Most of the companies operating in the space have seen losses climb despite revenue growth. Investors who have backed such startups pointed out that most of these companies are yet to achieve scale and should focus on growing their assets under management as their first business target.

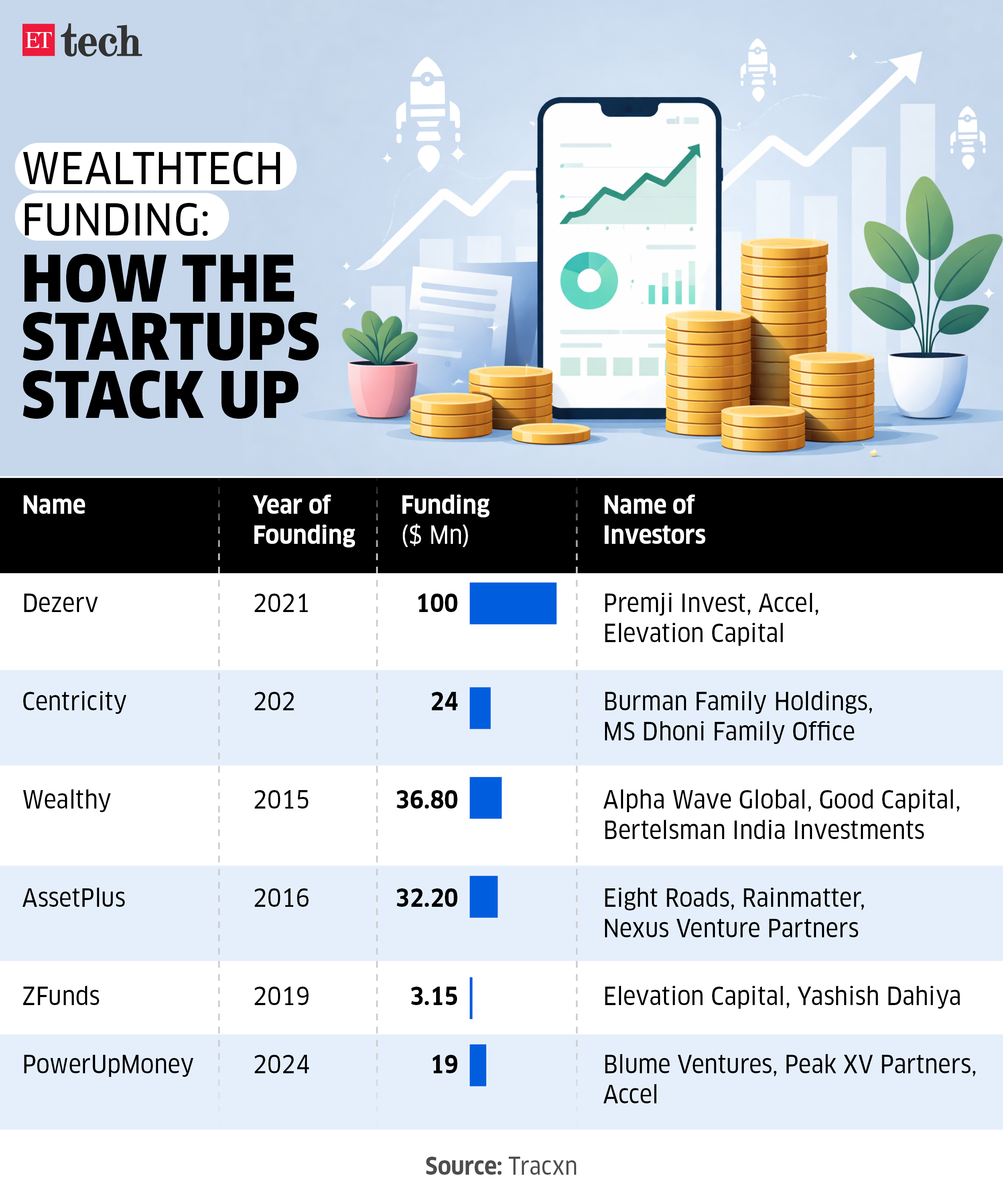

Dezerv, one of the largest new-age wealth management startups, reported Rs 66 crore in total operating revenue in FY25 and a net loss of Rs 112 crore. A year prior its revenue stood at Rs 26 crore with a net loss of Rs 74 crore. The Accel, Premji Invest-backed startup has raised $100 million in equity funding, with $40 million being poured in October 2025. The Bengaluru-based startup, which was founded in 2021, saw a 75% jump in its employee expenses to Rs 110.8 crore for FY25, compared to Rs 63 crore a year back.

ETtech

ETtechGurugram-based Centricity, which runs a digital private wealth management platform, reported total revenue of Rs 10 crore and a net loss of Rs 4.3 crore in its standalone business. The year prior its revenue stood at Rs 3.7 crore and a net loss of Rs 21 lakh. Founded in 2022, Centricity has raised around $24 million from Burman family holdings, MS Dhoni family office and others. At the consolidated level, Centricity reported earnings of Rs 931 crore in FY25, however the company spent Rs 916 crore in purchase of stocks and trades. Its net loss for FY25 at a consolidated level stood at Rs 31.7 crore, up 3.4 times from Rs 9.3 crore a year back.

“Most of these wealth firms are still sub-scale, so revenue isn’t the right yardstick to judge them by. The more meaningful signals are AUM growth…this is also a compounding business: as new customers are added and market returns remain supportive, AUM accumulates over time and revenues will scale disproportionately,” said Joseph Sebastian, vice president leading fintech and logistics investments at Blume Ventures.

To be sure, India is witnessing a dramatic rise in affluence, with the number of millionaire households (net worth = Rs 8.5 crore) surging 90% to 8.71 lakh in 2025 from 4.58 lakh in 2021, according to the Mercedes-Benz Hurun India Wealth Report 2025.

Some of the other startups in the wealth space have also reported revenues in the range of Rs 30 to 50 crore. Wealthy, a Bengaluru-based startup which offers digital solutions to mutual fund distributors, reported a consolidated revenue of Rs 35 crore in FY25, up 40% from Rs 25 crore a year back. During the same time period the company saw its losses climb to 35 crore from Rs 24 crore a year back.

Chennai-based AssetPlus reported Rs 34 crore in revenue and a net loss of Rs 21 crore. While the Rainmatter-backed firm’s revenue grew almost 2.5 times between 2024 and 2025, losses doubled as well in the same time period.

While the stock trading ecosystem saw a massive growth among tech-first brokers, wealth management as a sector has proven to be a tougher climb. Unlike stock brokers like Dhan, Zerodha and Groww where they operate as transactional platforms, the likes of Dezerv, Centricity and AssetPlus are asking people to park their funds with them. The latter is a tougher ask and it will take time for investors to build that level of trust with fintech applications, industry insiders said.

Founders in this sector often take the example of players like 360 One Wealth and Assets Management to show the potential revenue pool of this business. For context: 360 One closed its December quarter with operating revenue of Rs 806 crore and a net profit of Rs 331 crore. The company’s AUM stands at Rs 7.1 lakh crore.

“Actual wealth management is still largely manual, that’s where the opportunity sits: there is a large revenue pool, incumbents make serious profits, but they still play largely in the ultra and high net worth space, the whitespace is below that,” said Sameer Singh Jaini, founder of consulting firm The Digital Fifth.

Jain added that the winners in digital wealth won’t be app-only players but will have to invest in a physical or an assistance network to build trust with the mass affluent or emerging affluent segments in the country.

The question that also needs to be addressed is how big is this affluent segment in the country and is the economy growing fast enough creating enough middle class with surplus earnings who can invest in such long-term investment instruments.

“Any growing economy graduates from bank accounts to digital payments to consumer credit to insurance and wealth management, India will be no exception,” said a founder of a wealthtech startup who spoke on the condition of anonymity.

He added that for now these startups have one target of getting as much AUM as they can and offer steady returns in a consistent fashion, which will not only help build trust in the ecosystem but also help these startups compound their earnings.