Also in the letter:

■ Groww’s new offerings

■ ETtech Done Deals

■ India pushes for global AI rules

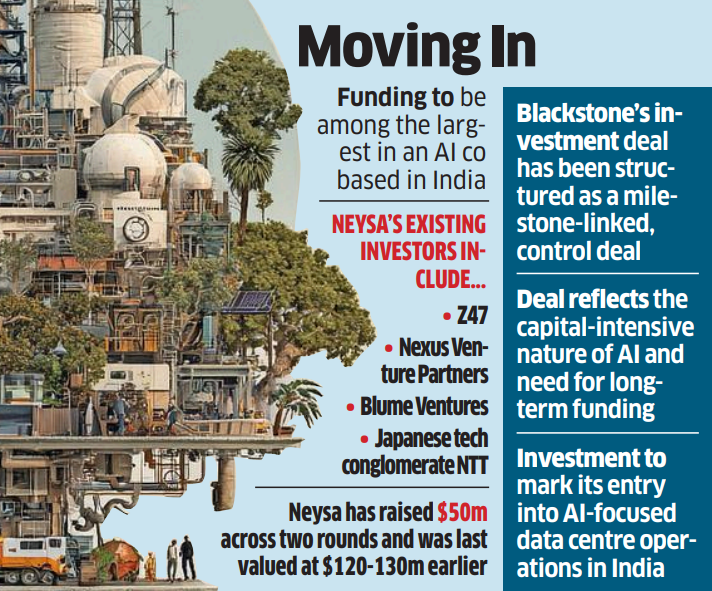

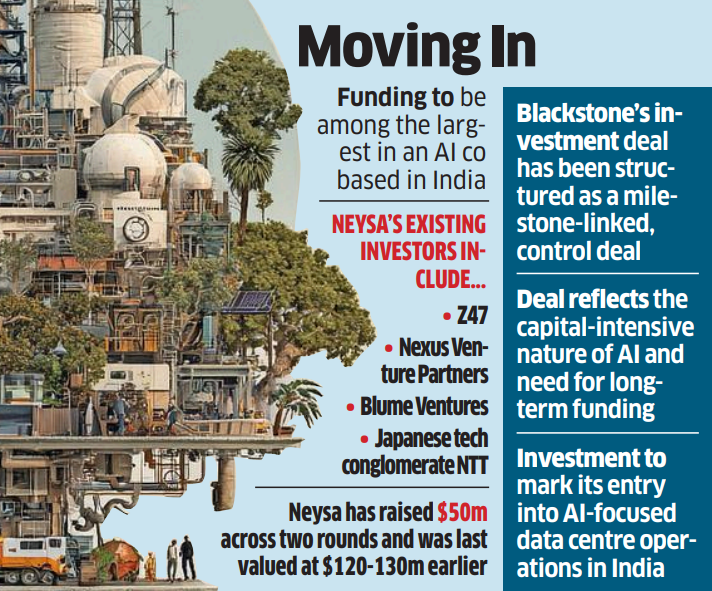

Blackstone finalises structured investment deal in AI cloud startup Neysa

Blackstone has finalised a structured investment in cloud infrastructure startup Neysa, a deal that will eventually give the investor a majority stake in the company, according to people in the know.

Deal details:

- Blackstone will invest $50-75 million in the first tranche at a valuation of around $300 million.

- The agreement includes milestone-linked follow-on funding, which will trigger Blackstone taking a controlling position in Neysa.

Tell me more: The transaction marks Blackstone’s entry into AI-focused data centre operations in India. After the deal closes, Blackstone will carve out Neysa as a new, dedicated data centre platform for its India strategy, with founder Sharad Sanghi continuing to lead the business.

Background: Neysa had attracted strong interest from global investors. Masayoshi Son’s SoftBank was in talks to write a growth investment cheque, while ET reported on December 3 that Silicon Valley VC fund Lightspeed Venture Partners had also joined the negotiations.

Also Read: AI to move from pilots to production, see wider adoption in 2026: Neysa’s Sharad Sanghi

Nano GCC attrition shaped by clearly defined roadmaps

India’s nano Global Capability Centres (GCCs) are splitting into two distinct cohorts, with employee retention increasingly determined by whether these units are built for the long-term or launched as short-term experiments.

What’s happening?

- Planned, long-term nano GCCs with teams of around 20 to 150 employees are reporting strong 12-month retention rates of about 80–88%, according to industry experts.

- Short-term or contract-based centres, often set up as “try-and-buy” pilots, are seeing much higher attrition, with exits quickly translating into delivery and continuity risks.

Why this matters: Retention has become a critical metric as competition for specialised technology skills intensifies and demand continues to outstrip supply.

“Demand for AI and platform engineering talent is growing 40-50% year-on-year, while true hands-on specialists account for less than 10% of India’s tech workforce. India also faces a 20-25% shortfall in specialised talent across advanced AI and ML, data engineering and ML infrastructure roles,” said Kapil Joshi, CEO of Quess Corp.

Also Read: Tier-II GCCs grapple with longer senior hiring cycles

What else? The shortage of niche skills is also altering hiring trends. Compensation for specialised roles in GenAI, MLOps, cloud, cybersecurity and data engineering has risen 18–22%, according to TeamLease.

Also Read: Smaller cities beating many congested state capitals in GCC race

Groww steps up wealth play via MF and portfolio management solutions

Wealthtech major Groww is pushing deeper into wealth management, building new offerings for both retail investors and high-net worth clients, according to three people familiar with the plans.

New products:

- Groww is exploring portfolio management services (PMS), which typically require a minimum investment of Rs 50 lakh and cater to wealthier clients.

- It is also developing offerings routed through mutual fund distributors (MFDs), targeting investors who prefer guided advice over do-it-yourself investing apps.

People familiar with Groww’s roadmap say the proposed products would mirror platforms such as AssetPlus, ZFunds, and Wealthy, which help investors build and manage mutual fund portfolios with professional support.

Financials: These expansion plans come alongside Groww’s December quarter results.

- Operating revenue: Rose 24.8% year-on-year (YoY) to Rs 1,216 crore.

- Net profit: Fell 27% YoY to Rs 547 crore.

Other Top Stories By Our Reporters

Spacetech startup EtherealX raises $20 million: Spacetech startup Ethereal Exploration Guild (EtherealX), a maker of reusable rockets, has secured $20.5 million in a round co-led by TDK Ventures and BIG Capital. The round also saw participation from Accel, Prosus, YourNest Venture Capital, BlueHill Capital, Campus Fund, and Riceberg Ventures.

AssetPlus raises Rs 175 crore: Wealthtech startup AssetPlus has raised Rs 175 crore (around $19.5 million) in a funding round led by Nexus Venture Partners, as the company looks to scale its distributor-led assisted wealth management model, cofounder and CEO Vishranth Suresh told ET.

India pushes for open-source repositories of AI use cases, tools: Establishing consensus among nations on creating common standards for artificial intelligence (AI) will be a key focus for India at the upcoming IndiaAI Impact Summit next month, said officials.

Global Picks We Are Reading

■ The AI Shift: why do men use AI at work more than women? (FT)

■ Grok’s biggest danger isn’t what it says — it’s where it lives (Rest of the World)

■ People still aren’t into buying cars online (Wired)

Source link