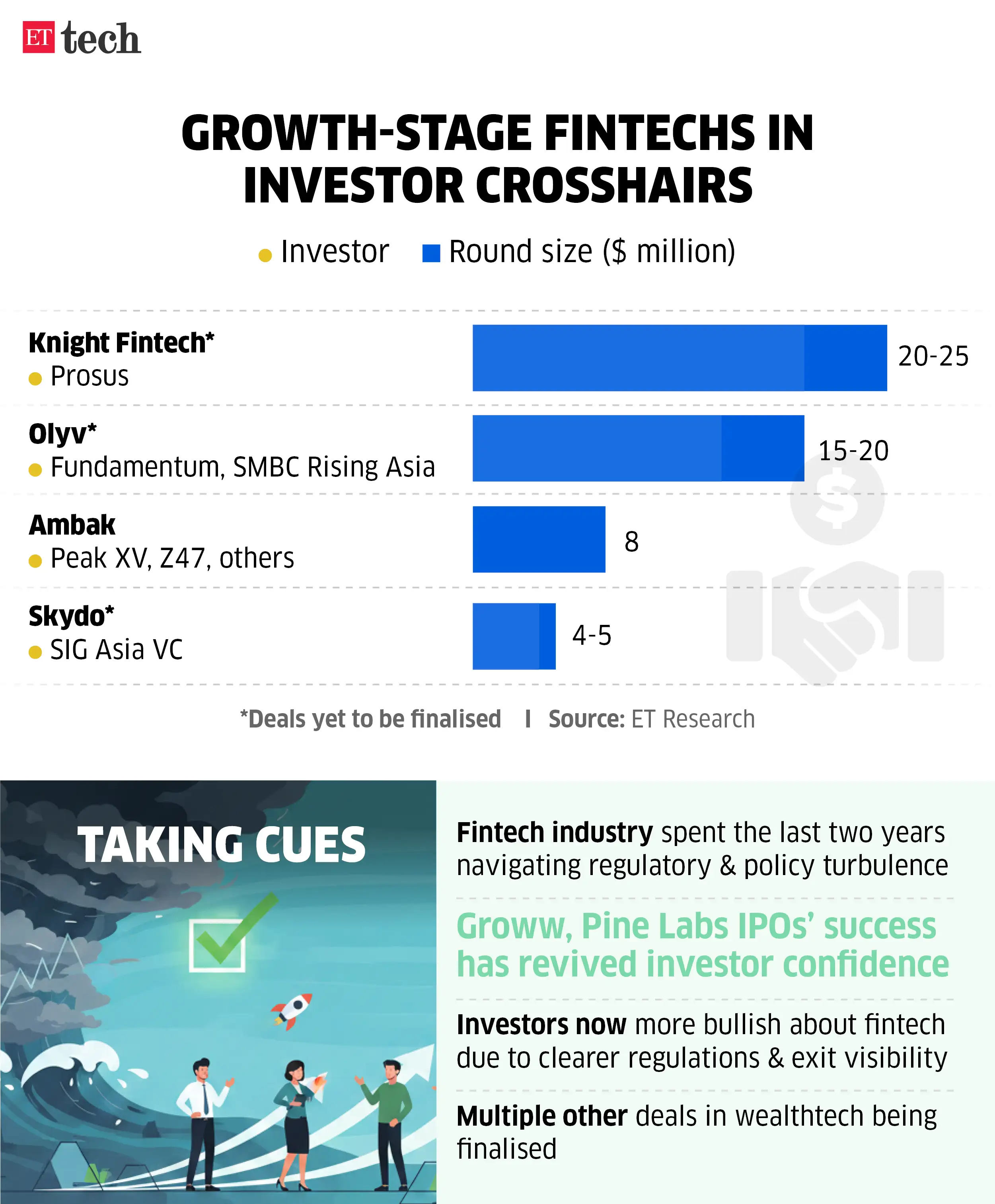

Furthermore, highly successful recent public listings of Pine Labs and Groww have strengthened exit prospects for risk investors in the Indian market, boosting the confidence for early-stage firms. ET reported on November 10 that the Groww IPO had quickened dealmaking in the wealth-tech segment, with several mid-stage startups now in discussions for sizeable fundraises.

Bengaluru-based consumer lending startup Olyv (formerly SmartCoin) is in late-stage discussions to close a $15–20 million round, people aware of the matter said.

The round is likely to be led by Nandan Nilekani-backed Fundamentum, with participation from Japan’s SMBC Rising Asia Fund, they said.

Home financing startup Ambak is raising $8 million from existing investors. The company passed a board resolution last month seeking to raise $3 million each from Z47 (previously Matrix Partners India) and Peak XV Partners and the remaining from DeVC India and Advantedge Technology Fund.

Ambak is founded by former Policybazaar senior executive Raghuveer Malik, ex-ZestMoney executive Rashi Garg, and Rameshwar Gupta, the former CTO of Freecharge.

It had raised $7 million from Peak XV’s accelerator programme Surge in January 2025. Back then, the company said it aimed to expand lending operations to 35 cities and target $1 billion in loan disbursements by March 2026.

“Besides Peak XV and Z47, some of Ambak’s other existing backers are also likely to participate,” said one of the persons cited above.

Email queries to these fintech startups and their potential investors remained unanswered until the publication of this report.

Lending: Policy clarity

Renewed interest in India’s fintech sector is being driven by a more stable policy environment around payments and lending, along with rising consumption trends.

Pune-based Fibe (previously EarlySalary), for instance, is in talks with International Finance Corporation for a $35 million round, as reported by ET in August. Gurugram-based advanced salary startup SalarySe recently closed an $11.5 million round led by Flourish Ventures and SIG Venture Capital.

Some large consumer lenders, including KreditBee and Kissht, are preparing to tap public markets for their next phase of growth.

ET reported on October 22 that festive-season purchases sparked a surge in instant lending, giving consumer lending startups a sudden boost in disbursals.

ETtech

ETtechThe tech spine

Besides digital lending startups, the fintech infrastructure space has emerged as an attractive segment, with several large venture funds looking to stretch their commitments to the segment. As banks and NBFCs (non-banking financial companies) undertake wide-scale digitisation projects, investors believe this segment provides the next big opportunity. Knight Fintech, which provides enterprise software for digital lending, co-lending and treasury management to banks and financial services firms, is in discussions with Dutch investment group Prosus for a $20–25 million funding round, two people aware of the matter said.

“Prosus is negotiating the deal… but other US-based private equity funds are also talking. The contours haven’t been finalised yet,” one of the persons cited above said. “Knight Fintech is currently tracking an ARR (annualised revenue run rate) of $10–12 million.”

Founded in 2019, Mumbai-based Knight Fintech closed a $20–25 million round led by Accel last year. Its other backers include 3one4 Capital and Blume Ventures.

Chennai-based M2P has raised $188 million across multiple rounds, emerging as one of the largest players in this space. Earlier this year, banking-tech startup Zeta raised $50 million from US-based healthcare and financial services major Optum.

Bengaluru-based cross-border payments startup Skydo is also looking to raise fresh capital. According to the people cited above, Skydo has held early discussions with SIG (Susquehanna International Group) Asia VC for a $4–5 million infusion.

“Skydo is stitching together a bigger round and is in talks with more investors, but the deal terms are not closed yet,” said one of the persons aware of the plans.

Skydo cofounder Movin Jain, responding to ET’s queries, declined to confirm the developments.