Under Secretary of State for Economic Growth and Energy, and Union IT Minister Ashwini Vaishnaw.

Ambassador Gor welcomed India to the framework, citing deepening US-India cooperation and calling the partnership a shared commitment to move forward together.

Qualcomm and Tata Electronics partner to manufacture Qualcomm Automotive Modules in India

Qualcomm Technologies and Tata Electronics announced a partnership to produce Qualcomm Automotive Modules at Tata Electronics’ new semiconductor assembly and test (OSAT) facility in Jagiroad, Assam.

More on the collab:

- Tata Electronics will become part of Qualcomm’s global network of module manufacturers.

- The facility will promote production for automotive digital cockpits, infotainment, connectivity and intelligent vehicle platforms.

- The move also aims to bolster supply chain flexibility and serve Indian as well as global automakers.

Govt plans to create ‘complete AI stack’ to power innovation: Jayant Chaudhary

Union Minister Jayant Chaudhary said the government is evaluating the creation of a “full AI stack” based on anonymised datasets to support researchers and startups.

Tell me more: Chaudhary also floated the idea of an audit mechanism for AI models. In the future, bodies like the Comptroller and Auditor General of India (CAG) could publish reports on AI systems to improve transparency and accountability.

Fintechs want to bank on agentic commerce

Fintech startups are positioning themselves dot the next shift in digital payments as AI-powered platforms begin to move from search and discovery through transaction execution.

What’s happening? Payment firms including Razorpay, Cashfree, PayU, Pine Labs, along with card networks such as Visa and Mastercard, are working to integrate with AI platforms like OpenAI’s ChatGPT and Anthropic’s Claude.

While the Reserve Bank of India does not yet permit fully autonomous AI-led transactions, companies are building rails in anticipation. The aim is that when AI agents are allowed to complete purchases end-to-end, the payment infrastructure should already be in place.

Tell me more: Razorpay CEO Harshil Mathur said UPI’s Reserve Pay is currently the only framework that allows limited agent-led payments.

- Consumers set a transaction cap for a specific merchant on a UPI app.

- Transactions within that cap can be processed automatically without requiring an OTP.

Also Read: OpenAI’s ChatGPT joins hands with Pine Labs to enable agentic commerce

Ola Electric to cut stores to 550 as sale slump widens

Ola Electric plans to cut its physical retail footprint to about 550 by the end of March, as it grapples with shrinking market share and operational strain, sources told us.

What’s the matter? The company has shut outlets across multiple cities, with staff at some locations asked to leave, according to insiders. The move marks a sharp reversal from last year, when Ola Electric had scaled up to nearly 4,000 outlets nationwide.

In its latest quarterly update, the company said it had already reduced the network to 700 stores as part of a “structural reset”.

By the numbers:

- Market share in the electric two-wheeler segment fell to 6.3% in January, down from about 26% a year earlier, according to the Vahan website.

- In the first 18 days of February, the company sold 2,575 vehicles, pushing market share to roughly 4.2%.

Source link